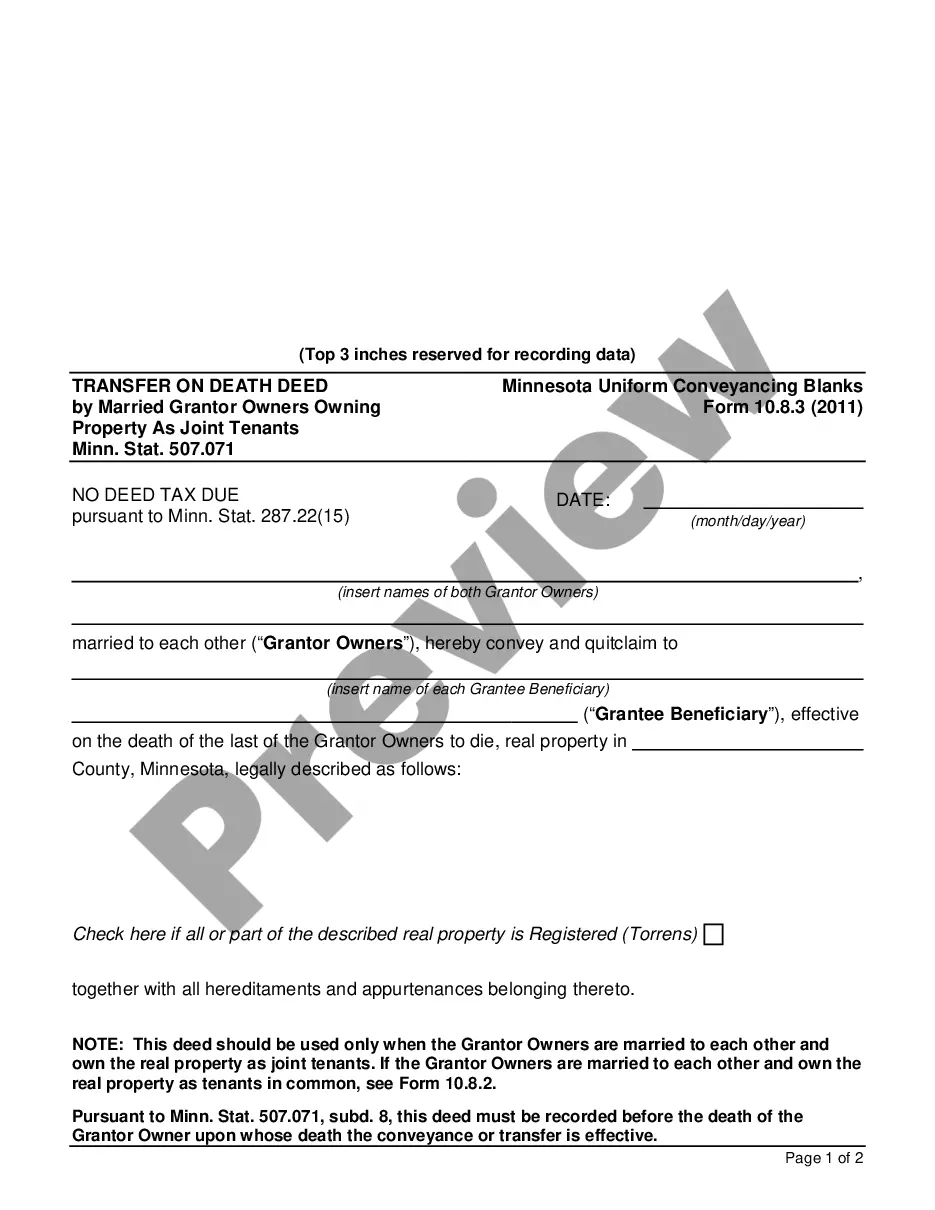

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Hennepin Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, commonly referred to as the "TODD by Married Granters Owners" deed, is a legal document governed by Minn. Stat. 507.071. This deed allows married couples who jointly own property in Hennepin County, Minnesota, to designate beneficiaries who will inherit the property upon their death, without the need for probate. Under Minn. Stat. 507.071, there are two types of transfer on death deeds available to married granter owners who own property as joint tenants: 1. Traditional TODD by Married Granters Owners Deed: This type of transfer on death deed allows married granter owners to designate a specific beneficiary or beneficiaries who will inherit the property after their death. The beneficiaries can be individuals, organizations, or even trusts. This deed provides the married granter owners with complete control over who will eventually own the property. 2. Contingent TODD by Married Granters Owners Deed: A contingent transfer on death deed allows married granter owners to designate primary beneficiaries who will inherit the property after their death. However, in the event that the primary beneficiaries predecease the granter owners, a secondary or contingent beneficiary will inherit the property. This type of deed allows for flexibility if the primary beneficiaries are unable to fulfill their role as heirs. By utilizing the Hennepin Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, married couples can ensure a seamless transfer of property to their chosen beneficiaries, avoiding the often lengthy and expensive probate process. It provides the opportunity to control the distribution of assets and simplifies the process of transferring property rights upon death. It is important to consult with a qualified attorney or legal professional when considering the use of a transfer on death deed to ensure compliance with legal requirements and to understand the implications and benefits specific to your situation.The Hennepin Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, commonly referred to as the "TODD by Married Granters Owners" deed, is a legal document governed by Minn. Stat. 507.071. This deed allows married couples who jointly own property in Hennepin County, Minnesota, to designate beneficiaries who will inherit the property upon their death, without the need for probate. Under Minn. Stat. 507.071, there are two types of transfer on death deeds available to married granter owners who own property as joint tenants: 1. Traditional TODD by Married Granters Owners Deed: This type of transfer on death deed allows married granter owners to designate a specific beneficiary or beneficiaries who will inherit the property after their death. The beneficiaries can be individuals, organizations, or even trusts. This deed provides the married granter owners with complete control over who will eventually own the property. 2. Contingent TODD by Married Granters Owners Deed: A contingent transfer on death deed allows married granter owners to designate primary beneficiaries who will inherit the property after their death. However, in the event that the primary beneficiaries predecease the granter owners, a secondary or contingent beneficiary will inherit the property. This type of deed allows for flexibility if the primary beneficiaries are unable to fulfill their role as heirs. By utilizing the Hennepin Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, married couples can ensure a seamless transfer of property to their chosen beneficiaries, avoiding the often lengthy and expensive probate process. It provides the opportunity to control the distribution of assets and simplifies the process of transferring property rights upon death. It is important to consult with a qualified attorney or legal professional when considering the use of a transfer on death deed to ensure compliance with legal requirements and to understand the implications and benefits specific to your situation.