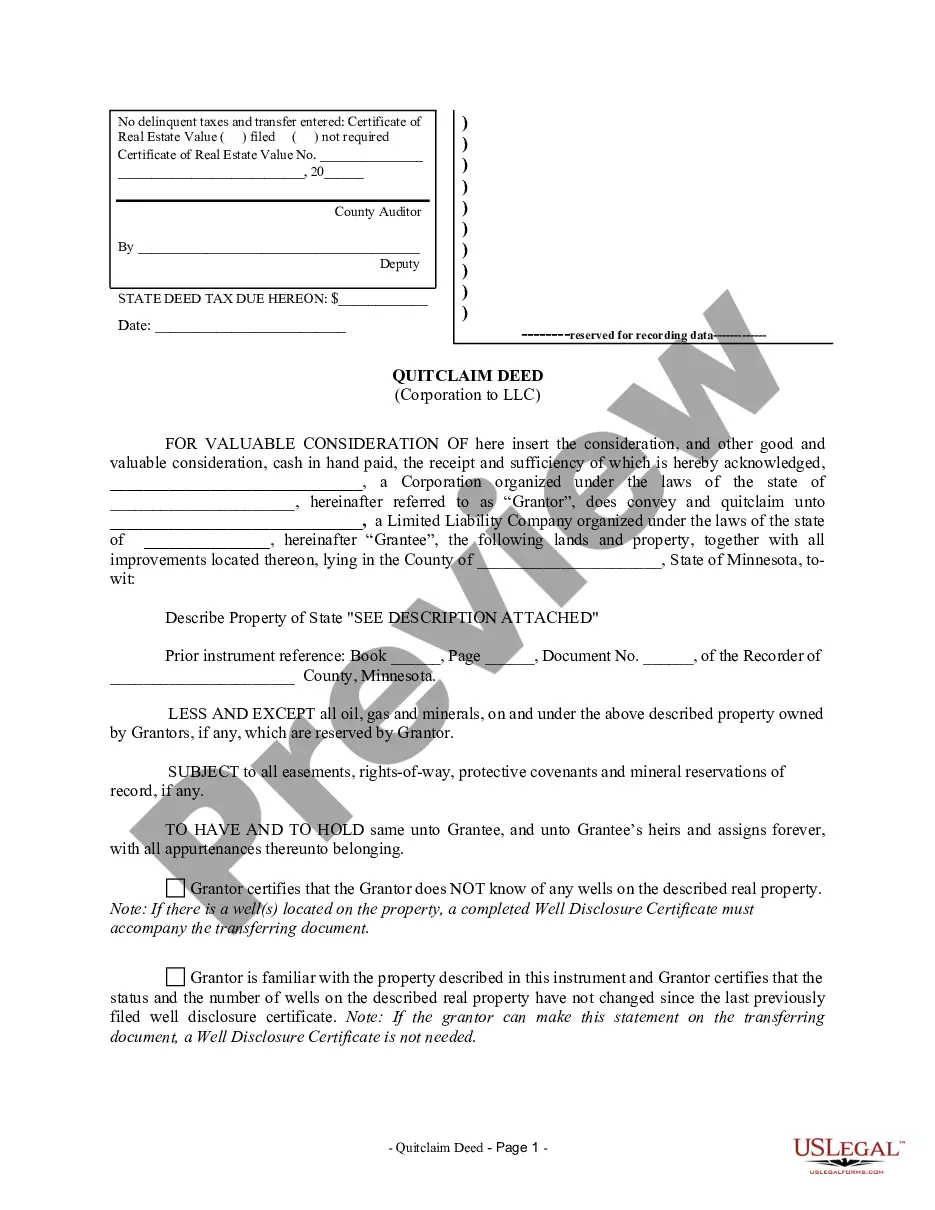

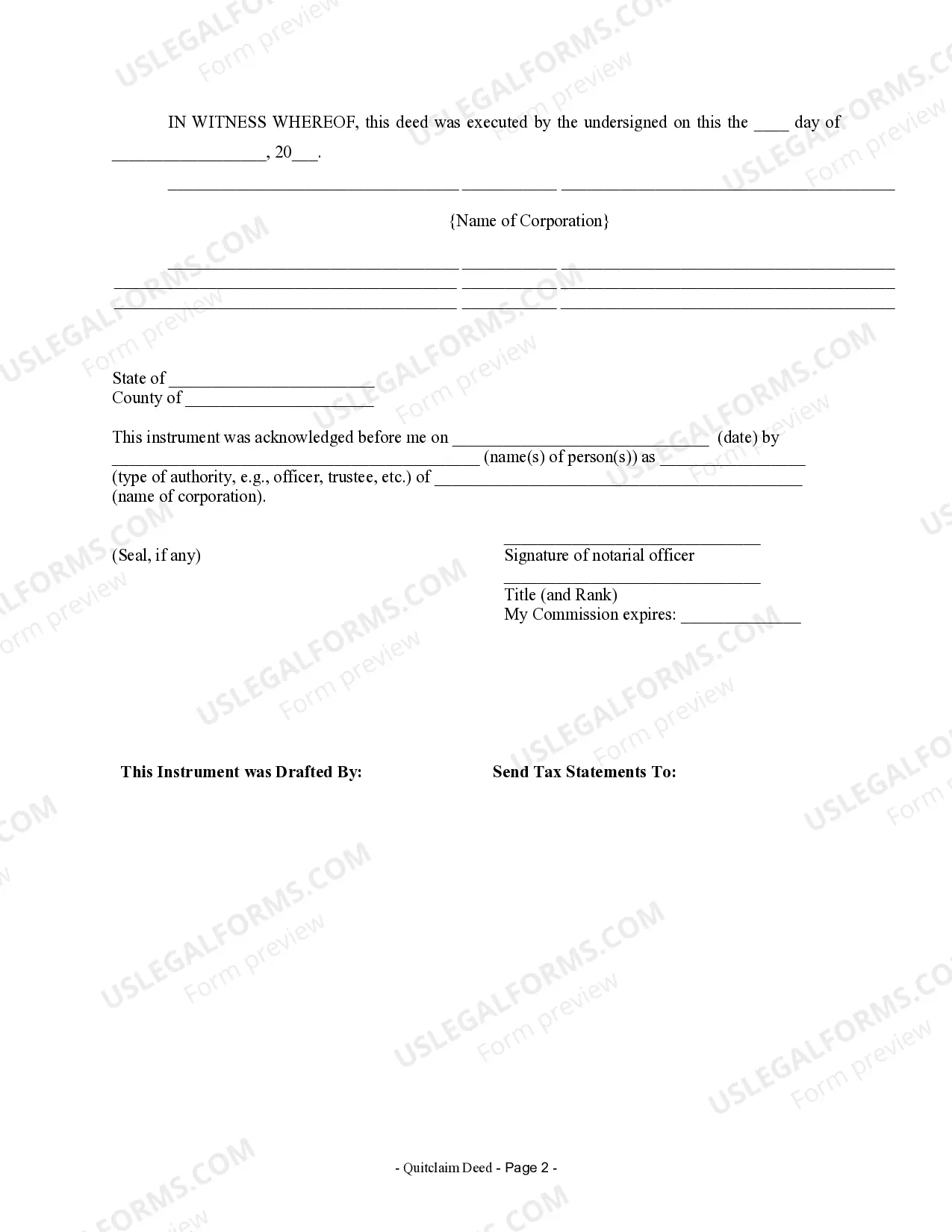

A Hennepin Minnesota Quitclaim Deed from Corporation to LLC is a legal document that facilitates the transfer of ownership of a property or real estate from a corporation to a limited liability company. This type of transaction typically occurs when a corporation decides to transfer a property's ownership to a newly formed LLC for various reasons such as restructuring, liability protection, or tax benefits. The Quitclaim Deed is a commonly used legal instrument in Hennepin County, Minnesota, for transferring property ownership. It differs from other types of deeds because it solely transfers the interest or claim that the corporation holds in the property to the LLC, without making any guarantees about the property's title or any existing liens or encumbrances. In Hennepin County, there may be different variations of Quitclaim Deeds from Corporation to LLC, depending on the specific circumstances and requirements of the parties involved. Some potential types may include: 1. General Hennepin Minnesota Quitclaim Deed from Corporation to LLC: This is the standard form of quitclaim deed used when a corporation decides to transfer ownership of a property to an LLC. It includes basic provisions, such as the names of the granter (corporation) and grantee (LLC), a legal description of the property, and any relevant terms and conditions. 2. Hennepin County Quitclaim Deed with Waiver of Liability: This type of quitclaim deed may be used when the corporation wants to transfer ownership to an LLC while waiving any liability associated with the property. It provides an extra layer of protection against potential claims or issues that may arise in the future. 3. Hennepin Minnesota Quitclaim Deed with Tax Considerations: In the case of a transfer that involves specific tax considerations, such as avoiding potential reassessment of property taxes, a specialized quitclaim deed may be utilized. This type of deed may include additional provisions or language aimed at meeting the requirements set forth by the state or local taxing authorities. It is important to consult with legal professionals or real estate experts familiar with Hennepin County's laws and regulations when considering a Quitclaim Deed from Corporation to LLC. These professionals can ensure that the appropriate deed type is used, and all necessary legal requirements are met during the transfer process.

Hennepin Minnesota Quitclaim Deed from Corporation to LLC

Description

How to fill out Hennepin Minnesota Quitclaim Deed From Corporation To LLC?

Getting verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Hennepin Minnesota Quitclaim Deed from Corporation to LLC becomes as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, obtaining the Hennepin Minnesota Quitclaim Deed from Corporation to LLC takes just a couple of clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Check the Preview mode and form description. Make sure you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to find the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Hennepin Minnesota Quitclaim Deed from Corporation to LLC. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!