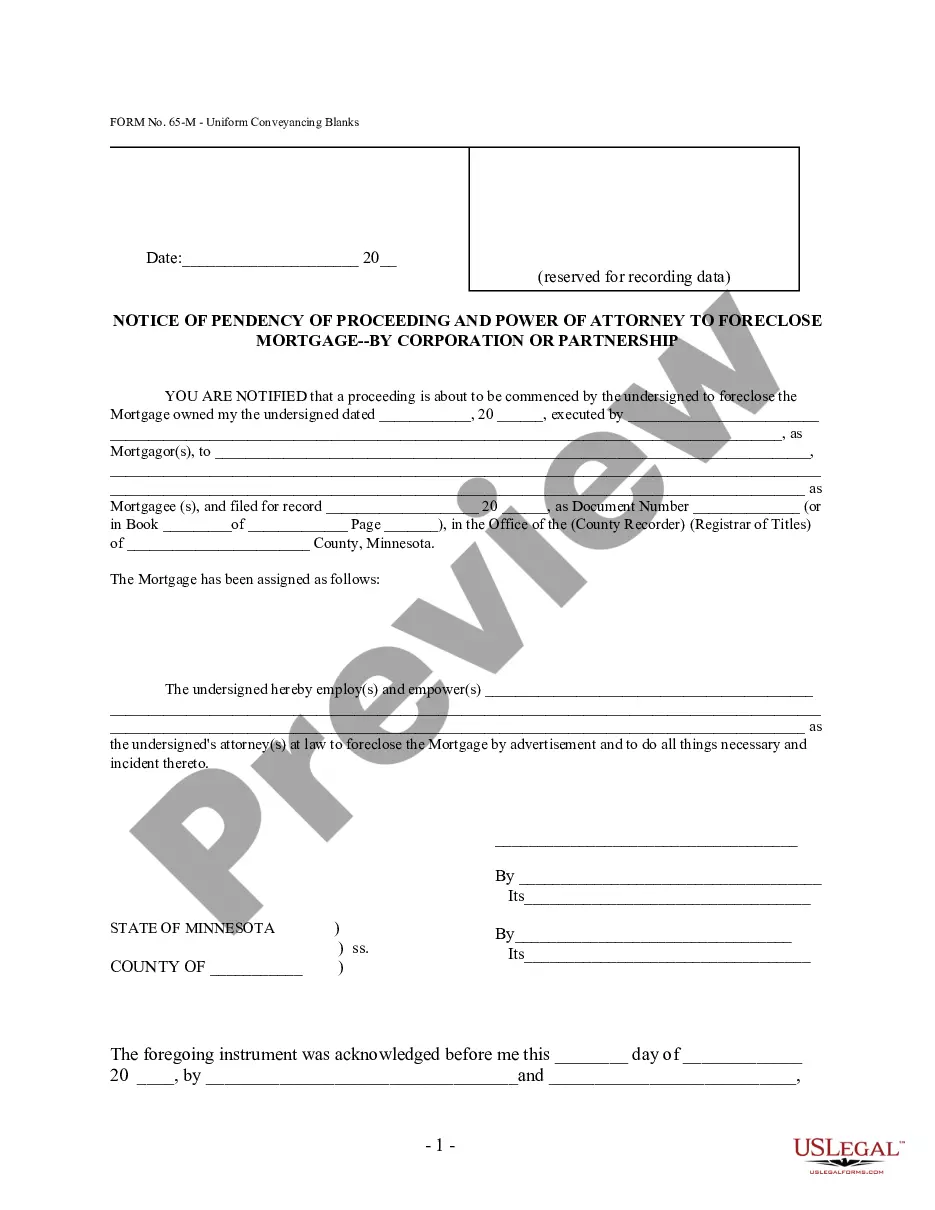

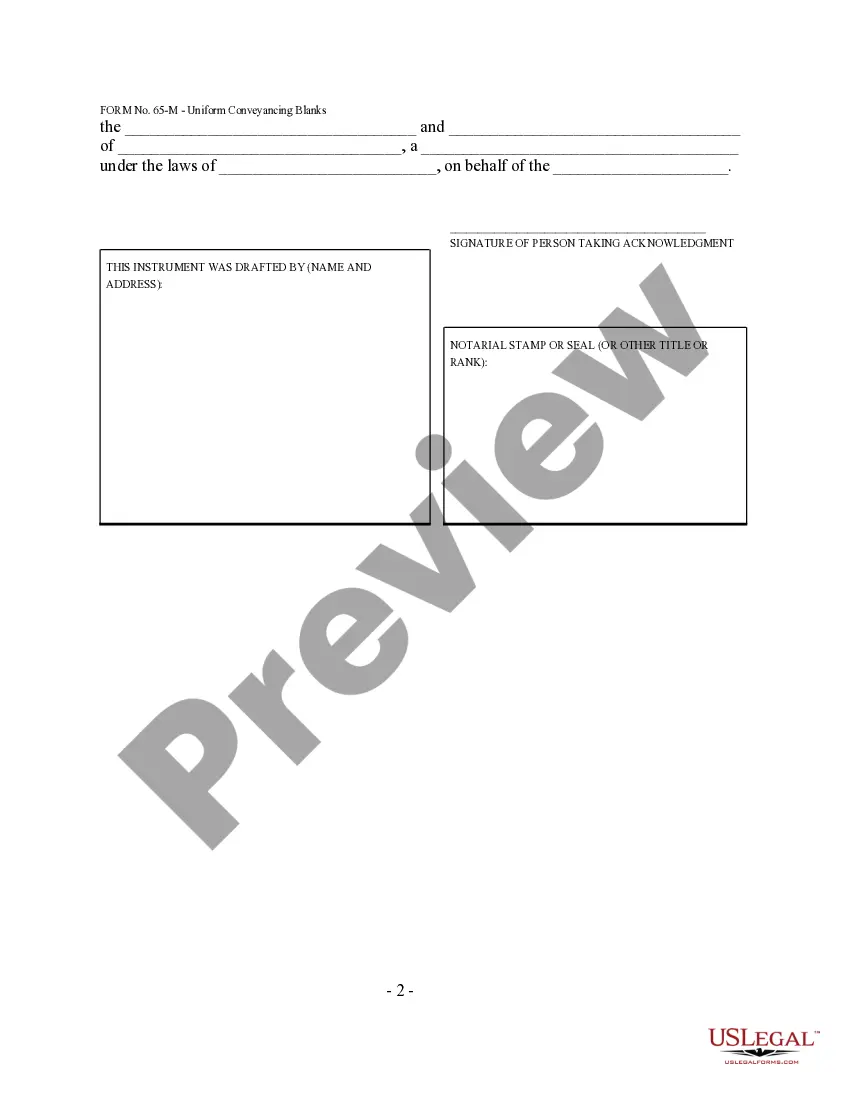

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Saint Paul Minnesota Notice of Pendency of Proceeding And Power of Attorney To Foreclose Mortgage by Business Entity — Form 60.1.2 is a legal document used in the state of Minnesota specifically in Saint Paul. It serves as a notice to all parties involved that a foreclosure proceeding is underway on a property due to default on a mortgage loan. This form is typically submitted by a business entity (such as a bank or mortgage lender) that holds the mortgage. The purpose of this notice is to inform interested parties, including the property owner, potential buyers, and other lien holders, that legal action has been initiated to foreclose on the property. It ensures transparency in the foreclosure process and allows interested parties to protect their rights and interests. The Notice of Pendency of Proceeding And Power of Attorney To Foreclose Mortgage by Business Entity — Form 60.1.2 contains several sections that must be accurately completed. These sections typically include: 1. Heading: This section includes the title of the form, indicating its purpose. 2. Property Information: Here, the complete and accurate address of the property being foreclosed upon is provided. This includes street address, city, state, and zip code. 3. Court Information: The name and district of the court where the foreclosure proceeding has been initiated must be stated. 4. Mortgagor Information: The full legal name(s) of the owner(s) or mortgagor(s) of the property must be included in this section. 5. Mortgagee Information: The name(s) and contact details of the business entity holding the mortgage are provided here. This includes the entity name, address, and any other relevant information. 6. Recording Information: Details of the document being recorded, such as the county where it will be recorded and the recording fee, are specified in this section. 7. Power of Attorney: A statement granting power of attorney to the attorney representing the mortgagee is included here. This allows the attorney to take necessary actions on behalf of the business entity during the foreclosure process. Different variations or types of the Saint Paul Minnesota Notice of Pendency of Proceeding And Power of Attorney To Foreclose Mortgage by Business Entity — Form 60.1.2 may exist, but they usually entail minor differences in formatting or specific information required by local regulations. It is crucial to use the most up-to-date and accurate form provided by the county or state government to ensure compliance with all legal requirements. In conclusion, the Saint Paul Minnesota Notice of Pendency of Proceeding And Power of Attorney To Foreclose Mortgage by Business Entity — Form 60.1.2 is a vital legal document that notifies interested parties about the initiation of a foreclosure proceeding. It aims to maintain transparency and provide necessary information to safeguard the rights and interests of all parties involved.