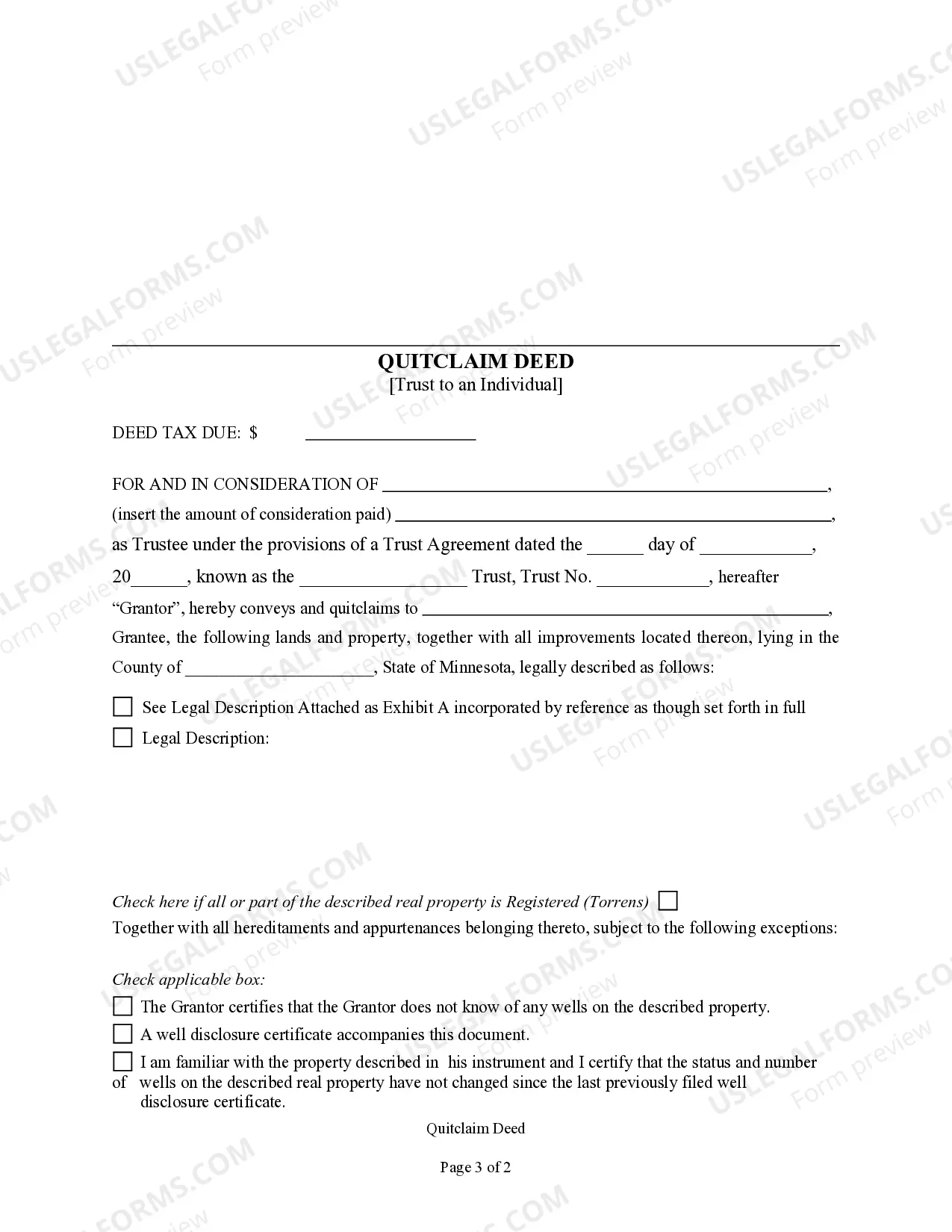

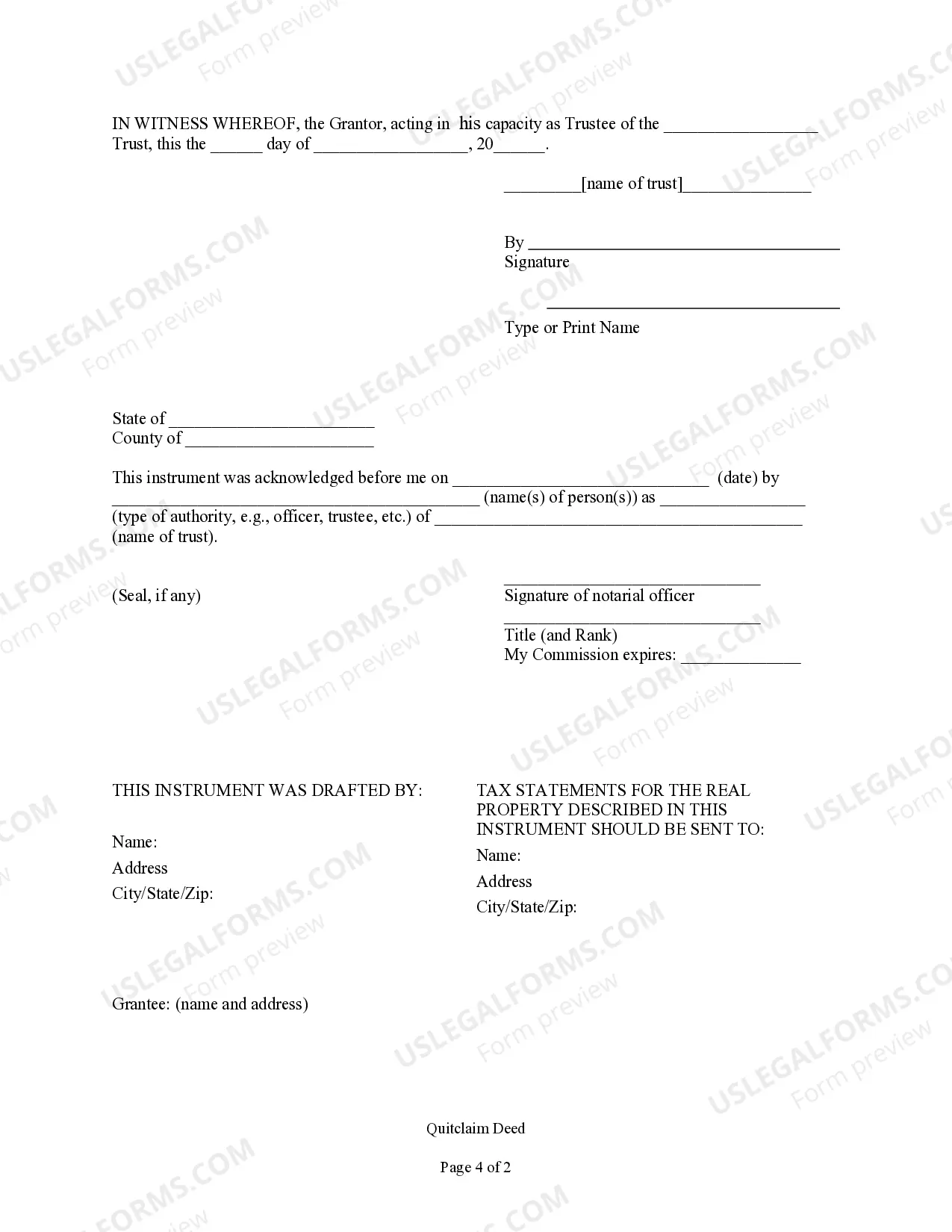

This form is a Quitclaim Deed where the grantor is the trustee of a trust acting on behalf of the trust and the grantee is an individual. Grantor conveys and quitclaims the described property to grantee. This deed complies with all state statutory laws.

A Hennepin Minnesota Quitclaim Deed — Trust to an Individual is a legal document that transfers ownership of real estate property from a trust to an individual using a quitclaim deed. This type of deed is commonly used in Hennepin County, Minnesota, to facilitate the transfer of property between a trust and an individual. A quitclaim deed is a legal instrument used to transfer real estate ownership from one party to another, typically without any warranties or guarantees regarding the property's title. This means that the individual receiving the property (the grantee) assumes all risks and responsibilities associated with the property's ownership. In Hennepin County, Minnesota, there are several types of quitclaim deeds that can be used to transfer property from a trust to an individual: 1. Hennepin Minnesota Quitclaim Deed — Trust to an Individual for Personal Use: This type of quitclaim deed is used when a trust transfers property to an individual for personal use, such as a primary residence or vacation home. The individual becomes the sole owner of the property, assuming all rights and responsibilities associated with homeownership. 2. Hennepin Minnesota Quitclaim Deed — Trust to an Individual for Investment: This type of quitclaim deed is used when a trust transfers property to an individual for investment purposes, such as rental properties or commercial real estate. The individual becomes the sole owner of the property, assuming all rights and responsibilities as an investor. 3. Hennepin Minnesota Quitclaim Deed — Trust to an Individual for Legal Purposes: This type of quitclaim deed is used when a trust transfers property to an individual for legal purposes, such as settling a legal dispute or transferring the property as part of an estate plan. The individual assumes ownership of the property, subject to any legal obligations or requirements associated with the transfer. When utilizing a Hennepin Minnesota Quitclaim Deed — Trust to an Individual, it is important to consult with a qualified real estate attorney or a trusted legal professional to ensure the deed is prepared correctly and all legal requirements are met. Additionally, both the trust and the individual should carefully review the terms of the deed before executing it to fully understand the rights and responsibilities involved in the transfer of ownership.