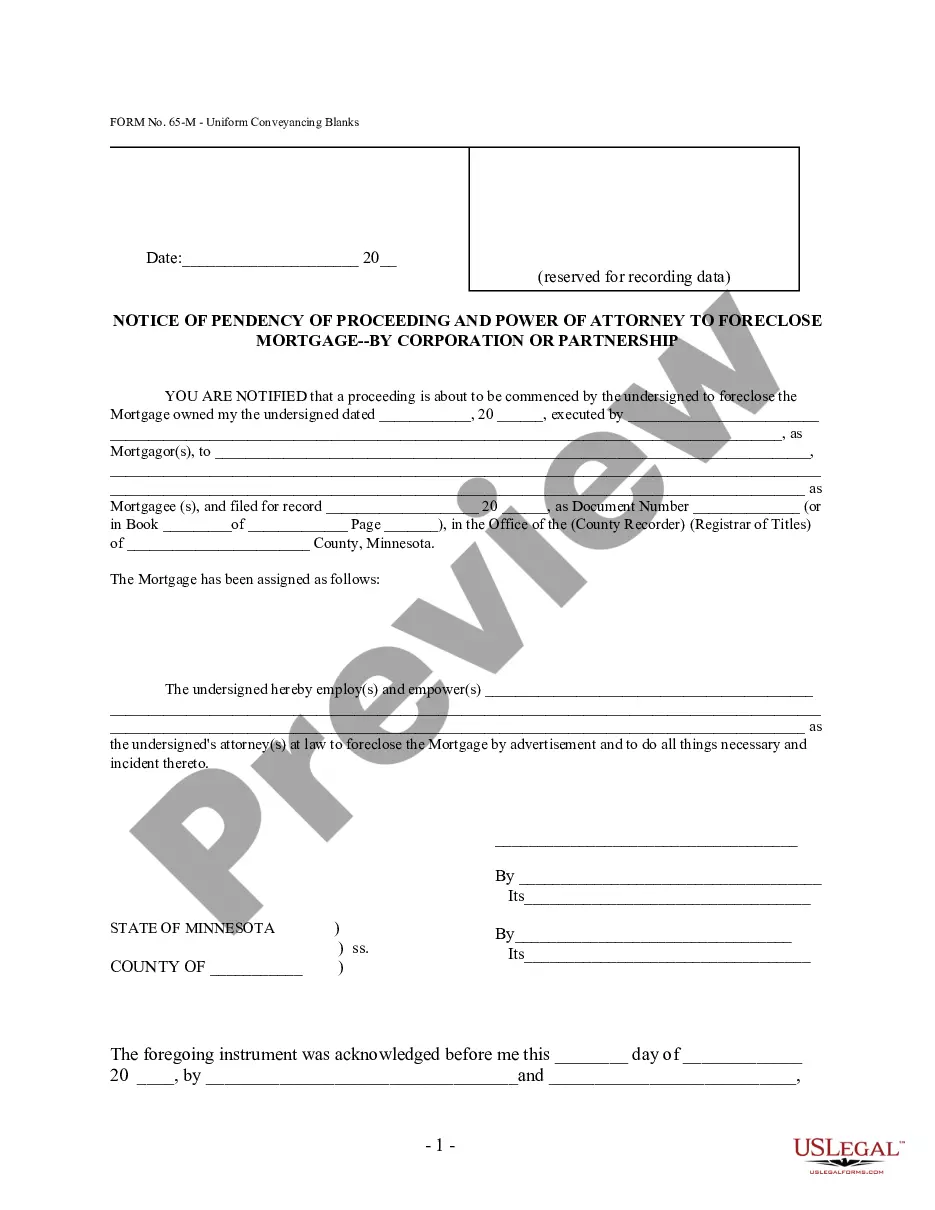

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms are to be used as a guide. The form is available here in PDF format.

Minneapolis Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2

Description

How to fill out Minnesota Notice Of Mortgage Foreclosure Sale And Affidavit Of Publication - Form 60.3.2?

Regardless of social or professional rank, completing legal documents is a regrettable requirement in today’s society. Frequently, it’s nearly impossible for someone lacking legal training to create such documents from the ground up, primarily due to the complex terminology and legal subtleties they involve.

This is where US Legal Forms can come to the rescue. Our service offers an extensive repository of over 85,000 ready-to-utilize state-specific templates that cater to nearly any legal circumstance. US Legal Forms also serves as an excellent resource for associates or legal advisors who seek greater efficiency in terms of time using our DIY forms.

It doesn't matter if you need the Minneapolis Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2 or any other document that would be applicable in your state or county, with US Legal Forms, everything is within reach. Here’s how to swiftly obtain the Minneapolis Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2 using our reliable service.

