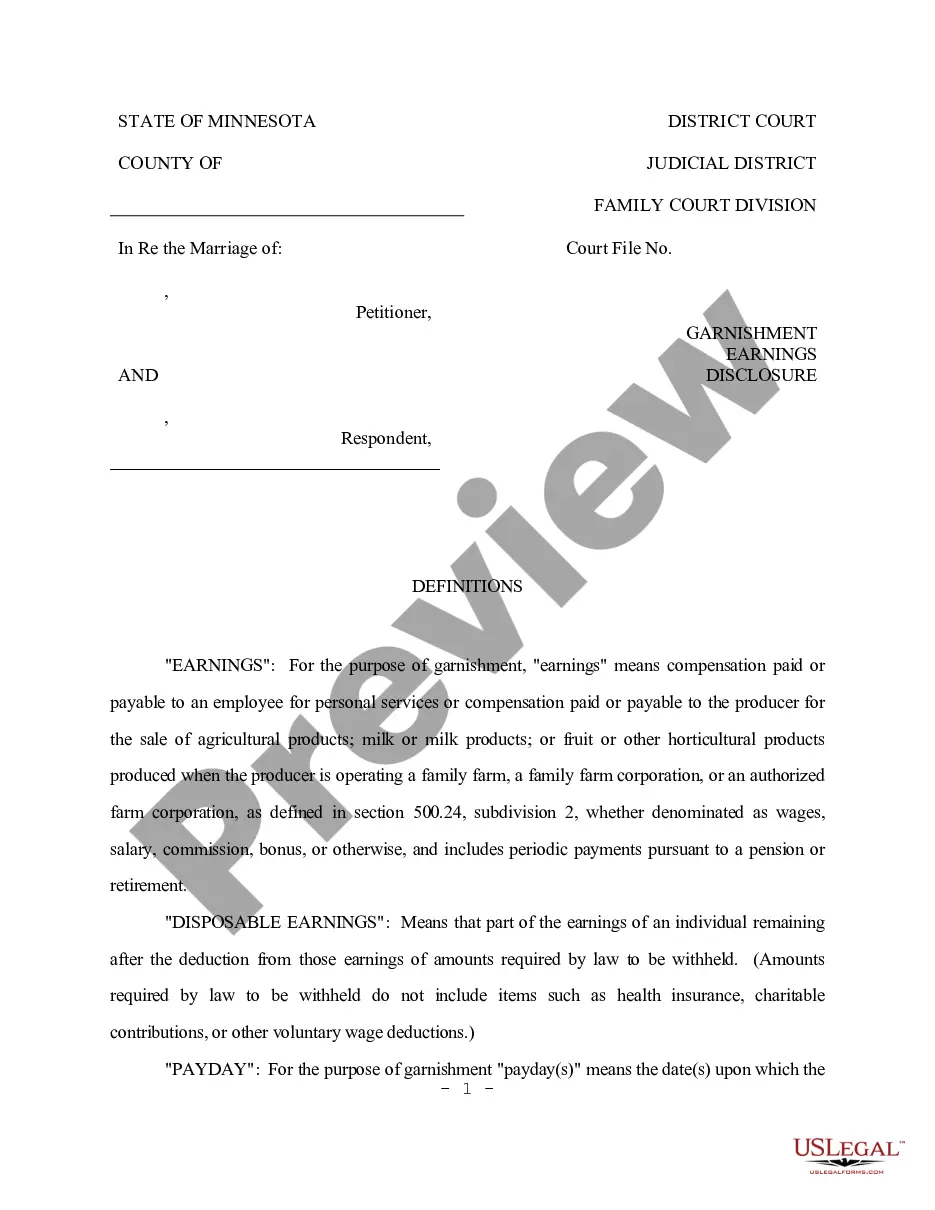

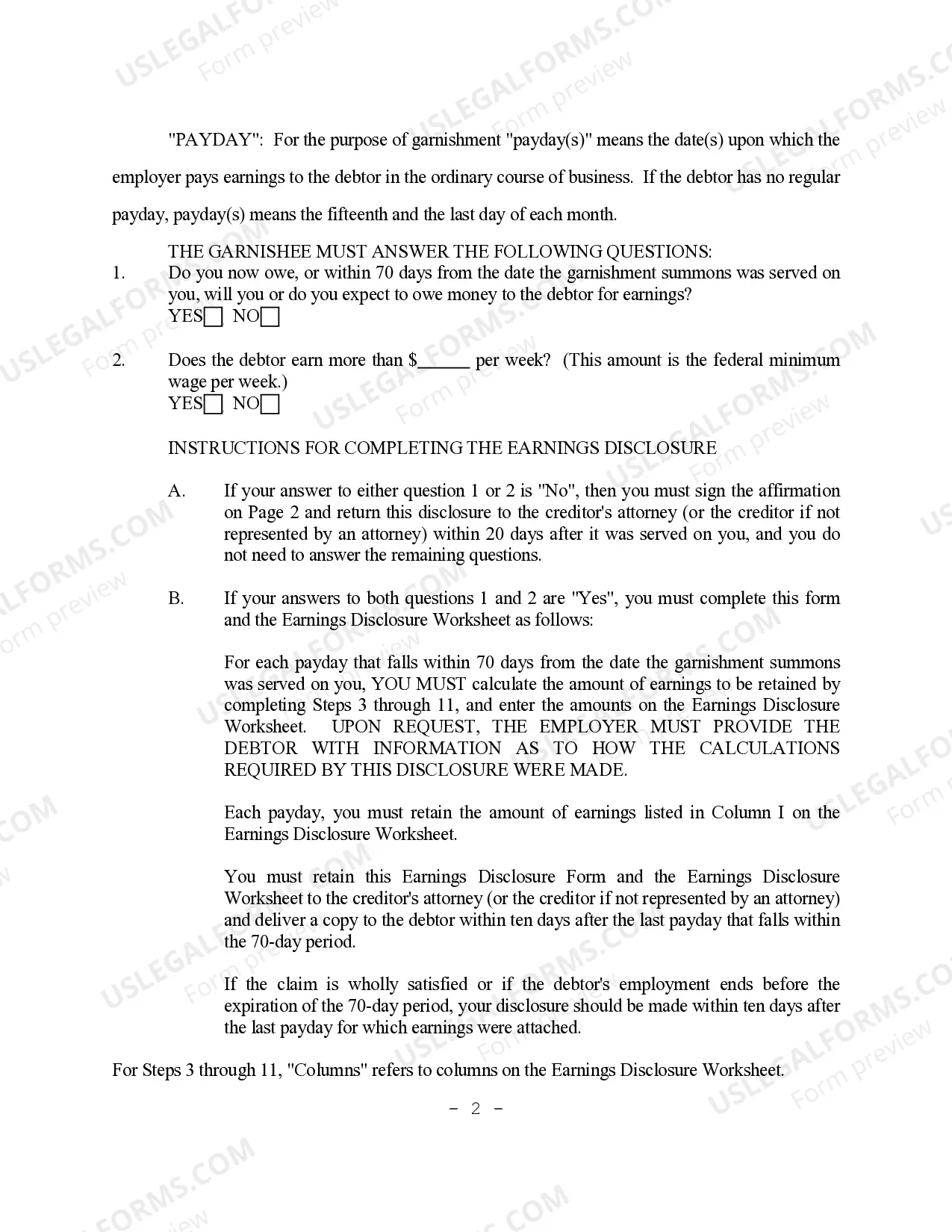

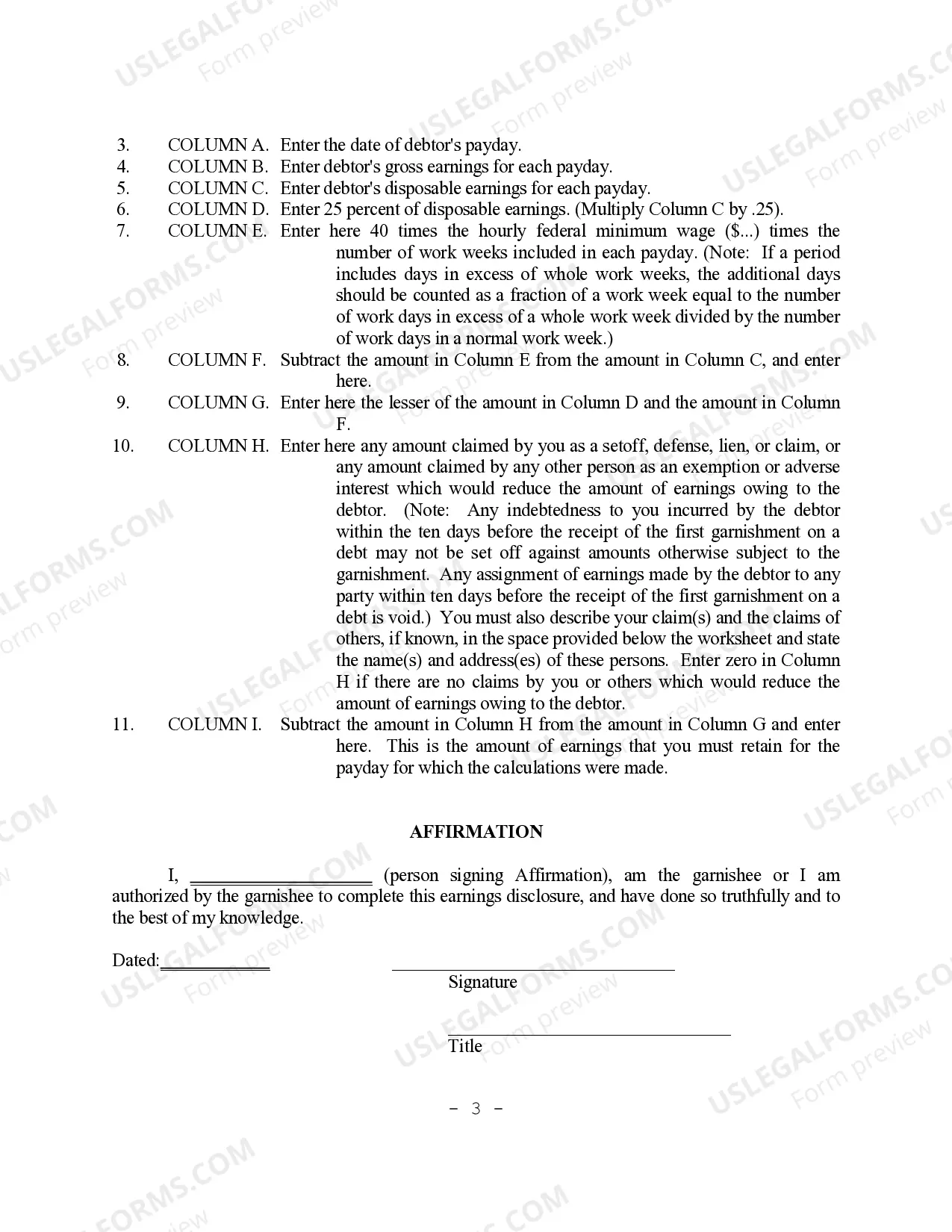

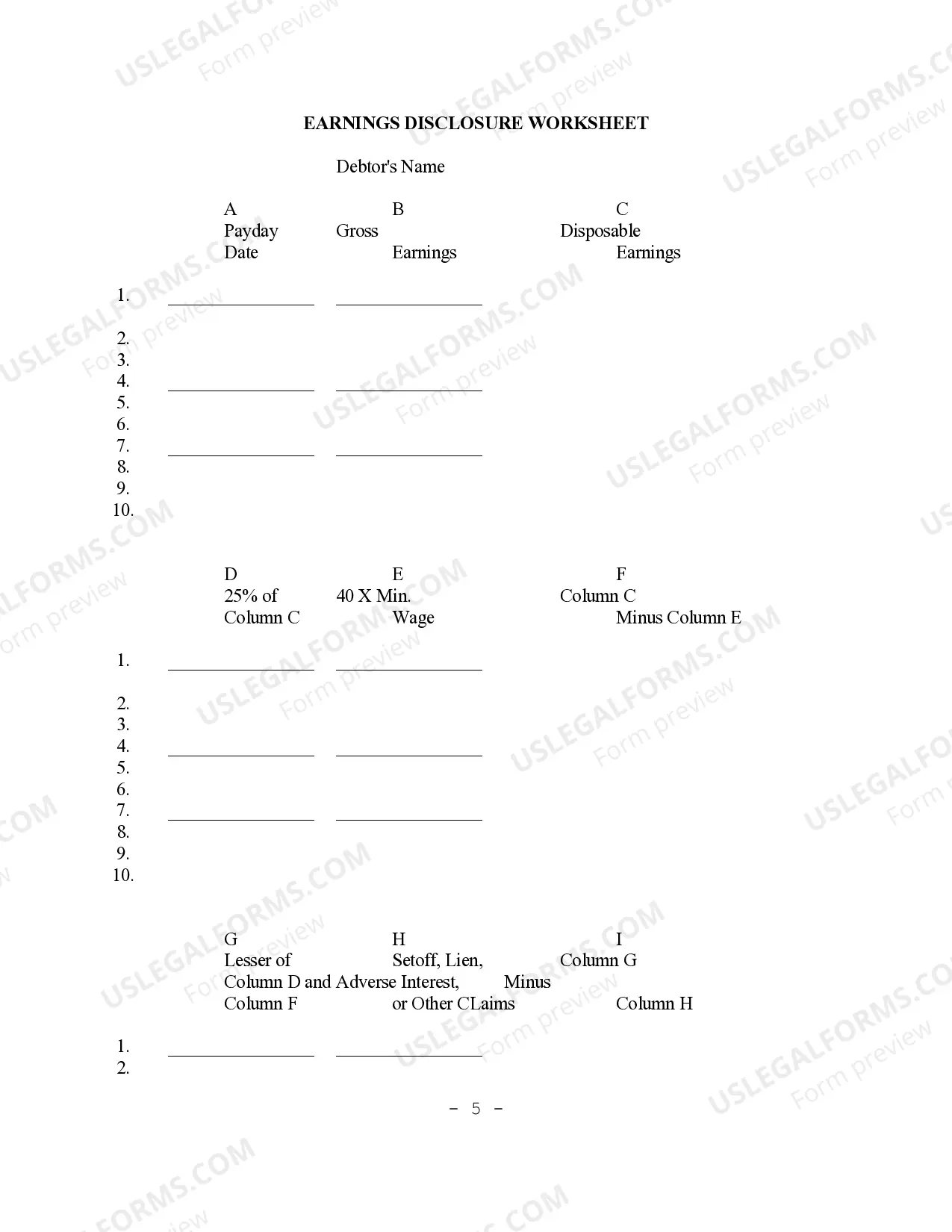

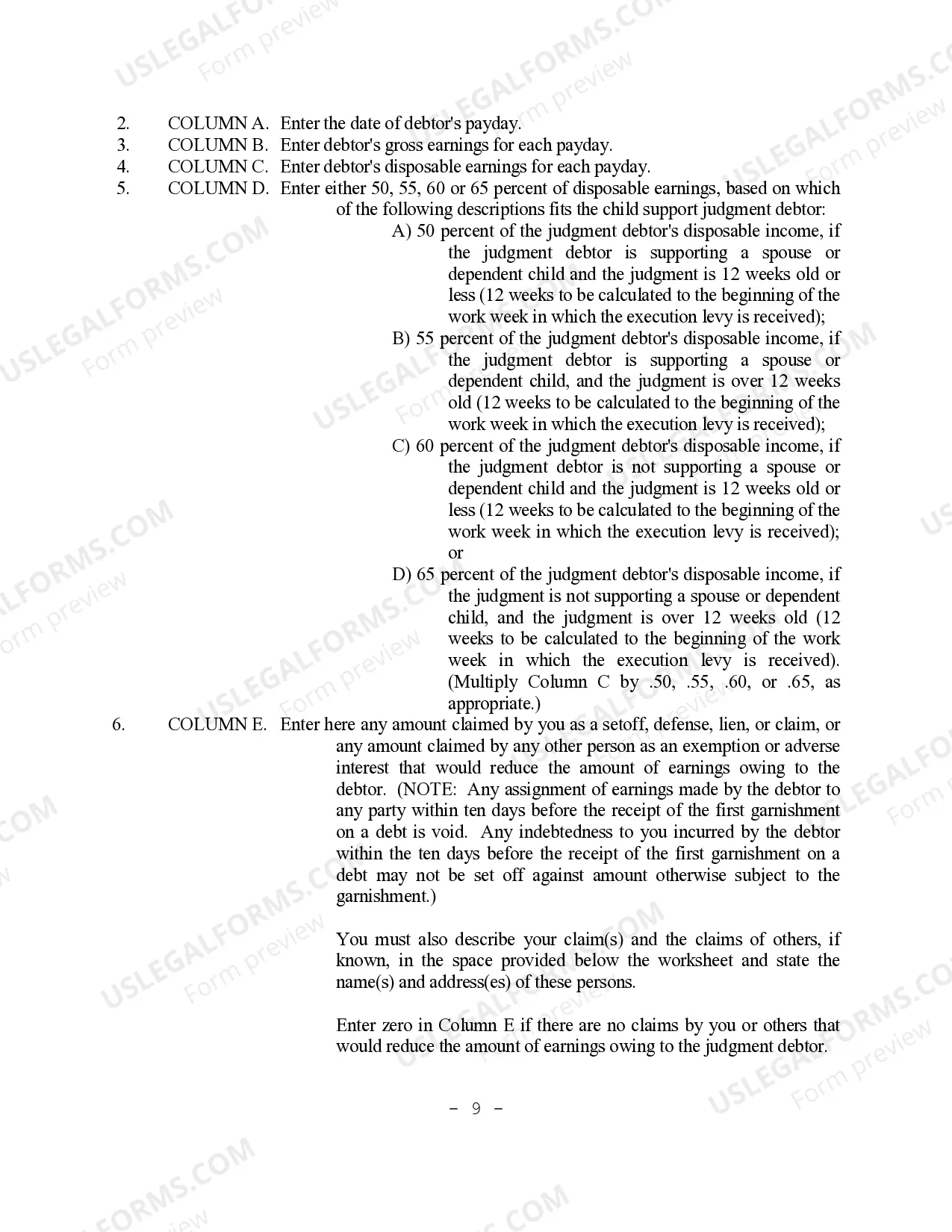

Minneapolis, Minnesota Garnishment Earnings Disclosure Instructions are a set of guidelines that outline the legal process for employers to comply with wage garnishment requests from judgment creditors. When an individual fails to repay a debt or fulfill a legal obligation, a creditor may obtain a court order to garnish a portion of their wages to satisfy the debt. The garnishment earnings disclosure instructions provide specific actions and information that employers must follow to ensure proper execution of wage garnishment. One type of Minneapolis, Minnesota Garnishment Earnings Disclosure Instruction is the Wage Garnishment Summons and Disclosure Form. This document is served to the employer by the creditor's attorney, notifying them of the garnishment request