A security deposit is a payment required by a landlord from a tenant to cover the expenses of any repairs of damages to the premises greater than normal "wear and tear." Everyday usage is normal wear and tear, but excess damage is a debated definition. A security deposit is not the same as rent. It is money that actually belongs to the tenant but is held by the landlord for tenant-caused damages and sometimes past-due rent. Without the agreement of the landlord, a security deposit may not legally be used as the last month's rent.

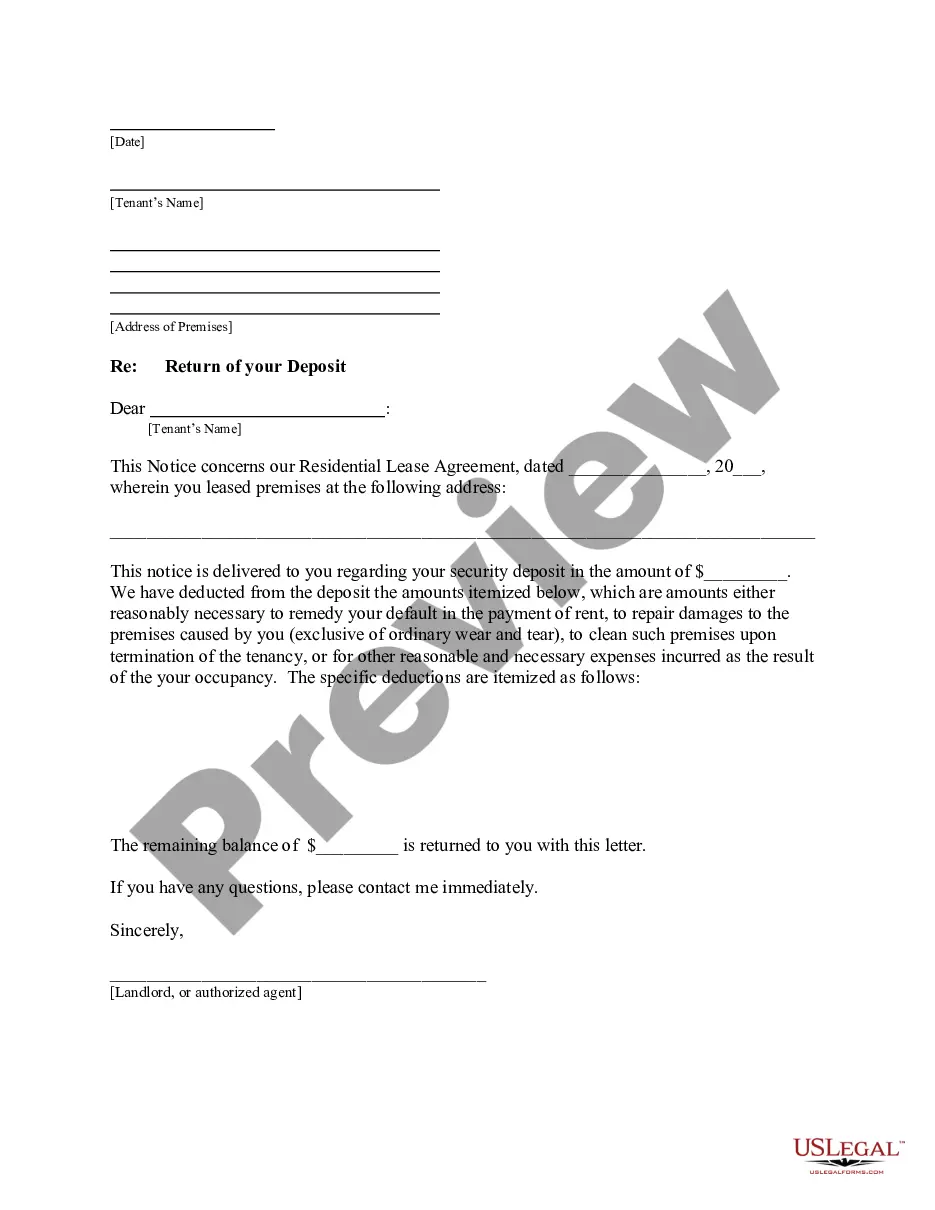

Laws vary by state, but some states place a limit on the amount of a security deposit that a landlord may charge. Some states also regulate where residential security deposits must be kept and when interest payments on the security deposits must be made to the tenant. State laws also define the time period after the tenant vacates within which the deposit must be returned to the tenant. Title: Saint Paul, Minnesota Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In Saint Paul, Minnesota, a landlord is required by law to return a tenant's security deposit within a certain time frame after the lease agreement has ended. This detailed description will guide landlords in writing a comprehensive letter to tenants, notifying them about the return of their security deposit with applicable deductions. Understanding the essential elements of such a letter can help ensure proper compliance with local regulations. Content: 1. Greeting and Introduction: — Begin the letter by addressing the tenant by name and expressing gratitude for their tenancy. — State that the purpose of the letter is to provide details regarding the return of their security deposit, highlighting any deductions made. 2. Security Deposit Overview: — Mention the original amount of the security deposit paid by the tenant when they first moved in. — Indicate the date on which the lease agreement ended, and briefly summarize the terms and conditions related to the security deposit return. 3. Deductions Explanation: — Clearly state the deductions made from the security deposit explaining the nature of each deduction. — Include specific details such as maintenance or repair costs, unpaid rent, outstanding utilities, or any other applicable charges. — If possible, attach supporting documents or itemized invoices addressing each deduction. 4. Security Deposit Refund: — Calculate the remaining amount of the security deposit after deducting applicable charges. — Clearly specify the amount that will be refunded to the tenant. — Mention the mode of refund, such as a check or direct deposit, and provide the necessary instructions for any additional steps required. 5. Informative Attachments: — Include copies of any relevant documentation, invoices, or receipts supporting the deductions made. — Address any outstanding balance, if applicable, and provide instructions for its resolution. 6. Contact Information: — Provide accurate contact details, including phone number and email, for the tenant to seek clarification or ask further questions. — Specify the deadline by which the tenant should respond if they disagree with the deductions or require additional information. 7. Closing: — Express gratitude for the tenant's occupancy, repeat best wishes, and sign the letter with your full name and title. — Encourage the tenant to contact you promptly if any further assistance is required. Types of Saint Paul, Minnesota Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Refund Letter: — This letter applies to most scenarios where the tenant is receiving a refund after valid deductions are made. 2. Itemized Security Deposit Deductions Letter: — In cases where there are various deductions from the security deposit, this letter provides a detailed breakdown of each charge. 3. Outstanding Balances Security Deposit Deductions Letter: — If the deductions exceed the security deposit amount, this letter addresses the remaining balance owed by the tenant, including instructions for repayment. Remember to consult Saint Paul's city ordinances and state laws regarding security deposit return requirements to ensure compliance and accuracy in the letter.

