Minneapolis Minnesota Garnishment Disclosure refers to the legal process mandated by the state of Minnesota in cases involving garnishment of wages. When an employee's wages are being garnished, their employer is required to provide them with a garnishment disclosure, which outlines key details about the wage garnishment process. This disclosure serves as an essential document that ensures transparency and informs employees about their rights, responsibilities, and the necessary steps involved in the garnishment process. It aims to protect the rights of employees and provides them with crucial information to manage their financial obligations effectively. The Minneapolis Minnesota Garnishment Disclosure typically includes the following key components: 1. Employer Information: The disclosure will include the employer's name, address, and contact information, ensuring that the employee knows the source of the document and whom to reach out to regarding any questions or concerns. 2. Employee Information: The employee's name, address, and contact information will also be included in the disclosure, confirming that it is exclusively intended for the employee receiving the garnishment notice. 3. Garnishment Details: The disclosure should precisely state the date the garnishment order was received, the court that issued the order, and the case number associated with the garnishment proceedings. This information helps employees verify the legitimacy of the garnishment. 4. Debt Details: The disclosure will outline the nature of the debt that led to the garnishment, such as unpaid child support, taxes, or other outstanding financial obligations. It will provide specific details about the debt owed, including the amount, the creditor's name and contact information. 5. Calculation of Garnishment Amount: The garnishment disclosure should clearly outline how the garnishment amount was calculated based on the employee's disposable earnings, as defined by Minnesota law. It will explain the percentage or fixed amount being withheld from the employee's wages each pay period. 6. Duration of Garnishment: The disclosure will specify the duration for which the garnishment will be in effect or until the debt is fully satisfied. It may indicate the end date or conditions under which the garnishment may be released, such as full repayment or alternative arrangements with the creditor. 7. Employee Rights: The disclosure should include information about the employee's rights, such as the ability to challenge the garnishment in court, request a hearing, or dispute any inaccuracies regarding the debt's validity or amount owed. It may also outline any rights to exemptions available under state law. There are no distinct types of Minneapolis Minnesota Garnishment Disclosure, but rather it refers to the standard information and requirements that must be covered in any garnishment disclosure issued to an employee in Minneapolis, Minnesota. In summary, the Minneapolis Minnesota Garnishment Disclosure is a vital document provided to employees facing wage garnishment. It ensures transparency, outlines essential details about the garnishment order, and informs employees about their rights, responsibilities, and options to address the debt.

Minneapolis Minnesota Garnishment Disclosure

Category:

State:

Minnesota

City:

Minneapolis

Control #:

MN-8448D

Format:

Word;

