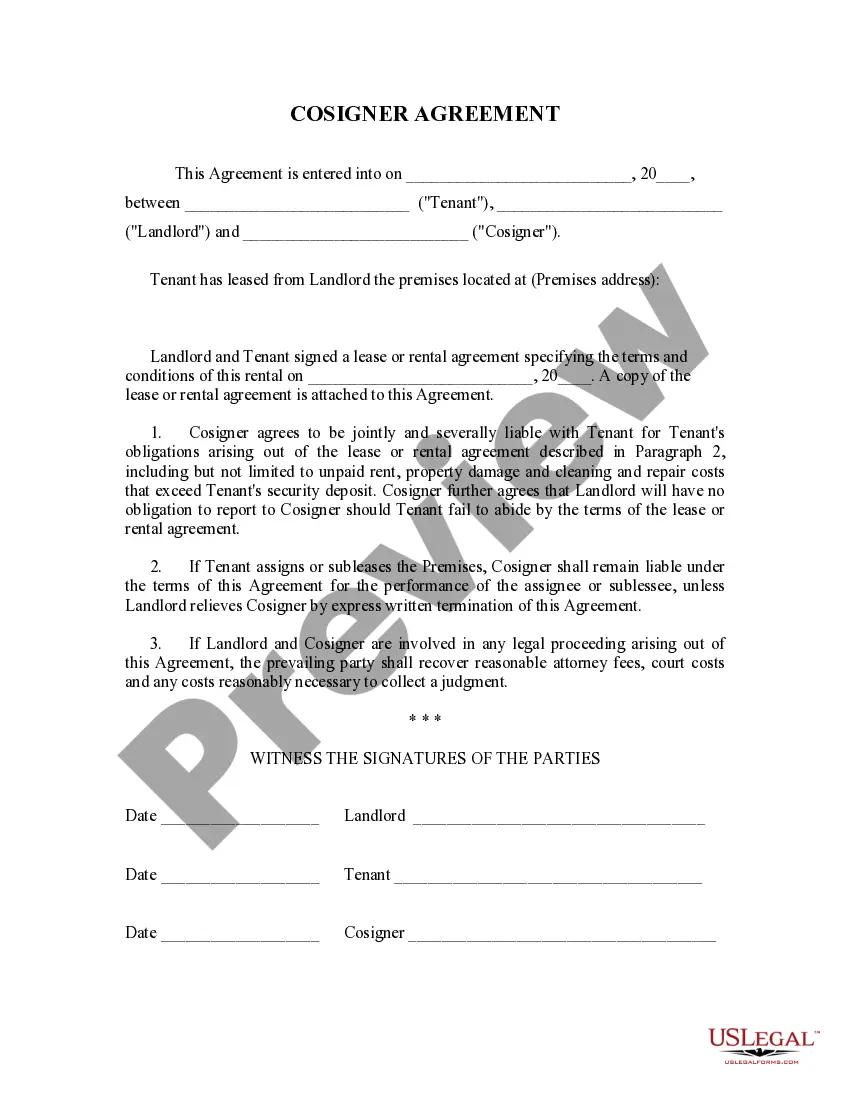

The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor). In Saint Paul, Minnesota, a Landlord Tenant Lease Co-Signer Agreement is a legally binding contract entered into between a landlord, a tenant, and a co-signer. This agreement is typically used when a tenant is unable to meet the landlord's rental requirements on their own, such as having a low credit score, insufficient income, or a limited rental history. A co-signer, also referred to as a guarantor, accepts legal responsibility for fulfilling the tenant's obligations under the lease if the tenant fails to do so. The Saint Paul Minnesota Landlord Tenant Lease Co-Signer Agreement outlines the rights and responsibilities of the landlord, tenant, and co-signer throughout the lease term. It is critical for all parties involved to thoroughly understand the terms and implications before signing the agreement. The document covers various aspects, such as the lease term, rent amount, security deposit, maintenance responsibilities, late fees, and lease termination procedures. In Saint Paul, there may be different types of Landlord Tenant Lease Co-Signer Agreements based on specific circumstances or requirements. For instance: 1. Student Co-Signer Agreement: This type of agreement is commonly used when a student tenant requires a co-signer due to having a limited credit history or income. It may outline additional terms related to student housing, such as roommate responsibilities or rules specific to university housing areas. 2. Low-Income Co-Signer Agreement: In cases where a tenant has a low income but meets other rental criteria, the landlord may require a co-signer to minimize the risk of non-payment. This type of agreement may address specific considerations related to subsidized housing or rental assistance programs. 3. Commercial Lease Co-Signer Agreement: Unlike residential leases, commercial leases often require co-signers due to the higher financial risks involved. A commercial lease co-signer agreement typically covers provisions specific to the commercial property, such as business permits, zoning regulations, or compliance with specific industry standards. It is crucial for all parties to review and understand the terms and implications of the specific Saint Paul Minnesota Landlord Tenant Lease Co-Signer Agreement they are entering. Seeking legal advice or consultation from a qualified attorney is highly recommended ensuring compliance with local laws and regulations, and to protect the rights and interests of all parties involved.

In Saint Paul, Minnesota, a Landlord Tenant Lease Co-Signer Agreement is a legally binding contract entered into between a landlord, a tenant, and a co-signer. This agreement is typically used when a tenant is unable to meet the landlord's rental requirements on their own, such as having a low credit score, insufficient income, or a limited rental history. A co-signer, also referred to as a guarantor, accepts legal responsibility for fulfilling the tenant's obligations under the lease if the tenant fails to do so. The Saint Paul Minnesota Landlord Tenant Lease Co-Signer Agreement outlines the rights and responsibilities of the landlord, tenant, and co-signer throughout the lease term. It is critical for all parties involved to thoroughly understand the terms and implications before signing the agreement. The document covers various aspects, such as the lease term, rent amount, security deposit, maintenance responsibilities, late fees, and lease termination procedures. In Saint Paul, there may be different types of Landlord Tenant Lease Co-Signer Agreements based on specific circumstances or requirements. For instance: 1. Student Co-Signer Agreement: This type of agreement is commonly used when a student tenant requires a co-signer due to having a limited credit history or income. It may outline additional terms related to student housing, such as roommate responsibilities or rules specific to university housing areas. 2. Low-Income Co-Signer Agreement: In cases where a tenant has a low income but meets other rental criteria, the landlord may require a co-signer to minimize the risk of non-payment. This type of agreement may address specific considerations related to subsidized housing or rental assistance programs. 3. Commercial Lease Co-Signer Agreement: Unlike residential leases, commercial leases often require co-signers due to the higher financial risks involved. A commercial lease co-signer agreement typically covers provisions specific to the commercial property, such as business permits, zoning regulations, or compliance with specific industry standards. It is crucial for all parties to review and understand the terms and implications of the specific Saint Paul Minnesota Landlord Tenant Lease Co-Signer Agreement they are entering. Seeking legal advice or consultation from a qualified attorney is highly recommended ensuring compliance with local laws and regulations, and to protect the rights and interests of all parties involved.