and providing instructions on how to comply. The form includes essential details such as the employee's name, address, social security number, and the amount to be withheld from their wages. Another common type of instruction is the Earnings Withholding Order (TWO). After receiving the Wage Garnishment Summons and Disclosure Form, employers must deduct the specified amount from the employee's wages and remit it to the proper authority or creditor. The TWO details the amount to be withheld, the duration of the garnishment, and where to send the withheld funds. Minneapolis, Minnesota Garnishment Earnings Disclosure Instructions also cover the obligations of employers regarding employee notifications. Employers must inform the employee about the wage garnishment order and provide them with a copy of the Wage Garnishment Summons and Disclosure Form. They may also need to explain the process, the amount deducted, and any potential exemptions the employee may qualify for. Additionally, the instructions outline the process for calculating the disposable earnings subject to garnishment. Certain income, such as child support or taxes, may be exempt from garnishment. Employers must accurately calculate the disposable income and ensure that the correct amount is withheld from each paycheck. Employers must also follow a strict timeline specified in the garnishment earnings disclosure instructions. Failure to comply with the order within the designated time frame may result in penalties or legal consequences for the employer. In conclusion, Minneapolis, Minnesota Garnishment Earnings Disclosure Instructions regulate the proper implementation of wage garnishment requests by creditors. These instructions encompass various documents like the Wage Garnishment Summons and Disclosure Form and Earnings Withholding Order, along with guidelines for employee notification and exempt income calculation. Employers must adhere to these instructions to ensure legal compliance and avoid any potential repercussions.