Rich Text

Instant download

Description

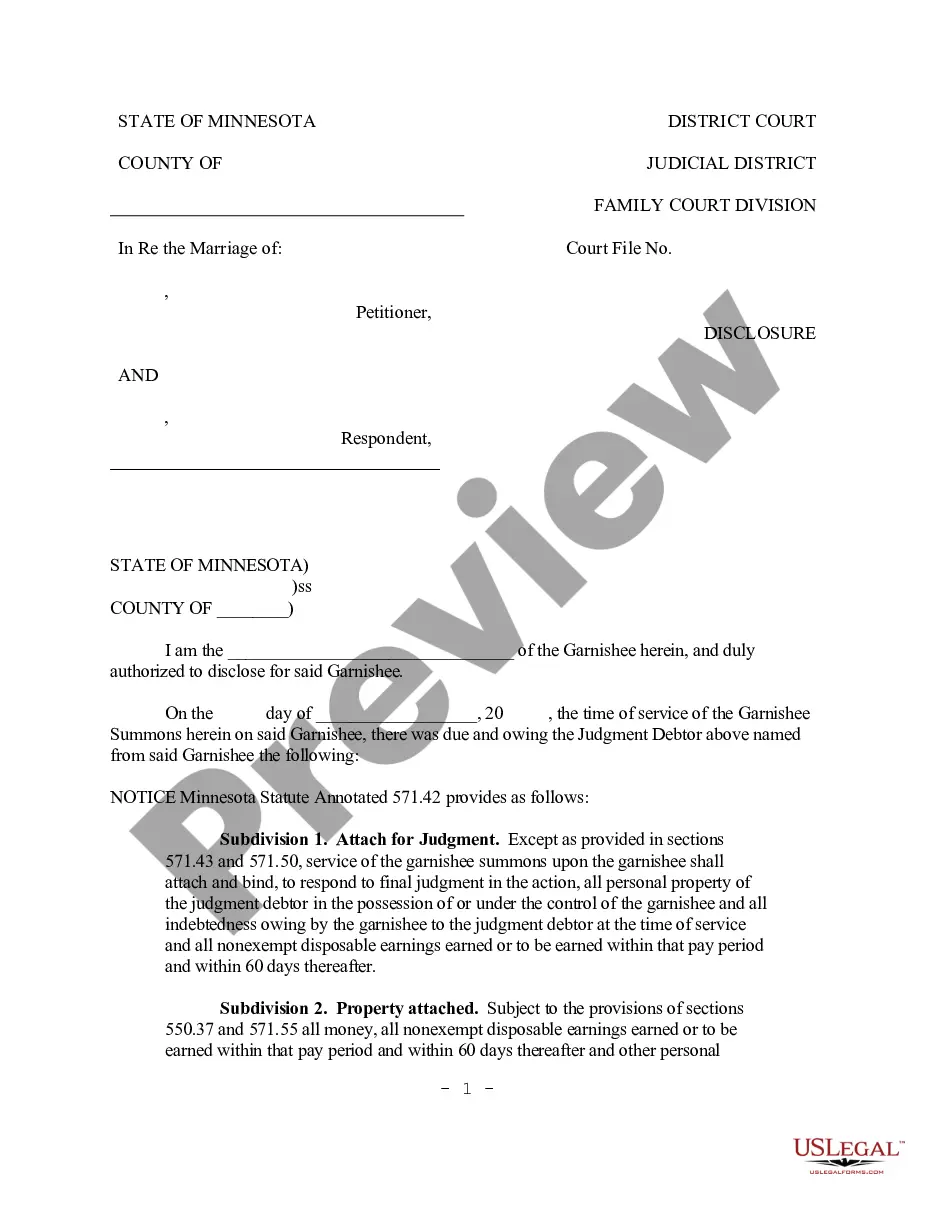

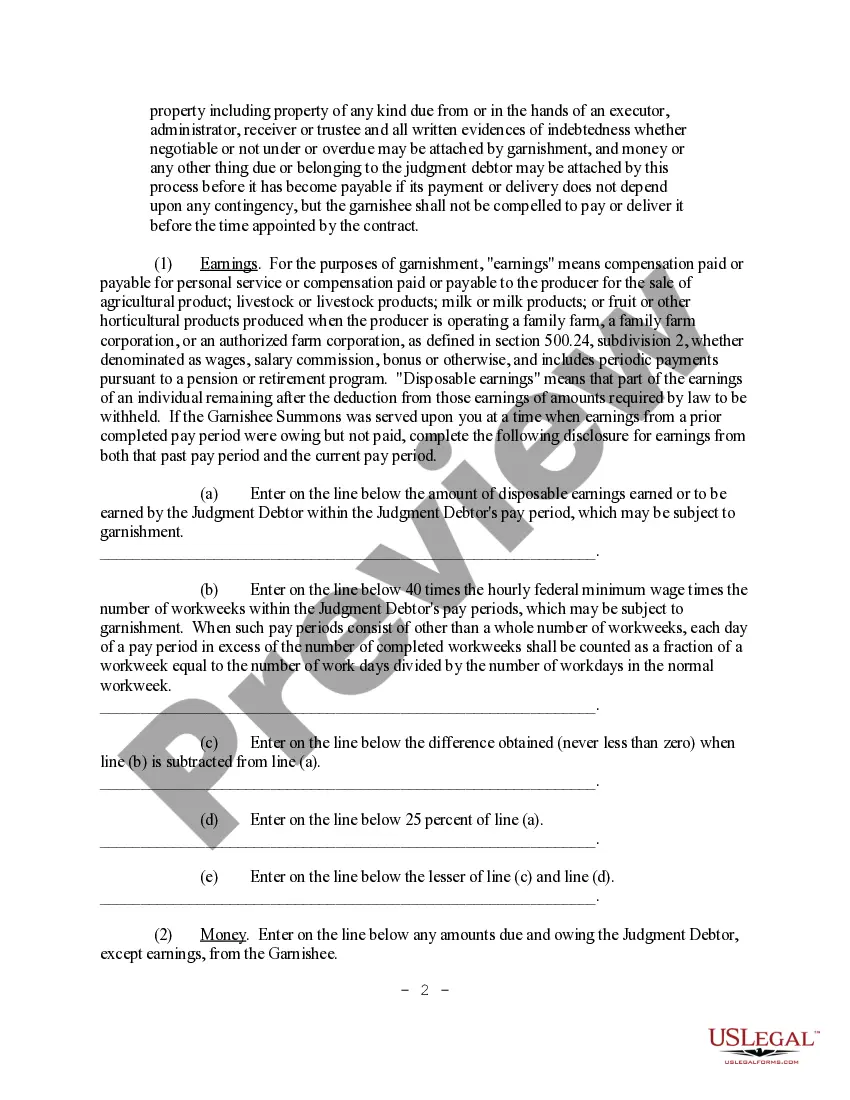

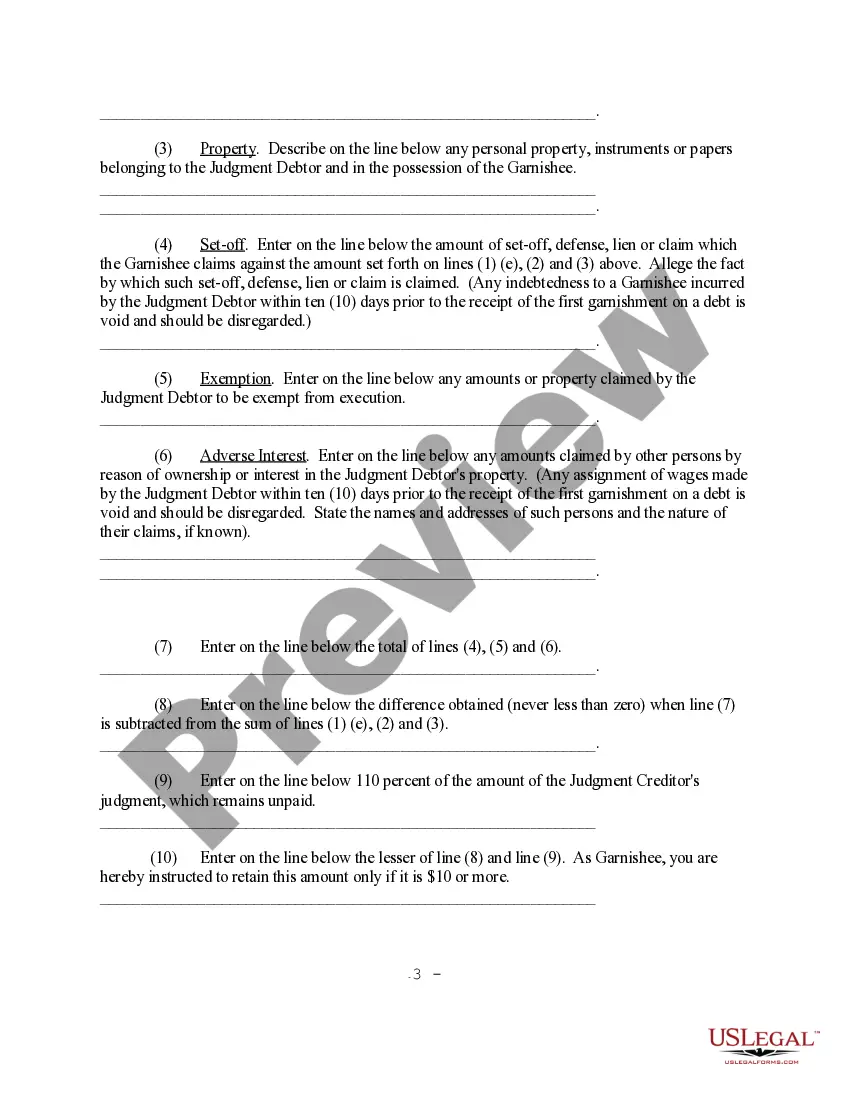

This form is a Garnishment Disclosure. The form includes topics such as: Earnings, Set-off, and Adverse Interest.

Minneapolis Minnesota Garnishment Disclosure refers to the legal process mandated by the state of Minnesota in cases involving garnishment of wages. When an employee's wages are being garnished, their employer is required to provide them with a garnishment disclosure, which outlines key details about the wage garnishment process. This disclosure serves as an essential document that ensures transparency and informs employees about their rights, responsibilities, and the necessary steps involved in the garnishment process. It aims to protect the rights of employees and provides them with crucial information to manage their financial obligations effectively. The Minneapolis Minnesota Garnishment Disclosure typically includes the following key components: 1. Employer Information: The disclosure will include the employer's name, address, and contact information, ensuring that the employee knows the source of the document and whom to reach out to regarding any questions or concerns. 