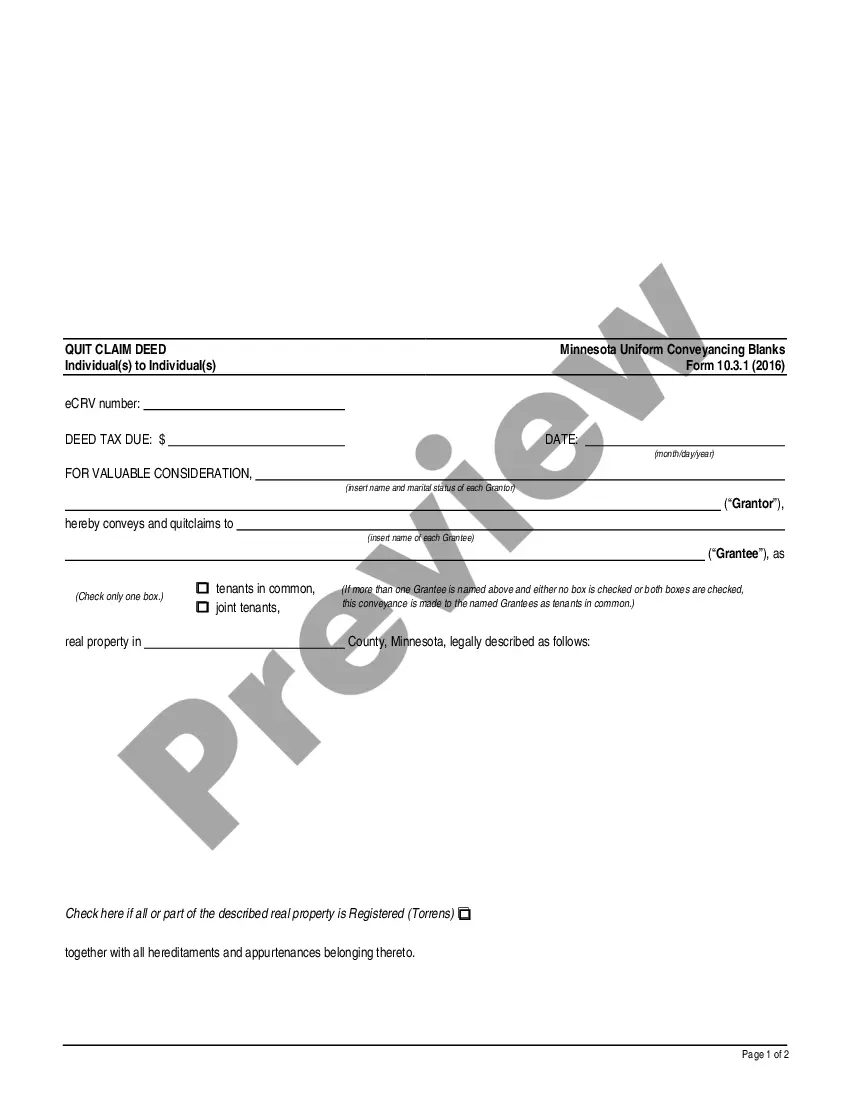

This form is a Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce.

Minneapolis Minnesota Quitclaim Deed Reserving Lien in Marriage Dissolution - Divorce - Judgment and Decree - UCBC Form 10.3.7

Description

How to fill out Minnesota Quitclaim Deed Reserving Lien In Marriage Dissolution - Divorce - Judgment And Decree - UCBC Form 10.3.7?

Regardless of one’s social or professional position, completing legal documents is a regrettable requirement in the modern world.

Often, it’s nearly impossible for someone without legal experience to produce such documents from scratch, primarily due to the intricate terminology and legal subtleties involved.

This is where US Legal Forms can be beneficial.

- Our platform provides an extensive repository of over 85,000 ready-to-use, state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also an excellent resource for associates or legal advisors looking to save time with our DIY forms.

- Whether you need the Minneapolis Minnesota Quitclaim Deed Reserving Lien in Marriage Dissolution - Divorce - Judgment and Decree - UCBC Form 10.3.7 or another document appropriate for your jurisdiction, US Legal Forms has you covered.

- Here’s how to quickly obtain the Minneapolis Minnesota Quitclaim Deed Reserving Lien in Marriage Dissolution - Divorce - Judgment and Decree - UCBC Form 10.3.7 using our reliable platform.

- If you are a current subscriber, simply Log In to your account and download the necessary form.

- However, if you are new to our platform, please follow these steps before acquiring the Minneapolis Minnesota Quitclaim Deed Reserving Lien in Marriage Dissolution - Divorce - Judgment and Decree - UCBC Form 10.3.7.

Form popularity

FAQ

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

A general warranty deed is used to transfer an interest in real estate in Minnesota in most real estate transactions. A Minnesota warranty deed conveys real property with warranty covenants to the buyer. It requires an acknowledgement of the grantor's signature.

A Minnesota quitclaim deed?also called a deed of quitclaim and release?is a deed that transfers Minnesota real estate with no warranty of title. The person who signs a quitclaim deed transfers whatever interest he or she has in the property but makes no promises about the status of the property's title.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

A quitclaim deed transfers the title of a property from one person to another, with little to no buyer protection. The grantor, the person giving away the property, gives their current deed to the grantee, the person receiving the property. The title is transferred without any amendments or additions.

How much deed tax must be paid? $495 must be paid when the deed is recorded. Who is responsible for paying the tax? The mortgagor (borrower) is liable for the MRT, while the seller is liable for the deed tax.

To write a Minnesota quitclaim deed form, you need to provide the following information: Preparer's name and address. Name and address of the person to whom the recorded deed should be returned. County where the property is located. The consideration paid for the property. Grantor's name and address.

A Minnesota quitclaim deed?also called a deed of quitclaim and release?is a deed that transfers Minnesota real estate with no warranty of title. The person who signs a quitclaim deed transfers whatever interest he or she has in the property but makes no promises about the status of the property's title.

8. Recording requirements and authorization. A transfer on death deed is valid if the deed is recorded in a county in which at least a part of the real property described in the deed is located and is recorded before the death of the grantor owner upon whose death the conveyance or transfer is effective.

State Deed Tax Typically, the deed tax is paid by the seller of a property. In the case of property transfer by quit claim deed, the deed tax may be paid by the grantor and would amount to 0.0033 times the net consideration.