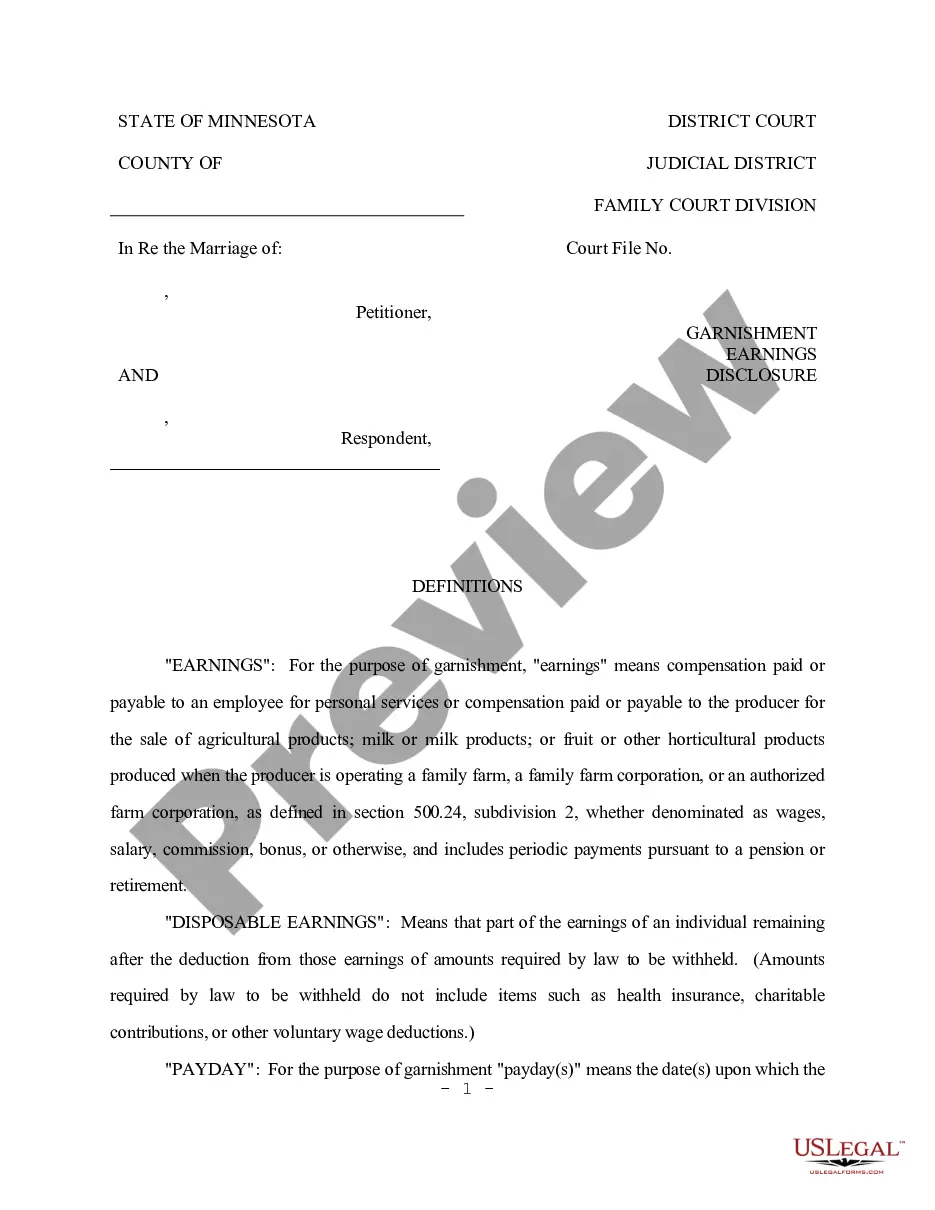

