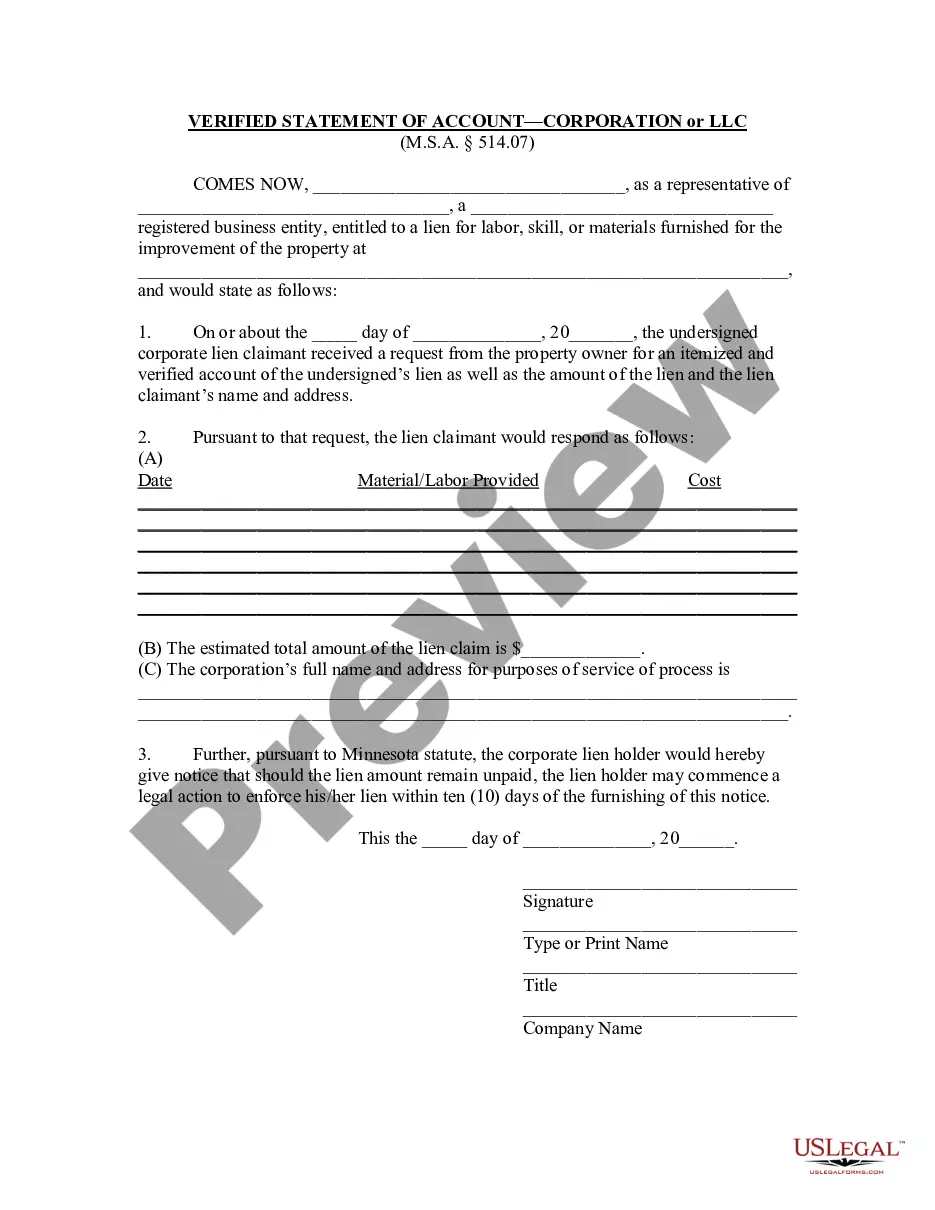

This form is used by a lien claimant to respond to a property owner's request for information about the lien. The request must be made within fifteen (15) days of the completion of work and the lien claimant may not pursue a court action to enforce the lien until ten days after the information is provided.

