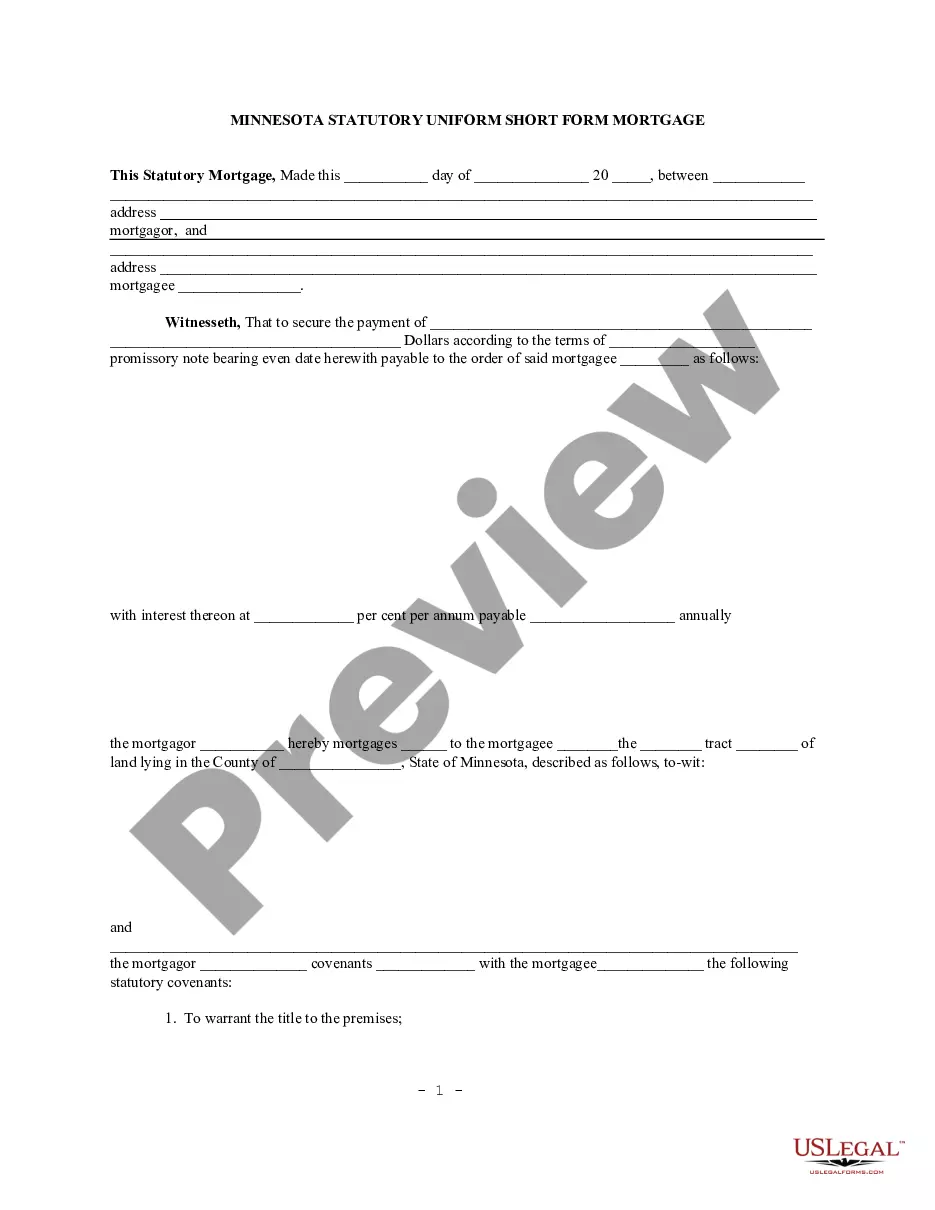

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms are to be used as a guide.