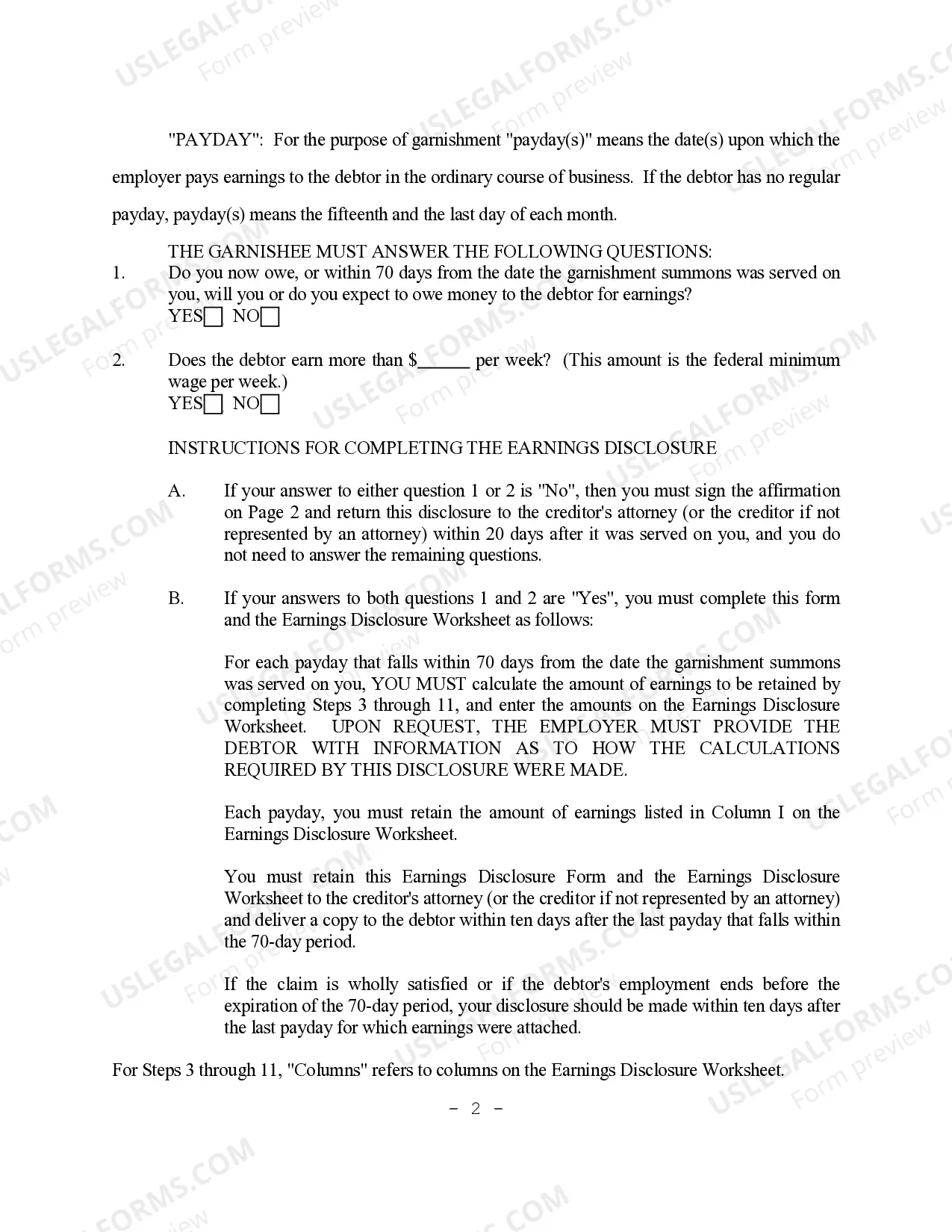

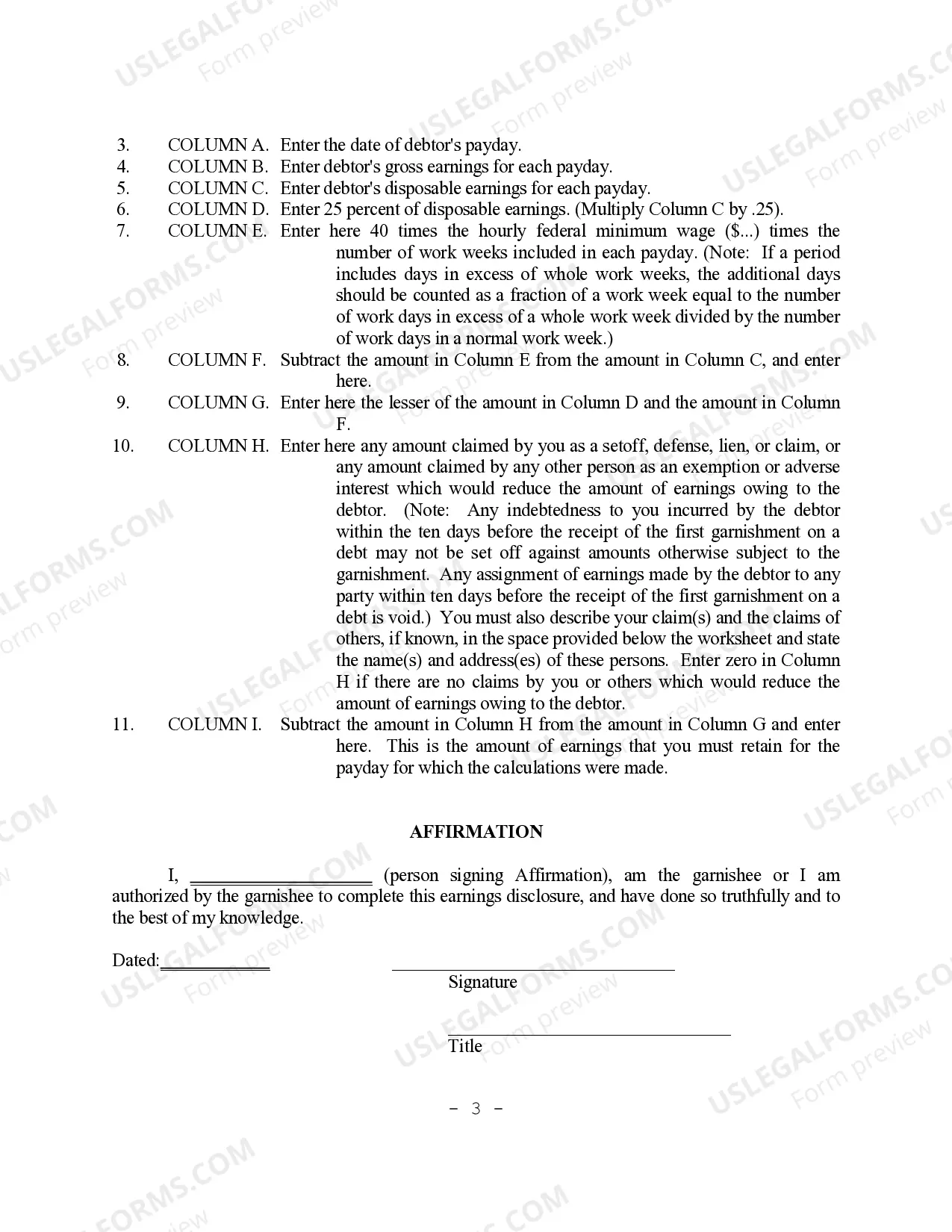

