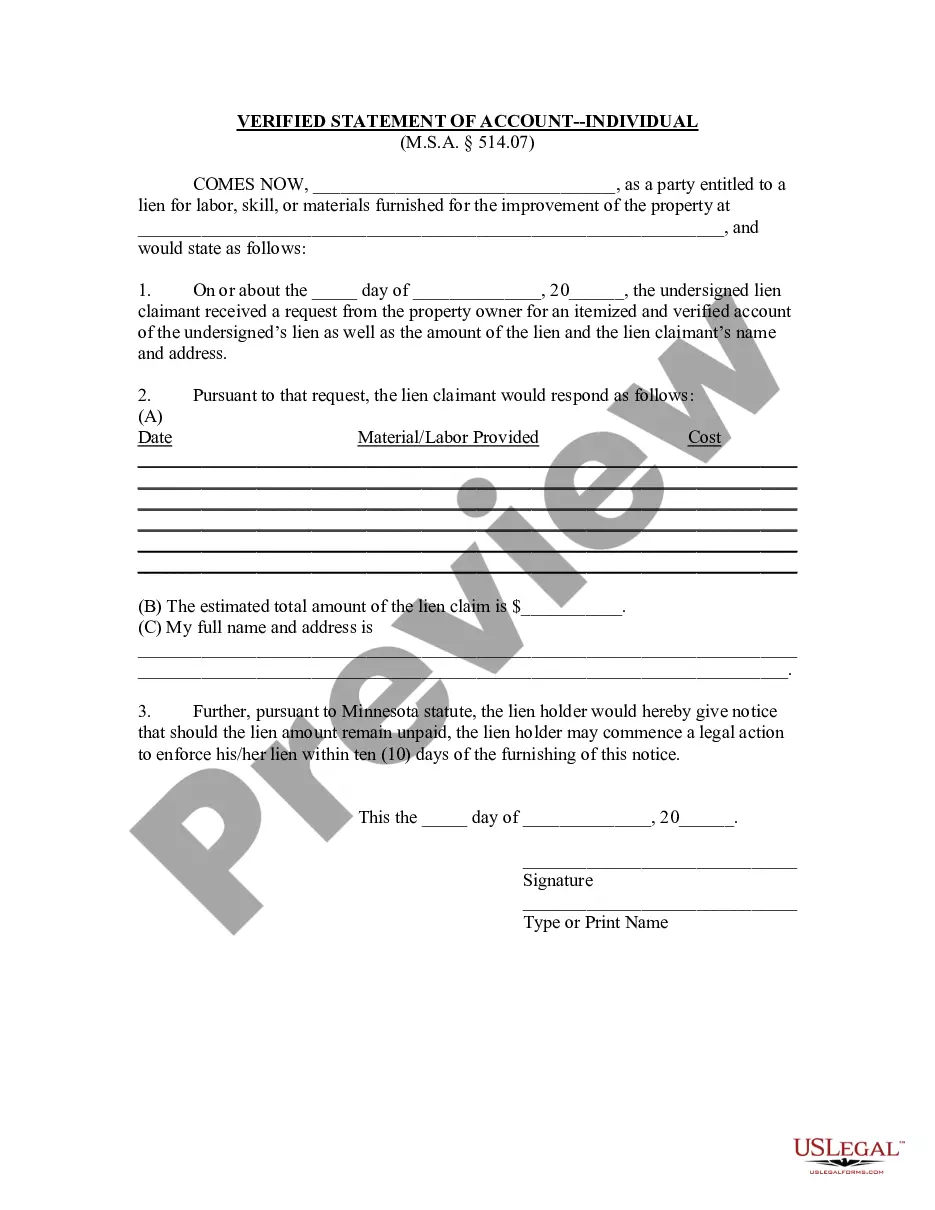

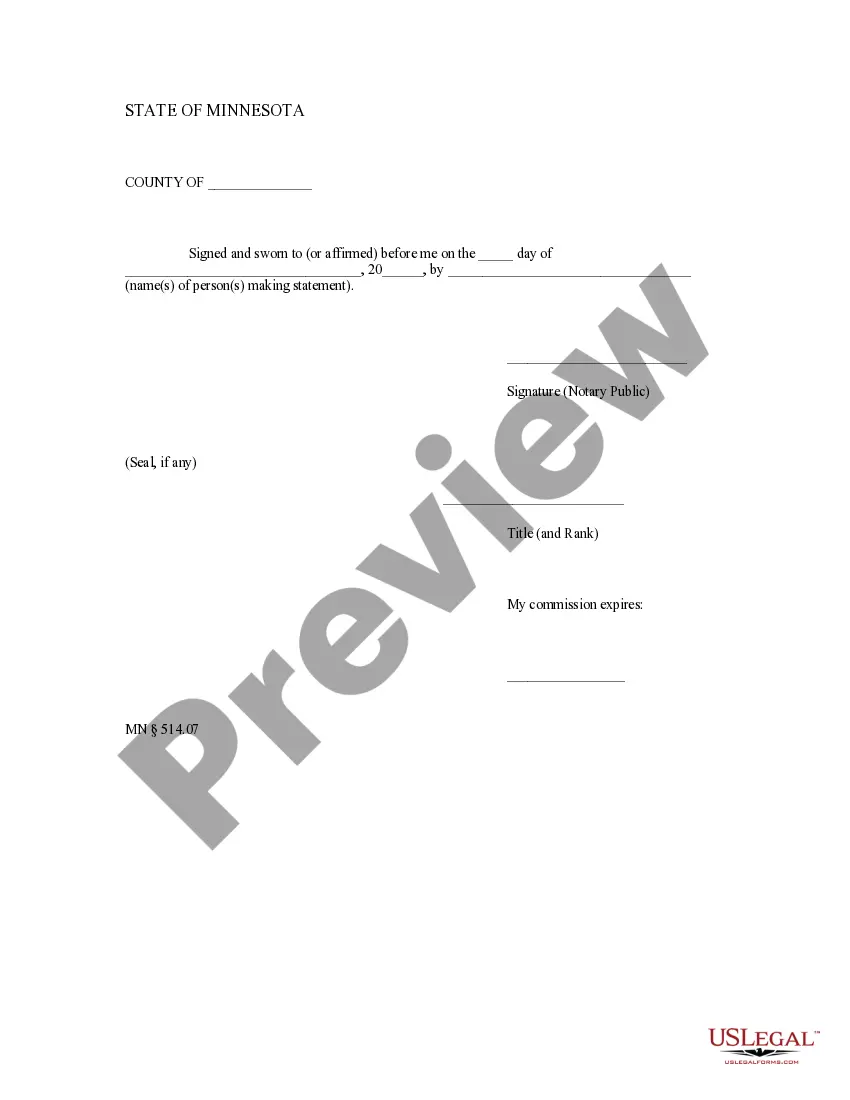

This form is used by a lien claimant to respond to a property owner's request for information about the lien. The request must be made within fifteen (15) days of the completion of work and the lien claimant may not pursue a court action to enforce the lien until ten days after the information is provided.

A Minneapolis Minnesota Verified Statement of Account — Individual is an official document that provides a detailed summary of a person's financial transactions and current balance in the Minneapolis, Minnesota area. This statement is often requested by individuals to gain a comprehensive understanding of their financial status and manage their accounts effectively. Keywords: Minneapolis Minnesota, Verified Statement of Account, Individual, financial transactions, current balance, comprehensive understanding, manage accounts. There are different types of Minneapolis Minnesota Verified Statement of Account — Individual, including: 1. Personal Checking Account Statement: This document focuses on the individual's personal checking account, providing a record of all deposited and withdrawn funds, as well as any fees or charges incurred within a specific period. 2. Savings Account Statement: This type of statement is designed for individuals who maintain a separate savings account. It outlines the details of all transactions made in the account, including deposits, withdrawals, and interest earned over a specific timeframe. 3. Credit Card Statement: For individuals who hold credit cards in Minneapolis, a verified statement of account is crucial. It offers a comprehensive overview of all credit card transactions, payments, outstanding balances, and any applicable interest charges. 4. Loan Account Statement: This type of statement focuses on an individual's loan accounts, such as mortgages, auto loans, or personal loans. It provides detailed information about the outstanding balance, installment payments, interest rates, and any potential penalties. 5. Investment Account Statement: Individuals who have investment accounts can request a verified statement of account to track their investment activities. It includes details about stocks, bonds, mutual funds, and other investment options, along with the current market value and any realized gains or losses. In conclusion, a Minneapolis Minnesota Verified Statement of Account — Individual is a crucial financial document that provides a