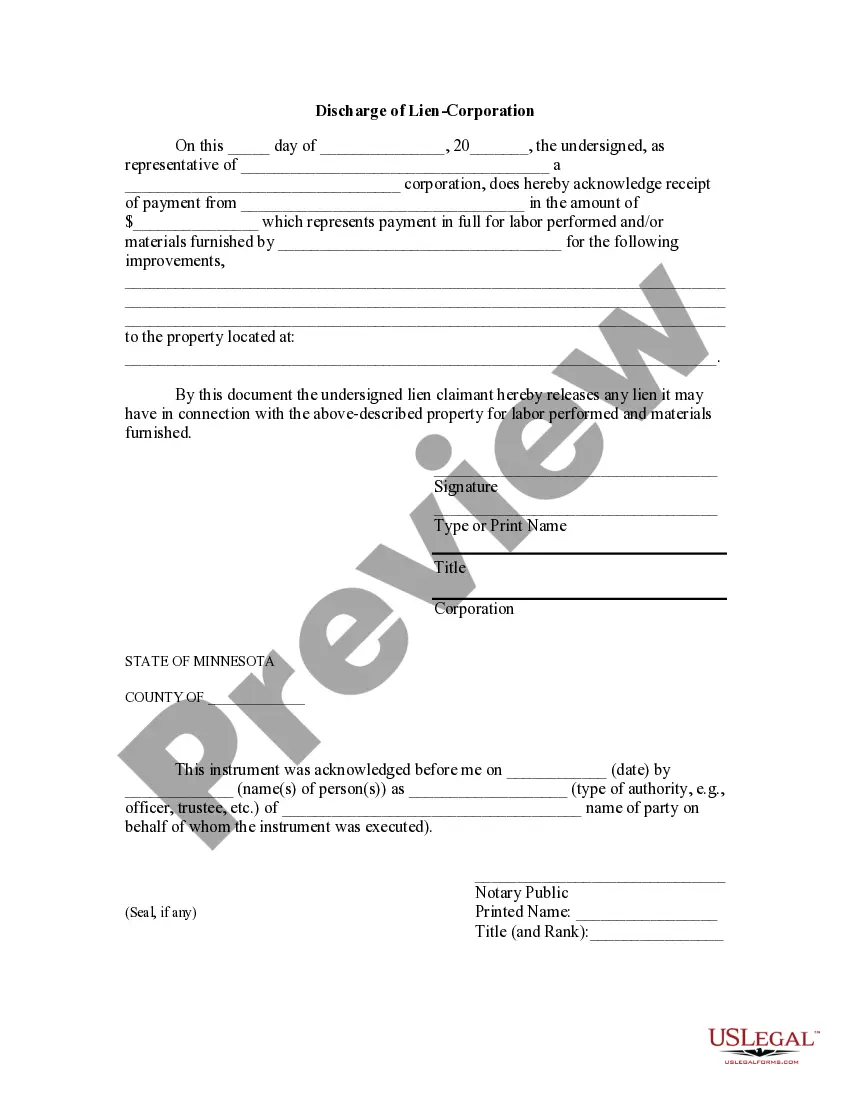

The Hennepin Minnesota Discharge of Lien process is an essential step for both corporations and LCS to remove a lien on property or assets within Hennepin County, Minnesota. This legal action allows businesses to release their claim on a property once the debt or obligation has been settled. By filing a Hennepin Minnesota Discharge of Lien, corporations and LCS can successfully remove any encumbrances and ensure that the property is free from any further claims. There are various types of Hennepin Minnesota Discharge of Lien processes available for corporations and LCS, depending on the specific situation. Here are a few types of Discharge of Lien procedures that businesses may encounter: 1. Mechanic's Lien Discharge: This type of lien occurs when a corporation or LLC provides labor, materials, or services for improvement or construction projects. When the debt related to the lien is resolved, the business may file a Mechanic's Lien Discharge to remove the encumbrance on the property. 2. Tax Lien Discharge: In cases where a corporation or LLC owes outstanding taxes, the government may place a tax lien on their property. Once the tax debt is settled, the business can file a Tax Lien Discharge to release the lien and regain full ownership of the property. 3. Judgment Lien Discharge: When a court awards a monetary judgment against a corporation or LLC, it can result in a judgment lien being placed on their assets or real estate. To remove this type of lien, the business can file a Judgment Lien Discharge after satisfying the judgment and paying the required amount. 4. Voluntary Lien Discharge: This type of discharge occurs when a corporation or LLC willingly chooses to release a lien on a property that they have previously filed. This could happen if the lien no longer serves a purpose or if the business wishes to facilitate a smooth transaction or transfer of ownership. It is essential for both corporations and LCS to comply with the specific requirements and procedures when filing for a Hennepin Minnesota Discharge of Lien. This typically involves completing the appropriate forms, providing necessary supporting documentation, and submitting the application to the relevant county office or courthouse. By understanding the different types of Hennepin Minnesota Discharge of Lien available and following the correct procedures, corporations and LCS can ensure the appropriate release of liens on their properties or assets within Hennepin County, Minnesota. Promptly addressing any outstanding liens is vital for businesses to maintain a clean title, establish credibility, and uphold their financial obligations.