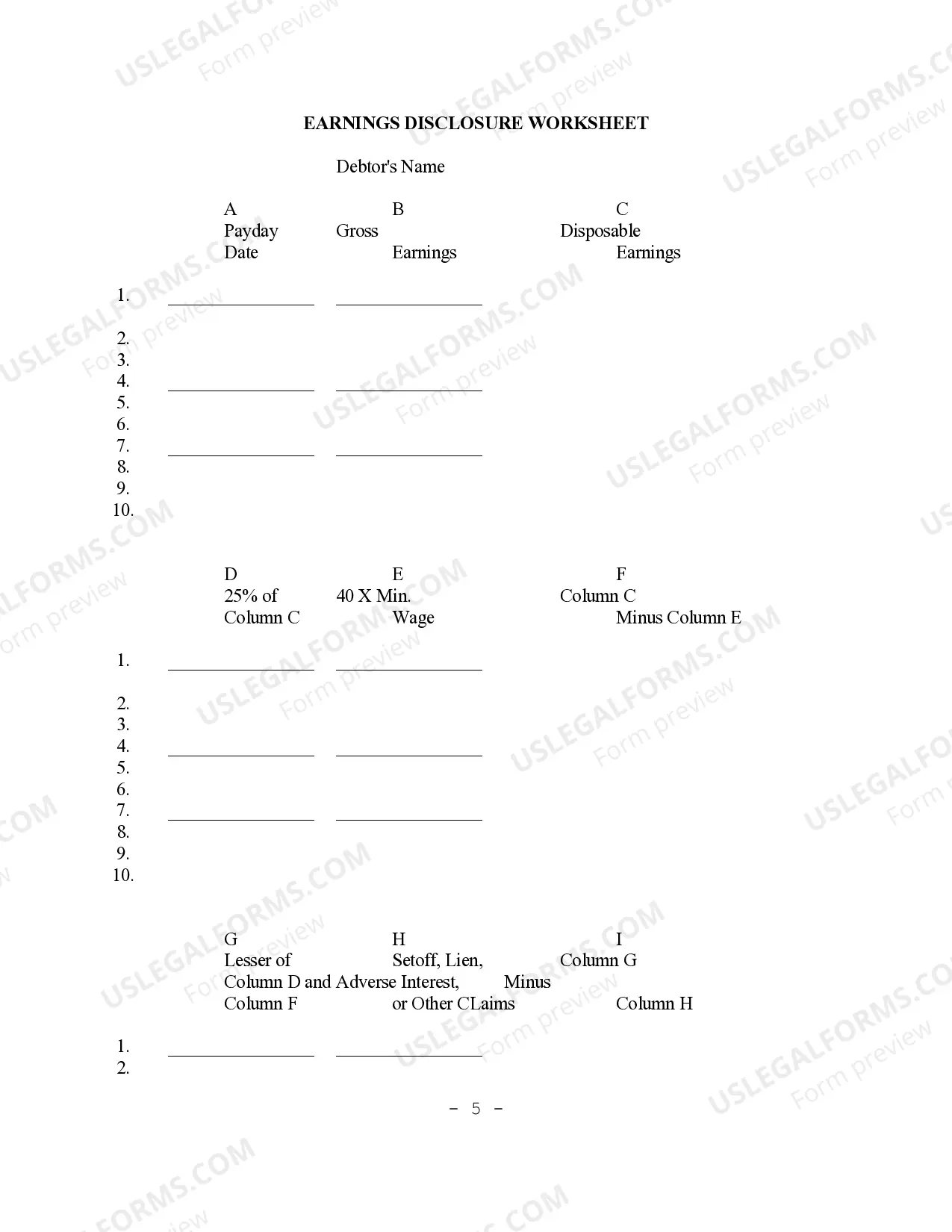