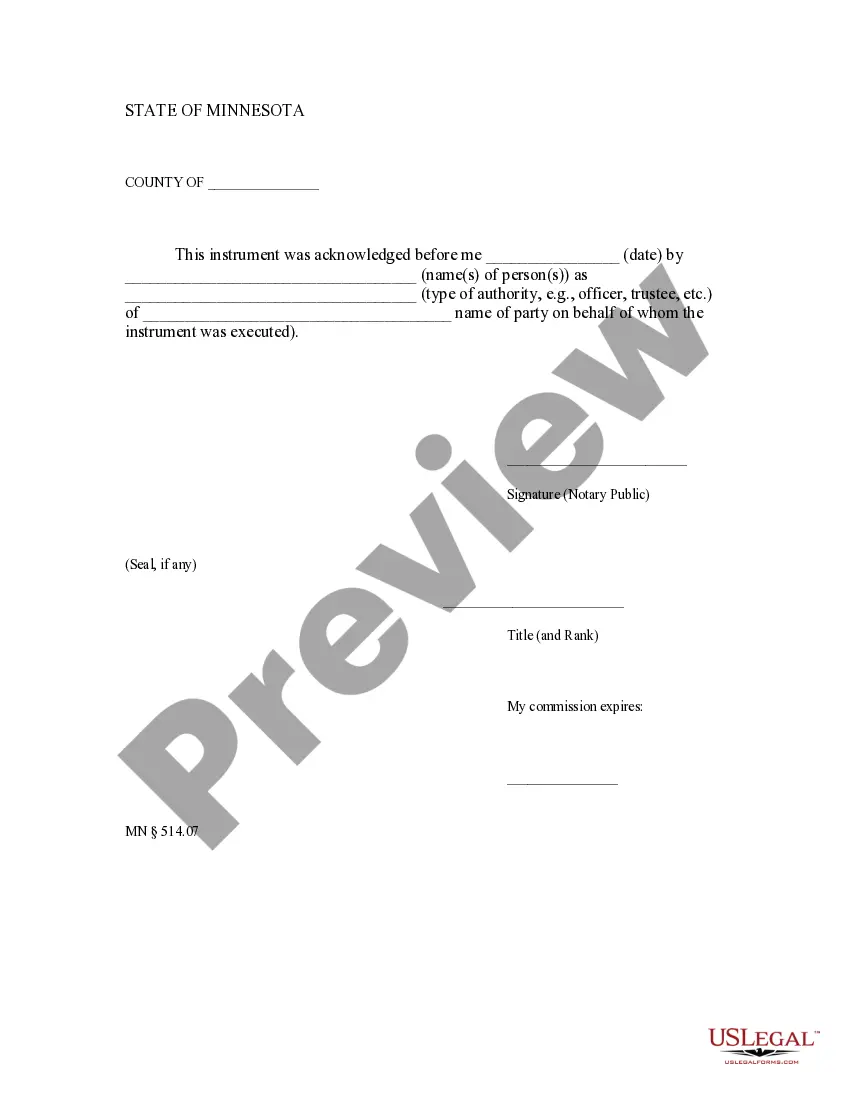

The Hennepin County Treasurer's Office in Minnesota issues a Verified Statement of Account for Corporations or LCS to provide accurate and comprehensive financial information regarding their business activities. This statement serves as a critical document for businesses to review and verify their financial records. The Verified Statement of Account confirms the financial position of corporations or Limited Liability Companies (LCS) operating within Hennepin County. It includes essential details such as account balances, transaction history, payment records, and other relevant financial information. This statement helps businesses ensure the accuracy of their records and facilitates the process of tax reporting, audits, financial planning, and compliance with legal requirements. Within Hennepin County, there are different types of Verified Statements of Account available for Corporations or LCS, depending on their specific needs and circumstances. These include: 1. Annual Verified Statement of Account — Corporation or LLC: This statement is prepared on an annual basis and provides a comprehensive overview of the financial activities throughout the year. It includes balance sheets, income statements, cash flow statements, and other relevant financial data. 2. Quarterly Verified Statement of Account — Corporation or LLC: Some businesses may choose to submit quarterly statements to closely monitor their financial performance on a more frequent basis. This statement allows for regular review and analysis of financial data to assess business growth and identify any potential issues. 3. Verified Statement of Account — Corporation or LLC for Tax Purposes: This type of statement is specifically tailored to meet tax reporting requirements. It includes detailed information such as income, expenses, deductions, and credits, enabling businesses to accurately report their tax liabilities to the appropriate authorities. 4. Verified Statement of Account — Corporation or LLC for Auditing Purposes: For businesses undergoing audits, this statement provides a transparent and detailed overview of their financial records. It assists auditors in assessing the accuracy and reliability of financial information, ensuring compliance with accounting standards and regulations. The Hennepin County Verified Statement of Account for Corporations or LCS is a crucial tool for businesses to maintain accurate financial records and demonstrate transparency. By regularly reviewing and verifying their account statements, corporations and LCS can effectively manage their finances, comply with legal requirements, and make informed business decisions.The Hennepin County Treasurer's Office in Minnesota issues a Verified Statement of Account for Corporations or LCS to provide accurate and comprehensive financial information regarding their business activities. This statement serves as a critical document for businesses to review and verify their financial records. The Verified Statement of Account confirms the financial position of corporations or Limited Liability Companies (LCS) operating within Hennepin County. It includes essential details such as account balances, transaction history, payment records, and other relevant financial information. This statement helps businesses ensure the accuracy of their records and facilitates the process of tax reporting, audits, financial planning, and compliance with legal requirements. Within Hennepin County, there are different types of Verified Statements of Account available for Corporations or LCS, depending on their specific needs and circumstances. These include: 1. Annual Verified Statement of Account — Corporation or LLC: This statement is prepared on an annual basis and provides a comprehensive overview of the financial activities throughout the year. It includes balance sheets, income statements, cash flow statements, and other relevant financial data. 2. Quarterly Verified Statement of Account — Corporation or LLC: Some businesses may choose to submit quarterly statements to closely monitor their financial performance on a more frequent basis. This statement allows for regular review and analysis of financial data to assess business growth and identify any potential issues. 3. Verified Statement of Account — Corporation or LLC for Tax Purposes: This type of statement is specifically tailored to meet tax reporting requirements. It includes detailed information such as income, expenses, deductions, and credits, enabling businesses to accurately report their tax liabilities to the appropriate authorities. 4. Verified Statement of Account — Corporation or LLC for Auditing Purposes: For businesses undergoing audits, this statement provides a transparent and detailed overview of their financial records. It assists auditors in assessing the accuracy and reliability of financial information, ensuring compliance with accounting standards and regulations. The Hennepin County Verified Statement of Account for Corporations or LCS is a crucial tool for businesses to maintain accurate financial records and demonstrate transparency. By regularly reviewing and verifying their account statements, corporations and LCS can effectively manage their finances, comply with legal requirements, and make informed business decisions.