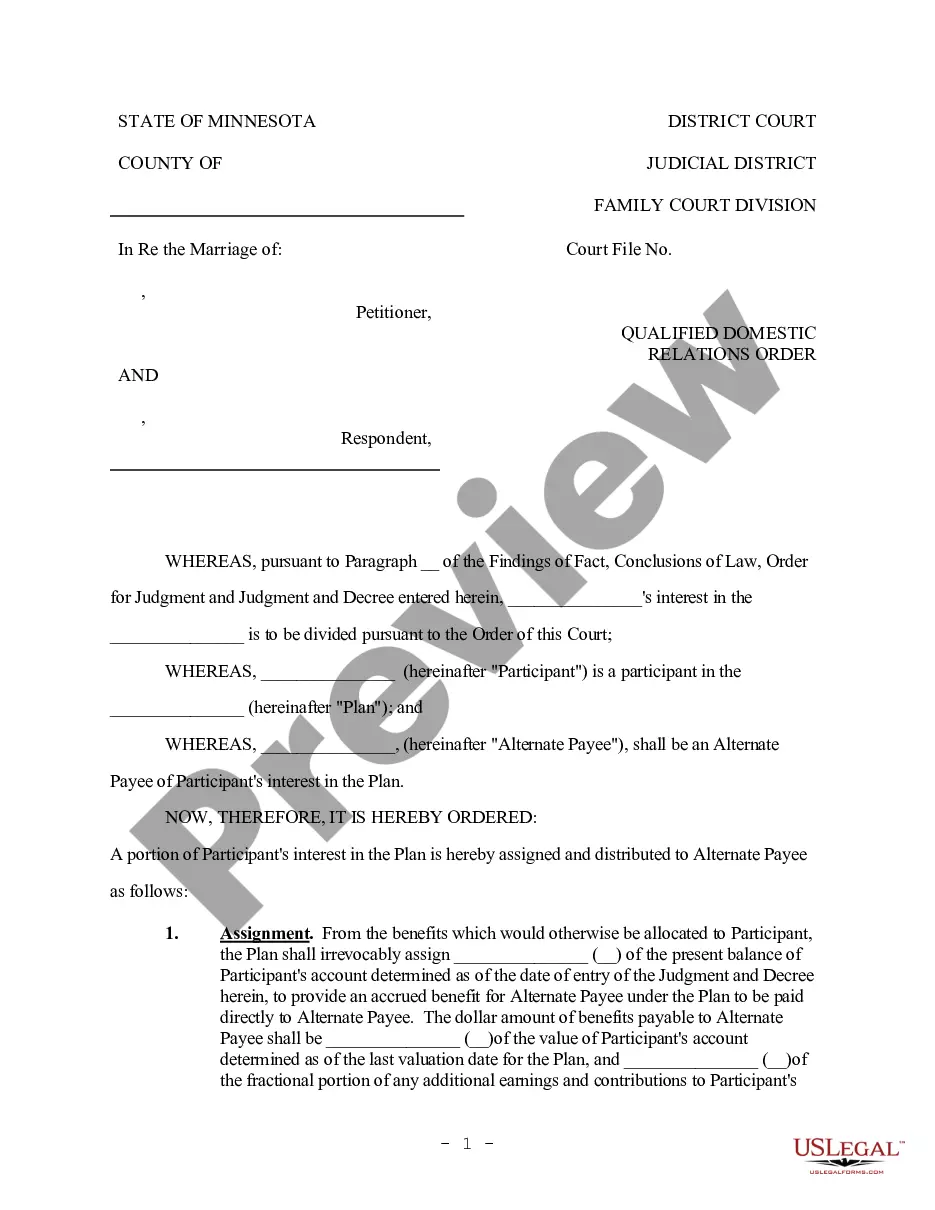

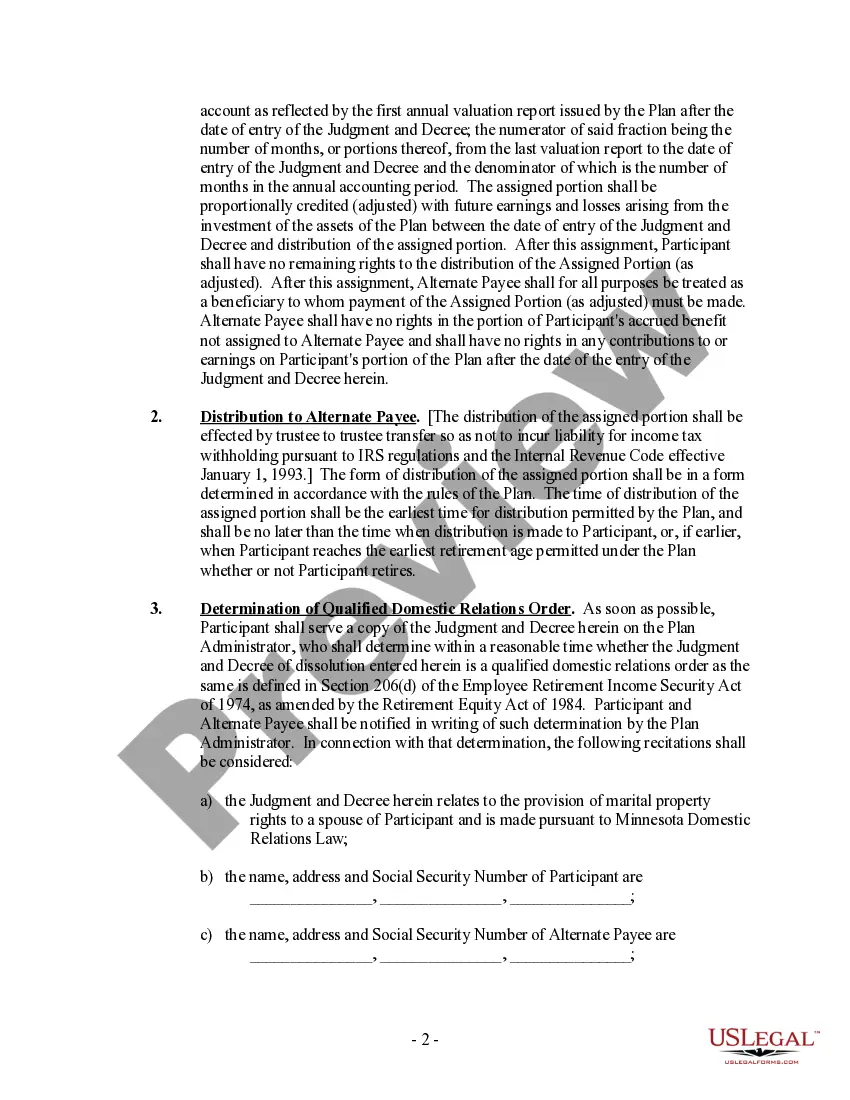

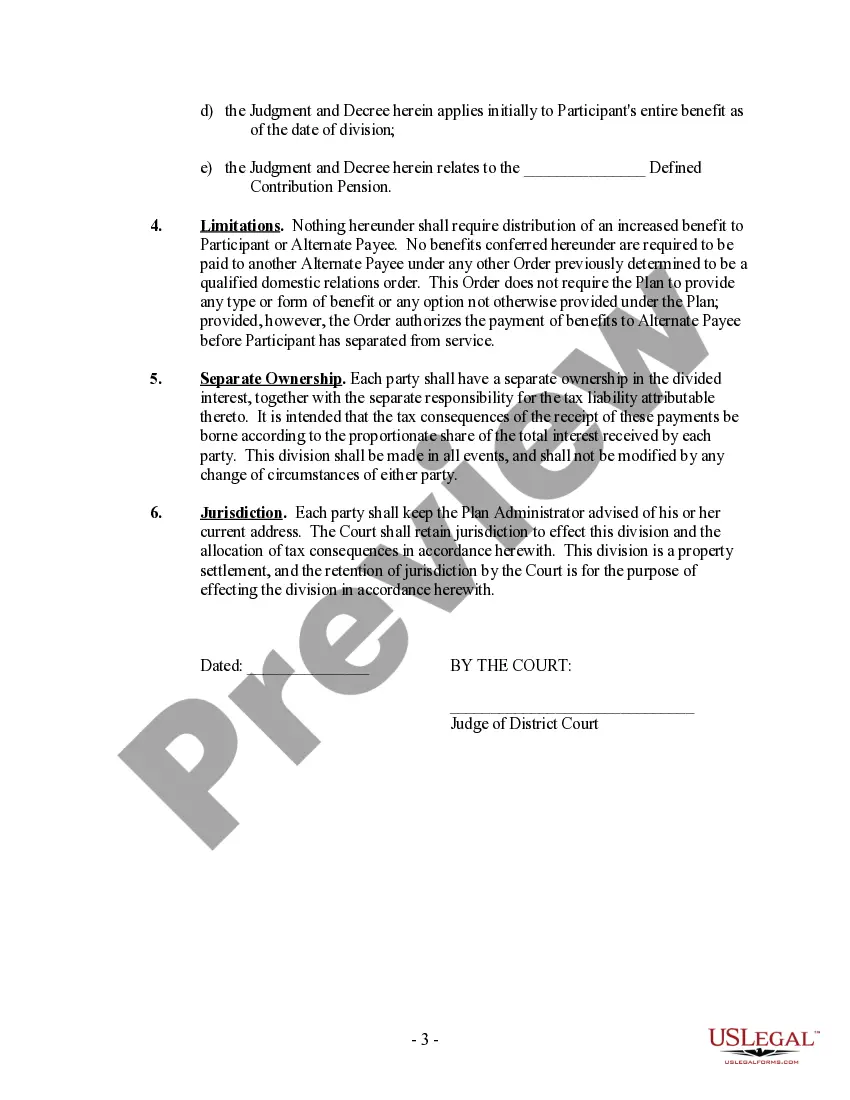

A Qualified Domestic Relations Order (QDR) — Assignment of Interests is a legal document used in Saint Paul, Minnesota, to divide and allocate retirement assets between divorcing spouses or former partners. This order recognizes the rights of the non-employee spouse/partner to receive a portion of the pension, 401(k), or other retirement benefits accumulated during the marriage or partnership. In Saint Paul, Minnesota, there are several types of QDR Os related to the assignment of interests in retirement plans: 1. Pension QDR: This type of QDR applies to traditional pension plans where an employee earns a defined benefit over time. The QDR specifies how much of the pension benefits accrued during the marriage or partnership will be assigned to the non-employee spouse. 2. 401(k) QDR: A 401(k) QDR deals with the division of funds held in a 401(k) retirement account. It outlines the amount or percentage of the account that will be awarded to the non-employee spouse/partner and provides instructions for the plan administrator to make the distribution. 3. IRA QDR: Individual Retirement Account (IRA) QDR is applicable to dividing interests in an IRA account. It details the amount or percentage of the IRA assets to be transferred to the non-employee spouse/partner and instructs the IRA custodian to facilitate the transfer. 4. Thrift Savings Plan QDR: Thrift Savings Plan (TSP) QDR is specific to the federal government employees' retirement savings plan. It enables the division of the TSP account, allowing the non-employee spouse to receive their share. It is crucial to consult an experienced family law attorney in Saint Paul, Minnesota, to create and execute a QDR properly. The QDR must meet specific requirements outlined by the retirement plan administrator and comply with the legal guidelines established by both the state and federal laws. To initiate the process, the divorcing spouses/partners must draft a QDR that includes essential information such as personal details of the participants, the retirement plan details, the division amount, the method of payment, and the necessary