You’re all set! You can now proceed to print the document or complete it online. If you encounter any problems accessing your purchased documents, you can easily find them in the My documents section.

No matter the issue you’re trying to resolve, US Legal Forms is here to assist you. Try it out today and experience the benefits for yourself.

- If you are currently a subscriber, you can simply Log In to your account to download the appropriate document.

- However, if you are a newcomer to our platform, be sure to follow these steps prior to acquiring the Minneapolis Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2.

- Ensure that the form you have selected is appropriate for your locality, as the laws of one state or county may not apply to another.

- Review the document and read through a brief description (if available) of situations the form can be utilized for.

- If the chosen document does not fulfill your requirements, you can start over and look for the appropriate form.

- Click Buy now and select the subscription plan that best suits your needs.

- Log In to your account {using your Log In credentials or create a new one from the beginning.

- Choose your payment option and proceed to download the Minneapolis Minnesota Notice of Mortgage Foreclosure Sale And Affidavit of Publication - Form 60.3.2 once the payment has been completed.

Form popularity

FAQ

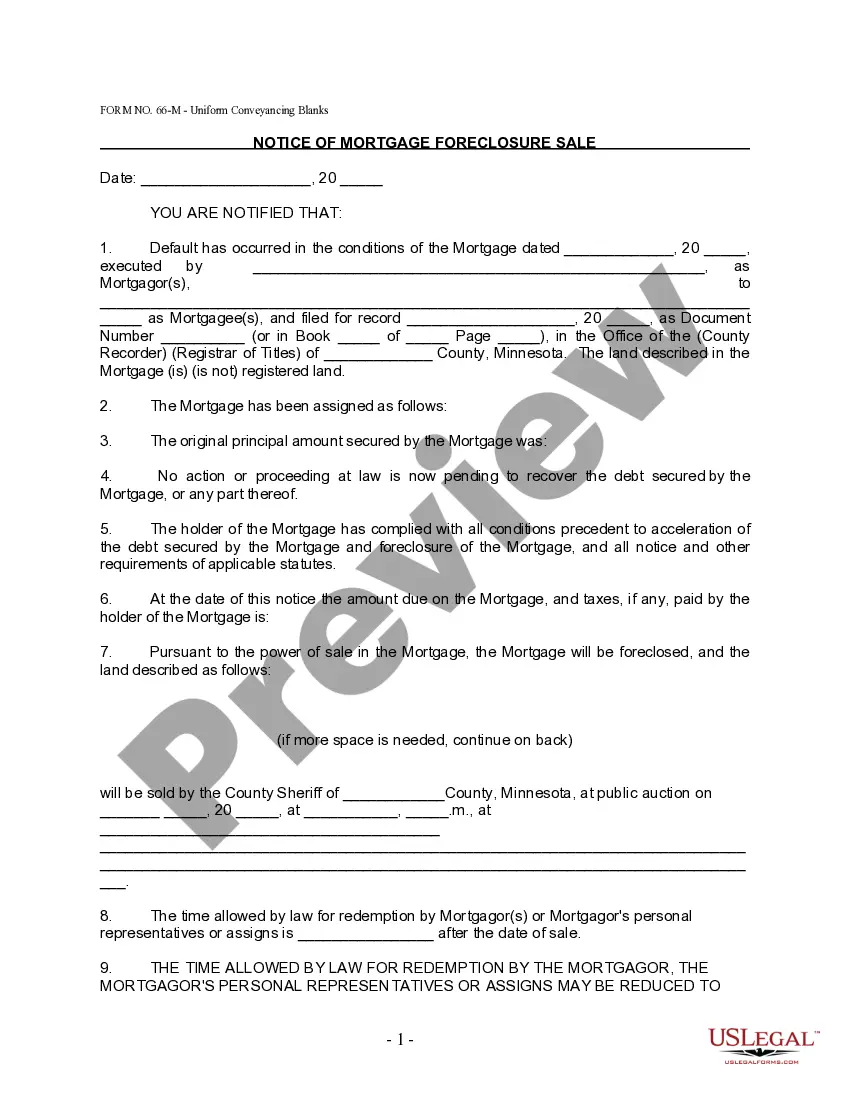

What Is the Foreclosure Process in Minnesota? If you default on your mortgage payments in Minnesota, the lender may foreclose using a judicial or nonjudicial method.

