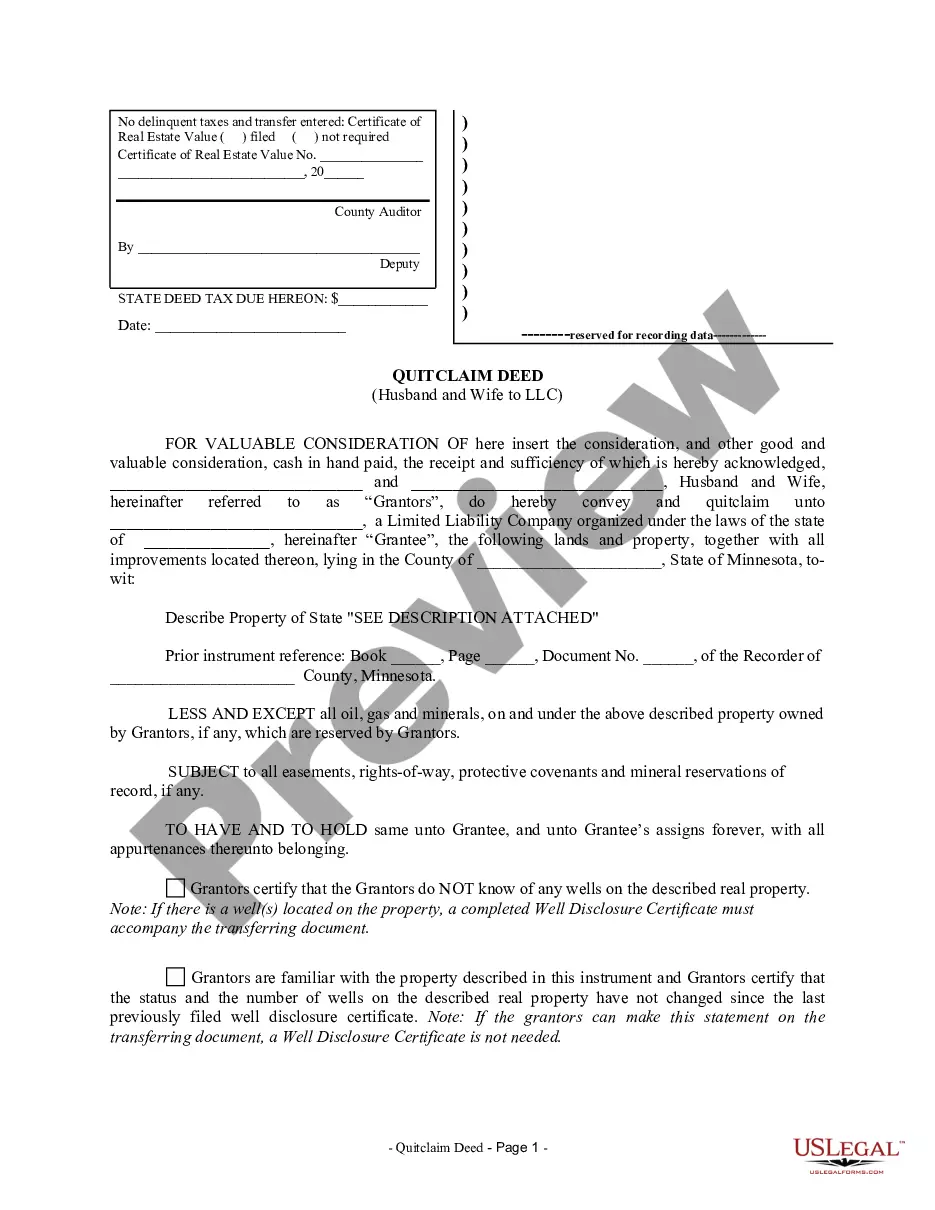

A Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC is a legal document used when a married couple wishes to transfer their interest in a property to a Limited Liability Company (LLC). This type of deed is commonly used for estate planning purposes, asset protection, or business purposes. The Hennepin County, Minnesota, Quitclaim Deed from Husband and Wife to LLC involves the transfer of property ownership rights without any warranties or guarantees by the granters (husband and wife). By executing this deed, the couple conveys their interest in the property, both separately and collectively, to the LLC. This type of deed is often employed by couples who want to protect their personal assets by transferring the property to a business entity, such as an LLC. It can also be useful for tax strategies, separation of personal and business assets, or when financing is involved for the LLC's operations. Different types of Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC may include: 1. Hennepin Minnesota Single Parcel Quitclaim Deed from Husband and Wife to LLC: This is used when transferring ownership of a single property held jointly by the couple to the LLC. 2. Hennepin Minnesota Multiple Parcel Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when the couple wishes to transfer ownership of multiple parcels of property to the LLC. 3. Hennepin Minnesota Residential Quitclaim Deed from Husband and Wife to LLC: Specifically intended for residential properties, this type of deed is used to transfer ownership of a home, condominium, or townhouse owned jointly by the couple to the LLC. 4. Hennepin Minnesota Commercial Quitclaim Deed from Husband and Wife to LLC: Used when transferring ownership of commercial properties, such as office buildings, retail spaces, or warehouses, from husband and wife to the LLC. It is important to note that executing a Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC requires compliance with relevant Minnesota state laws and regulations. Parties involved should consult with legal professionals or real estate experts to ensure a smooth and legally compliant transfer of ownership.

Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out Hennepin Minnesota Quitclaim Deed From Husband And Wife To LLC?

We always strive to minimize or avoid legal damage when dealing with nuanced law-related or financial affairs. To do so, we sign up for attorney services that, usually, are very expensive. However, not all legal issues are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of turning to legal counsel. We offer access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Hennepin Minnesota Quitclaim Deed from Husband and Wife to LLC is suitable for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!