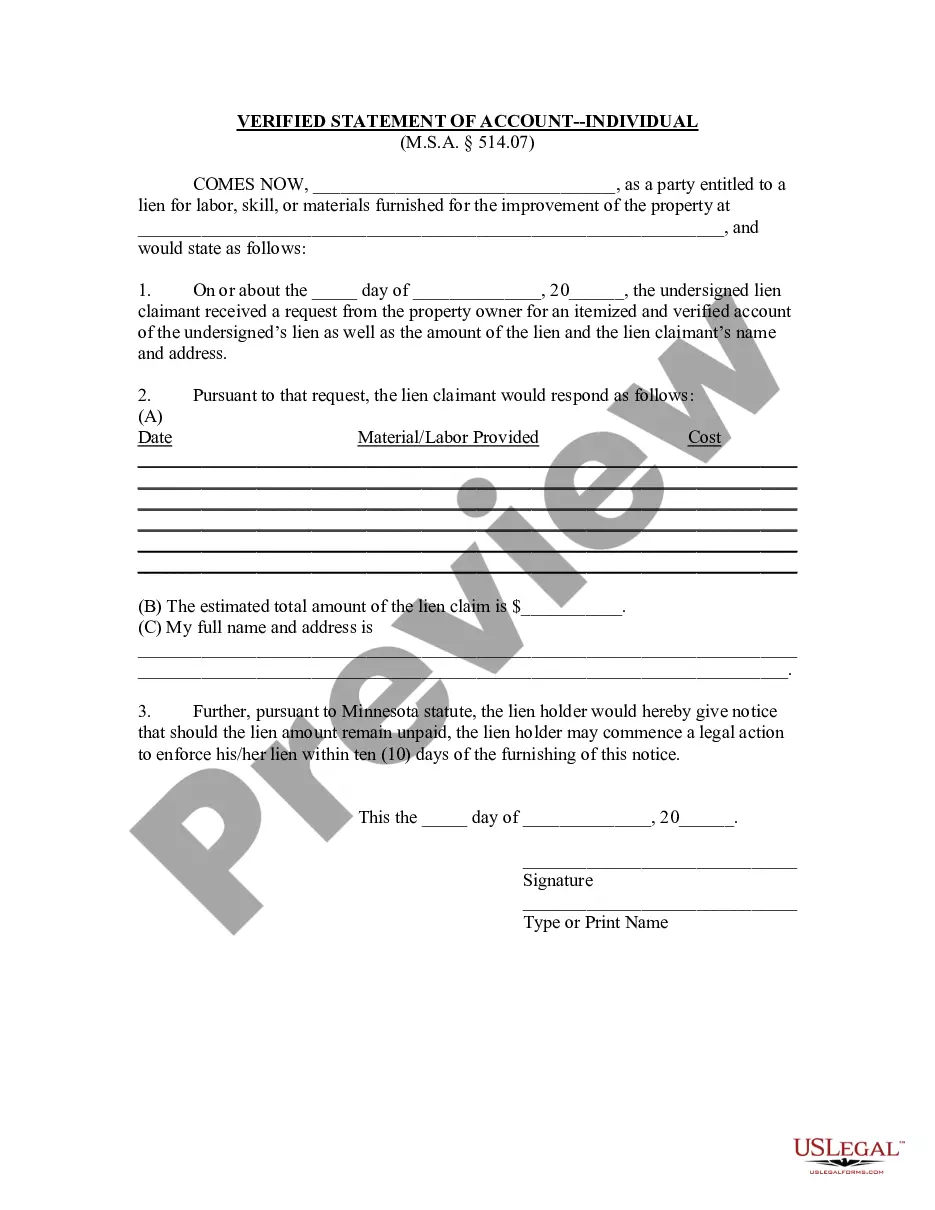

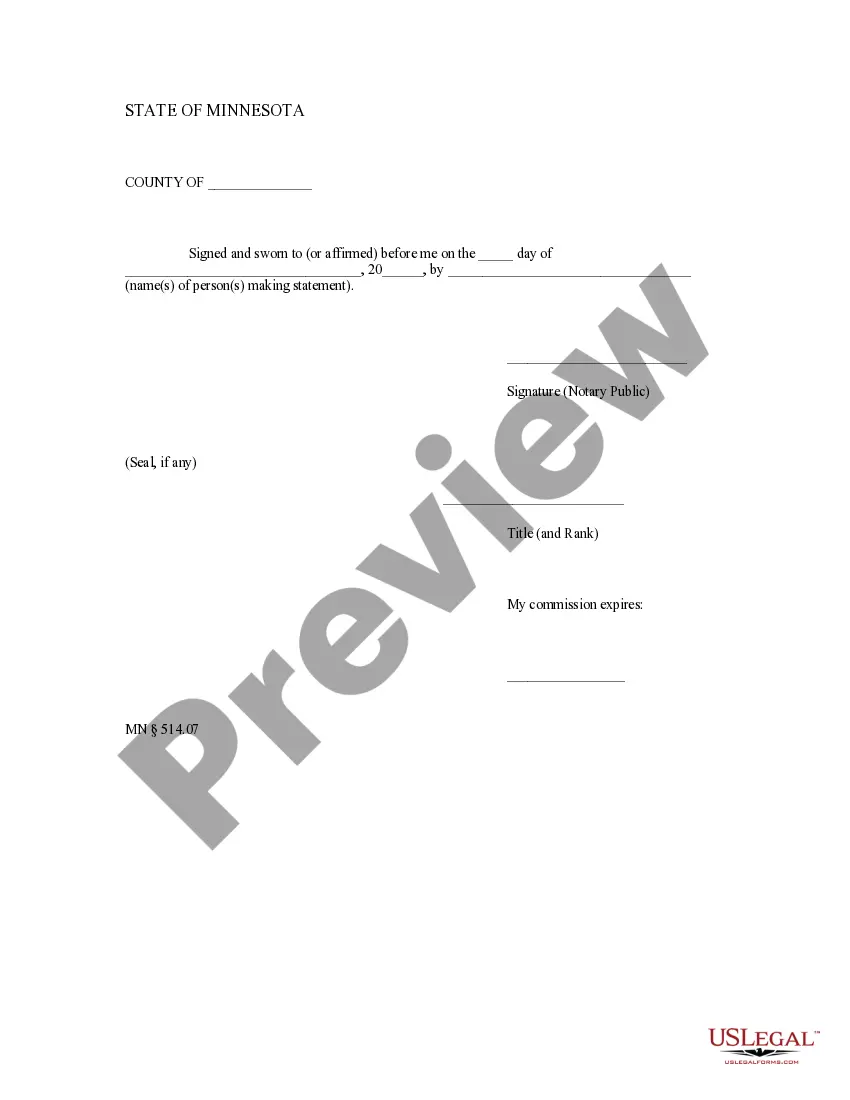

This form is used by a lien claimant to respond to a property owner's request for information about the lien. The request must be made within fifteen (15) days of the completion of work and the lien claimant may not pursue a court action to enforce the lien until ten days after the information is provided.

Saint Paul Minnesota Verified Statement of Account - Individual

Description

How to fill out Saint Paul Minnesota Verified Statement Of Account - Individual?

Locating validated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents for both personal and professional requirements and various real-life situations.

All the forms are correctly categorized by area of application and jurisdiction, making it as simple as ABC to search for the Saint Paul Minnesota Verified Statement of Account - Individual.

Maintaining records organized and in compliance with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates readily available for any needs!

- For those already acquainted with our service and who have utilized it previously, obtaining the Saint Paul Minnesota Verified Statement of Account - Individual takes merely a few clicks.

- All you need to do is Log In to your account, select the document, and click Download to save it on your device.

- The procedure requires only a couple of additional steps for new users.

- Follow the instructions below to get started with the most comprehensive online form library.

- Ensure you’ve chosen the appropriate one that aligns with your requirements and adheres to your local jurisdiction standards.

Form popularity

FAQ

You can access your federal tax account through a secure login at IRS.gov/account.