Hennepin Minnesota Discharge of Lien - Corporation

Description

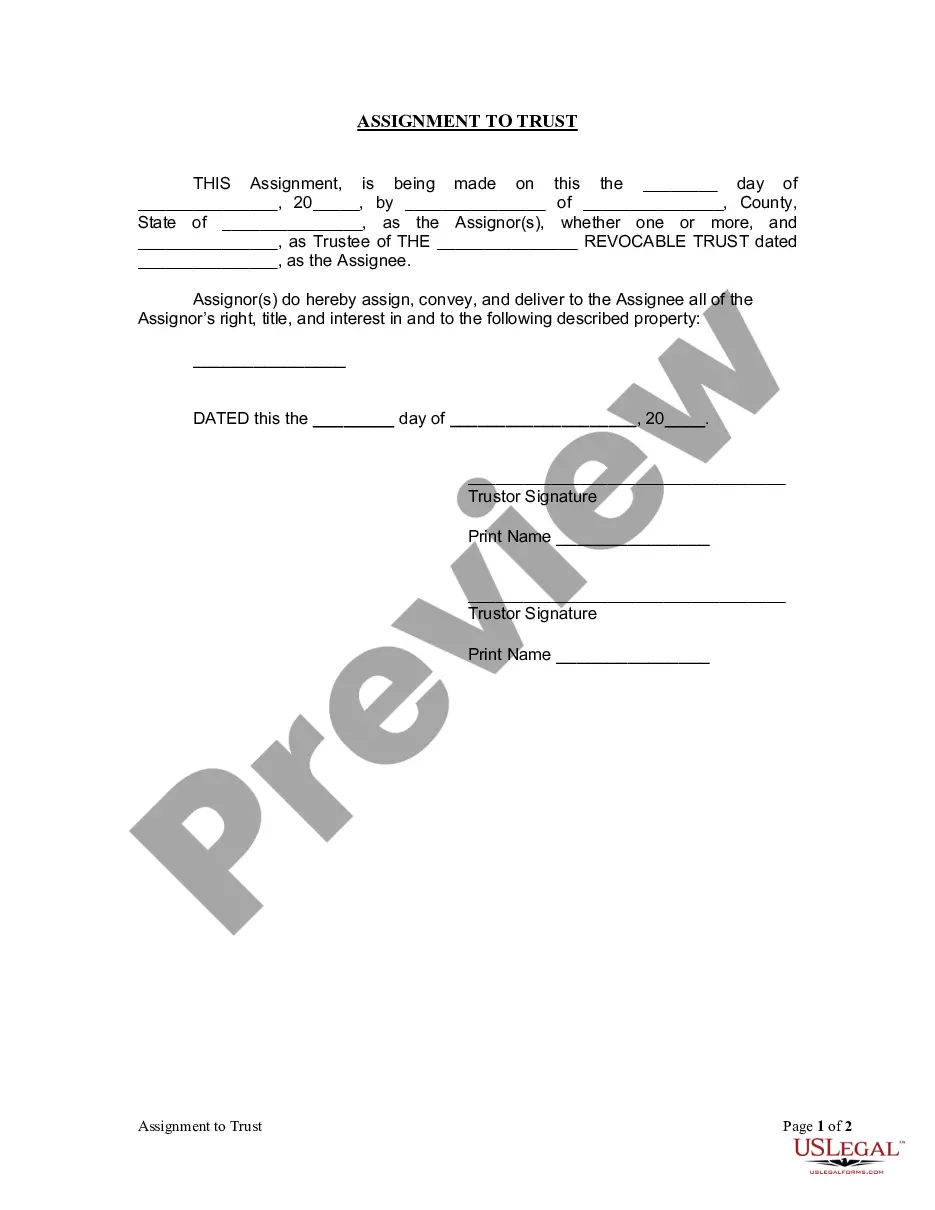

How to fill out Minnesota Discharge Of Lien - Corporation?