Minneapolis Minnesota Garnishment Earnings Disclosure Instructions

Description

How to fill out Minneapolis Minnesota Garnishment Earnings Disclosure Instructions?

Regardless of social or professional status, filling out law-related documents is an unfortunate necessity in today’s professional environment. Too often, it’s virtually impossible for someone with no law background to create such papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms comes in handy. Our service offers a massive library with more than 85,000 ready-to-use state-specific documents that work for almost any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

No matter if you require the Minneapolis Minnesota Garnishment Earnings Disclosure Instructions or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how to get the Minneapolis Minnesota Garnishment Earnings Disclosure Instructions in minutes using our reliable service. If you are presently an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are new to our library, make sure to follow these steps prior to downloading the Minneapolis Minnesota Garnishment Earnings Disclosure Instructions:

- Be sure the form you have found is suitable for your area considering that the rules of one state or county do not work for another state or county.

- Review the document and go through a brief outline (if provided) of cases the paper can be used for.

- If the form you picked doesn’t meet your requirements, you can start over and search for the necessary document.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or register for one from scratch.

- Select the payment method and proceed to download the Minneapolis Minnesota Garnishment Earnings Disclosure Instructions as soon as the payment is completed.

You’re all set! Now you can proceed to print out the document or fill it out online. Should you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.