Title: Saint Paul, Minnesota Letter from Landlord to Tenant Returning Security Deposit Less Deductions Introduction: In Saint Paul, Minnesota, a landlord is required by law to return a tenant's security deposit within a certain time frame after the lease agreement has ended. This detailed description will guide landlords in writing a comprehensive letter to tenants, notifying them about the return of their security deposit with applicable deductions. Understanding the essential elements of such a letter can help ensure proper compliance with local regulations. Content: 1. Greeting and Introduction: — Begin the letter by addressing the tenant by name and expressing gratitude for their tenancy. — State that the purpose of the letter is to provide details regarding the return of their security deposit, highlighting any deductions made. 2. Security Deposit Overview: — Mention the original amount of the security deposit paid by the tenant when they first moved in. — Indicate the date on which the lease agreement ended, and briefly summarize the terms and conditions related to the security deposit return. 3. Deductions Explanation: — Clearly state the deductions made from the security deposit explaining the nature of each deduction. — Include specific details such as maintenance or repair costs, unpaid rent, outstanding utilities, or any other applicable charges. — If possible, attach supporting documents or itemized invoices addressing each deduction. 4. Security Deposit Refund: — Calculate the remaining amount of the security deposit after deducting applicable charges. — Clearly specify the amount that will be refunded to the tenant. — Mention the mode of refund, such as a check or direct deposit, and provide the necessary instructions for any additional steps required. 5. Informative Attachments: — Include copies of any relevant documentation, invoices, or receipts supporting the deductions made. — Address any outstanding balance, if applicable, and provide instructions for its resolution. 6. Contact Information: — Provide accurate contact details, including phone number and email, for the tenant to seek clarification or ask further questions. — Specify the deadline by which the tenant should respond if they disagree with the deductions or require additional information. 7. Closing: — Express gratitude for the tenant's occupancy, repeat best wishes, and sign the letter with your full name and title. — Encourage the tenant to contact you promptly if any further assistance is required. Types of Saint Paul, Minnesota Letters from Landlord to Tenant Returning Security Deposit Less Deductions: 1. Standard Security Deposit Refund Letter: — This letter applies to most scenarios where the tenant is receiving a refund after valid deductions are made. 2. Itemized Security Deposit Deductions Letter: — In cases where there are various deductions from the security deposit, this letter provides a detailed breakdown of each charge. 3. Outstanding Balances Security Deposit Deductions Letter: — If the deductions exceed the security deposit amount, this letter addresses the remaining balance owed by the tenant, including instructions for repayment. Remember to consult Saint Paul's city ordinances and state laws regarding security deposit return requirements to ensure compliance and accuracy in the letter.