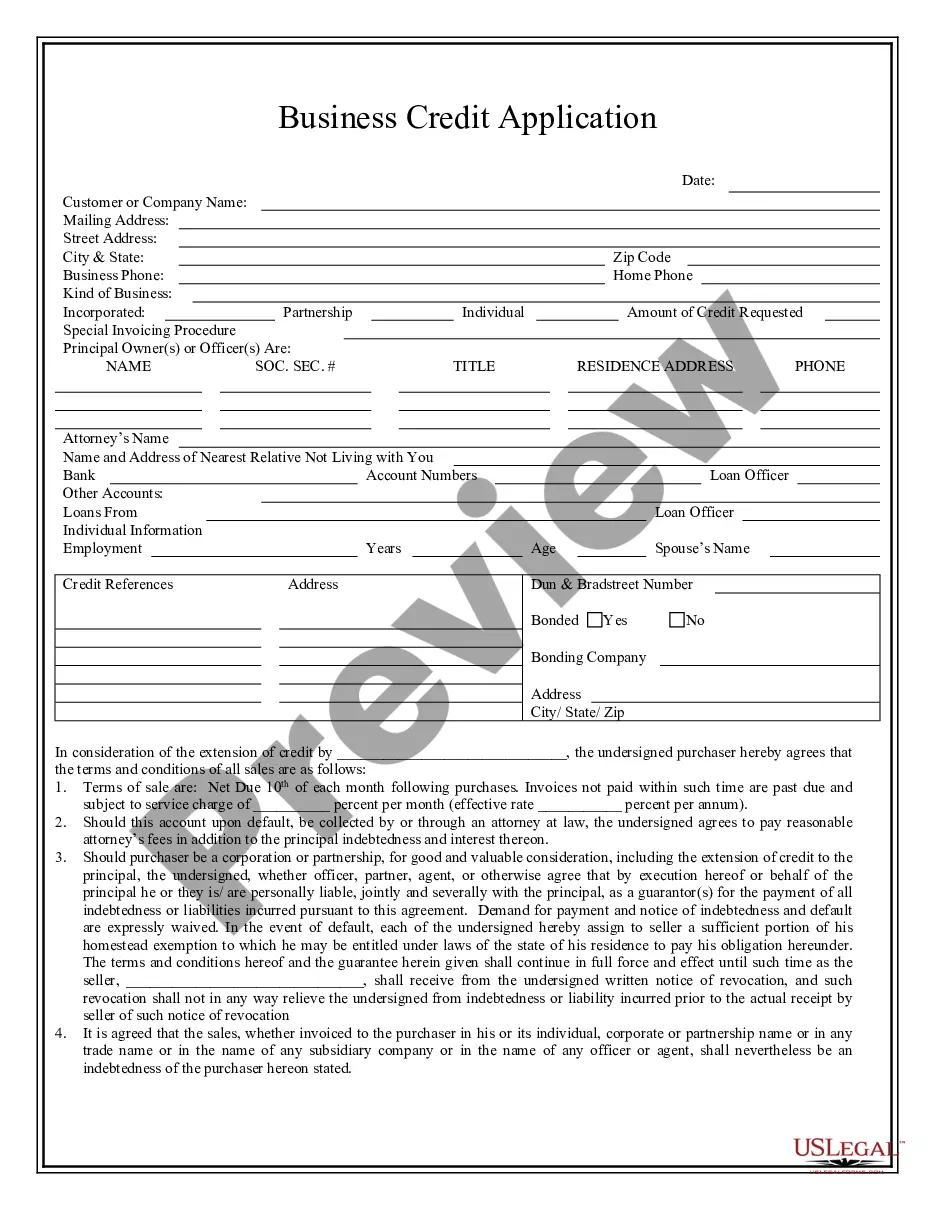

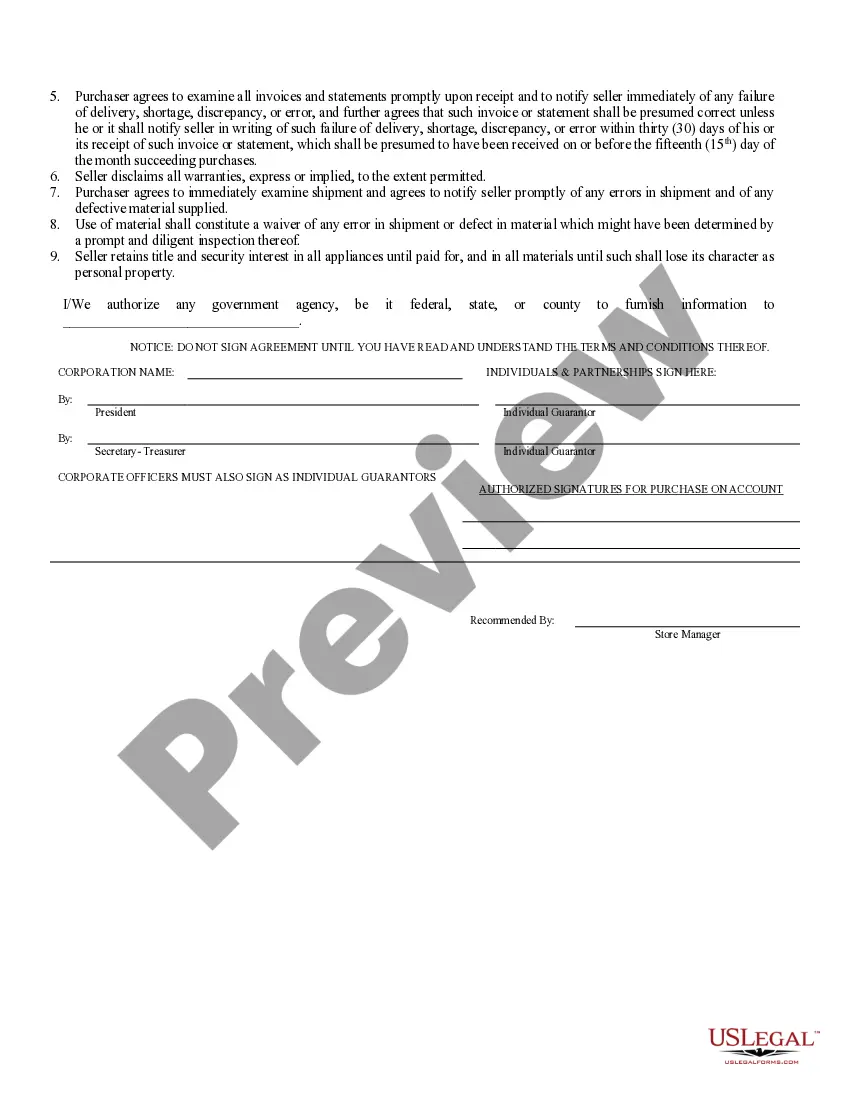

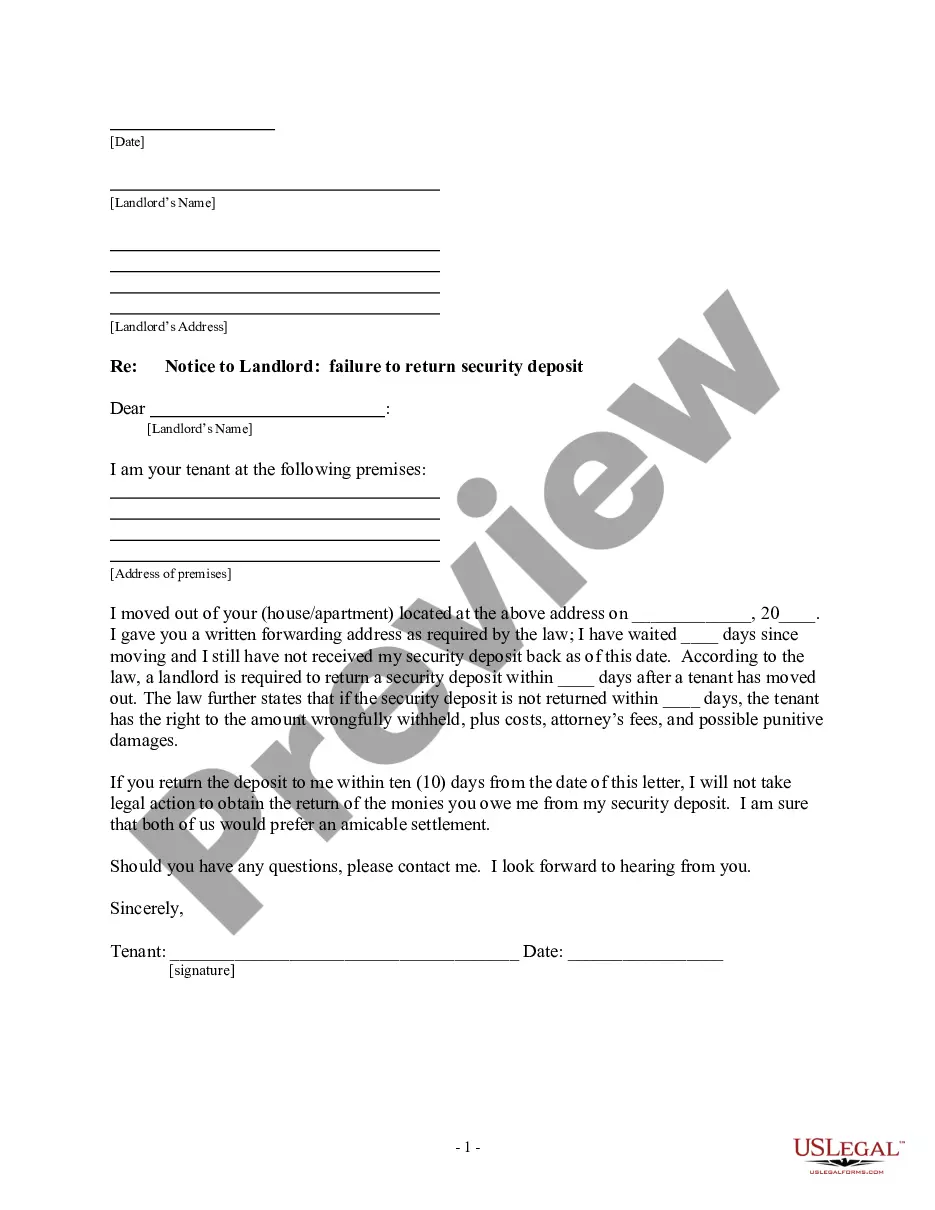

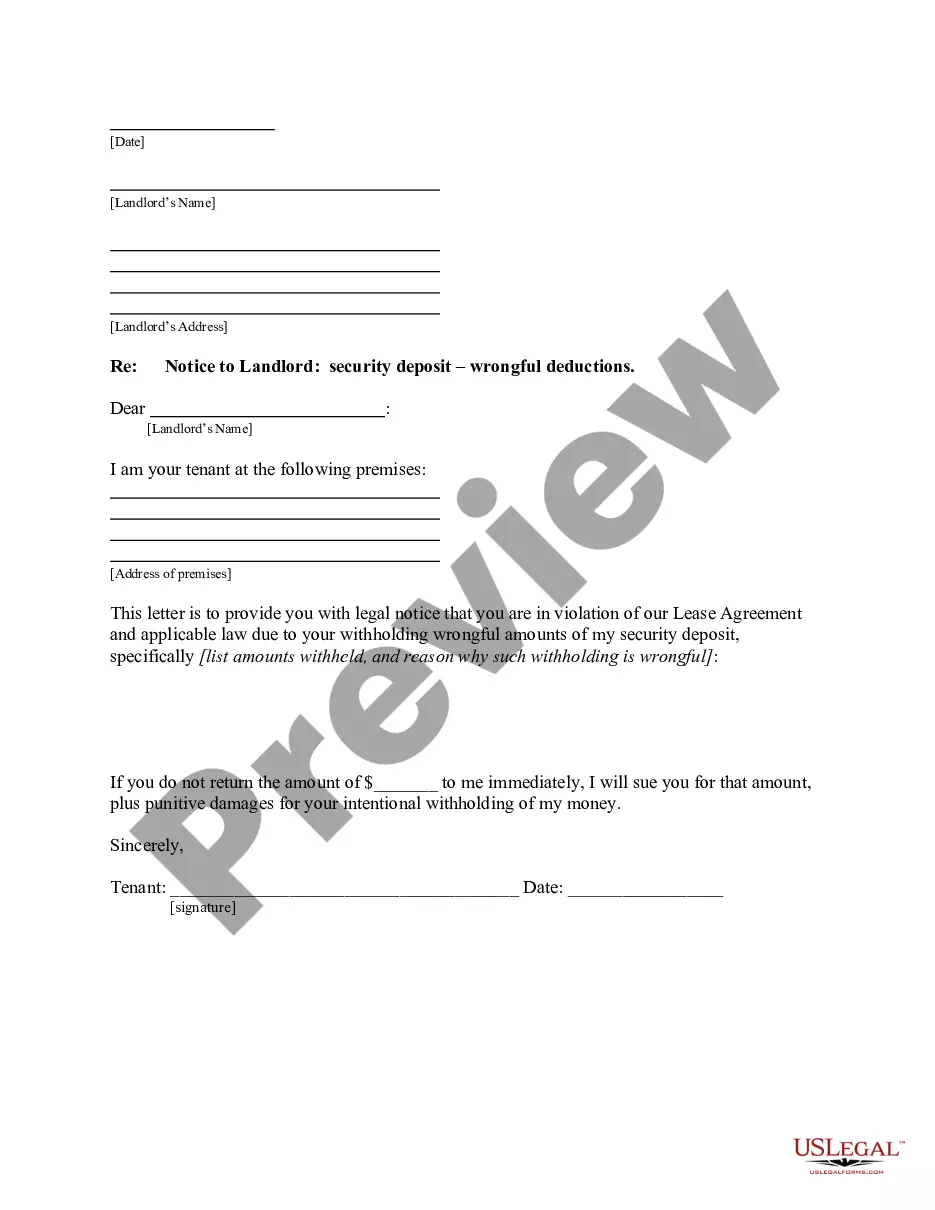

Minneapolis Minnesota Business Credit Application is a formal document designed specifically for businesses operating in the Minneapolis area of Minnesota to apply for credit from financial institutions or lending organizations. This application serves as an essential tool for companies seeking financial assistance to support their operations, expansion, or other business-related needs. The Minneapolis Minnesota Business Credit Application typically requires businesses to provide detailed information about their company, including the legal name, address, contact details, and the nature of their business activities. Additionally, the application may include an overview of the company's history, management structure, and the number of employees. Financial information is crucial when applying for business credit, and as such, the application will often demand a comprehensive breakdown of the company's financial statements. This includes income statements, balance sheets, cash flow statements, and tax returns. Lenders use this information to assess the financial health and repayment capacity of the business. The application may also require a detailed outline of the requested credit amount and the purpose for which