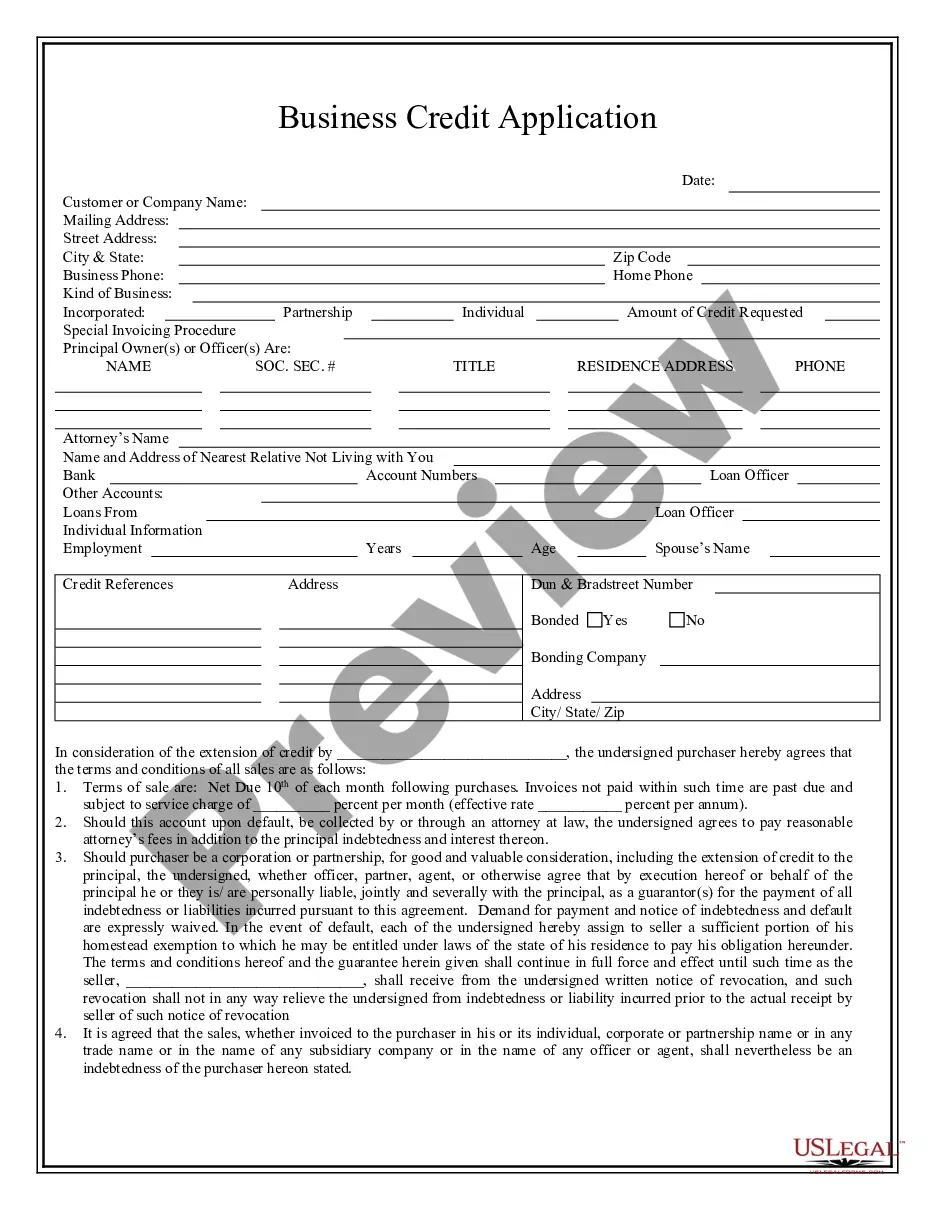

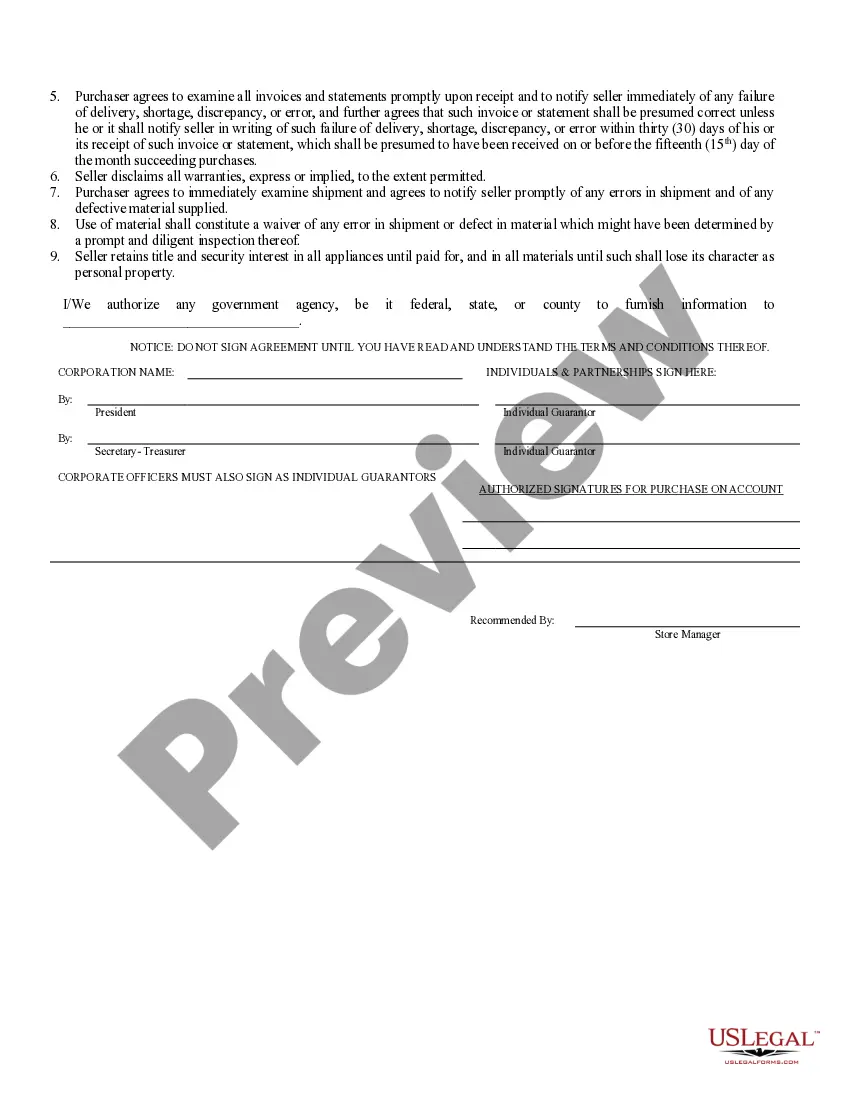

The Hennepin Minnesota Business Credit Application is a comprehensive form utilized by businesses in Hennepin County, Minnesota, to apply for credit from financial institutions or other lending entities. This application serves as a crucial tool for entrepreneurs and established businesses seeking financial assistance to support their growth, expansion, or ongoing operations. Keyword 1: Hennepin Minnesota Business Credit Application Keyword 2: Hennepin County, Minnesota Keyword 3: businesses Keyword 4: credit Keyword 5: application Keyword 6: financial institutions Keyword 7: lending entities Keyword 8: entrepreneurs Keyword 9: growth Keyword 10: expansion Keyword 11: operations This application captures vital information about the applying business, including its legal entity type, contact details, business history, financial standing, and credit requirements. Different types of the Hennepin Minnesota Business Credit Application may exist based on specific lending institutions or their preferred format. However, the core content of the application generally remains constant, focusing on gathering essential business and financial information. The application may include sections such as: 1. Business Information: This section collects details about the business's legal name, ownership structure (sole proprietorship, LLC, corporation, etc.), and business address. It may also request the number of years the business has been operating. 2. Contact Information: Here, the application seeks primary contact details of the business, including the name of the key contact person, their position, phone number, email, and any additional authorized representatives. 3. Financial Information: This section requires an overview of the business's financial health, including its annual revenue, net income, accounts payable and receivable, assets and liabilities, and any outstanding debts or mortgages. 4. Business Plan: Many credit applications request a brief description of the business's mission, vision, products or services, target market, competitive advantage, and growth plans. This section helps lenders assess the viability of the business and its potential to generate sufficient income to repay the applied credit. 5. Credit Request: Applicants must specify the type and amount of credit they require. This may include lines of credit, term loans, equipment financing, or any other funding needs. Businesses should also provide details on how they plan to utilize the credit and the desired repayment terms. 