comprehensive overview of an individual's financial activities, balances, and transactions. It helps individuals effectively manage their finances and make informed decisions about their accounts.A Minneapolis Minnesota Verified Statement of Account — Individual is an official document that provides a detailed summary of a person's financial transactions and current balance in the Minneapolis, Minnesota area. This statement is often requested by individuals to gain a comprehensive understanding of their financial status and manage their accounts effectively. Keywords: Minneapolis Minnesota, Verified Statement of Account, Individual, financial transactions, current balance, comprehensive understanding, manage accounts. There are different types of Minneapolis Minnesota Verified Statement of Account — Individual, including: 1. Personal Checking Account Statement: This document focuses on the individual's personal checking account, providing a record of all deposited and withdrawn funds, as well as any fees or charges incurred within a specific period. 2. Savings Account Statement: This type of statement is designed for individuals who maintain a separate savings account. It outlines the details of all transactions made in the account, including deposits, withdrawals, and interest earned over a specific timeframe. 3. Credit Card Statement: For individuals who hold credit cards in Minneapolis, a verified statement of account is crucial. It offers a comprehensive overview of all credit card transactions, payments, outstanding balances, and any applicable interest charges. 4. Loan Account Statement: This type of statement focuses on an individual's loan accounts, such as mortgages, auto loans, or personal loans. It provides detailed information about the outstanding balance, installment payments, interest rates, and any potential penalties. 5. Investment Account Statement: Individuals who have investment accounts can request a verified statement of account to track their investment activities. It includes details about stocks, bonds, mutual funds, and other investment options, along with the current market value and any realized gains or losses. In conclusion, a Minneapolis Minnesota Verified Statement of Account — Individual is a crucial financial document that provides a comprehensive overview of an individual's financial activities, balances, and transactions. It helps individuals effectively manage their finances and make informed decisions about their accounts.