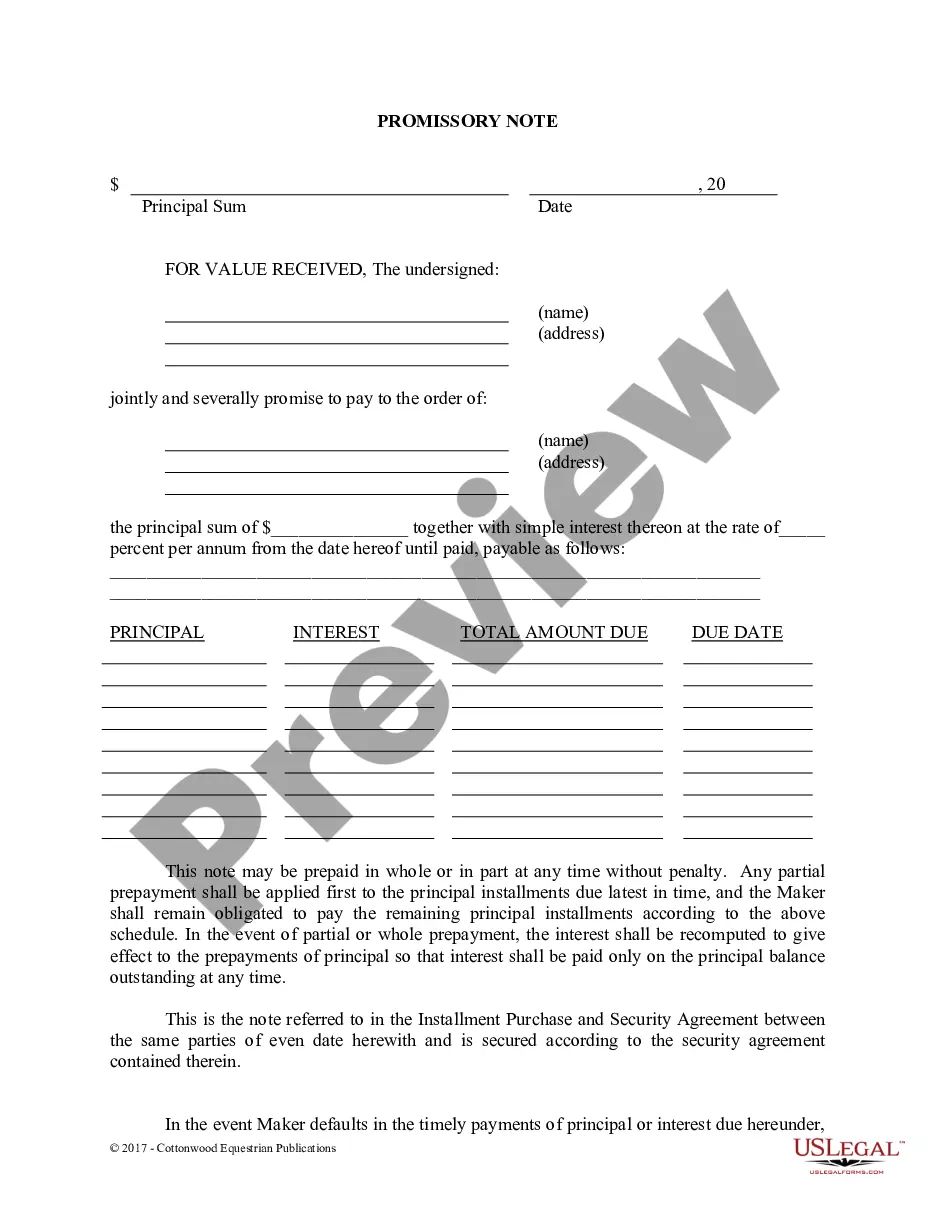

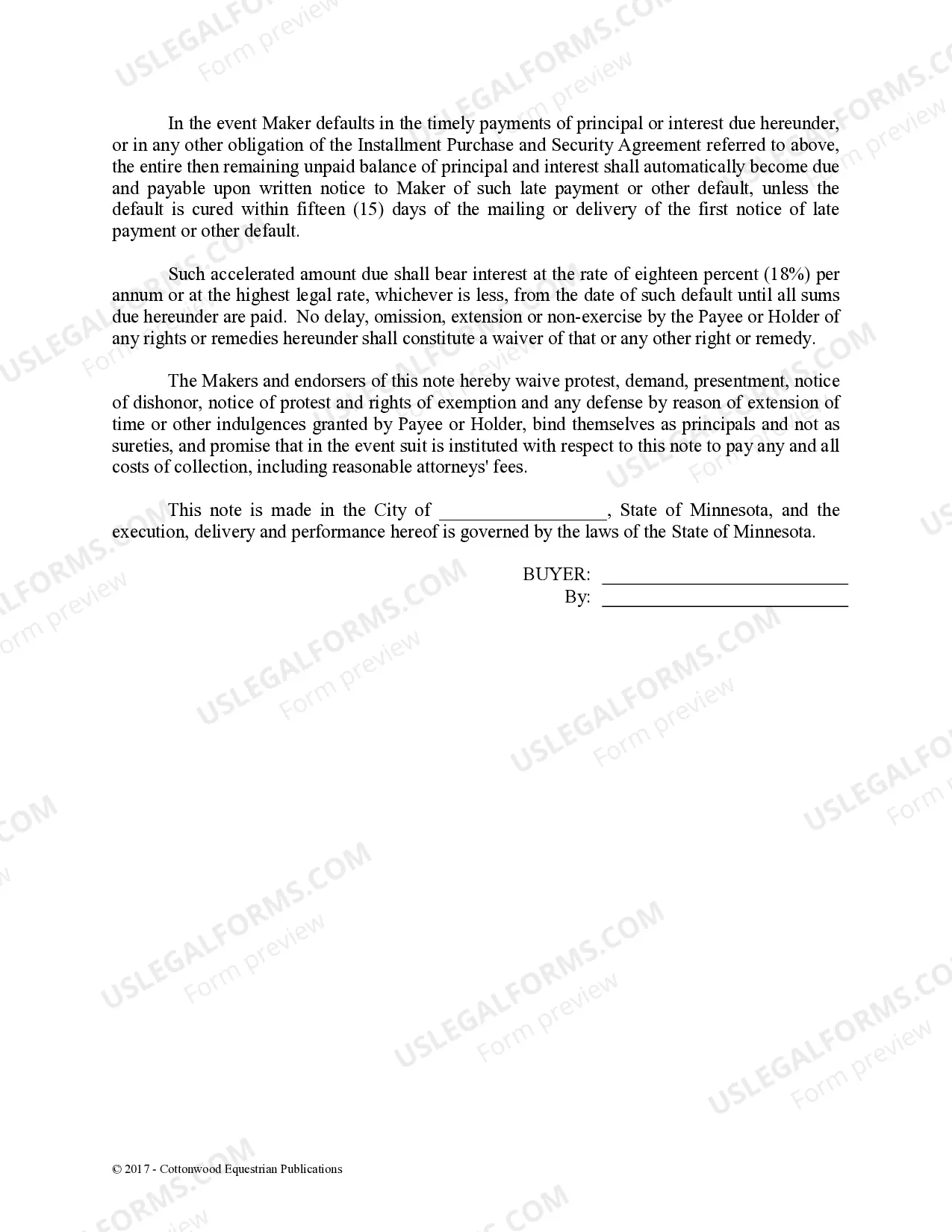

The Hennepin Minnesota Promissory Note — Horse Equine Forms is a legally binding document designed to record a financial agreement between a lender and a borrower in the horse equine industry within Hennepin County, Minnesota. This note outlines the terms and conditions of a loan related to horse-related activities such as buying, selling, leasing, boarding, or any other equine business ventures. The Hennepin Minnesota Promissory Note — Horse Equine Forms generally consists of the following elements: 1. Parties: This section identifies the lender (the party providing funds) and the borrower (the party receiving funds) by their full legal names and contact information. 2. Loan Amount: Here, the principal sum to be borrowed is specified, indicating the exact amount of money that the lender will be providing to the borrower. It is essential to mention the currency in which the loan will be made. 3. Interest Rate: This part states the annual interest rate at which the borrowed amount will accrue interest. It is crucial to clearly define if the interest will be simple or compound interest to avoid any confusion. 4. Payment Terms: The Promissory Note outlines the repayment terms, including the schedule of payments. This includes the due dates, the frequency of payments (e.g., monthly, bi-monthly), and whether it will be paid in installments or as a lump sum. Additionally, it may mention any late payment penalties or grace periods for missed payments. 