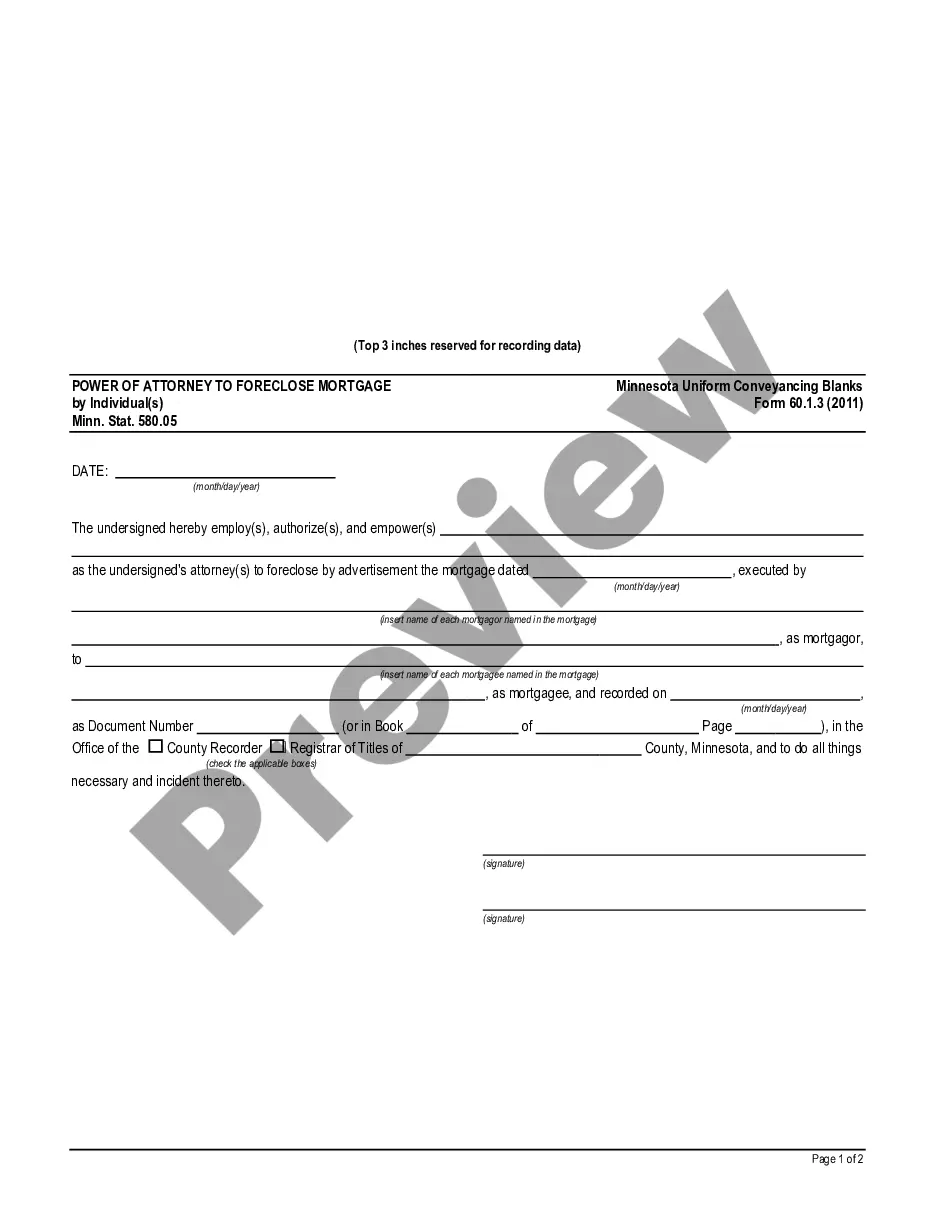

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Hennepin Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 is a legal provision that allows individuals in Hennepin County, Minnesota to grant someone else the authority to act on their behalf in foreclosing a mortgage. This statute provides a detailed framework for executing and utilizing such powers of attorney in mortgage foreclosure proceedings. Under Minn. Stat. 580.05, there are two main types of power of attorney to foreclose a mortgage: 1. Limited Power of Attorney to Foreclose Mortgage: This type of power of attorney grants the appointed individual the specific authority to initiate and carry out foreclosure proceedings on behalf of the property owner. This limited power allows the agent to handle all relevant aspects of the foreclosure process, including initiating legal actions, attending hearings, negotiating with borrowers, and executing any required documents. 2. General Power of Attorney to Foreclose Mortgage: With a general power of attorney, the designated agent is granted broader authority over the foreclosure process. In addition to the actions mentioned in the limited power of attorney, individuals with a general power of attorney can exercise more general control over the property's affairs, such as managing finances, making decisions regarding repairs or improvements, and dealing with other legal matters related to the property or the mortgage. It is important to note that the specifics of a power of attorney and its terms may vary depending on the individual circumstances, preferences, and the language included in the document. Minn. Stat. 580.05 provides a structured legal framework to ensure that the power of attorney is properly executed, approved, and recorded. It requires specific language to be included in the power of attorney document and mandates that a copy of the power of attorney must be filed with the county recorder or registrar of titles where the property is situated. This statutory provision aims to protect the rights and interests of all parties involved in the foreclosure process and ensure compliance with the law. In conclusion, Hennepin Minnesota Power of Attorney to Foreclose Mortgage by Individuals — Minn. Stat. 580.05 enables property owners in Hennepin County, Minnesota to grant a trusted individual the authority to handle foreclosure proceedings on their behalf. By providing a legal framework and specifying the requirements for executing a power of attorney, the statute ensures transparency, accountability, and proper documentation throughout the foreclosure process.