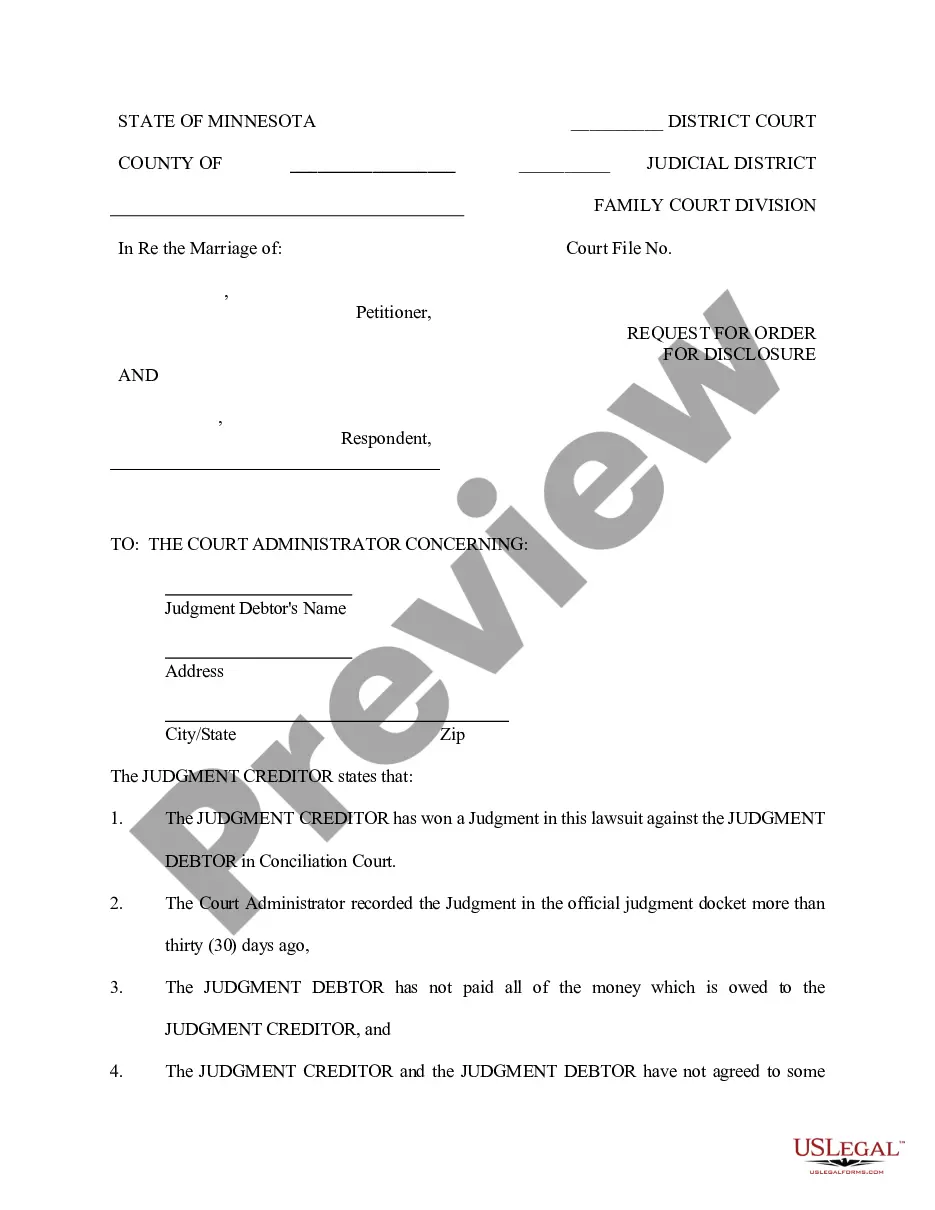

Title: Understanding the Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor: A Comprehensive Overview Introduction: The Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor is a legal process used to ensure complete financial transparency from the individual or entity responsible for fulfilling a court judgment. Through this motion, the judgment creditor seeks to obtain detailed information regarding the financial status of the judgment debtor, aiding in the execution of the judgment. This article will delve into the specifics of this motion, its purpose, procedure, and any possible variations. 1. Definition of the Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor: The Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor is a legal document filed by the judgment creditor to request information regarding the assets, income, liabilities, and financial affairs of the judgment debtor. 2. Purpose of the Motion: The main objective of this motion is to provide the judgment creditor with a comprehensive understanding of the judgment debtor's financial capabilities. It enables the creditor to determine the most effective methods for enforcing the court judgment, such as wage garnishment, property liens, or bank account levies. 3. Key Information Requested: The motion typically requires the judgment debtor to disclose various financial details, including but not limited to: — Assets: Bank accounts, real estate, vehicles, business interests, investments, etc. — Income: Salary, wages, commissions, pensions, rental income, etc. — Liabilities: Debts, mortgages, loans, credit card balances, etc. — Expenditures: Monthly expenses, bills, medical costs, insurance, etc. 4. Procedure for Filing the Motion: To initiate the process, the judgment creditor must adhere to specific steps, which might include: — Obtaining the necessary forms: Depending on the jurisdiction, specific forms may be required to file the motion. — Completing the forms: The judgment creditor must accurately fill out the forms, providing detailed information about the judgment debtor, the amount of the judgment, and other relevant details as required. — Filing the motion: The completed motion forms must be filed with the appropriate Hennepin Minnesota court and served to the judgment debtor, ensuring all relevant parties are aware of the action. 5. Types or Variations of the Motion: While the fundamental purpose of the Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor remains the same, there may be slight variations depending on specific circumstances. Some possible variations may include: — Emergency Motion: Used when the judgment creditor believes the judgment debtor poses a flight risk or is attempting to hide assets, leading to an expedited financial disclosure process. — Post-Judgment Discovery: Filed after the initial judgment led to a failed attempt at collection, this motion seeks to uncover additional financial details that were not previously disclosed or uncovered. Conclusion: The Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor is a powerful tool enabling judgment creditors to access crucial financial information necessary for enforcing a court judgment successfully. By understanding the purpose, procedure, and possible variations of this motion, both judgment creditors and debtors can navigate the legal process more effectively. Always consult with legal professionals for accurate advice tailored to your specific situation.

Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor

Description

How to fill out Hennepin Minnesota Motion For Order Compelling Financial Disclosure By Judgment Debtor?

Are you looking for a reliable and affordable legal forms provider to buy the Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor? US Legal Forms is your go-to choice.

Whether you need a basic arrangement to set rules for cohabitating with your partner or a package of documents to advance your divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time in the My Forms tab.

Are you new to our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor conforms to the regulations of your state and local area.

- Go through the form’s description (if available) to learn who and what the form is good for.

- Restart the search if the template isn’t good for your specific situation.

Now you can create your account. Then select the subscription plan and proceed to payment. Once the payment is done, download the Hennepin Minnesota Motion for Order Compelling Financial Disclosure by Judgment Debtor in any available format. You can get back to the website at any time and redownload the form without any extra costs.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a go now, and forget about wasting your valuable time learning about legal papers online once and for all.