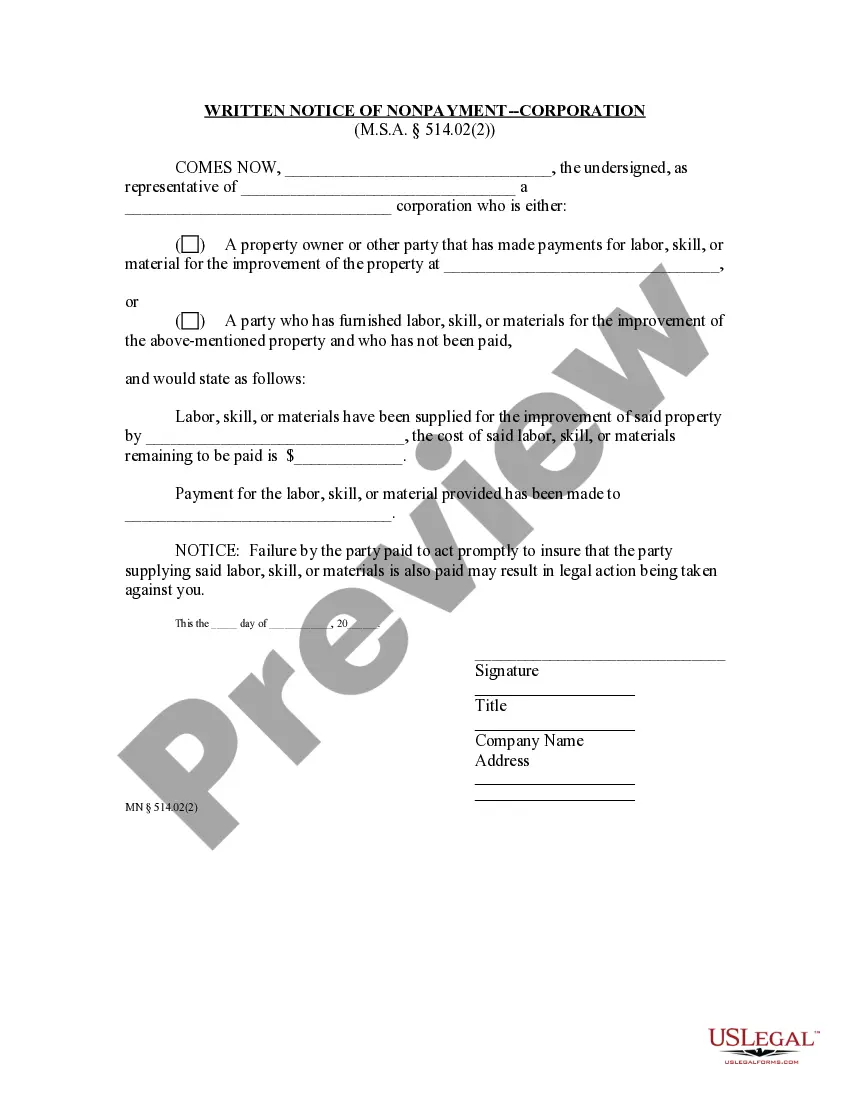

Minnesota law has many provisions which require mandatory communication between the different parties involved in a construction project. In this form, the party that has been paying the contractor, or the subcontractor that has not been paid, provides notice to the contractor that a subcontractor has not yet been paid for services provided.

Title: Hennepin Minnesota Written Notice of Nonpayment — Corporation or LLC Description: In Hennepin County, Minnesota, a written notice of nonpayment is a crucial legal document that serves to address instances where a corporation or limited liability company (LLC) fails to meet their financial obligations. This detailed description will provide an overview of the Hennepin Minnesota Written Notice of Nonpayment for Corporation or LLC and highlight the different types of notices that may be applicable in various scenarios. Types of Hennepin Minnesota Written Notice of Nonpayment — Corporation or LLC: 1. Initial Notice of Nonpayment: The Initial Notice of Nonpayment is the first formal written communication that a creditor or the party owed money sends to the delinquent corporation or LLC. This notice explicitly notifies the debtor of outstanding payments due and provides a designated timeframe to resolve the issue. It outlines the relevant details of the debt and warns of potential legal consequences if the nonpayment continues. 2. Notice of Intent to Sue: If the Initial Notice of Nonpayment fails to yield any response from the corporation or LLC, the creditor may proceed to send a Notice of Intent to Sue. This notice indicates the creditor's intention to file a lawsuit against the debtor unless the outstanding amounts are settled promptly. It underscores the importance of resolving the matter amicably to avoid expensive litigation and potential damage to the debtor's reputation. 3. Notice of Default: When the creditor continues to experience nonpayment despite previous notices, they may issue a Notice of Default. This notice emphasizes that the debtor has officially defaulted on their financial obligations. It documents the exact amount owed, timelines for repayment, and any additional charges, such as interest or penalties. The notice also notifies the debtor of possible further legal action and outlines potential consequences, such as a negative impact on credit ratings or seizure of assets. 4. Notice of Acceleration: In situations where the debtor has persistently failed to fulfill their payment obligations through previous notices, the creditor may opt to send a Notice of Acceleration. This notice demands immediate full payment of the remaining outstanding balance. Failing to comply with the Notice of Acceleration may prompt the creditor to proceed with legal actions, such as filing a lawsuit or recording a lien against the debtor's assets. 5. Notice of Demand for Payment: The Notice of Demand for Payment is a final notice that a creditor may choose to send before initiating legal proceedings. This notice reiterates the amount owed, outstanding payment details, and specifies a final deadline for payment. It warns the debtor of serious consequences, including legal action and potential financial loss, if immediate payment is not made. In summary, the Hennepin Minnesota Written Notice of Nonpayment for Corporation or LLC is a formal documentation process that ensures creditors uphold their rights when faced with nonpayment situations. The types of notices mentioned above outline the step-by-step progression towards resolving the issue, from initial communication to potential legal actions that may be taken to recover the outstanding debt.