legal language. The drafted QDR should then be submitted to the court for approval and ultimately be delivered to the plan administrator for implementation. Having a well-crafted Saint Paul, Minnesota Qualified Domestic Relations Order — Assignment of Interests ensures a fair and equitable distribution of retirement assets, safeguarding the financial interests of both parties involved.

Saint Paul Minnesota Qualified Domestic Relations Order - Assignment of Interests

Description

How to fill out Saint Paul Minnesota Qualified Domestic Relations Order - Assignment Of Interests?

We consistently strive to reduce or avert legal complications when engaging with intricate legal or financial matters.

To achieve this, we enlist attorney services that are often prohibitively costly.

However, not all legal issues are as complicated.

Many of them can be addressed independently.

Utilize US Legal Forms whenever you need to locate and download the Saint Paul Minnesota Qualified Domestic Relations Order - Assignment of Interests or any other form swiftly and securely. Simply Log In to your account and click the Get button next to it. If you happen to misplace the form, you can always retrieve it again from within the My documents tab.

- US Legal Forms is an online repository of current DIY legal documents encompassing everything from wills and powers of attorney to incorporation articles and dissolution petitions.

- Our platform empowers you to manage your affairs autonomously, eliminating the necessity for a lawyer's services.

- We provide access to legal document templates that are not always readily accessible.

- Our templates are tailored to specific states and regions, which significantly streamlines the search process.

Form popularity

FAQ

A spouse or former spouse who receives QDRO benefits from a retirement plan reports the payments received as if he or she were a plan participant. The spouse or former spouse is allocated a share of the participant's cost (investment in the contract) equal to the cost times a fraction.

There are several options for QDRO distributions. You can take the funds as a lump sum but will be subject to a mandatory withholding tax, which is 20% for federal taxes. You may also be subject to state taxes depending on where you live.

