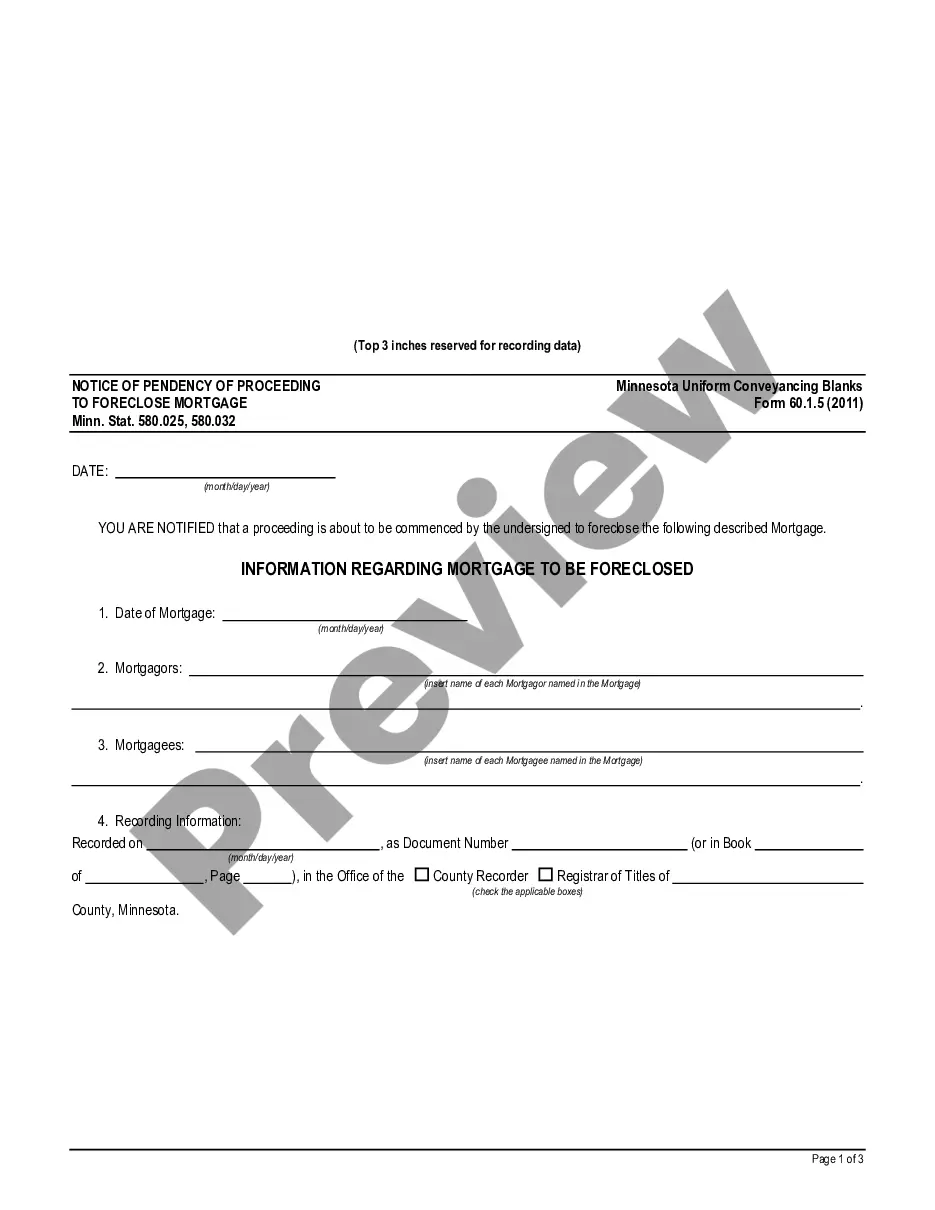

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Title: Understanding the Saint Paul Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage: A Comprehensive Guide Keywords: Saint Paul Minnesota, Notice of Pendency, Proceeding, Foreclosure Mortgage Introduction: In Saint Paul, Minnesota, homeowners facing the threat of foreclosure may receive a Notice of Pendency of Proceeding to Foreclosure Mortgage. This legal document serves as a crucial notification that initiates the foreclosure process, aiming to inform property owners of an impending foreclosure proceeding. This article aims to provide a detailed description of this notice as well as different types that may exist. 1. What is a Notice of Pendency in Saint Paul, Minnesota? The Notice of Pendency, also known as Li's Pendent, is a legal document filed with the County Recorder's Office by the lender or mortgagee when the process of initiating foreclosure commences. Its purpose is to provide public notice that there is a pending lawsuit concerning a specific property. 2. Understanding the Foreclosure Mortgage Process: Foreclosure is a legal procedure through which a lender attempts to reclaim ownership of a property due to non-payment of the mortgage loan. The Notice of Pendency is a prerequisite step before the foreclosure process can proceed. 3. Importance of the Notice of Pendency: The Notice of Pendency, once filed, alerts interested parties that a property is subject to a foreclosure lawsuit. It prevents the sale or transfer of the property until the foreclosure process is complete. 4. Key Details Included in the Notice of Pendency: — Property Identification: The notice includes the exact legal description, address, and other relevant details about the property involved in the foreclosure proceedings. — Parties Involved: It includes the names of the plaintiff (lender) and defendant (property owner) involved in the foreclosure lawsuit. — Date: The filing date of the notice is provided, serving as a point of reference for the foreclosure timeline. — County Recorder's Office: The notice includes the contact information of the office where the Notice of Pendency is filed. 5. Different Types of Saint Paul Minnesota Notice of Pendency: a) Default Notice of Pendency: This type of notice is typically sent to homeowners who have fallen behind on their mortgage payments. b) Tax Lien Notice of Pendency: This notice may be issued when property owners fail to pay property taxes, and a foreclosure attempt is made by the local government. Conclusion: Receiving a Notice of Pendency of Proceeding to Foreclosure Mortgage in Saint Paul, Minnesota, is a critical juncture for homeowners. This notice serves as a formal alert of an impending foreclosure proceeding and requires immediate attention. Familiarizing oneself with this notice and seeking legal assistance promptly is crucial for property owners to navigate