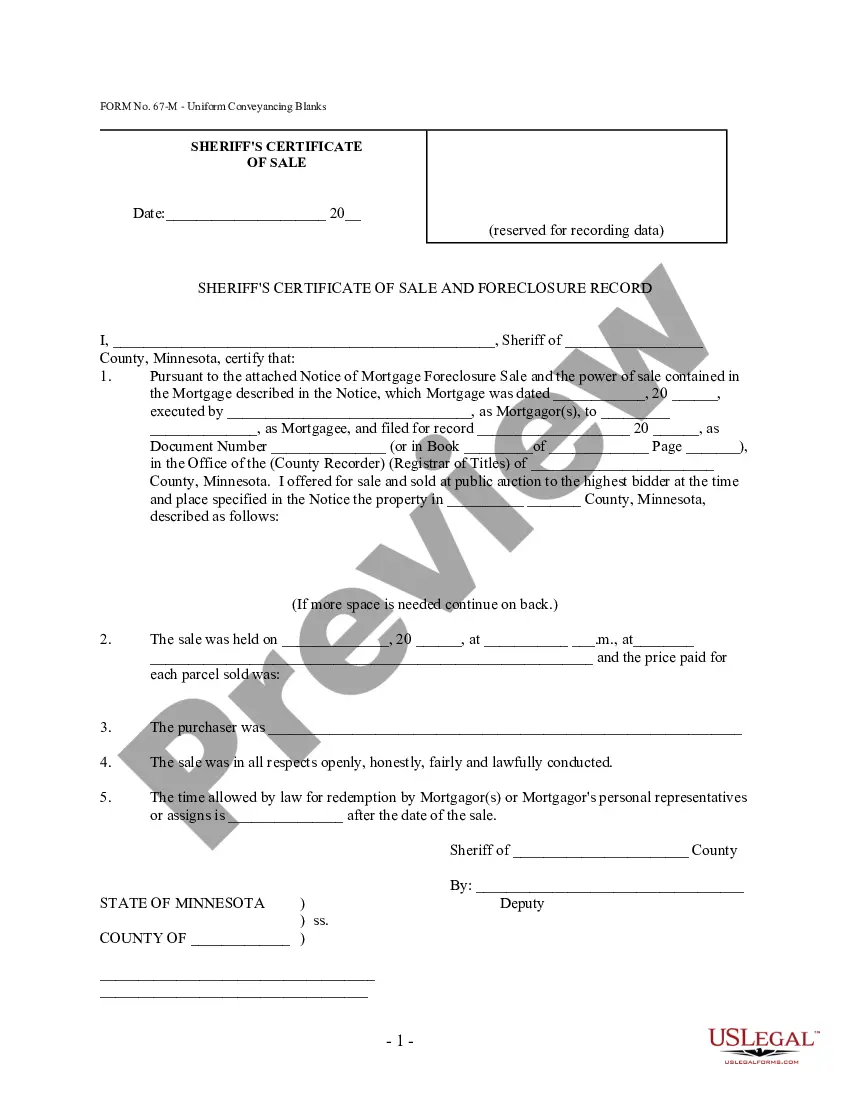

The term ?redemption period? refers to the period of time after a foreclosure sale (sheriff's sale) has been held. For residential property in Minnesota, the redemption period is typically six months, but in some cases twelve months.

Based on information compiled by the National Consumer Law Center (NCLC), at least 10 states can be generally classified as non-recourse for residential mortgages: Alaska, Arizona, California, Hawaii, Minnesota, Montana, North Dakota, Oklahoma, Oregon, and Washington.

The term ?redemption period? refers to the period of time after a foreclosure sale (sheriff's sale) has been held. For residential property in Minnesota, the redemption period is typically six months, but in some cases twelve months.

The term ?redemption period? refers to the period of time after a foreclosure sale (sheriff's sale) has been held. For residential property in Minnesota, the redemption period is typically six months, but in some cases twelve months.

Redemption is a period after your home has already been sold at a foreclosure sale when you can still reclaim your home. You will need to pay the outstanding mortgage balance and all costs incurred during the foreclosure process. Many states have some type of redemption period.

Most foreclosures in Minnesota are nonjudicial, which means the lender doesn't have to go through state court to foreclose.

Foreclosures are usually nonjudicial in the following states: Alabama, Alaska, Arizona, Arkansas, California, Colorado, District of Columbia (sometimes), Georgia, Idaho, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Mexico (sometimes), North Carolina,

After the sheriff's sale, the borrower typically has a ?redemption period? of six months, and can remain in the home during this period (in some cases, the redemption period may be extended to twelve months). During the redemption period, the borrower may attempt to refinance the home through a new mortgage.

The sale is followed by a redemption period, which is usually six months. Accordingly, assuming there is no bankruptcy filing, a typical foreclosure by advertisement (including the typical six month redemption period) generally takes around eight to nine months.