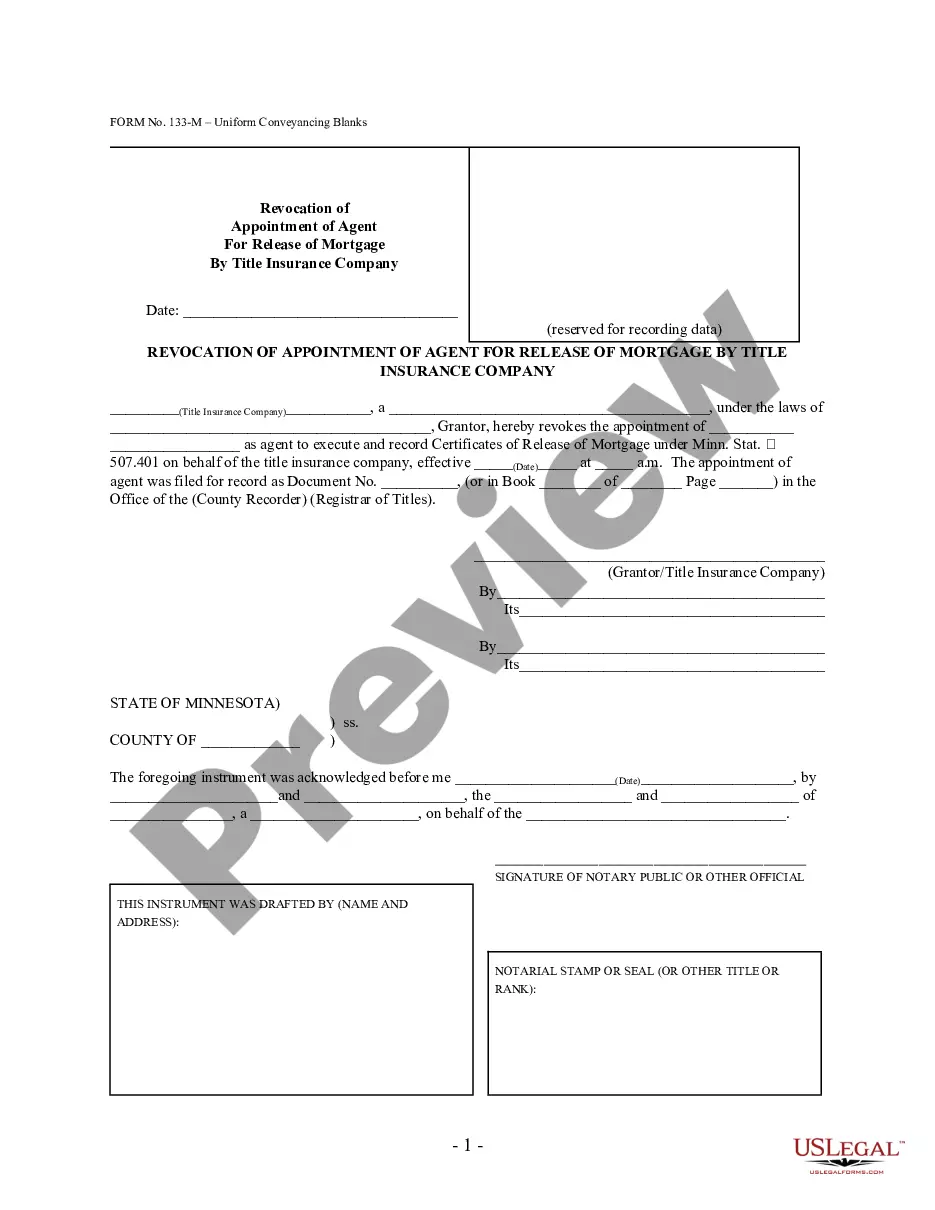

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce.

The Saint Paul Minnesota Revocation of Appointment of Agent For Release Mortgage by Title Insurance Company — Minn. Stat507.400— - UCBC Form 20.7.6 is a legal document used in the state of Minnesota for the purpose of revoking the appointment of an agent who was previously authorized to release a mortgage on behalf of a title insurance company. This form is governed by the Minnesota Statute 507.401 and must adhere to the requirements outlined by the CBC Form 20.7.6. This Revocation of Appointment of Agent For Release Mortgage form is used to formally withdraw the authority granted to an agent to release a mortgage, which is typically granted by a title insurance company. The agent, who was previously authorized to handle such transactions, will no longer have the power to release any mortgages on behalf of the company. By filing this revocation form, the title insurance company effectively notifies all parties involved, including borrowers, lenders, and other relevant entities, that the previously appointed agent's authority is being terminated. This step is crucial to ensure that the release of mortgages is handled appropriately and that the company retains control over its mortgage-related activities. It's important to note that there are no specific variations or types of this particular form mentioned. However, it is always advisable to consult with legal professionals or the relevant authorities to ensure compliance with the specific requirements in Saint Paul, Minnesota. In conclusion, the Saint Paul Minnesota Revocation of Appointment of Agent For Release Mortgage by Title Insurance Company — Minn. Stat507.400— - UCBC Form 20.7.6 serves as a crucial legal document for title insurance companies operating in Saint Paul, Minnesota. It allows them to formally revoke the authority previously granted to an agent for releasing mortgages, ensuring that the company maintains control over these important transactions.The Saint Paul Minnesota Revocation of Appointment of Agent For Release Mortgage by Title Insurance Company — Minn. Stat507.400— - UCBC Form 20.7.6 is a legal document used in the state of Minnesota for the purpose of revoking the appointment of an agent who was previously authorized to release a mortgage on behalf of a title insurance company. This form is governed by the Minnesota Statute 507.401 and must adhere to the requirements outlined by the CBC Form 20.7.6. This Revocation of Appointment of Agent For Release Mortgage form is used to formally withdraw the authority granted to an agent to release a mortgage, which is typically granted by a title insurance company. The agent, who was previously authorized to handle such transactions, will no longer have the power to release any mortgages on behalf of the company. By filing this revocation form, the title insurance company effectively notifies all parties involved, including borrowers, lenders, and other relevant entities, that the previously appointed agent's authority is being terminated. This step is crucial to ensure that the release of mortgages is handled appropriately and that the company retains control over its mortgage-related activities. It's important to note that there are no specific variations or types of this particular form mentioned. However, it is always advisable to consult with legal professionals or the relevant authorities to ensure compliance with the specific requirements in Saint Paul, Minnesota. In conclusion, the Saint Paul Minnesota Revocation of Appointment of Agent For Release Mortgage by Title Insurance Company — Minn. Stat507.400— - UCBC Form 20.7.6 serves as a crucial legal document for title insurance companies operating in Saint Paul, Minnesota. It allows them to formally revoke the authority previously granted to an agent for releasing mortgages, ensuring that the company maintains control over these important transactions.