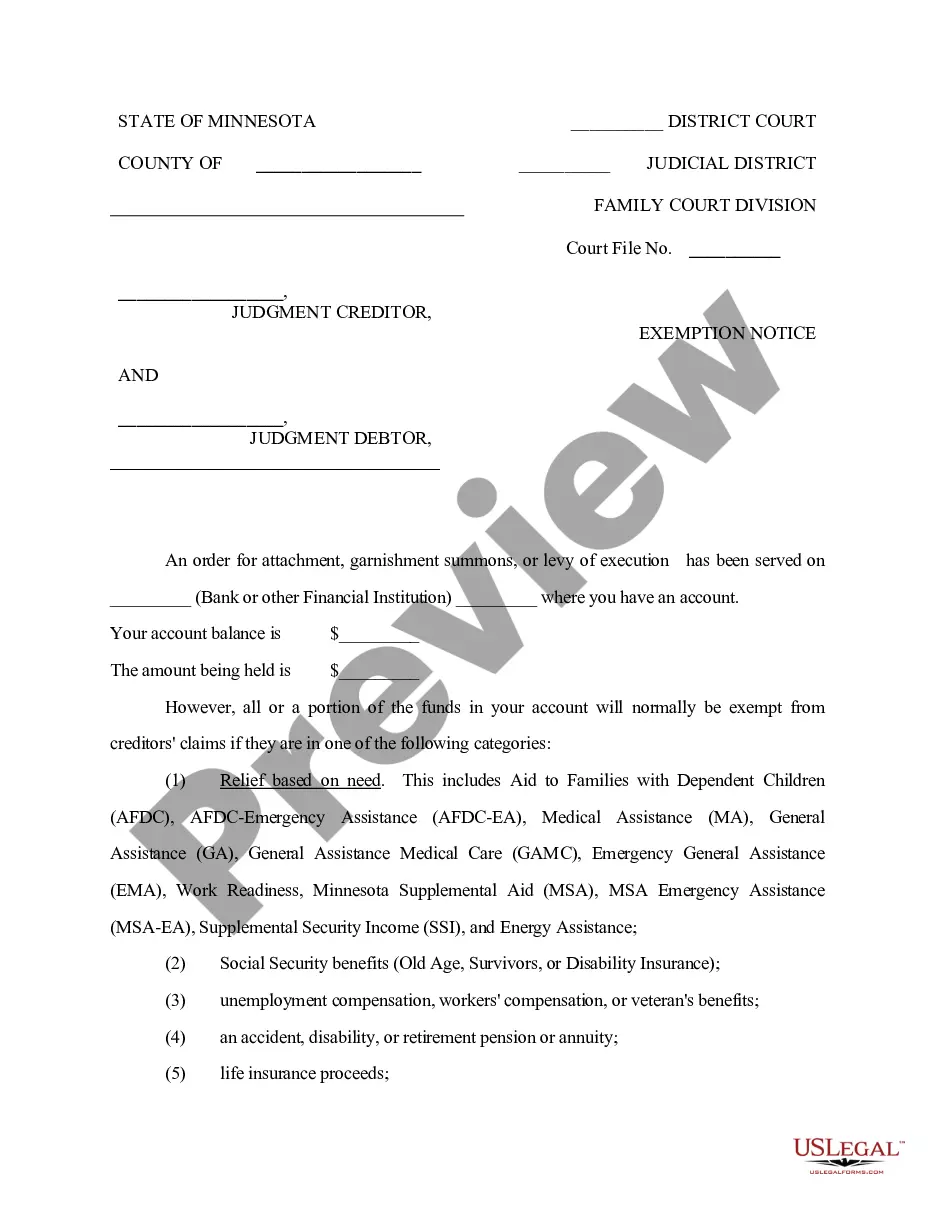

Hennepin County, Minnesota offers a Partial Exemption from Garnishment for residents who are facing financial hardships and need protection from having their wages garnished by creditors. This exemption aims to provide relief to vulnerable individuals and prevent excessive financial strain. Under the Hennepin Minnesota Partial Exemption from Garnishment, certain types of income are safeguarded against creditor collection efforts. This allows individuals and families to maintain a minimum level of income necessary for basic living expenses, ensuring they can meet essential needs such as housing, food, and healthcare. There are different types of Hennepin Minnesota Partial Exemptions from Garnishment, each designed to address specific situations and protect various sources of income. These exemptions include: 1. Wage Exemption: This type of exemption ensures that a percentage of an individual's wages cannot be garnished, safeguarding their primary source of income. It allows them to continue meeting their financial obligations while still having enough to cover essential living expenses. 2. Public Benefits Exemption: This exemption protects certain types of government assistance or public benefits from garnishments. It includes benefits like Social Security, Supplemental Security Income (SSI), unemployment compensation, disability benefits, and veterans' benefits. These benefits often serve as a lifeline for individuals and families, providing vital support in times of need. 3. Retirement and Pension Exemption: Individuals who have retired or received a pension in Hennepin County may be eligible for this exemption, protecting a portion or the entirety of their retirement income from being garnished. This exemption acknowledges the importance of securing financial stability during one's retirement years. 4. Child Support and Alimony Exemption: This exemption ensures that child support and alimony payments received by individuals in Hennepin County are not subject to creditor garnishment. It provides critical support to custodial parents or former spouses who rely on these payments to maintain their own financial well-being and that of their children. It's important to note that the specific regulations, requirements, and limitations associated with Hennepin Minnesota Partial Exemption from Garnishment may vary depending on individual circumstances. Consulting with a legal professional or seeking assistance from organizations specializing in debt relief can help individuals navigate the process and understand the full extent of their exemptions. Overall, the Hennepin Minnesota Partial Exemption from Garnishment serves as a crucial safeguard for residents experiencing financial hardship, protecting specific income sources necessary for their well-being. These exemptions aim to strike a balance between debtors' obligations and ensuring individuals have access to essential resources, thereby promoting financial stability and preventing excessive hardship.

Hennepin Minnesota Partial Exemption from Garnishment

Description