5. Security Agreement: In some cases, the Promissory Note may include a provision for a security interest, allowing the lender to take possession of certain assets (such as horses, equipment, or other collateral) in case of default by the borrower. 6. Governing Law and Jurisdiction: This section establishes that the Promissory Note will be governed under the laws of Hennepin County, Minnesota, specifying that any disputes arising from the agreement will be resolved within the local legal jurisdiction. Different types of Hennepin Minnesota Promissory Note — Horse Equine Forms may include variations catering to specific loan arrangements in the horse equine industry, such as: 1. Purchase or Sale Agreement Promissory Note: This form is used when the loan is related to the purchase or sale of a horse, clearly outlining the terms of the transaction, including the payment terms, delivery conditions, and any warranties or responsibilities of the parties involved. 2. Lease Agreement Promissory Note: This form is utilized when the loan is related to the leasing of a horse, detailing the lease terms, payment obligations, duration of the lease, and any stipulations regarding the care and use of the horse during the lease period. 3. Boarding Agreement Promissory Note: This type of Promissory Note is used when the loan is related to the boarding of a horse, specifying the cost of boarding, payment terms, responsibilities of the boarding facility, and any additional services provided. These specialized forms allow for customization and clarity within the horse equine industry, ensuring that all parties involved have a clear understanding of the terms and protecting their legal rights.

