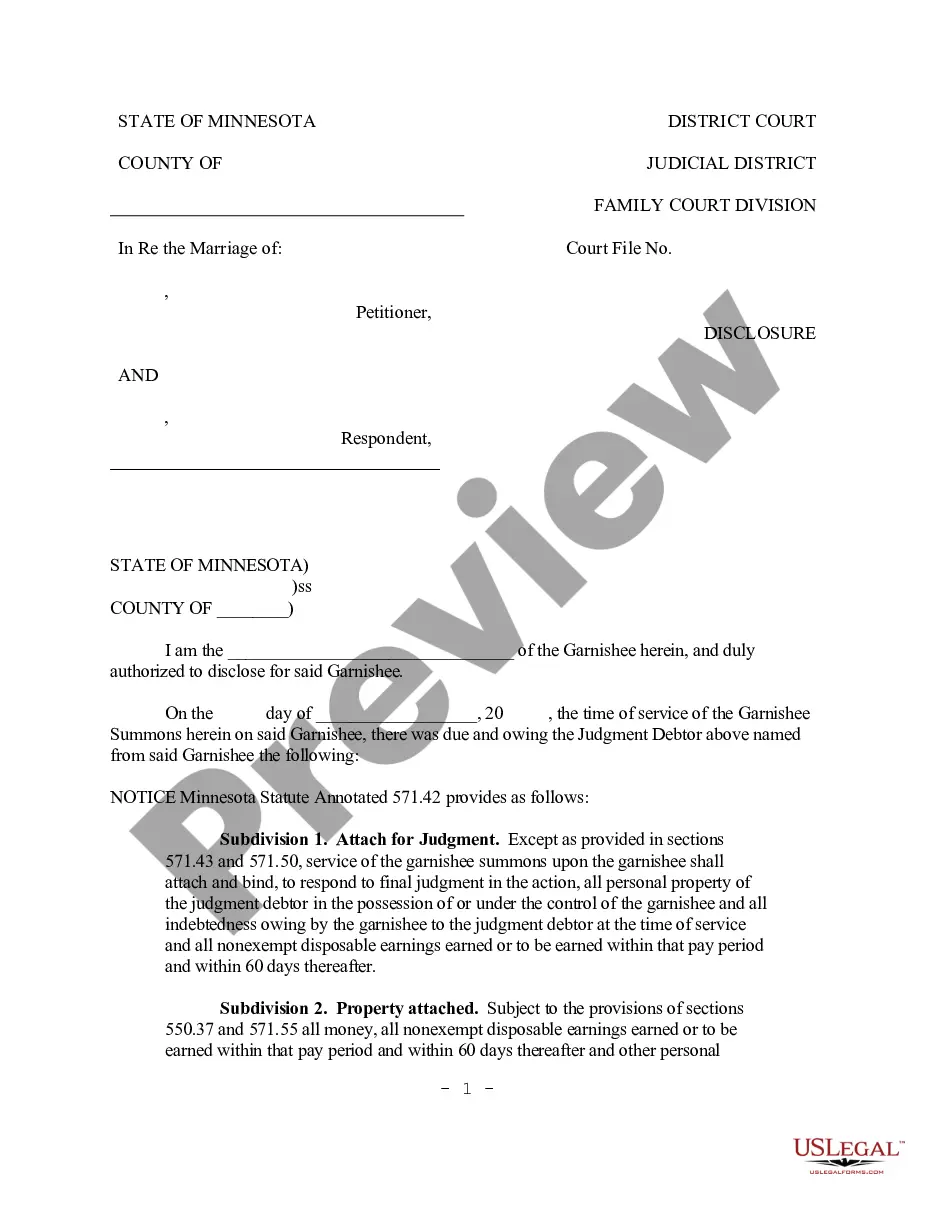

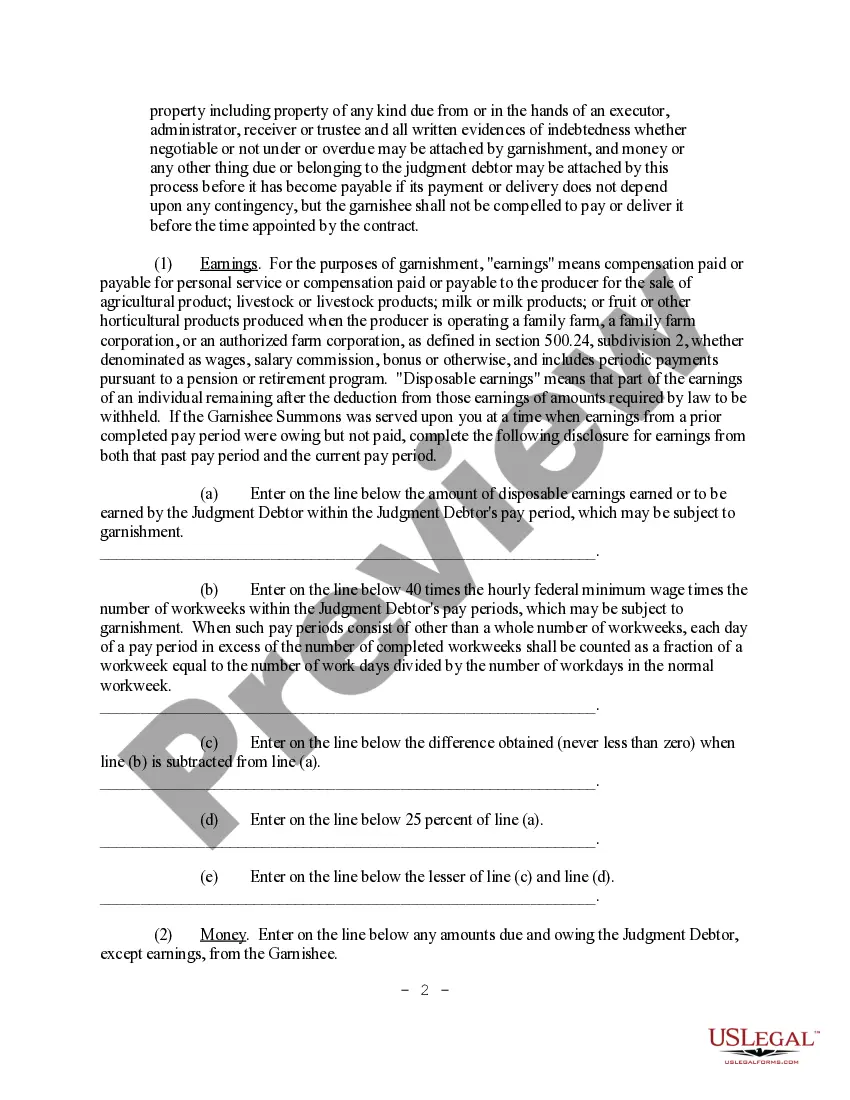

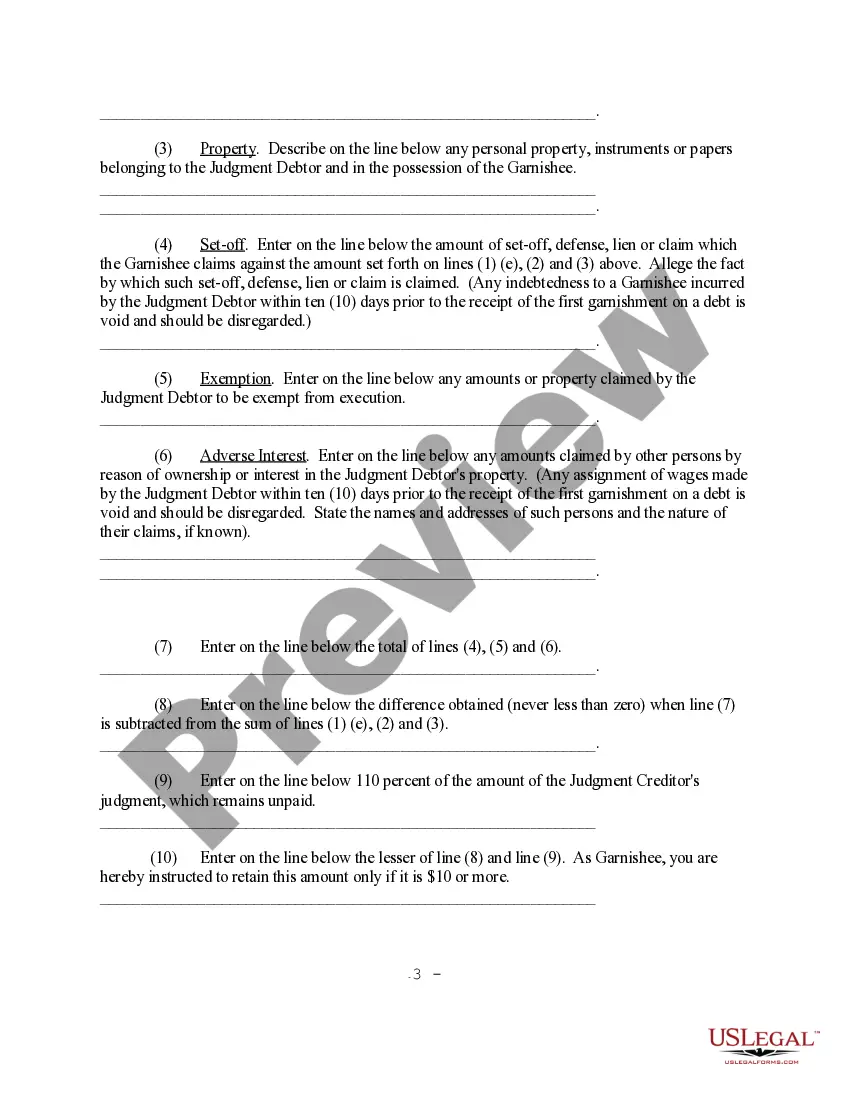

Saint Paul Minnesota Garnishment Disclosure is a legal process that involves the state of Minnesota's regulations and guidelines regarding garnishments on wages or bank accounts. This disclosure aims to inform individuals who are subject to a garnishment order about their rights, responsibilities, and the legal implications associated with this process. The garnishment disclosure in Saint Paul, Minnesota provides detailed information about the garnishment process, including the legal requirements, procedures, and limitations. It ensures that individuals understand their rights to protect a portion of their wages or bank account from being taken to satisfy a debt. There are several types of garnishment disclosures applicable