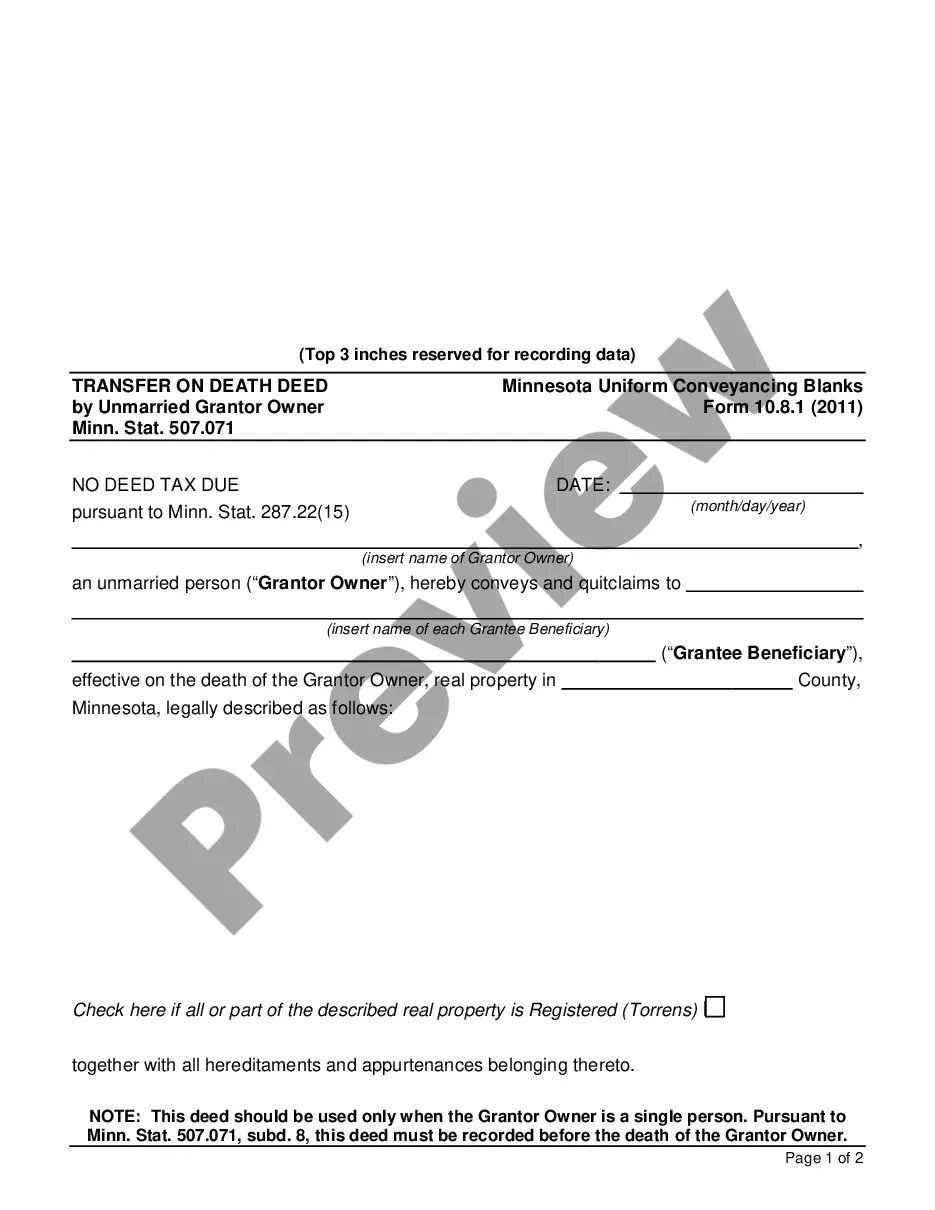

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

When it comes to estate planning in Minneapolis, Minnesota, one option to consider is a Transfer on Death Deed (TODD) under Minn. Stat. 507.071, specifically designed for unmarried granter owners. This legal instrument allows an individual to transfer their real estate property to designated beneficiaries upon their death, without the need for probate. A Minneapolis Minnesota Transfer on Death Deed by Unmarried Granter Owner Minn. Stat. 507.071 is a straightforward and effective way to ensure smooth property transfer and avoid potential complications. By naming beneficiaries, owners retain full control and ownership of their property during their lifetime while also having the ability to modify or revoke the TODD as needed. Some keywords related to the Minneapolis Minnesota Transfer on Death Deed include: 1. Minneapolis: The specific location where the property is situated, emphasizing the jurisdiction's unique laws and regulations. 2. Minnesota: The state in which the property is located, necessitating compliance with the relevant state statutes and legal provisions. 3. Transfer on Death Deed: This legal instrument allows the transfer of real estate property to named beneficiaries upon the owner's death, bypassing the probate process. 4. Unmarried Granter Owner: This specific type of TODD applies to individuals who are not married and solely own the property in question. 5. Minn. Stat. 507.071: Refers to the Minnesota Statute that governs and outlines the requirements and procedures for Transfer on Death Deeds. It's important to note that there aren't different types of Minneapolis Minnesota Transfer on Death Deeds specific to unmarried granter owners under Minn. Stat. 507.071. However, variations may exist when considering different types of property ownership or other specific estate planning needs. By understanding the benefits and implications of a Minneapolis Minnesota Transfer on Death Deed by Unmarried Granter Owner Minn. Stat. 507.071, individuals can make informed decisions regarding their estate plan. Seeking legal advice from a qualified attorney specializing in estate planning is advisable to ensure compliance with all legal requirements and tailoring the TODD to personal circumstances.When it comes to estate planning in Minneapolis, Minnesota, one option to consider is a Transfer on Death Deed (TODD) under Minn. Stat. 507.071, specifically designed for unmarried granter owners. This legal instrument allows an individual to transfer their real estate property to designated beneficiaries upon their death, without the need for probate. A Minneapolis Minnesota Transfer on Death Deed by Unmarried Granter Owner Minn. Stat. 507.071 is a straightforward and effective way to ensure smooth property transfer and avoid potential complications. By naming beneficiaries, owners retain full control and ownership of their property during their lifetime while also having the ability to modify or revoke the TODD as needed. Some keywords related to the Minneapolis Minnesota Transfer on Death Deed include: 1. Minneapolis: The specific location where the property is situated, emphasizing the jurisdiction's unique laws and regulations. 2. Minnesota: The state in which the property is located, necessitating compliance with the relevant state statutes and legal provisions. 3. Transfer on Death Deed: This legal instrument allows the transfer of real estate property to named beneficiaries upon the owner's death, bypassing the probate process. 4. Unmarried Granter Owner: This specific type of TODD applies to individuals who are not married and solely own the property in question. 5. Minn. Stat. 507.071: Refers to the Minnesota Statute that governs and outlines the requirements and procedures for Transfer on Death Deeds. It's important to note that there aren't different types of Minneapolis Minnesota Transfer on Death Deeds specific to unmarried granter owners under Minn. Stat. 507.071. However, variations may exist when considering different types of property ownership or other specific estate planning needs. By understanding the benefits and implications of a Minneapolis Minnesota Transfer on Death Deed by Unmarried Granter Owner Minn. Stat. 507.071, individuals can make informed decisions regarding their estate plan. Seeking legal advice from a qualified attorney specializing in estate planning is advisable to ensure compliance with all legal requirements and tailoring the TODD to personal circumstances.