There are usually 7 steps required to complete the QDRO process: Step 1 Gathering Information.Step 2 Drafting your QDRO.Step 3 Approval By the Other Party.Step 4 Approval by Plan as Draft.Step 5 Signature of QDRO by Judge of the State Divorce Court.Step 6 Obtain a Certified Copy of the QDRO.

Here's how the process, which may take up to 90 days, works. Once the Plan Administrator has received all required forms, the division is calculated. When the calculations are completed, the Special Claims unit sends the alternate payee his or her payment options and the forms for claiming the benefits.

How Do QDRO Distributions Work? There are several options for QDRO distributions. You can take the funds as a lump sum but will be subject to a mandatory withholding tax, which is 20% for federal taxes. You may also be subject to state taxes depending on where you live.

When will I receive my money? Some retirement or pension plans make funds payable under QDRO's available as soon as they approve the QDRO. If the plan being divided is an IRA or a Federal Thrift Savings Plan, the funds may be withdrawn immediately.

Once the QDRO has been approved in draft form, it is presented to the Divorce Court for signature by a Judge. This step may be done by the party (or parties) and/or the attorney(s), or by me. The QDRO is often submitted together with the other divorce papers.

A QDRO allows a former spouse to receive a predefined amount of their spouse's retirement plan assets. For example, a QDRO might pay out 50% of the account's value that has grown during the marriage. The funds, as a result of the QDRO, could then be transferred or rolled over into an IRA for the beneficiary spouse.

Without a QDRO, your partner's retirement funds may not be included in the divorce settlement agreement, even if you have a legal right to a portion of your partner's retirement assets. In general, the QDRO form must be completed and presented to court well before your divorce moves into the final stages.

After Special Claims receives and accepts the claim forms and any other required documents, distributions begin or are made to the alternate payee within 30 to 60 days.