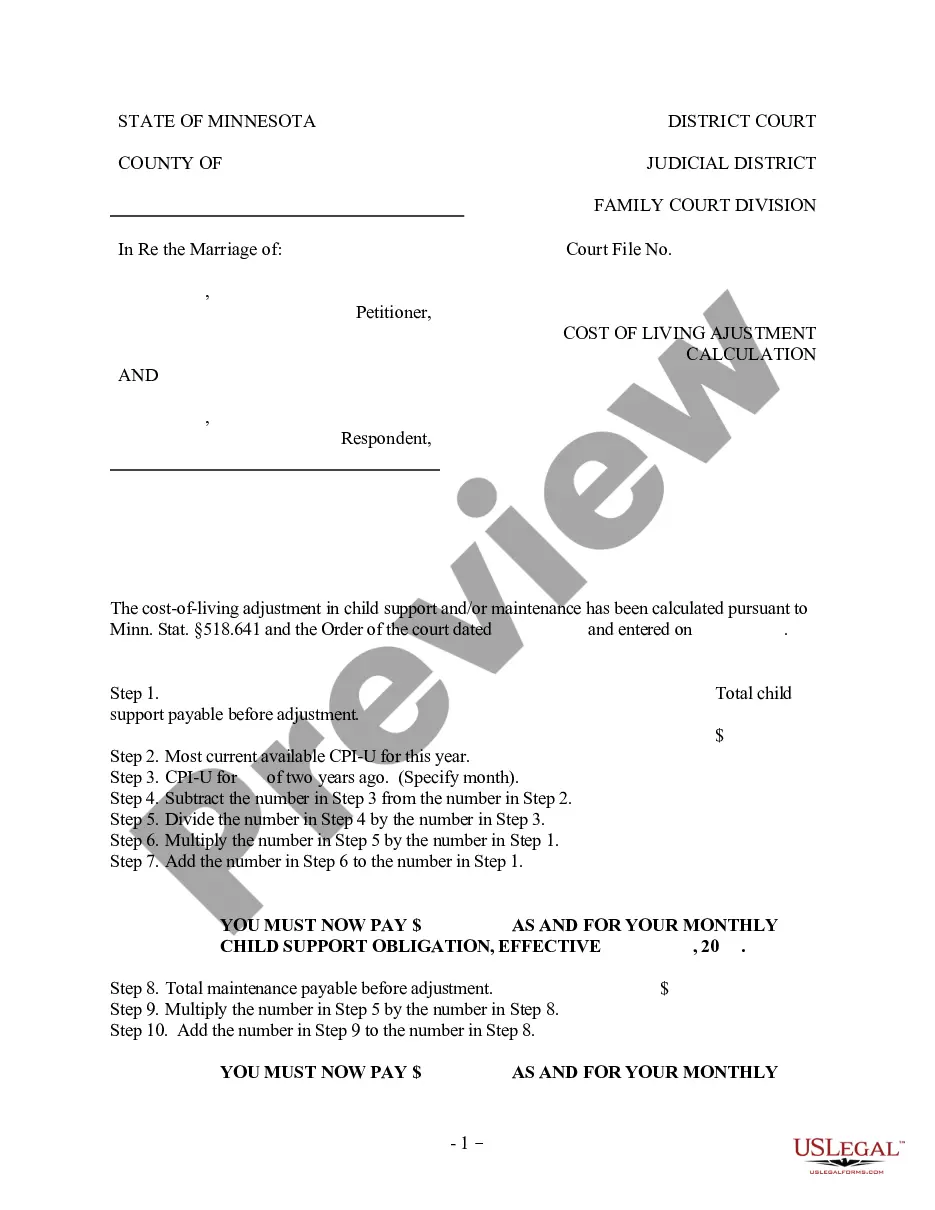

Hennepin County, Minnesota follows specific guidelines and formulas when calculating the Cost of Living Adjustment (COLA) for child support payments. The COLA ensures that child support amounts keep up with inflation and changes in the cost of living. Here are the key factors and types of COLA calculations used in Hennepin County: 1. Consumer Price Index (CPI): Hennepin County uses the CPI to determine the percentage increase in the cost of goods and services over a specific time period. The CPI measures changes in the average prices paid by urban consumers for a market basket of goods and services. It is widely recognized as a reliable indicator of inflation. 2. Basic Child Support Obligation (BCO): The BCO is the starting point for calculating child support in Hennepin County. It is based on the combined income of both parents and the number of children requiring support. The COLA calculation is applied to the BCO amount to adjust it for changes in the cost of living. 3. Annual COLA Adjustment: Hennepin County recalculates child support every year to reflect the most recent changes in the cost of living. The annual COLA adjustment is typically determined by comparing the CPI for the calendar year with the CPI from the previous year. If there is an increase in the CPI, the COLA adjustment will be applied to the child support amount. 4. Historical COLA Adjustments: Hennepin County keeps a record of previous COLA adjustments for child support. This allows them to track the changes in child support amounts over time and ensures consistent application of the COLA calculation formula. 5. Mandatory Review Period: In Hennepin County, child support orders are subject to review every three years. During this review, the COLA adjustment is considered to determine if the child support amount needs to be modified due to changes in the cost of living. If the CPI has increased significantly since the last COLA adjustment, a modification may be necessary. Hennepin County aims to provide a fair and accurate child support calculation that reflects the changing economic conditions. The COLA calculation plays a vital role in ensuring that child support payments keep pace with inflation and the rising cost of living in Minnesota.

Hennepin Minnesota Cost of Living Adjustment Calculation for Child Support

Description

How to fill out Hennepin Minnesota Cost Of Living Adjustment Calculation For Child Support?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial matters. To accomplish this, we sign up for legal services that, as a rule, are very expensive. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based library of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of turning to legal counsel. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Hennepin Minnesota Cost of Living Adjustment Calculation for Child Support or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can create your account within minutes.

