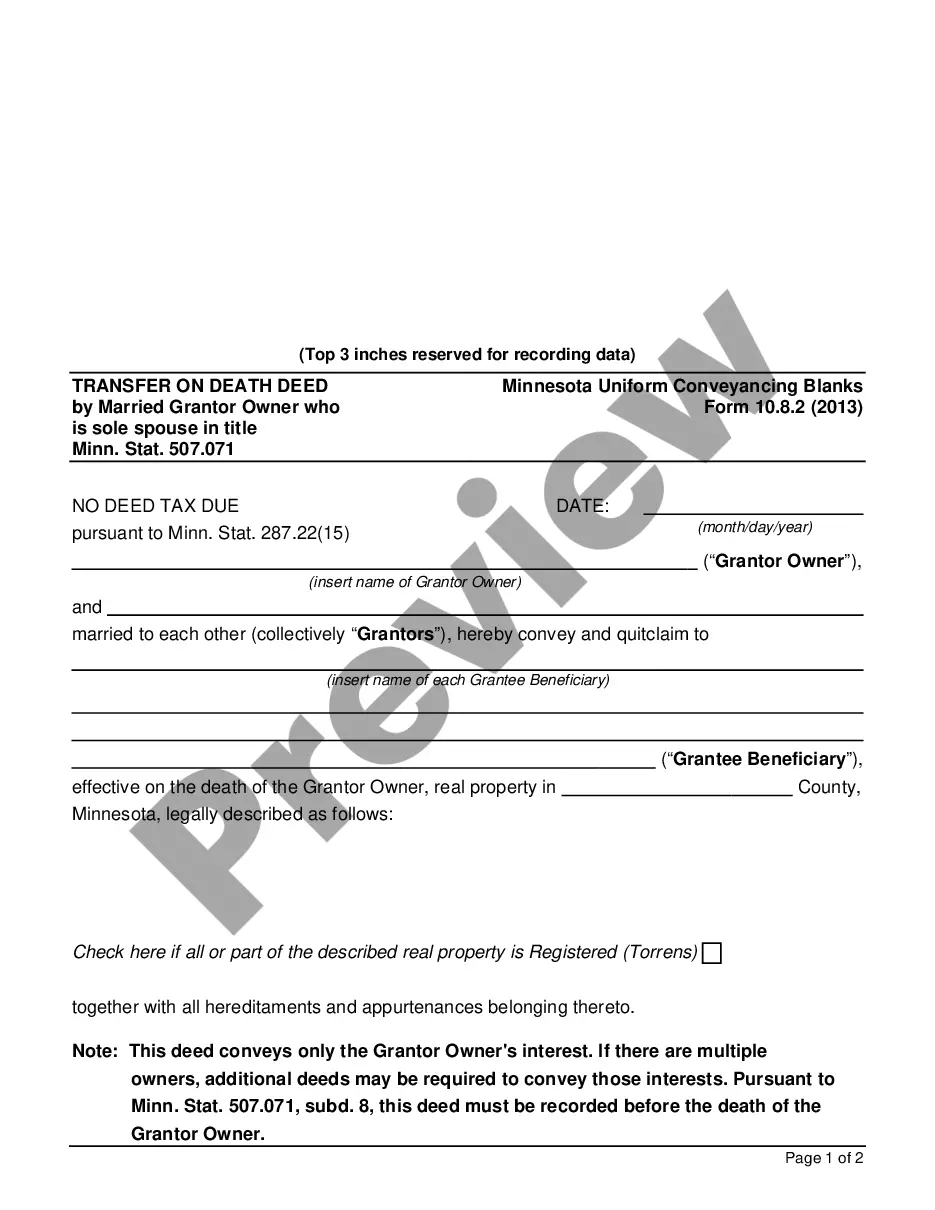

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Minneapolis Minnesota Transfer on Death Deed by Married Granter Owner who is the sole spouse in title Minn. Stat. 507.071 is a legal instrument that allows married individuals, who are the sole owner of real property, to designate a beneficiary who will inherit the property upon the death of the granter. This type of deed is governed by Minnesota Statute 507.071, which provides specific guidelines for creating and executing the transfer on death deed. By using this deed, married individuals in Minneapolis can ensure a smooth transfer of their property to their intended beneficiary without the need for probate or complicated estate planning. There are two primary types of Minneapolis Minnesota Transfer on Death Deed by Married Granter Owner who is sole spouse in title Minn. Stat. 507.071: 1. Joint Tenancy with Rights of Survivorship (TWOS): This type of deed allows married couples to hold the property jointly. If one spouse passes away, the ownership automatically transfers to the surviving spouse without the need for probate. However, the transfer on death aspect of the deed will only come into effect after the death of the surviving spouse. 2. Tenancy in Common (TIC): With this type of deed, each spouse owns a specific percentage of the property. Upon the death of one spouse, their percentage of ownership can be transferred to the designated beneficiary stated in the transfer on death deed. The surviving spouse retains their percentage of ownership until their death when it will pass to their designated beneficiary. By utilizing the Minneapolis Minnesota Transfer on Death Deed by Married Granter Owner who is sole spouse in title Minn. Stat. 507.071, married individuals can have peace of mind knowing that their property will transfer smoothly to their chosen beneficiary, avoiding the need for probate and potentially costly court proceedings. Important keywords for this content: Minneapolis, Minnesota, Transfer on Death Deed, Married Granter Owner, Sole Spouse, Title, Minn. Stat. 507.071, legal instrument, beneficiary, inherit, death of the granter, real property, probate, estate planning, Joint Tenancy with Rights of Survivorship, TWOS, Tenancy in Common, TIC, transfer smoothly, court proceedings.The Minneapolis Minnesota Transfer on Death Deed by Married Granter Owner who is the sole spouse in title Minn. Stat. 507.071 is a legal instrument that allows married individuals, who are the sole owner of real property, to designate a beneficiary who will inherit the property upon the death of the granter. This type of deed is governed by Minnesota Statute 507.071, which provides specific guidelines for creating and executing the transfer on death deed. By using this deed, married individuals in Minneapolis can ensure a smooth transfer of their property to their intended beneficiary without the need for probate or complicated estate planning. There are two primary types of Minneapolis Minnesota Transfer on Death Deed by Married Granter Owner who is sole spouse in title Minn. Stat. 507.071: 1. Joint Tenancy with Rights of Survivorship (TWOS): This type of deed allows married couples to hold the property jointly. If one spouse passes away, the ownership automatically transfers to the surviving spouse without the need for probate. However, the transfer on death aspect of the deed will only come into effect after the death of the surviving spouse. 2. Tenancy in Common (TIC): With this type of deed, each spouse owns a specific percentage of the property. Upon the death of one spouse, their percentage of ownership can be transferred to the designated beneficiary stated in the transfer on death deed. The surviving spouse retains their percentage of ownership until their death when it will pass to their designated beneficiary. By utilizing the Minneapolis Minnesota Transfer on Death Deed by Married Granter Owner who is sole spouse in title Minn. Stat. 507.071, married individuals can have peace of mind knowing that their property will transfer smoothly to their chosen beneficiary, avoiding the need for probate and potentially costly court proceedings. Important keywords for this content: Minneapolis, Minnesota, Transfer on Death Deed, Married Granter Owner, Sole Spouse, Title, Minn. Stat. 507.071, legal instrument, beneficiary, inherit, death of the granter, real property, probate, estate planning, Joint Tenancy with Rights of Survivorship, TWOS, Tenancy in Common, TIC, transfer smoothly, court proceedings.