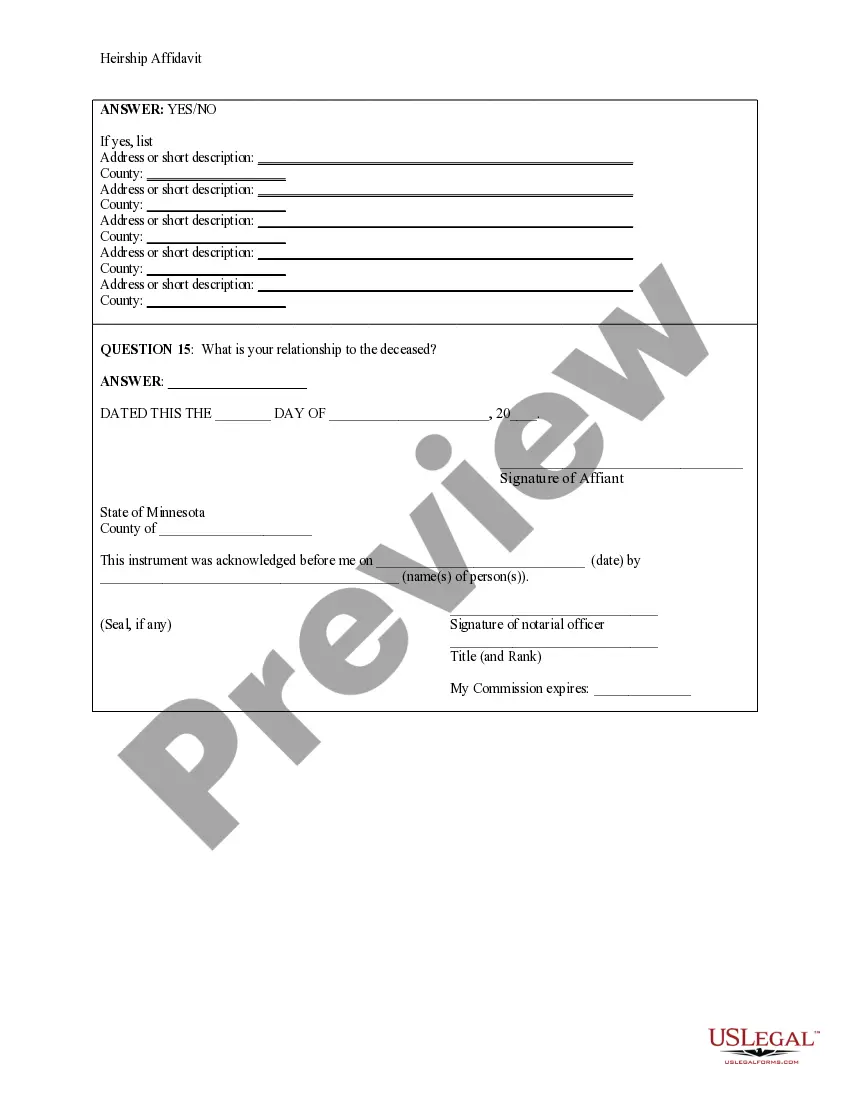

Minneapolis Minnesota Heirship Affidavit - Descent

Description

How to fill out Minnesota Heirship Affidavit - Descent?

We consistently attempt to reduce or evade legal complications when navigating intricate legal or financial matters.

To achieve this, we enlist legal services that are typically quite expensive.

However, not every legal issue is equally intricate. Many of them can be handled by ourselves.

US Legal Forms is an online repository of current DIY legal documents covering everything from wills and power of attorneys to articles of incorporation and dissolution petitions.

Simply Log In to your account and click the Get button next to it. If you happen to lose the document, you can always re-download it in the My documents section. The process is equally straightforward if you’re a newcomer to the site! You can establish your account in just a few minutes. Ensure to verify if the Minneapolis Minnesota Heirship Affidavit - Descent adheres to the laws and regulations of your state and area. Additionally, it’s crucial that you review the form’s description (if available), and if you detect any inconsistencies with what you were originally seeking, look for another template. Once you’ve confirmed that the Minneapolis Minnesota Heirship Affidavit - Descent is suitable for you, you can choose the subscription plan and make a payment. Afterwards, you can download the document in any compatible file format. For over 24 years of our existence, we’ve assisted millions by offering ready to customize and contemporary legal forms. Take advantage of US Legal Forms now to conserve time and resources!

- Our platform empowers you to manage your affairs independently without hiring a lawyer.

- We offer access to legal document templates that may not always be available to the public.

- Our templates are specific to states and regions, greatly easing the search process.

- Make the most of US Legal Forms whenever you need to quickly and safely find and download the Minneapolis Minnesota Heirship Affidavit - Descent or any other form.

Form popularity

FAQ

If there are descendants, usually the surviving spouse and surviving children share in the assets of a deceased person's estate. When there is no surviving spouse, or any surviving children, the estate's assets pass to the parents.

If there is no one in that class, next in line are grandparents, or their descendants if no grandparents survive. To recap, the people who would inherit from your estate if you die without a will are, in order: spouse and/or children, parents, siblings, nieces/nephews, grandparents, aunts/uncles, cousins.

It is very often a husband, wife or civil partner, or someone that you live with. It does not have to be a blood relative; it can be a good friend. You can give the name of more than one next of kin.

A Massachusetts small estate affidavit is a legal document used to present a claim on the estate or part of the estate of a deceased loved one. The petitioner, or affiant, must provide detailed information about the estate, the property in question, the decedent, and any other potential heirs.

An heir is a person who is legally entitled to collect an inheritance when a deceased person did not formalize a last will and testament. Generally speaking, heirs who inherit the property are children, descendants, or other close relatives of the decedent.

Generally, the heirs of the decedent are their surviving spouse and children, including all of decedent's biological children and adopted children.

?Next of kin? for inheritance purposes under Minnesota law means the relatives that inherit under the intestacy statutes and are: Surviving spouse. Descendants. Parents.

If you are named as an heir, you may have to prove to the estate trustee that you are the person named. This can be done by showing the estate trustee identification or providing an affidavit.

In Minnesota, if you are married and you die without a will, what your spouse gets depends on whether or not you have living descendants -- children, grandchildren, or great-grandchildren. If you don't, your spouse inherits all of your intestate property.

525.312 DECREE OF DESCENT. The decree of descent shall operate to assign the property free and clear of any and all claims for medical assistance arising under section 525.313 without regard to the final disposition of those claims. The court may appoint two or more disinterested persons to appraise the property.