2. Employee Information: The employee's name, address, and contact information will also be included in the disclosure, confirming that it is exclusively intended for the employee receiving the garnishment notice. 3. Garnishment Details: The disclosure should precisely state the date the garnishment order was received, the court that issued the order, and the case number associated with the garnishment proceedings. This information helps employees verify the legitimacy of the garnishment. 4. Debt Details: The disclosure will outline the nature of the debt that led to the garnishment, such as unpaid child support, taxes, or other outstanding financial obligations. It will provide specific details about the debt owed, including the amount, the creditor's name and contact information. 5. Calculation of Garnishment Amount: The garnishment disclosure should clearly outline how the garnishment amount was calculated based on the employee's disposable earnings, as defined by Minnesota law. It will explain the percentage or fixed amount being withheld from the employee's wages each pay period. 6. Duration of Garnishment: The disclosure will specify the duration for which the garnishment will be in effect or until the debt is fully satisfied. It may indicate the end date or conditions under which the garnishment may be released, such as full repayment or alternative arrangements with the creditor. 7. Employee Rights: The disclosure should include information about the employee's rights, such as the ability to challenge the garnishment in court, request a hearing, or dispute any inaccuracies regarding the debt's validity or amount owed. It may also outline any rights to exemptions available under state law. There are no distinct types of Minneapolis Minnesota Garnishment Disclosure, but rather it refers to the standard information and requirements that must be covered in any garnishment disclosure issued to an employee in Minneapolis, Minnesota. In summary, the Minneapolis Minnesota Garnishment Disclosure is a vital document provided to employees facing wage garnishment. It ensures transparency, outlines essential details about the garnishment order, and informs employees about their rights, responsibilities, and options to address the debt.

Free preview

How to fill out Minneapolis Minnesota Garnishment Disclosure?

If you’ve already utilized our service before, log in to your account and download the Minneapolis Minnesota Garnishment Disclosure on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make certain you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Minneapolis Minnesota Garnishment Disclosure. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your individual or professional needs!