6. Supporting Documents: Lenders often require supporting documents, such as financial statements (balance sheet, income statement), tax returns, bank statements, and business licenses. These documents aid in verifying the provided information and assessing the creditworthiness of the business. 7. Authorization and Consent: The application concludes with an acknowledgment and consent section where the applicant authorizes the lender to conduct credit checks, verify information, and communicate with credit reporting agencies, banks, or other third parties, as necessary. It is important to note that the specific sections and requirements may differ among various Hennepin Minnesota Business Credit Applications, depending on the lending institution's policies, industry requirements, and credit evaluation criteria. Therefore, applicants should carefully review the application form and provide accurate and comprehensive information to maximize their chances of approval.

Hennepin Minnesota Business Credit Application

Description

How to fill out Hennepin Minnesota Business Credit Application?

Benefit from the US Legal Forms and obtain immediate access to any form you want. Our useful platform with a large number of documents allows you to find and get virtually any document sample you will need. You are able to export, fill, and certify the Hennepin Minnesota Business Credit Application in just a few minutes instead of surfing the Net for several hours attempting to find the right template.

Using our catalog is a superb way to improve the safety of your document filing. Our professional lawyers on a regular basis check all the records to make certain that the templates are appropriate for a particular state and compliant with new acts and regulations.

How do you obtain the Hennepin Minnesota Business Credit Application? If you have a profile, just log in to the account. The Download button will appear on all the samples you look at. In addition, you can find all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Find the template you need. Make sure that it is the form you were hoping to find: check its title and description, and use the Preview function if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Launch the downloading process. Select Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order utilizing a credit card or PayPal.

- Save the document. Pick the format to obtain the Hennepin Minnesota Business Credit Application and edit and fill, or sign it for your needs.

US Legal Forms is probably the most extensive and trustworthy template libraries on the web. Our company is always ready to assist you in any legal procedure, even if it is just downloading the Hennepin Minnesota Business Credit Application.

Feel free to take advantage of our service and make your document experience as convenient as possible!