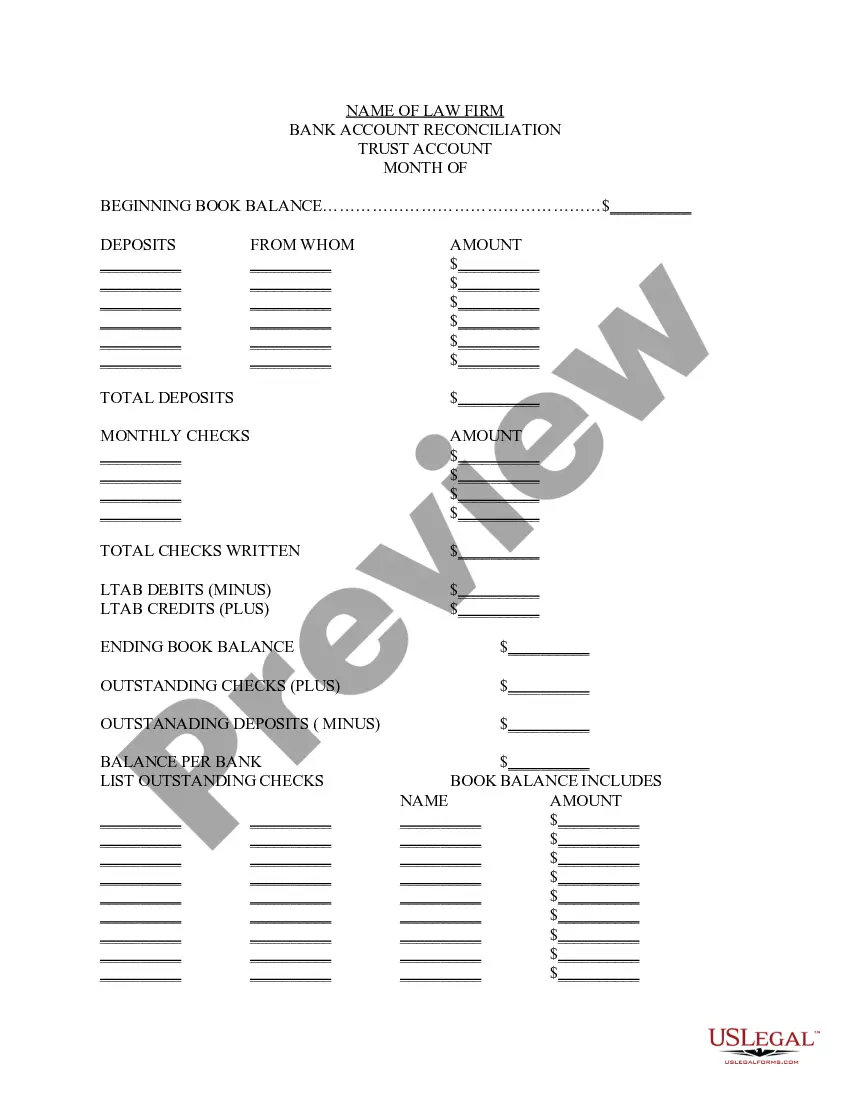

When managing a trust account, it is vital to carry out a monthly reconciliation to ensure accuracy and financial transparency. In this article, we will delve into the detailed description of what a Saint Paul Minnesota Monthly reconciliation of trust account from a bank statement entails, along with discussing various templates available to streamline the process. A Saint Paul Minnesota Monthly Reconciliation of Trust Account from a bank statement involves carefully comparing and matching the transactions listed in the bank statement with the corresponding entries in the trust account ledger. This process ensures that all deposits, withdrawals, fees, and other financial activities are accurately recorded and accounted for. It aims to detect any discrepancies and resolve them promptly to maintain the financial integrity of the trust account. To simplify the reconciliation procedure, professionals often utilize templates specifically designed for trust account reconciliations. These templates provide a structured format where relevant information can be easily inputted and cross-referenced. The templates typically include the following sections: 1. Bank Statement Information: This section incorporates details such as the bank's name, account number, statement date, opening and closing balances, and any specific notifications or remarks provided by the bank. 2. Trust Account Ledger Information: Here, you input the corresponding information from the trust account ledger, including opening and closing balances. It is essential to ensure that the trust account ledger is up-to-date and reflects all relevant transactions. 3. Reconciliation Summary: This section serves as the primary output of the reconciliation process, clearly outlining the reconciled balances, along with any discrepancies found. It is crucial to identify the reasons behind these discrepancies and take appropriate actions to rectify them. 4. Reconciling Items: In this section, you list all the transactions that contribute to the reconciliation differences. These can include outstanding checks, deposits in transit, bank fees, interest earned, and any other items yet to be posted or cleared. 5. Adjustments: If necessary, this section allows you to record any adjustments made to correct errors or inconsistencies. It is essential to properly document and explain any adjustments made during the reconciliation process. While the fundamental structure remains consistent, different variations of the Saint Paul Minnesota Monthly reconciliation of trust account from bank statement templates may exist depending on specific needs or regulations. These variations could include templates tailored to different types of trust accounts, such as real estate trust accounts, escrow trust accounts, or attorney trust accounts. In conclusion, conducting a detailed Saint Paul Minnesota Monthly reconciliation of trust account from a bank statement is crucial to ensure accuracy and financial transparency. Utilizing templates designed for trust account reconciliations streamlines the process and aids in efficiently identifying and resolving any discrepancies. Whether it be for real estate, escrow, or attorney trust accounts, employing an appropriate template helps safeguard the financial integrity of trust accounts, providing peace of mind to trust administrators, beneficiaries, and regulatory bodies.

Saint Paul Minnesota Monthly reconciliation of trust account from bank statement - template

Description

How to fill out Saint Paul Minnesota Monthly Reconciliation Of Trust Account From Bank Statement - Template?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for someone with no legal education to create such paperwork from scratch, mainly because of the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a huge catalog with more than 85,000 ready-to-use state-specific forms that work for practically any legal scenario. US Legal Forms also serves as an excellent resource for associates or legal counsels who want to save time using our DYI forms.

No matter if you require the Saint Paul Minnesota Monthly reconciliation of trust account from bank statement - template or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how to get the Saint Paul Minnesota Monthly reconciliation of trust account from bank statement - template quickly using our trusted platform. In case you are presently a subscriber, you can go on and log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Saint Paul Minnesota Monthly reconciliation of trust account from bank statement - template:

- Be sure the form you have found is good for your location considering that the regulations of one state or area do not work for another state or area.

- Preview the document and read a quick outline (if provided) of scenarios the document can be used for.

- If the one you selected doesn’t meet your needs, you can start over and search for the necessary form.

- Click Buy now and choose the subscription option that suits you the best.

- Log in to your account login information or register for one from scratch.

- Pick the payment method and proceed to download the Saint Paul Minnesota Monthly reconciliation of trust account from bank statement - template once the payment is done.

You’re all set! Now you can go on and print out the document or fill it out online. Should you have any issues locating your purchased forms, you can quickly access them in the My Forms tab.

Whatever situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.