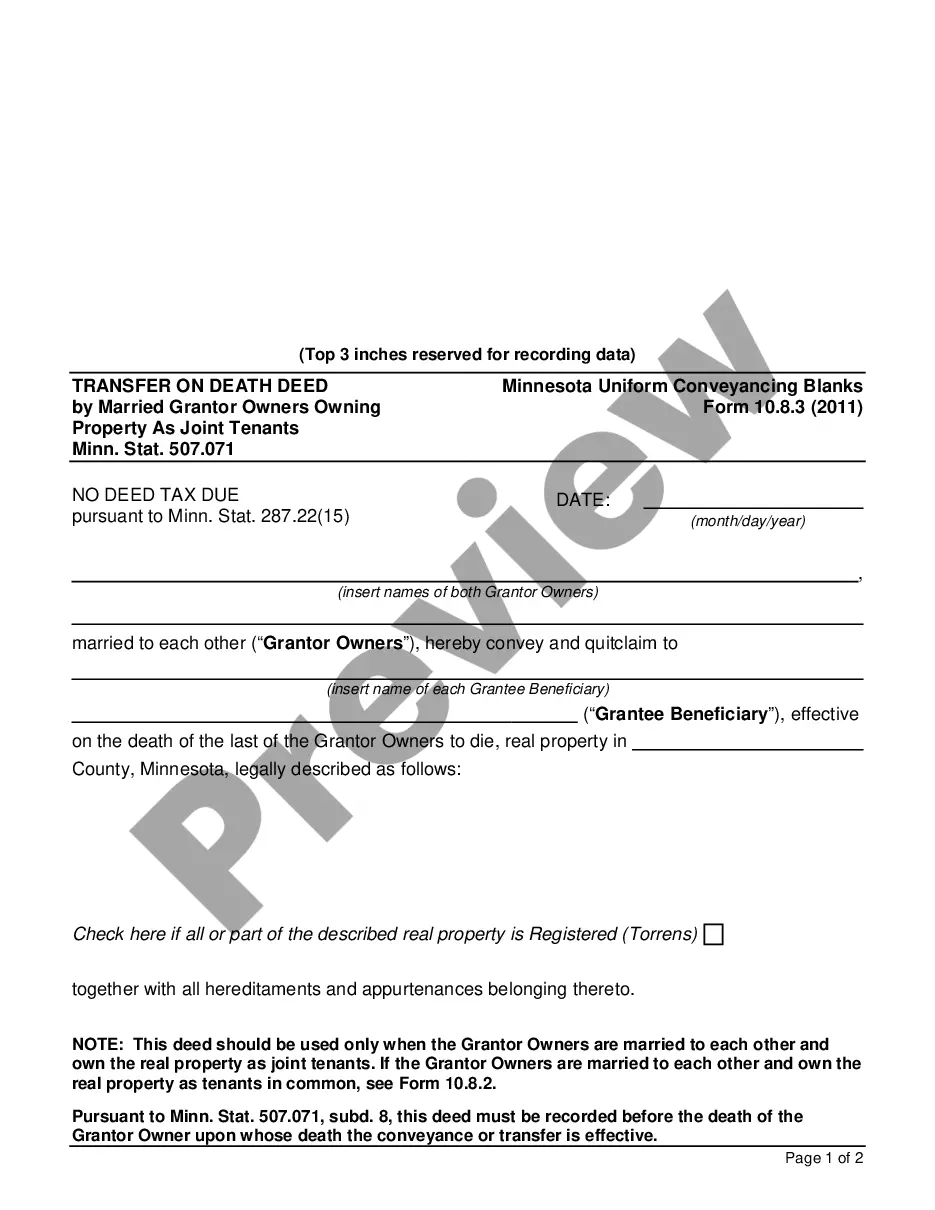

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Saint Paul Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, governed by Minn. Stat. 507.071, is a legal instrument used in estate planning to transfer real estate seamlessly upon the death of the granter(s). This deed allows married couples who jointly own property to designate a beneficiary who will become the new owner automatically, without the need for probate court involvement. There are two primary types of Saint Paul Minnesota Transfer on Death Deeds by Married Granter Owners Owning Property as Joint Tenants governed by Minn. Stat. 507.071: 1. Traditional Transfer on Death Deed: This type of deed is commonly used by married couples in Saint Paul, Minnesota, who wish to ensure a smooth transfer of assets upon their death. It allows the granter(s) — the couple – to name one or more beneficiaries who will receive their share of the property after their death. The surviving spouse retains full ownership and control over the property until their death, after which the property automatically passes to the designated beneficiary/beneficiaries. 2. Contingent Transfer on Death Deed: This variation of the Transfer on Death Deed is suitable for married couples who have a primary beneficiary in mind but want to provide an alternative plan should the beneficiary predecease them. With a contingent Transfer on Death Deed, the granter(s) can designate a secondary or contingent beneficiary who will inherit the property if the primary beneficiary cannot. The Saint Paul Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants provides many benefits. First and foremost, it allows married couples to avoid the time-consuming and costly probate process that is typically required for real estate transfers. Secondly, it offers flexibility, as the granter(s) can revoke or amend the deed at any time during their lifetime, ensuring their wishes are up to date. Lastly, it provides peace of mind for the granter(s) by guaranteeing a seamless transfer of ownership to their chosen beneficiary/beneficiaries. It is crucial to consult an experienced estate planning attorney to ensure that all legal requirements are met while creating a Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants in Saint Paul, Minnesota. Properly executed deeds and accurate consideration of the present and future interests of all parties involved will help protect the property rights and smooth transfer of assets for both the granter(s) and the beneficiaries.The Saint Paul Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants, governed by Minn. Stat. 507.071, is a legal instrument used in estate planning to transfer real estate seamlessly upon the death of the granter(s). This deed allows married couples who jointly own property to designate a beneficiary who will become the new owner automatically, without the need for probate court involvement. There are two primary types of Saint Paul Minnesota Transfer on Death Deeds by Married Granter Owners Owning Property as Joint Tenants governed by Minn. Stat. 507.071: 1. Traditional Transfer on Death Deed: This type of deed is commonly used by married couples in Saint Paul, Minnesota, who wish to ensure a smooth transfer of assets upon their death. It allows the granter(s) — the couple – to name one or more beneficiaries who will receive their share of the property after their death. The surviving spouse retains full ownership and control over the property until their death, after which the property automatically passes to the designated beneficiary/beneficiaries. 2. Contingent Transfer on Death Deed: This variation of the Transfer on Death Deed is suitable for married couples who have a primary beneficiary in mind but want to provide an alternative plan should the beneficiary predecease them. With a contingent Transfer on Death Deed, the granter(s) can designate a secondary or contingent beneficiary who will inherit the property if the primary beneficiary cannot. The Saint Paul Minnesota Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants provides many benefits. First and foremost, it allows married couples to avoid the time-consuming and costly probate process that is typically required for real estate transfers. Secondly, it offers flexibility, as the granter(s) can revoke or amend the deed at any time during their lifetime, ensuring their wishes are up to date. Lastly, it provides peace of mind for the granter(s) by guaranteeing a seamless transfer of ownership to their chosen beneficiary/beneficiaries. It is crucial to consult an experienced estate planning attorney to ensure that all legal requirements are met while creating a Transfer on Death Deed by Married Granter Owners Owning Property as Joint Tenants in Saint Paul, Minnesota. Properly executed deeds and accurate consideration of the present and future interests of all parties involved will help protect the property rights and smooth transfer of assets for both the granter(s) and the beneficiaries.