How to fill out Hennepin Minnesota Partial Exemption From Garnishment?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s world. Very often, it’s almost impossible for a person with no law education to create this sort of papers cfrom the ground up, mainly due to the convoluted jargon and legal nuances they involve. This is where US Legal Forms comes in handy. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal situation. US Legal Forms also is an excellent resource for associates or legal counsels who want to save time utilizing our DYI forms.

No matter if you need the Hennepin Minnesota Partial Exemption from Garnishment or any other document that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Hennepin Minnesota Partial Exemption from Garnishment quickly employing our trustworthy platform. If you are already a subscriber, you can go on and log in to your account to get the appropriate form.

Nevertheless, in case you are a novice to our platform, make sure to follow these steps prior to obtaining the Hennepin Minnesota Partial Exemption from Garnishment:

- Be sure the template you have chosen is suitable for your area since the rules of one state or county do not work for another state or county.

- Review the document and read a quick description (if available) of cases the document can be used for.

- If the form you selected doesn’t suit your needs, you can start again and search for the suitable document.

- Click Buy now and pick the subscription option that suits you the best.

- Access an account {using your credentials or create one from scratch.

- Choose the payment gateway and proceed to download the Hennepin Minnesota Partial Exemption from Garnishment as soon as the payment is done.

You’re good to go! Now you can go on and print the document or complete it online. In case you have any problems getting your purchased documents, you can quickly find them in the My Forms tab.

Regardless of what case you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.

Form popularity

FAQ

Limits on Wage Garnishment in Minnesota In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage.

You can stop a garnishment by: Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

Limits on Wage Garnishment in Minnesota In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.

Creditors and debt collectors do not want to put more effort than they have to into your case. Even after a garnishment has started, there is always the opportunity to try to negotiate a resolution. Putting pressure and trying to negotiate provides you a chance to stop the garnishment.

There are four ways to stop a garnishment in Minnesota: (1) claim an exemption; (2) negotiate a settlement; (3) vacate the judgment; and (4) file bankruptcy.

One of the first steps you can take is to try and work with the creditor that wants to garnish your wages. You may be able to negotiate a smaller monthly payment than the amount that would be taken out of your paycheck.

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

To claim that your wages are exempt from garnishment, you must promptly return to the creditor's attorney the ?Debtor's Exemption Claim Notice? that came with the Notice of Intent to Garnish Earnings. You must include a copy of your last 60 days of bank statements with this paperwork.