in Saint Paul, Minnesota, including: 1. Wage Garnishment Disclosure: This type of disclosure pertains to the garnishment of an individual's wages or salary. It explains the percentage of wages that can be garnished, exemptions, and the procedure for challenging the garnishment. 2. Bank Account Garnishment Disclosure: This disclosure focuses on garnishments related to bank accounts. It outlines the process for freezing and seizing funds from a person's bank account to satisfy a debt. 3. Child Support Garnishment Disclosure: Provides individuals with information specific to garnishments related to child support payments. It highlights the legal obligations, exceptions, and procedures related to wage garnishments for child support. 4. Spousal Support Garnishment Disclosure: This disclosure addresses garnishments for spousal support payments. It informs individuals about their rights, responsibilities, and exemptions regarding wage garnishments for spousal support. 5. Tax Debt Garnishment Disclosure: Pertains to the garnishment of wages or bank accounts by government agencies to satisfy unpaid taxes. It explains the process, limitations, and exemptions associated with garnishments for tax debts. All types of Saint Paul Minnesota Garnishment Disclosures emphasize the importance of understanding one's rights and options when facing garnishments. It is crucial for individuals to review and comprehend the disclosure thoroughly, seeking legal advice if necessary, to ensure compliance with the state's regulations and to protect their financial well-being.

Saint Paul Minnesota Garnishment Disclosure

Category:

State:

Minnesota

City:

Saint Paul

Control #:

MN-8448D

Format:

Word;