- Make sure to check if the Hennepin Minnesota Cost of Living Adjustment Calculation for Child Support complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Hennepin Minnesota Cost of Living Adjustment Calculation for Child Support would work for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!

Form popularity

FAQ

To set parenting time, the court looks at factors such as the child's age, the child's safety, and the child's past relationship with the noncustodial parent. There are 12 best interest factors the Court must consider. In general, a noncustodial parent gets a minimum of 25% of the parenting time.

How is the basic child support amount calculated? Basic child support is calculated based on the combined gross income of both parents and is allocated based on each parent's proportionate share of the combined parental income for child support. Minn. Stat.

A parenting time restriction is anything that would substantially limit or have a negative effect on a parent's ability to maintain the existing parent-child relationship. Restrictions on parenting time may be made before any parenting time is court ordered.

It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If there is no increase, there can be no COLA.

These guidelines provided for the individual to pay 25% of his or her net income for one child, 30% for two children, 35% for three children, and so on.

The parties have combined net income of $4,000 per month. Thus, the father's percentage of the parties' combined net income is 60%; the mother's is 40%.... WifeHusbandGuideline percentage required for 2 children:30%30%Guideline amount of child support:$900$420Percent of time parent has custody:40%60%4 more rows

Percentage of time is generally calculated by counting the number of overnights the child spends with the parent in a year. 10% time =36 overnights or less. 10 to 45% time = 37 to 171 overnights. The law presumes that both parents can or should work.

California calculates parenting time percentage using per year. Based on the timeshare arrangement, parents add the number of visitation hours per year and divide that number by 8,760 (the total number of hours in one year).

How is the basic child support amount calculated? Basic child support is calculated based on the combined gross income of both parents and is allocated based on each parent's proportionate share of the combined parental income for child support.

Some parents are able to manage a roughly 50/50 custody split, meaning that the child lives with each parent an equal amount of time. This can work if both parents live close to one another and to the child's school, and are able to exchange the child regularly without difficulty.