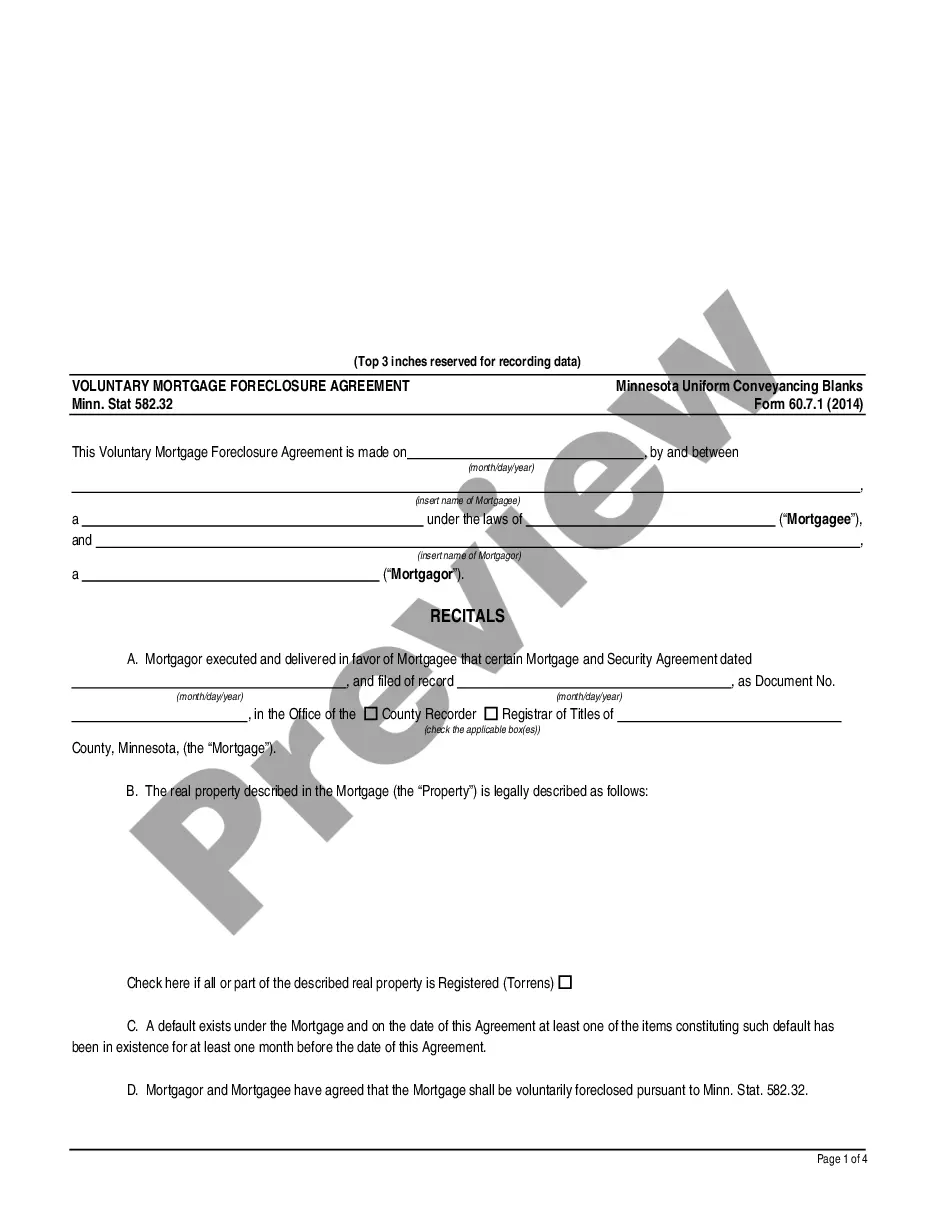

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

The Hennepin Minnesota Voluntary Mortgage Foreclosure Agreement is a legal document that outlines the terms and conditions between a borrower and a lender when the borrower voluntarily agrees to surrender their property in order to avoid foreclosure. This agreement is specific to Hennepin County, Minnesota and follows the state's foreclosure laws. The voluntary mortgage foreclosure agreement serves as a beneficial option for borrowers who are unable to make their mortgage payments and want to avoid the legal proceedings and potential damage to their credit caused by a forced foreclosure. By entering into this agreement, borrowers can work with their lender to find a mutually agreeable solution while minimizing the financial and emotional impacts. Key terms and conditions that may be included in the Hennepin Minnesota Voluntary Mortgage Foreclosure Agreement include: 1. Surrender of Property: The borrower agrees to voluntarily surrender the property to the lender and vacate within a specified timeframe. 2. Waiver of Liability: The lender agrees to waive any further claims against the borrower regarding the unpaid mortgage debt in exchange for the property surrender. 3. Foreclosure Process: The agreement may outline the procedures for the lender to file a foreclosure action with the court and how the borrower will cooperate during this process. 4. Occupancy Costs: The agreement may address the responsibility for payment of taxes, insurance, maintenance, and other costs related to the property during the transition period. 5. Credit Reporting: The agreement may discuss the lender's approach to reporting the voluntary foreclosure to credit bureaus and how it could impact the borrower's credit score. 6. Deficiency Judgment: Depending on the circumstances, the agreement may address whether the lender will pursue a deficiency judgment against the borrower for the difference between the outstanding mortgage balance and the property's sale price. 7. Financial Obligations: The agreement may detail any outstanding financial obligations, such as unpaid property taxes or homeowner association fees, and how they will be resolved. Different types of Hennepin Minnesota Voluntary Mortgage Foreclosure Agreements may vary depending on the specific negotiation between the borrower and the lender. This could include modifications to the terms mentioned above or the addition of unique clauses to meet the needs of both parties while ensuring compliance with state and local foreclosure laws. In conclusion, the Hennepin Minnesota Voluntary Mortgage Foreclosure Agreement is an essential legal document that provides a framework for borrowers and lenders to navigate the process of surrendering a property to avoid foreclosure. By understanding the terms and conditions outlined in this agreement, individuals can make informed decisions about their financial future while minimizing the potential negative consequences of a forced foreclosure.