If your direct deposit fails because you closed your account, the Minnesota Department of Revenue will send you a paper check.

Access Tax Records in Online Account You can view your tax records now in your Online Account. This is the fastest, easiest way to: Find out how much you owe.

You are a Minnesota resident or spent at least 183 days in the state. You lived in and paid rent on a Minnesota building where the owner was assessed property tax or made payments in lieu of property tax. Your household income for 2021 was less than $64,920.

It is dependent upon a difference between the tax that is owed to the Treasury at the end of the year and the amount that has been withheld throughout the year. If the amount of tax owed is less than the latter number, that individual receives a tax refund.

For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

?Requirements to claim the refund ?You owned and lived in the same home on January 2, 2021, and on January 2, 2022. Your home's net property tax increased by more than 12% from 2021 to 2022. The net property tax increase was at least $100. The increase was not because of improvements you made to the property.

Business Tax Return Information For refund information on federal tax returns other than Form 1040, U.S. Individual Income Tax Return, call, toll free, at 800-829-4933. From outside the U.S., call 267-941-1000. TTY/TDD: 800-829-4059. Where's My Refund?

Looking for your property tax statement? You can get a copy of your property tax statement from the county website or county treasurer where the property is located. For websites and contact information, visit County Websites on Minnesota.gov.

The ?additional? or ?special? property tax refund, generally referred to as ?targeting,? directs property tax relief to homeowners who have large property tax increases from one year to the next.