through the foreclosure process successfully.Title: Understanding the Saint Paul Minnesota Notice of Pendency of Proceeding to Foreclosure Mortgage: A Comprehensive Guide Keywords: Saint Paul Minnesota, Notice of Pendency, Proceeding, Foreclosure Mortgage Introduction: In Saint Paul, Minnesota, homeowners facing the threat of foreclosure may receive a Notice of Pendency of Proceeding to Foreclosure Mortgage. This legal document serves as a crucial notification that initiates the foreclosure process, aiming to inform property owners of an impending foreclosure proceeding. This article aims to provide a detailed description of this notice as well as different types that may exist. 1. What is a Notice of Pendency in Saint Paul, Minnesota? The Notice of Pendency, also known as Li's Pendent, is a legal document filed with the County Recorder's Office by the lender or mortgagee when the process of initiating foreclosure commences. Its purpose is to provide public notice that there is a pending lawsuit concerning a specific property. 2. Understanding the Foreclosure Mortgage Process: Foreclosure is a legal procedure through which a lender attempts to reclaim ownership of a property due to non-payment of the mortgage loan. The Notice of Pendency is a prerequisite step before the foreclosure process can proceed. 3. Importance of the Notice of Pendency: The Notice of Pendency, once filed, alerts interested parties that a property is subject to a foreclosure lawsuit. It prevents the sale or transfer of the property until the foreclosure process is complete. 4. Key Details Included in the Notice of Pendency: — Property Identification: The notice includes the exact legal description, address, and other relevant details about the property involved in the foreclosure proceedings. — Parties Involved: It includes the names of the plaintiff (lender) and defendant (property owner) involved in the foreclosure lawsuit. — Date: The filing date of the notice is provided, serving as a point of reference for the foreclosure timeline. — County Recorder's Office: The notice includes the contact information of the office where the Notice of Pendency is filed. 5. Different Types of Saint Paul Minnesota Notice of Pendency: a) Default Notice of Pendency: This type of notice is typically sent to homeowners who have fallen behind on their mortgage payments. b) Tax Lien Notice of Pendency: This notice may be issued when property owners fail to pay property taxes, and a foreclosure attempt is made by the local government. Conclusion: Receiving a Notice of Pendency of Proceeding to Foreclosure Mortgage in Saint Paul, Minnesota, is a critical juncture for homeowners. This notice serves as a formal alert of an impending foreclosure proceeding and requires immediate attention. Familiarizing oneself with this notice and seeking legal assistance promptly is crucial for property owners to navigate through the foreclosure process successfully.