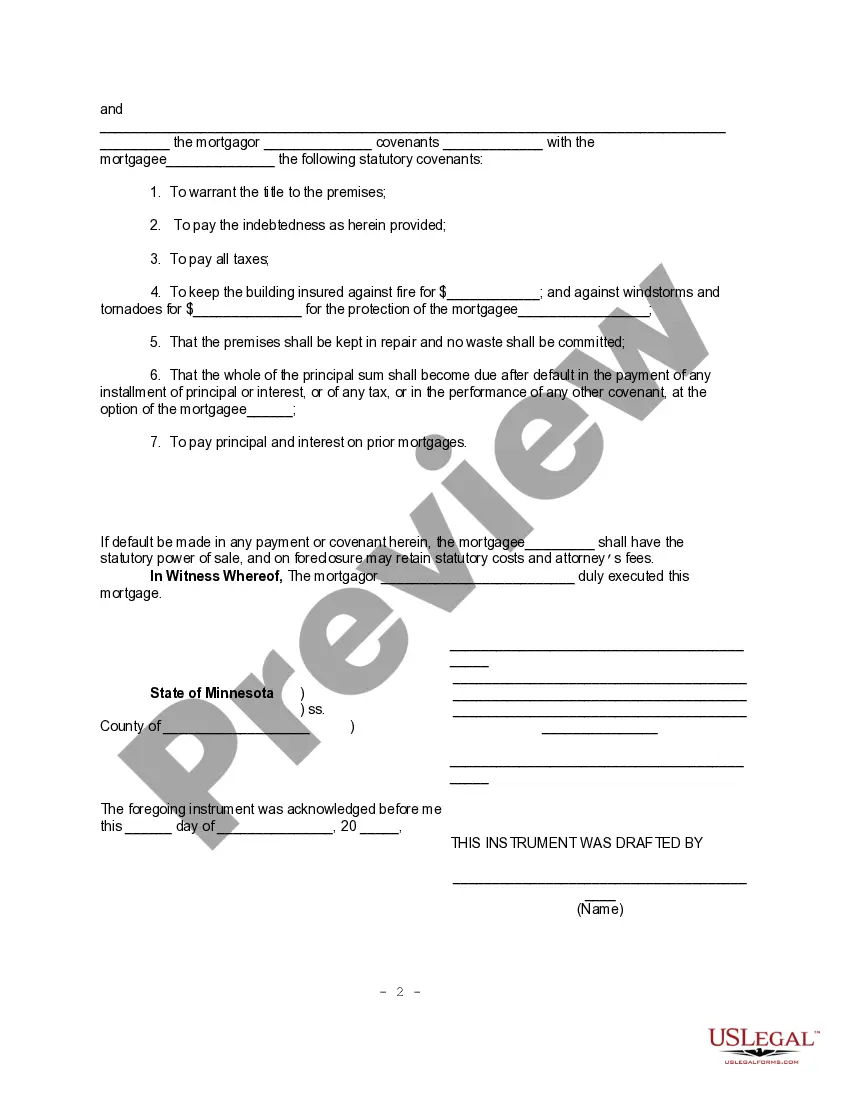

The Minneapolis Minnesota Statutory Uniform Short Form Mortgage, also known as CBC Form 100-M, is a legal document used in Minneapolis, Minnesota, to secure a loan by offering real estate property as collateral. This form follows the statutory guidelines of the state and serves as a standardized agreement between the borrower and the lender. The CBC Form 100-M is essential in the mortgage process as it outlines the rights and obligations of both parties, ensuring a clear understanding of the terms and conditions of the loan. It provides a framework for the repayment schedule, interest rates, and any applicable fees or penalties. Key elements covered in the Minneapolis Minnesota Statutory Uniform Short Form Mortgage include the identification of the borrower(s) and lender(s), details of the mortgaged property (including legal description and address), the loan amount, and the repayment terms. It will also specify the rights of the lender in the event of default, such as the ability to initiate foreclosure proceedings. It's important to note that there may be different variations or revisions of the Minneapolis Minnesota Statutory Uniform Short Form Mortgage CBCBC Form 100-M, depending on updates in state laws or specific requirements. Furthermore, it's crucial for both parties involved to use the most recent version and consult legal professionals to ensure compliance with any changes. The CBC Form 100-M is a vital tool in the mortgage industry, providing a standardized format that protects the interests of both lenders and borrowers in Minneapolis, Minnesota. Ensuring a comprehensive understanding of this document is crucial for anyone involved in mortgage transactions in the area.The Minneapolis Minnesota Statutory Uniform Short Form Mortgage, also known as CBC Form 100-M, is a legal document used in Minneapolis, Minnesota, to secure a loan by offering real estate property as collateral. This form follows the statutory guidelines of the state and serves as a standardized agreement between the borrower and the lender. The CBC Form 100-M is essential in the mortgage process as it outlines the rights and obligations of both parties, ensuring a clear understanding of the terms and conditions of the loan. It provides a framework for the repayment schedule, interest rates, and any applicable fees or penalties. Key elements covered in the Minneapolis Minnesota Statutory Uniform Short Form Mortgage include the identification of the borrower(s) and lender(s), details of the mortgaged property (including legal description and address), the loan amount, and the repayment terms. It will also specify the rights of the lender in the event of default, such as the ability to initiate foreclosure proceedings. It's important to note that there may be different variations or revisions of the Minneapolis Minnesota Statutory Uniform Short Form Mortgage CBCBC Form 100-M, depending on updates in state laws or specific requirements. Furthermore, it's crucial for both parties involved to use the most recent version and consult legal professionals to ensure compliance with any changes. The CBC Form 100-M is a vital tool in the mortgage industry, providing a standardized format that protects the interests of both lenders and borrowers in Minneapolis, Minnesota. Ensuring a comprehensive understanding of this document is crucial for anyone involved in mortgage transactions in the area.