Rich Text

Instant download

Description

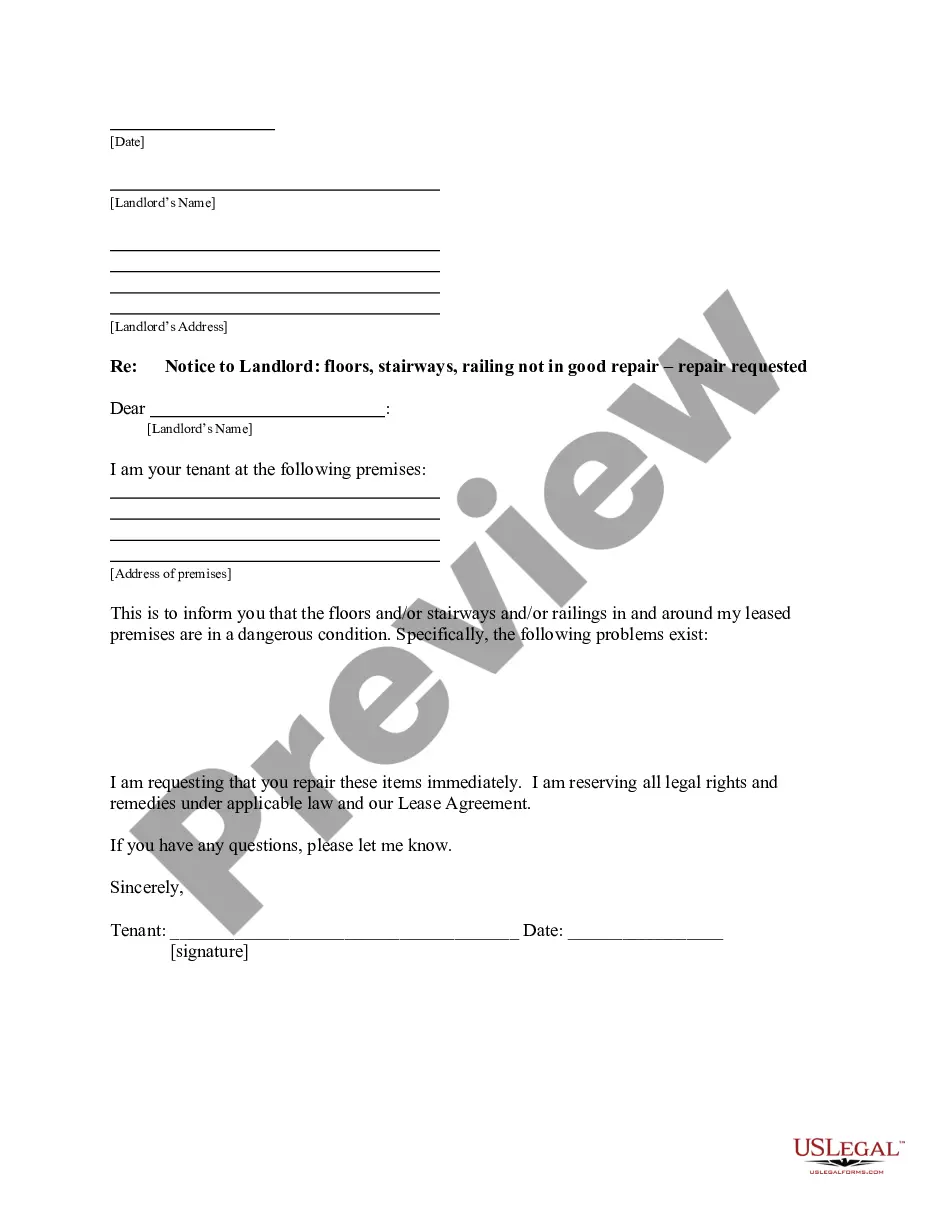

This form is a Garnishment Disclosure. The form includes topics such as: Earnings, Set-off, and Adverse Interest.

Saint Paul Minnesota Garnishment Disclosure is a legal process that involves the state of Minnesota's regulations and guidelines regarding garnishments on wages or bank accounts. This disclosure aims to inform individuals who are subject to a garnishment order about their rights, responsibilities, and the legal implications associated with this process. The garnishment disclosure in Saint Paul, Minnesota provides detailed information about the garnishment process, including the legal requirements, procedures, and limitations. It ensures that individuals understand their rights to protect a portion of their wages or bank account from being taken to satisfy a debt. There are several types of garnishment disclosures applicable in Saint Paul, Minnesota, including: 1. Wage Garnishment Disclosure: This type of disclosure pertains to the garnishment of an individual's wages or salary. It explains the percentage of wages that can be garnished, exemptions, and the procedure for challenging the garnishment. 2. Bank Account Garnishment Disclosure: This disclosure focuses on garnishments related to bank accounts. It outlines the process for freezing and seizing funds from a person's bank account to satisfy a debt. 3. Child Support Garnishment Disclosure: Provides individuals with information specific to garnishments related to child support payments. It highlights the legal obligations, exceptions, and procedures related to wage garnishments for child support. 4. Spousal Support Garnishment Disclosure: This disclosure addresses garnishments for spousal support payments. It informs individuals about their rights, responsibilities, and exemptions regarding wage garnishments for spousal support. 5. Tax Debt Garnishment Disclosure: Pertains to the garnishment of wages or bank accounts by government agencies to satisfy unpaid taxes. It explains the process, limitations, and exemptions associated with garnishments for tax debts. All types of Saint Paul Minnesota Garnishment Disclosures emphasize the importance of understanding one's rights and options when facing garnishments. It is crucial for individuals to review and comprehend the disclosure thoroughly, seeking legal advice if necessary, to ensure compliance with the state's regulations and to protect their financial well-being.

Free preview

How to fill out Saint Paul Minnesota Garnishment Disclosure?

If you’ve already used our service before, log in to your account and save the Saint Paul Minnesota Garnishment Disclosure on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make certain you’ve found an appropriate document. Look through the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Saint Paul Minnesota Garnishment Disclosure. Opt for the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!