it will be utilized. This helps lenders evaluate whether the loan aligns with the business's goals and ensures that the funds will be used responsibly. Additionally, businesses may need to provide collateral details when applying for credit. Collateral is an asset or property that can be used to secure the debt and act as a guarantee for repayment. Providing collateral can increase the chances of loan approval and potentially allow for lower interest rates. Different types of Minneapolis Minnesota Business Credit Applications may be available to cater to specific needs or industries. Examples include: 1. Small Business Loan Application: Geared towards startups or small businesses seeking financial assistance to establish or grow their operations. 2. Expansion Loan Application: Specifically designed for companies looking to expand their existing business operations, finance new projects, or invest in additional locations or facilities. 3. Equipment Financing Application: Aimed at businesses that require funds to purchase or lease equipment, machinery, or vehicles essential for their operations. 4. Working Capital Loan Application: Meant for businesses that require additional cash flow to manage day-to-day operations, fund inventory purchases, or support payroll obligations. 5. Commercial Real Estate Loan Application: Suited for companies seeking to purchase, construct, or renovate commercial properties such as offices, warehouses, or retail spaces. In conclusion, the Minneapolis Minnesota Business Credit Application is a comprehensive document that enables businesses in Minneapolis to apply for credit from financial institutions. It requires detailed information about the company's operations, financials, and intended use of credit. Different types of applications cater to specific business needs, such as small business loans, expansion loans, equipment financing, working capital loans, and commercial real estate loans.

Minneapolis Minnesota Business Credit Application

Description

How to fill out Minneapolis Minnesota Business Credit Application?

If you are searching for a valid form template, it’s extremely hard to find a more convenient service than the US Legal Forms website – probably the most considerable libraries on the internet. With this library, you can get thousands of document samples for company and personal purposes by types and states, or key phrases. With our advanced search feature, finding the most recent Minneapolis Minnesota Business Credit Application is as elementary as 1-2-3. In addition, the relevance of each and every file is confirmed by a team of expert lawyers that on a regular basis review the templates on our website and revise them based on the latest state and county laws.

If you already know about our platform and have a registered account, all you should do to receive the Minneapolis Minnesota Business Credit Application is to log in to your account and click the Download option.

If you make use of US Legal Forms the very first time, just refer to the instructions below:

- Make sure you have found the form you need. Check its explanation and utilize the Preview feature to see its content. If it doesn’t meet your requirements, use the Search option at the top of the screen to find the needed record.

- Confirm your decision. Choose the Buy now option. Following that, choose your preferred subscription plan and provide credentials to register an account.

- Process the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Select the file format and save it to your system.

- Make changes. Fill out, edit, print, and sign the acquired Minneapolis Minnesota Business Credit Application.

Every form you add to your account does not have an expiry date and is yours forever. It is possible to gain access to them using the My Forms menu, so if you want to receive an additional duplicate for modifying or printing, you can return and download it again whenever you want.

Take advantage of the US Legal Forms professional collection to get access to the Minneapolis Minnesota Business Credit Application you were looking for and thousands of other professional and state-specific samples on one website!