Hennepin Minnesota Promissory Note - Horse Equine Forms

Category:

State:

Minnesota

County:

Hennepin

Control #:

MN-14-06

Format:

Word;

Rich Text

Instant download

Description

This is a promissory note for use in connection with the sale and purchase of a horse where financing is involved. It is a simple interest note that may be used in conjunction with an Installment Purchase and Security Agreement.

The Hennepin Minnesota Promissory Note — Horse Equine Forms is a legally binding document designed to record a financial agreement between a lender and a borrower in the horse equine industry within Hennepin County, Minnesota. This note outlines the terms and conditions of a loan related to horse-related activities such as buying, selling, leasing, boarding, or any other equine business ventures. The Hennepin Minnesota Promissory Note — Horse Equine Forms generally consists of the following elements: 1. Parties: This section identifies the lender (the party providing funds) and the borrower (the party receiving funds) by their full legal names and contact information. 2. Loan Amount: Here, the principal sum to be borrowed is specified, indicating the exact amount of money that the lender will be providing to the borrower. It is essential to mention the currency in which the loan will be made. 3. Interest Rate: This part states the annual interest rate at which the borrowed amount will accrue interest. It is crucial to clearly define if the interest will be simple or compound interest to avoid any confusion. 4. Payment Terms: The Promissory Note outlines the repayment terms, including the schedule of payments. This includes the due dates, the frequency of payments (e.g., monthly, bi-monthly), and whether it will be paid in installments or as a lump sum. Additionally, it may mention any late payment penalties or grace periods for missed payments. 5. Security Agreement: In some cases, the Promissory Note may include a provision for a security interest, allowing the lender to take possession of certain assets (such as horses, equipment, or other collateral) in case of default by the borrower. 6. Governing Law and Jurisdiction: This section establishes that the Promissory Note will be governed under the laws of Hennepin County, Minnesota, specifying that any disputes arising from the agreement will be resolved within the local legal jurisdiction. Different types of Hennepin Minnesota Promissory Note — Horse Equine Forms may include variations catering to specific loan arrangements in the horse equine industry, such as: 1. Purchase or Sale Agreement Promissory Note: This form is used when the loan is related to the purchase or sale of a horse, clearly outlining the terms of the transaction, including the payment terms, delivery conditions, and any warranties or responsibilities of the parties involved. 2. Lease Agreement Promissory Note: This form is utilized when the loan is related to the leasing of a horse, detailing the lease terms, payment obligations, duration of the lease, and any stipulations regarding the care and use of the horse during the lease period. 3. Boarding Agreement Promissory Note: This type of Promissory Note is used when the loan is related to the boarding of a horse, specifying the cost of boarding, payment terms, responsibilities of the boarding facility, and any additional services provided. These specialized forms allow for customization and clarity within the horse equine industry, ensuring that all parties involved have a clear understanding of the terms and protecting their legal rights.

Free preview

How to fill out Hennepin Minnesota Promissory Note - Horse Equine Forms?

If you’ve already utilized our service before, log in to your account and download the Hennepin Minnesota Promissory Note - Horse Equine Forms on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Make sure you’ve found the right document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Hennepin Minnesota Promissory Note - Horse Equine Forms. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!