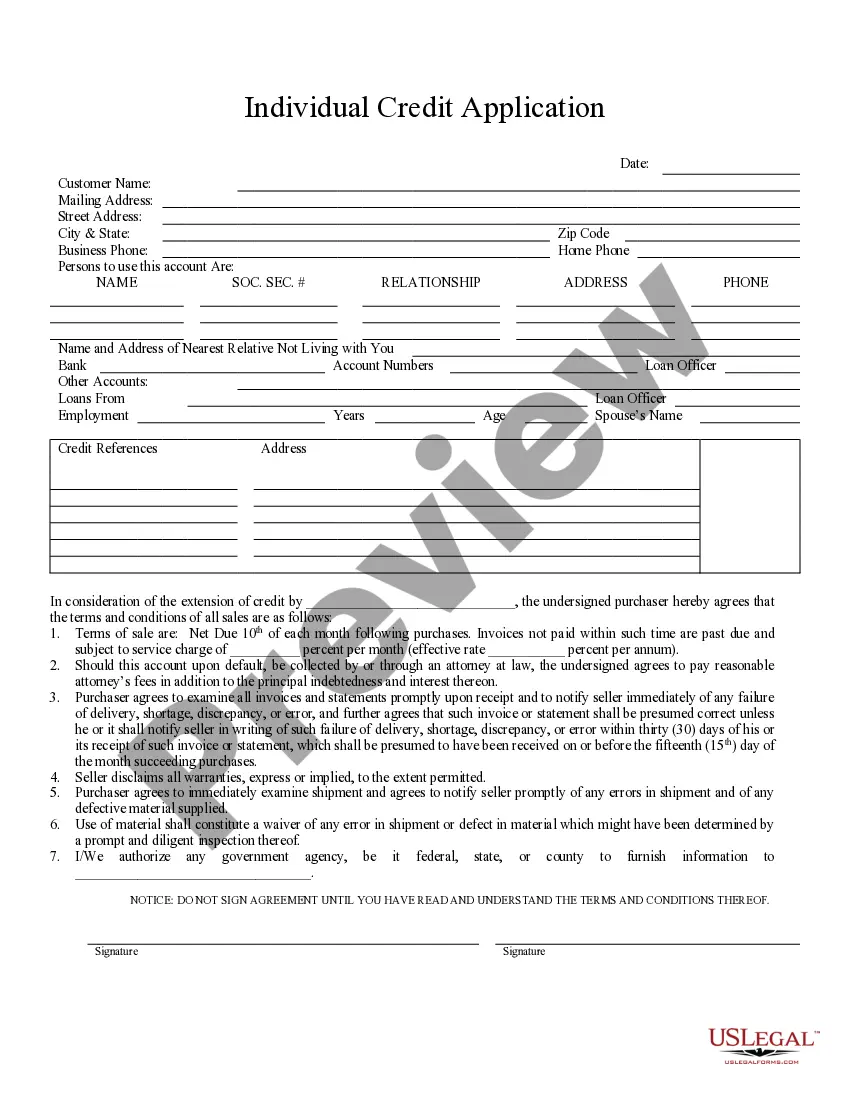

The Saint Paul Minnesota Individual Credit Application is a formal document used by individuals in Saint Paul, Minnesota, to apply for credit at various financial institutions or lenders. This application serves as a means for individuals to request credit, such as loans, mortgages, or credit cards, from these institutions. It is an essential step in the process of obtaining credit and allows lenders to assess the creditworthiness and financial history of applicants before extending credit. The Saint Paul Minnesota Individual Credit Application typically requests detailed personal and financial information from the applicant, such as their full name, address, contact details, social security number, employment information, income details, and existing debts or credit obligations. This information helps lenders evaluate the applicant's ability to repay the credit and make an informed decision regarding the approval or denial of the credit request. Different types of Saint Paul Minnesota Individual Credit Applications may exist based on the specific financial institution or lender. Some common variations include: 1. Mortgage Credit Application: This type of application is specific to individuals seeking credit to finance a home purchase or refinance an existing mortgage. It usually requires additional information related to the property being financed, such as its address, purchase price or appraised value, and details of any existing liens or loans on the property. 2. Personal Loan Credit Application: Designed for individuals seeking unsecured loans for personal reasons, this type of application focuses on the applicant's personal financial situation, employment history, and purpose of the loan. It may require supporting documents such as bank statements, pay stubs, or income tax returns to verify the applicant's financial stability. 3. Credit Card Application: This type of application is specific to individuals applying for a credit card. It typically includes information on the applicant's income, employment status, credit history, and may require details about any existing credit cards or financial obligations. 4. Auto Loan Credit Application: Tailored for individuals seeking financing for a vehicle purchase, this application includes information about the desired vehicle, such as make, model, and year. It also requires details about the applicant's income, employment, and existing debts. 5. Student Loan Credit Application: Geared towards individuals seeking financial assistance for higher education, this application focuses on the applicant's educational background, anticipated costs, and the types of loans or aid they are seeking. Regardless of the type of Saint Paul Minnesota Individual Credit Application, it is crucial for applicants to provide accurate and complete information to enhance their chances of approval. Lenders rely on this information to assess an applicant's credit risk and determine their eligibility for credit products.

Saint Paul Minnesota Individual Credit Application

Description

How to fill out Saint Paul Minnesota Individual Credit Application?

Getting verified templates specific to your local laws can be challenging unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Saint Paul Minnesota Individual Credit Application gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Saint Paul Minnesota Individual Credit Application takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Follow the guidelines below to get started with the most extensive online form catalogue:

- Look at the Preview mode and form description. Make certain you’ve chosen the correct one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Saint Paul Minnesota Individual Credit Application. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!