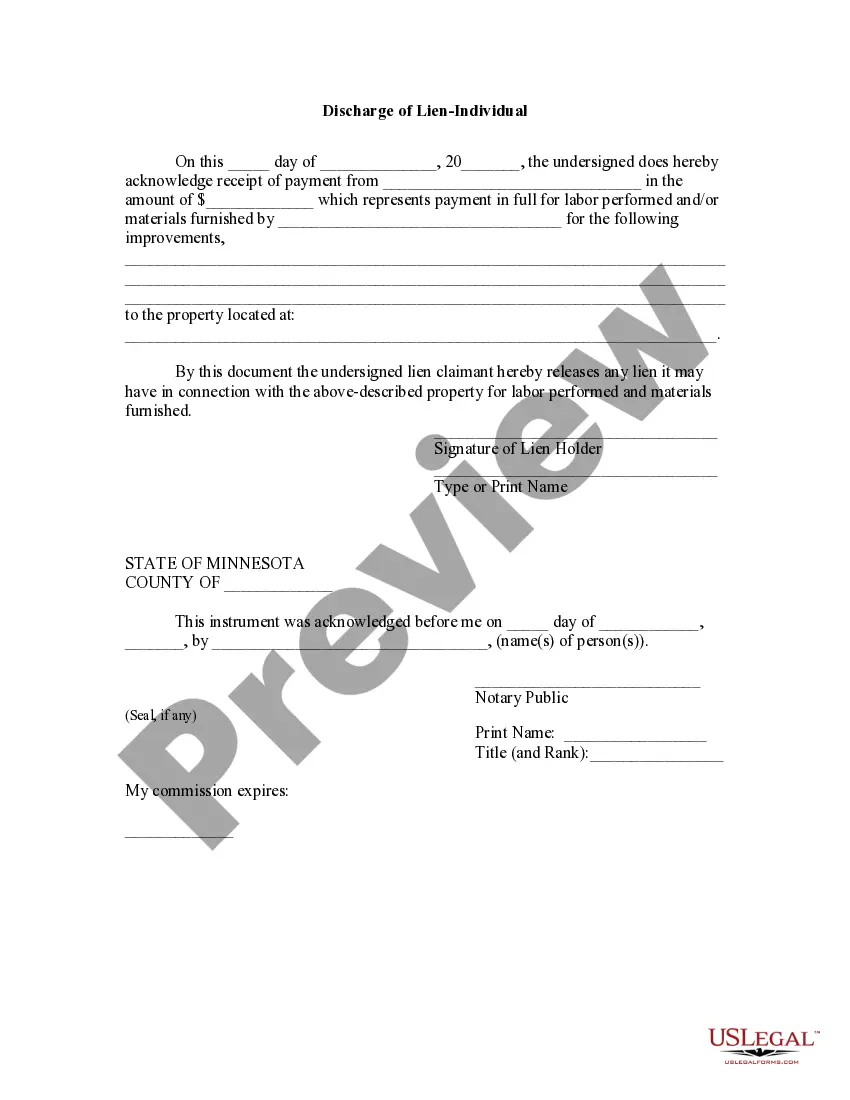

Minnesota law does not have a specific provision for the release of a lien. However, this form is a general use form that would allow a lien holder to provide notice that the lien is released after being paid in full.

