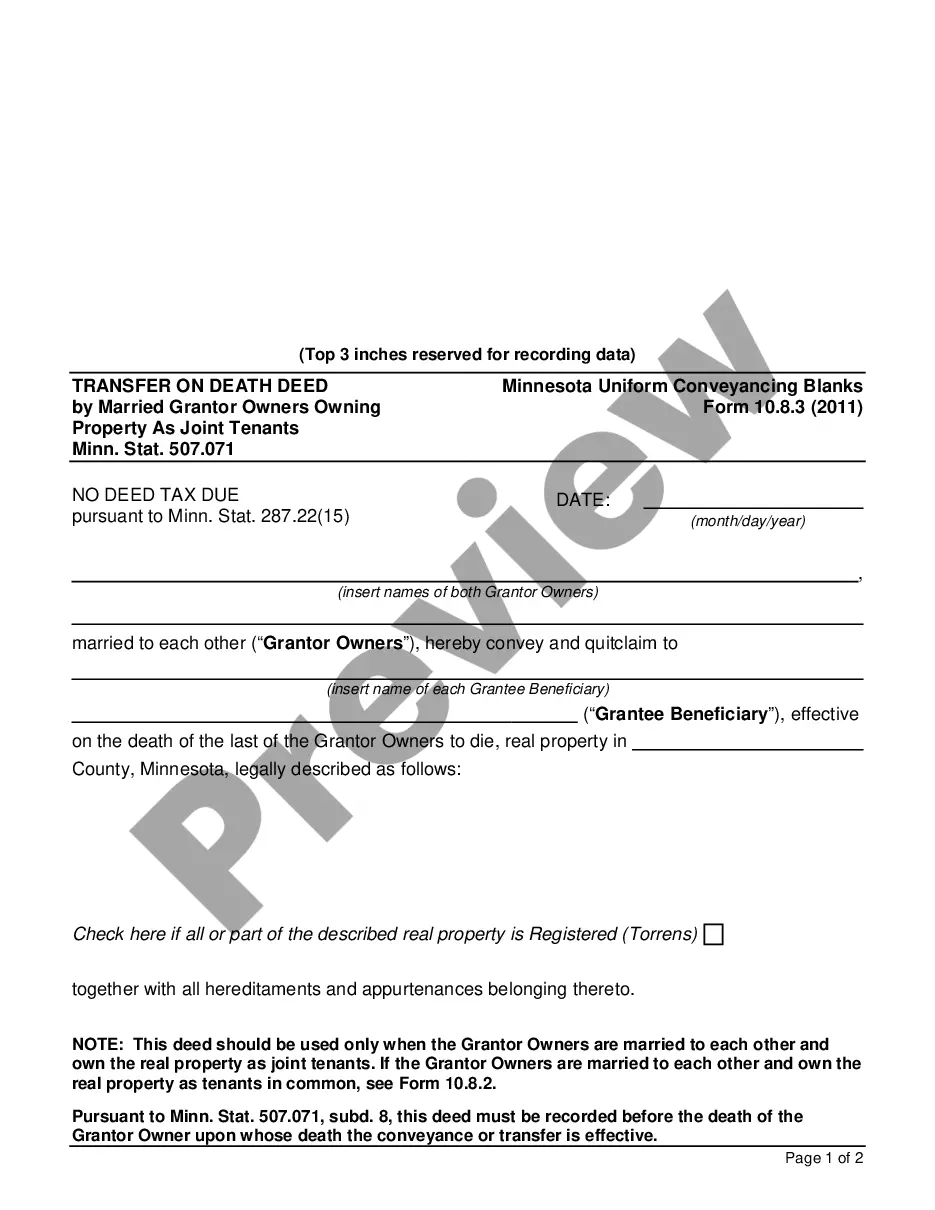

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Minneapolis Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, governed by Minn. Stat. 507.071, is a legal instrument that allows married individuals to transfer their property upon their death without the need for probate. This deed provides a straightforward and efficient way to ensure the seamless transfer of property rights to the intended beneficiaries. Under this statute, there are various types of Transfer on Death Deed options available to married granter owners who jointly own property. Let's delve into the details of each type: 1. Simple Transfer on Death Deed: A married couple owning property as joint tenants can use this type of deed to designate one or more primary beneficiaries who will inherit the property after the death of both spouses. They can also name contingent beneficiaries in case the primary beneficiaries are unable to receive the property. 2. Revocable Transfer on Death Deed: This option grants married granter owners the flexibility to change or revoke the designated beneficiaries at any time during their lifetime. It offers an ideal solution for those who anticipate potential changes in circumstances or relationships. 3. Alternative Transfer on Death Deed: In specific situations where the primary beneficiaries named in the deed are unable or unwilling to accept the property upon the deaths of the granter owners, this provision allows married couples to designate alternative beneficiaries. This ensures that the property is transferred smoothly, even if the initial beneficiaries cannot fulfill their role. With any of these Transfer on Death Deeds, it's vital to understand the key elements involved. The married granter owners must be mindful of the following aspects: a) Legal Requirements: The deed must comply with the specific statutory language outlined in Minn. Stat. 507.071, including the necessary written consent and signatures of both spouses. b) Joint Tenancy Ownership: The granter owners must be registered as joint tenants, which grants them equal ownership and survivorship rights. This means that upon the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share of the property. c) Beneficiary Designation: The married granter owners must clearly identify the primary and alternative beneficiaries, including their full names, addresses, and contact information. Such specific designations prevent any confusion or legal disputes later on. d) Recording the Deed: To ensure the Transfer on Death Deed is enforceable and legally binding, it must be properly recorded with the appropriate county office where the property is located. Understanding the nuances of the Minneapolis Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, as defined in Minn. Stat. 507.071, is essential for married couples seeking a simplified and efficient means to transfer their property without the complexities of probate. By carefully considering the different options available and following the legal requirements, couples can achieve their intended distribution of property and provide security for their loved ones.