If you are looking for a pertinent form, it’s incredibly challenging to discover a more user-friendly service than the US Legal Forms website – one of the most extensive online repositories.

With this repository, you can locate thousands of templates for organizational and personal uses categorized by types and regions, or keywords.

With our sophisticated search capability, obtaining the latest Hennepin Minnesota Discharge of Lien - Corporation or LLC is as straightforward as 1-2-3.

Complete the purchase. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and save it on your device. Make adjustments. Complete, edit, print, and sign the received Hennepin Minnesota Discharge of Lien - Corporation or LLC.

- Furthermore, the relevance of every document is validated by a team of experienced attorneys who routinely examine the templates on our site and refresh them in accordance with the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Hennepin Minnesota Discharge of Lien - Corporation or LLC is to Log In to your profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have accessed the sample you require. Review its details and utilize the Preview feature (if accessible) to view its contents. If it doesn’t satisfy your needs, employ the Search field at the top of the page to find the appropriate record.

- Confirm your selection. Click the Buy now button. Subsequently, select the desired subscription package and provide information to create an account.

Form popularity

FAQ

To get a lien release form, you can visit the official website of Hennepin County or utilize online resources such as USLegalForms. This platform provides an easy process to find the Hennepin Minnesota Discharge of Lien - Corporation form you require. Just select the appropriate form, fill it out with the necessary details, and follow the submission guidelines to ensure your lien is released efficiently.

You can obtain a lien release form from various sources, including local government offices in Hennepin County, or online platforms that specialize in legal forms. Websites like USLegalForms offer a simple and convenient way to access the Hennepin Minnesota Discharge of Lien - Corporation forms you need. Make sure to verify that the form meets your specific requirements and complies with state laws.

To write a letter requesting a lien release, start with your contact information, followed by the date and the recipient's information. Clearly state your request for the Hennepin Minnesota Discharge of Lien - Corporation, including any relevant details about the lien. Be sure to provide supporting documents, if necessary, and conclude with a polite request for prompt action on your request.

Finding an old lien release can be challenging, but start by checking your personal records or contacting the lienholder directly. If you are unable to locate it, consider searching public records through your county recorder's office. USLegalForms can assist you with the research process for your Hennepin Minnesota Discharge of Lien - Corporation.

In Minnesota, lien releases typically do not require notarization, but it is advisable to confirm with the lienholder. Always double-check the requirements to ensure compliance with local laws. For your benefit, USLegalForms provides up-to-date information regarding the necessary steps for Hennepin Minnesota Discharge of Lien - Corporation.

If the company that placed the lien is no longer operational, it may complicate obtaining a lien release. You might need to provide proof of payment or that the debt has been satisfied. USLegalForms offers resources to help you navigate these situations effectively, including models for engaging in a Hennepin Minnesota Discharge of Lien - Corporation.

To remove a lien in Minnesota, you typically need to satisfy the terms of the lien and request a discharge from the lienholder. Once they approve your request, they will file the necessary paperwork with the state. Consider using USLegalForms to access templates and guidance for the Hennepin Minnesota Discharge of Lien - Corporation, making the removal process more efficient.

The speed of obtaining a lien release largely depends on the efficiency of the lienholder. Generally, it can take anywhere from a few days to a couple of weeks. Using USLegalForms can streamline the process and help you navigate through obtaining a timely Hennepin Minnesota Discharge of Lien - Corporation.

Getting a copy of your lien release letter involves contacting the lienholder or the entity that issued the lien. Make sure you have your account details ready to help them locate your records quickly. For added convenience, consider using USLegalForms, which can guide you through the process of retrieving necessary documents related to Hennepin Minnesota Discharge of Lien - Corporation.

To obtain your lien release letter, you must contact the lienholder directly. Provide them with the necessary information, such as your name, property details, and any reference numbers associated with the lien. You can also utilize services like USLegalForms to ensure you follow the correct procedures for Hennepin Minnesota Discharge of Lien - Corporation.