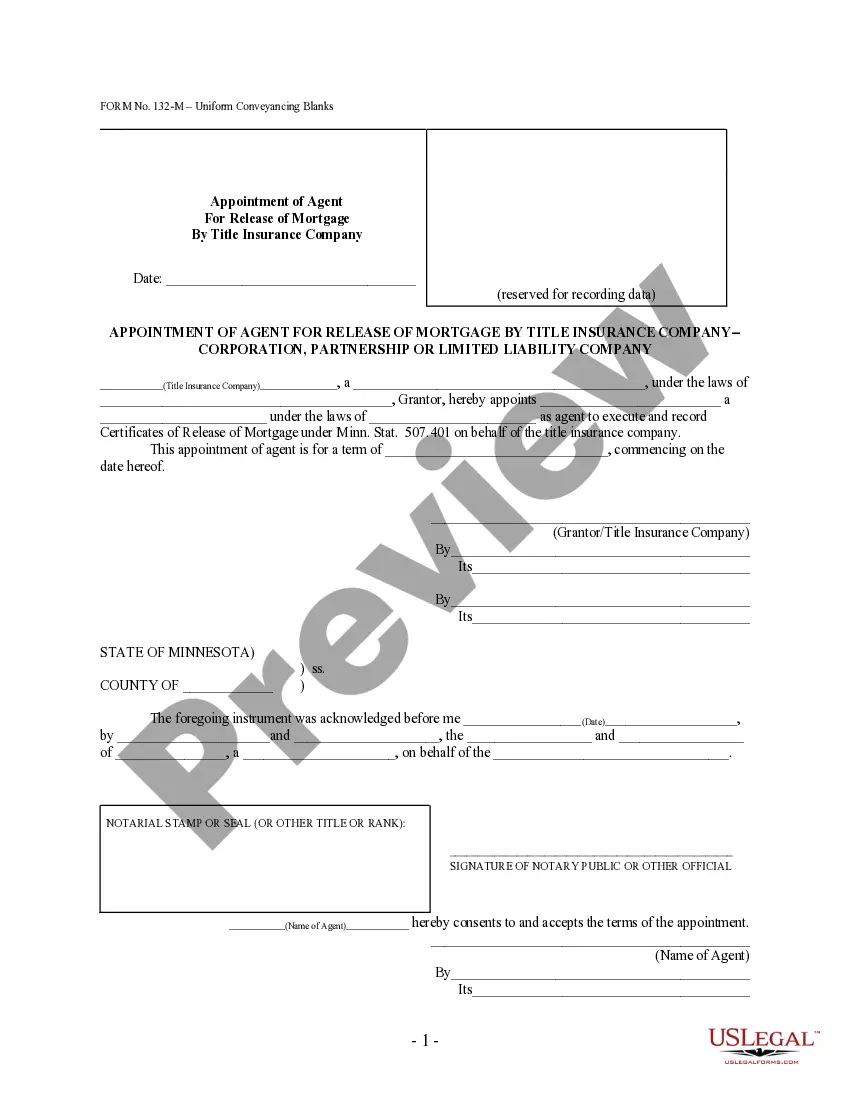

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Hennepin Minnesota Certificate And Request For Notice by Business Entity — Form 60.6.2 is a legal document that serves a specific purpose in the state of Minnesota. This form is commonly used by business entities to request notice of any legal actions or proceedings involving a particular property. The purpose of this form is to ensure that business entities are notified in a timely manner of any legal actions or proceedings related to property ownership or interest they hold in Hennepin County, Minnesota. By submitting this form, the business entity is requesting to be informed about any forthcoming court cases, foreclosure proceedings, or other legal matters that may affect their rights or interests. The Hennepin Minnesota Certificate And Request For Notice by Business Entity — Form 60.6.2 is an essential tool for business entities to protect their interests and stay informed about any potential legal actions. By completing this form, the entity will be added to the list of interested parties, ensuring that they receive legal notices and updates regarding the property in question. It is important for business entities in Hennepin County, Minnesota to understand the different types of notices that can be requested using this form. Here are a few variations: 1. Foreclosure Notice: This type of notice ensures that the business entity will receive updates and notifications regarding foreclosure proceedings related to the property mentioned in the form. This is particularly crucial for entities holding mortgage interests or liens on the property. 2. Court Case Notice: By filing this form, the business entity can request to be notified of any ongoing or upcoming court cases involving the property. This allows them to stay informed about potential legal actions that may affect their rights or interests. 3. Tax Lien Notice: In cases where the property has tax liens, the business entity can use this form to request notice of any tax-related proceedings, such as tax lien sales or redemption periods. By utilizing the Hennepin Minnesota Certificate And Request For Notice by Business Entity — Form 60.6.2, business entities can ensure that they are kept informed about any legal actions or proceedings that may impact their property interests in Hennepin County, Minnesota. It is recommended that businesses consult with legal professionals to accurately complete and submit this form, ensuring their rights and interests are protected.The Hennepin Minnesota Certificate And Request For Notice by Business Entity — Form 60.6.2 is a legal document that serves a specific purpose in the state of Minnesota. This form is commonly used by business entities to request notice of any legal actions or proceedings involving a particular property. The purpose of this form is to ensure that business entities are notified in a timely manner of any legal actions or proceedings related to property ownership or interest they hold in Hennepin County, Minnesota. By submitting this form, the business entity is requesting to be informed about any forthcoming court cases, foreclosure proceedings, or other legal matters that may affect their rights or interests. The Hennepin Minnesota Certificate And Request For Notice by Business Entity — Form 60.6.2 is an essential tool for business entities to protect their interests and stay informed about any potential legal actions. By completing this form, the entity will be added to the list of interested parties, ensuring that they receive legal notices and updates regarding the property in question. It is important for business entities in Hennepin County, Minnesota to understand the different types of notices that can be requested using this form. Here are a few variations: 1. Foreclosure Notice: This type of notice ensures that the business entity will receive updates and notifications regarding foreclosure proceedings related to the property mentioned in the form. This is particularly crucial for entities holding mortgage interests or liens on the property. 2. Court Case Notice: By filing this form, the business entity can request to be notified of any ongoing or upcoming court cases involving the property. This allows them to stay informed about potential legal actions that may affect their rights or interests. 3. Tax Lien Notice: In cases where the property has tax liens, the business entity can use this form to request notice of any tax-related proceedings, such as tax lien sales or redemption periods. By utilizing the Hennepin Minnesota Certificate And Request For Notice by Business Entity — Form 60.6.2, business entities can ensure that they are kept informed about any legal actions or proceedings that may impact their property interests in Hennepin County, Minnesota. It is recommended that businesses consult with legal professionals to accurately complete and submit this form, ensuring their rights and interests are protected.