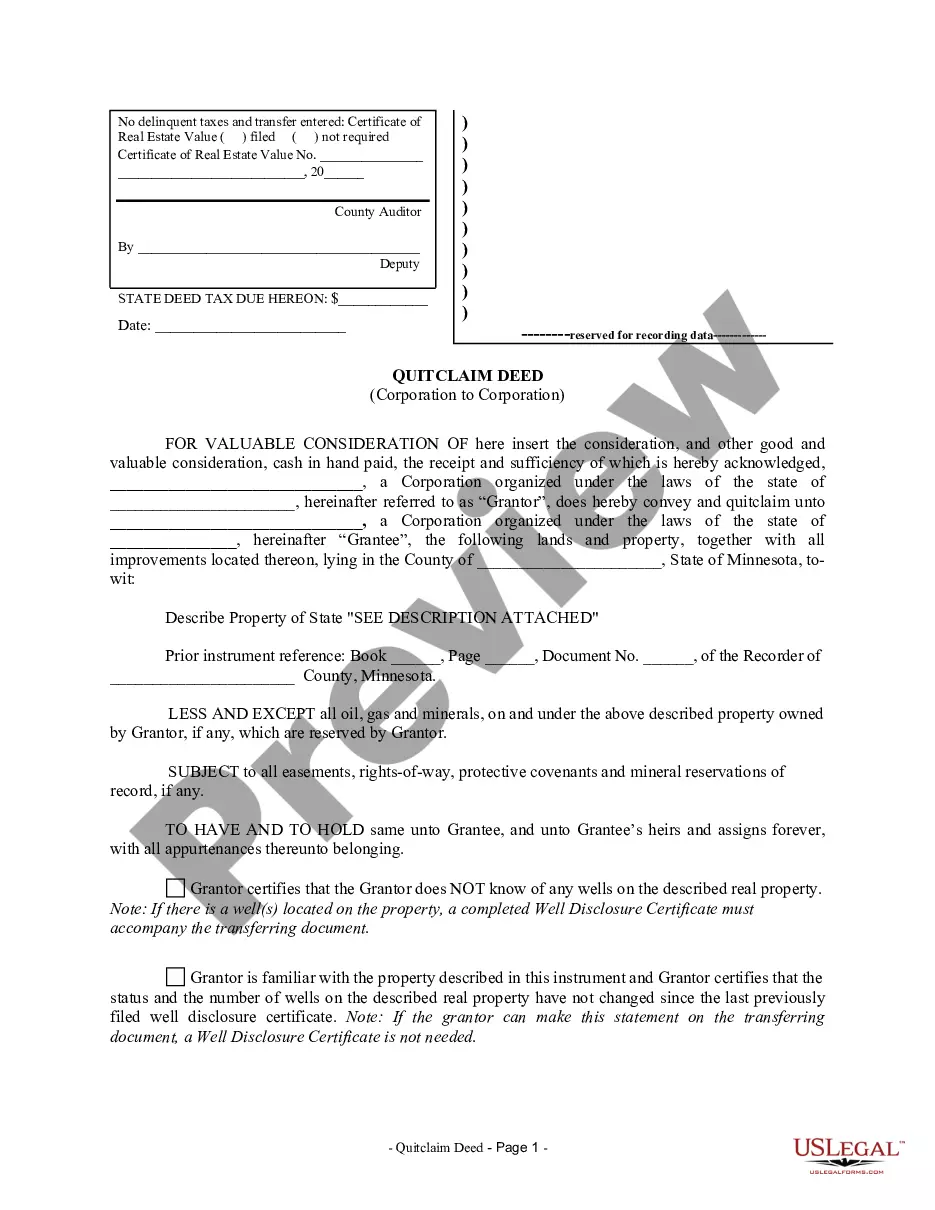

A Hennepin Minnesota Quitclaim Deed from Corporation to Corporation refers to a legal document that facilitates the transfer of ownership rights of a property from one corporation to another within Hennepin County, Minnesota. This type of deed is commonly used when a corporation wishes to transfer its interest in a property to another corporation without making any guarantees about the property's title. The Hennepin Minnesota Quitclaim Deed from Corporation to Corporation is a straightforward method for corporations to conduct property transactions. It is important for both parties involved to understand the implications of this type of deed, as it transfers ownership "as-is." Therefore, the granter corporation does not provide any warranty regarding the title, liens, or encumbrances on the property being transferred. In Hennepin County, there are several variations of the Quitclaim Deed from Corporation to Corporation that may be used depending on specific circumstances: 1. Hennepin Minnesota General Quitclaim Deed: This is the most commonly used type of quitclaim deed. It conveys the granter corporation's interest in the property to the grantee corporation without providing any warranties. 2. Hennepin Minnesota Quitclaim Deed with Covenants Against Granter's Acts: This variation of the quitclaim deed allows for limited warranties. The granter corporation guarantees that it has not performed any acts that could negatively impact the title of the property. 3. Hennepin Minnesota Special Warranty Deed: While technically not a quitclaim deed, it is worth mentioning this deed type. In a special warranty deed, the granter corporation provides limited warranties against the granter's own actions, such as encumbrances or defects created by the granter. When dealing with a Hennepin Minnesota Quitclaim Deed from Corporation to Corporation, it is advisable for both parties to consult with a qualified attorney or real estate professional to ensure all legal requirements are met and that the transfer is executed correctly. This will protect the interests of both the granter and grantee corporations in the transaction, minimizing potential risks and disputes in the future.

Hennepin Minnesota Quitclaim Deed from Corporation to Corporation

Description

How to fill out Hennepin Minnesota Quitclaim Deed From Corporation To Corporation?

Are you looking for a trustworthy and affordable legal forms supplier to buy the Hennepin Minnesota Quitclaim Deed from Corporation to Corporation? US Legal Forms is your go-to choice.

Whether you require a simple agreement to set rules for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t universal and frameworked based on the requirements of separate state and area.

To download the form, you need to log in account, find the needed template, and click the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Check if the Hennepin Minnesota Quitclaim Deed from Corporation to Corporation conforms to the regulations of your state and local area.

- Go through the form’s details (if available) to learn who and what the form is good for.

- Start the search over if the template isn’t suitable for your legal scenario.

Now you can create your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Hennepin Minnesota Quitclaim Deed from Corporation to Corporation in any available file format. You can return to the website when you need and redownload the form free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a go now, and forget about spending your valuable time researching legal paperwork online once and for all.