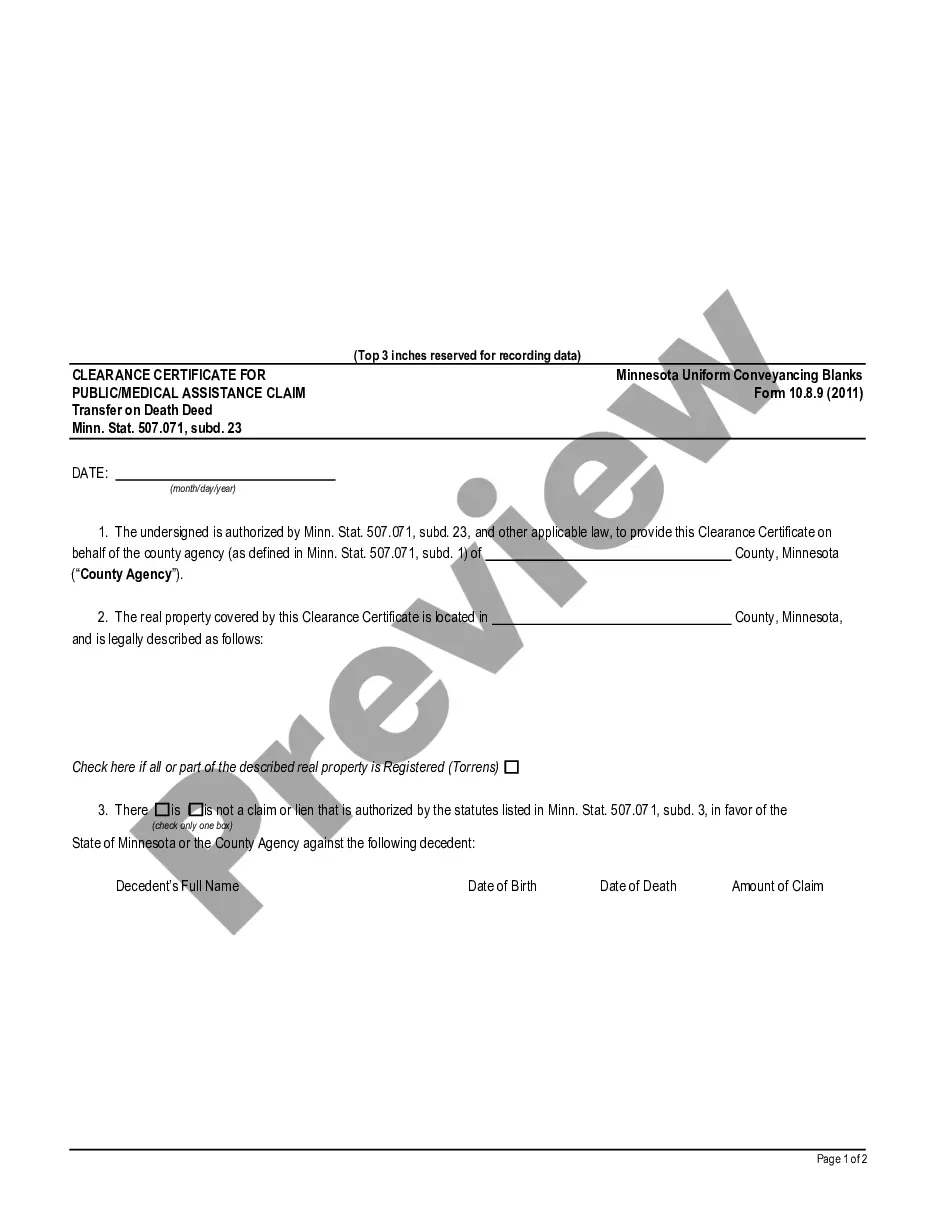

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Saint Paul Minnesota Clearance Certificate for Public / Medical Assistance Claim is a legal document that pertains to the Transfer on Death Deed as defined by Minn. Stat. 507.071, sub. 23. This certificate serves as proof that any applicable liens or claims for public or medical assistance have been cleared from the property mentioned in the Transfer on Death Deed. The purpose of this clearance certificate is to ensure that the property is transferred to the named beneficiaries without any encumbrances. It provides assurance to the beneficiaries that they will receive the property free and clear of any outstanding debts or obligations. There are two main types of Saint Paul Minnesota Clearance Certificates for Public / Medical Assistance Claim — Transfer on Death Deed Minn. Stat. 507.071, sub. 23: 1. Public Assistance Clearance Certificate: This type of certificate confirms that any claims or liens related to public assistance programs, such as Medicaid or welfare, have been cleared from the property. It ensures that the property can be transferred to the intended beneficiaries without any complications arising from public assistance debts. 2. Medical Assistance Clearance Certificate: This certificate specifically addresses any claims or liens related to medical assistance provided by the state. It certifies that all medical assistance debts have been resolved, allowing for a smooth transfer of the property to the designated beneficiaries. These clearance certificates play a crucial role in the completion of a Transfer on Death Deed, as they provide legal evidence that the property is free from any public or medical assistance claims. This protects both the beneficiaries and the estate by ensuring a clean transfer and minimizing the risk of future disputes or complications. It is important to consult with a qualified attorney or legal professional in Saint Paul, Minnesota, to understand the specific requirements and procedures for obtaining the appropriate clearance certificate for a Transfer on Death Deed.