Minneapolis, Minnesota Discharge of Lien — Individual: Key Facts and Types A Discharge of Lien, specifically in Minneapolis, Minnesota, refers to a legal document that enables an individual to clear or remove a previously filed lien on their property. This process is crucial for individuals who have paid off their debt, resolved a legal judgment, or wish to transfer ownership of their property. Types of Minneapolis, Minnesota Discharge of Lien — Individual: 1. Mechanic's Lien Discharge: A Mechanic's Lien Discharge is utilized when a property owner has settled their financial obligations with a contractor or subcontractor who placed the lien on the property. By filing this type of discharge, the individual seeks to demonstrate that the lien no longer affects their property and ensure its marketability. 2. Judgment Lien Discharge: A Judgment Lien Discharge is applicable when a property owner has successfully satisfied a legal judgment. This discharge serves as evidence that the judgment lien no longer impacts their property, protecting their rights and title. 3. Li's Pendent Discharge: A Li's Pendent Discharge is utilized to remove a Notice of Pending Action or Li's Pendent from a property's title. This type of discharge is relevant when a property owner has resolved any pending legal disputes, allowing them to ensure the marketability and free transferability of their property. 4. Property Tax Lien Discharge: A Property Tax Lien Discharge is necessary for individuals who have cleared their outstanding property tax debts. This discharge serves as proof that the property tax lien no longer encumbers their property, enabling smooth property transfers or mortgage refinancing. 5. Federal Tax Lien Discharge: A Federal Tax Lien Discharge is filed to release a federal tax lien placed on an individual's property once they have fulfilled their tax obligations. This discharge is essential for individuals who wish to sell their property or refinance their mortgage, removing any hindrance caused by the lien. To initiate the Discharge of Lien process in Minneapolis, Minnesota, an individual must comply with specific requirements, including filing a formal request and paying fees at the appropriate county office or the District Court. It is advisable to consult an attorney or legal professional well-versed in real estate law to ensure a smooth and successful discharge. By obtaining a Minneapolis, Minnesota Discharge of Lien — Individual, property owners can remove any encumbrances or obstacles to their property's marketability, ensuring smooth transactions and peace of mind. Remember, each type of discharge is unique to the specific lien it is intended to remove, be it a mechanic's lien, judgment lien, is pendent, property tax lien, or federal tax lien.Minneapolis, Minnesota Discharge of Lien — Individual: Key Facts and Types A Discharge of Lien, specifically in Minneapolis, Minnesota, refers to a legal document that enables an individual to clear or remove a previously filed lien on their property. This process is crucial for individuals who have paid off their debt, resolved a legal judgment, or wish to transfer ownership of their property. Types of Minneapolis, Minnesota Discharge of Lien — Individual: 1. Mechanic's Lien Discharge: A Mechanic's Lien Discharge is utilized when a property owner has settled their financial obligations with a contractor or subcontractor who placed the lien on the property. By filing this type of discharge, the individual seeks to demonstrate that the lien no longer affects their property and ensure its marketability. 2. Judgment Lien Discharge: A Judgment Lien Discharge is applicable when a property owner has successfully satisfied a legal judgment. This discharge serves as evidence that the judgment lien no longer impacts their property, protecting their rights and title. 3. Li's Pendent Discharge: A Li's Pendent Discharge is utilized to remove a Notice of Pending Action or Li's Pendent from a property's title. This type of discharge is relevant when a property owner has resolved any pending legal disputes, allowing them to ensure the marketability and free transferability of their property. 4. Property Tax Lien Discharge: A Property Tax Lien Discharge is necessary for individuals who have cleared their outstanding property tax debts. This discharge serves as proof that the property tax lien no longer encumbers their property, enabling smooth property transfers or mortgage refinancing. 5. Federal Tax Lien Discharge: A Federal Tax Lien Discharge is filed to release a federal tax lien placed on an individual's property once they have fulfilled their tax obligations. This discharge is essential for individuals who wish to sell their property or refinance their mortgage, removing any hindrance caused by the lien. To initiate the Discharge of Lien process in Minneapolis, Minnesota, an individual must comply with specific requirements, including filing a formal request and paying fees at the appropriate county office or the District Court. It is advisable to consult an attorney or legal professional well-versed in real estate law to ensure a smooth and successful discharge. By obtaining a Minneapolis, Minnesota Discharge of Lien — Individual, property owners can remove any encumbrances or obstacles to their property's marketability, ensuring smooth transactions and peace of mind. Remember, each type of discharge is unique to the specific lien it is intended to remove, be it a mechanic's lien, judgment lien, is pendent, property tax lien, or federal tax lien.