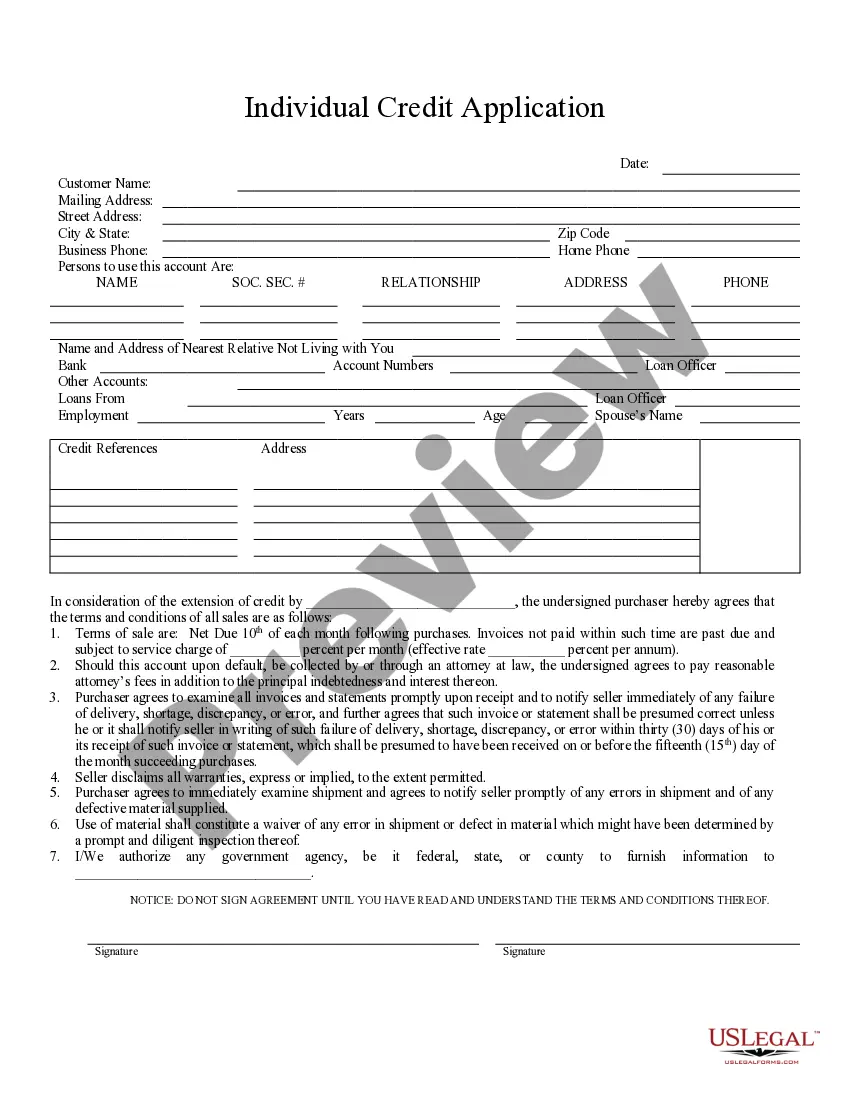

Hennepin Minnesota Individual Credit Application is a formal document used by residents of Hennepin County, Minnesota, to apply for individual credit or loans from financial institutions, such as banks or credit unions. This application serves as a means of assessing an individual's creditworthiness and financial stability before granting them credit. The Hennepin Minnesota Individual Credit Application typically requires personal information, such as the applicant's full name, address, social security number, contact details, employment history, income details, and monthly expenses. Additionally, the application may ask for details about the purpose of the loan, requested loan amount, and desired repayment terms. By submitting the Hennepin Minnesota Individual Credit Application, applicants authorize the financial institution to access their credit history, verify their employment and income details, and perform background checks if necessary. The purpose of this rigorous evaluation is to determine if the applicant has a good credit score, a stable income source, and the ability to repay the loan within the specified time period. There are various types of Hennepin Minnesota Individual Credit Applications available depending on the specific loan or credit product being applied for. These may include: 1. Mortgage Loan Application — This type of application is used when applying for a loan to purchase a residential property or refinance an existing mortgage. It requires more detailed information about the property being purchased, including its value, type, and location. 2. Auto Loan Application — This application is specific to individuals seeking financing to purchase a vehicle. It may require details about the car make, model, year, and mileage. 3. Personal Loan Application — For individuals seeking unsecured loans, this application is used to apply for personal loans for various purposes, such as debt consolidation, home improvements, or medical expenses. 4. Credit Card Application — This type of application is used when applying for a credit card issued by a financial institution. It typically focuses on an individual's credit history, income, and ability to manage credit. These are just a few examples of the various types of Hennepin Minnesota Individual Credit Applications that individuals can encounter when seeking credit or loans in Hennepin County, Minnesota. It is important to carefully complete these forms, provide accurate information, and understand the terms and conditions associated with each credit product to make informed financial decisions.

Hennepin Minnesota Individual Credit Application

Description

How to fill out Hennepin Minnesota Individual Credit Application?

Regardless of social or professional status, completing legal forms is an unfortunate necessity in today’s professional environment. Very often, it’s almost impossible for someone without any legal education to draft such paperwork cfrom the ground up, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes to the rescue. Our service provides a huge library with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also serves as a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

Whether you need the Hennepin Minnesota Individual Credit Application or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hennepin Minnesota Individual Credit Application quickly using our trustworthy service. If you are presently a subscriber, you can go ahead and log in to your account to download the needed form.

However, if you are unfamiliar with our platform, make sure to follow these steps prior to downloading the Hennepin Minnesota Individual Credit Application:

- Be sure the template you have found is specific to your location considering that the regulations of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if available) of scenarios the paper can be used for.

- If the form you picked doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and choose the subscription plan you prefer the best.

- with your credentials or register for one from scratch.

- Select the payment method and proceed to download the Hennepin Minnesota Individual Credit Application once the payment is completed.

You’re good to go! Now you can go ahead and print the form or complete it online. Should you have any issues getting your purchased forms, you can easily access them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Give it a try now and see for yourself.