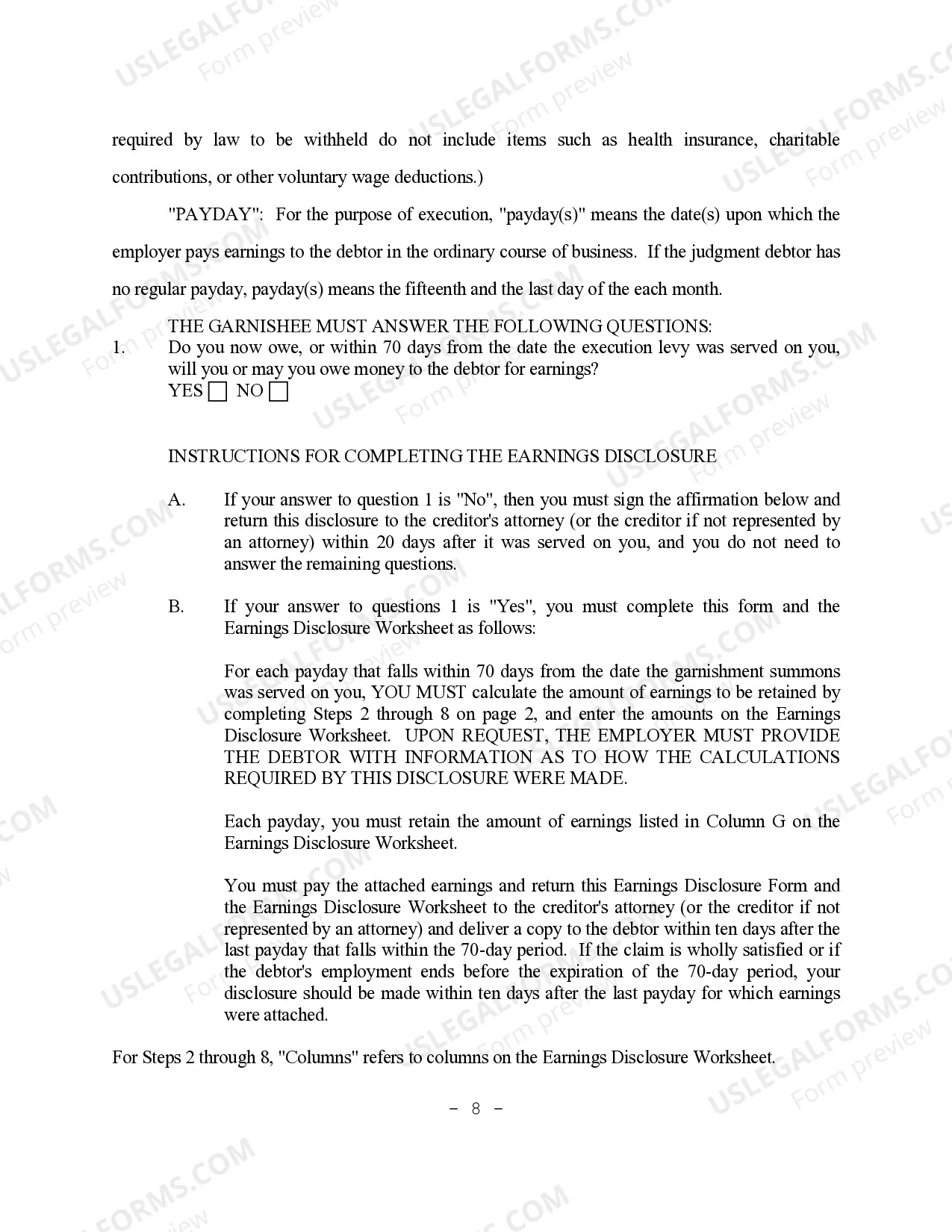

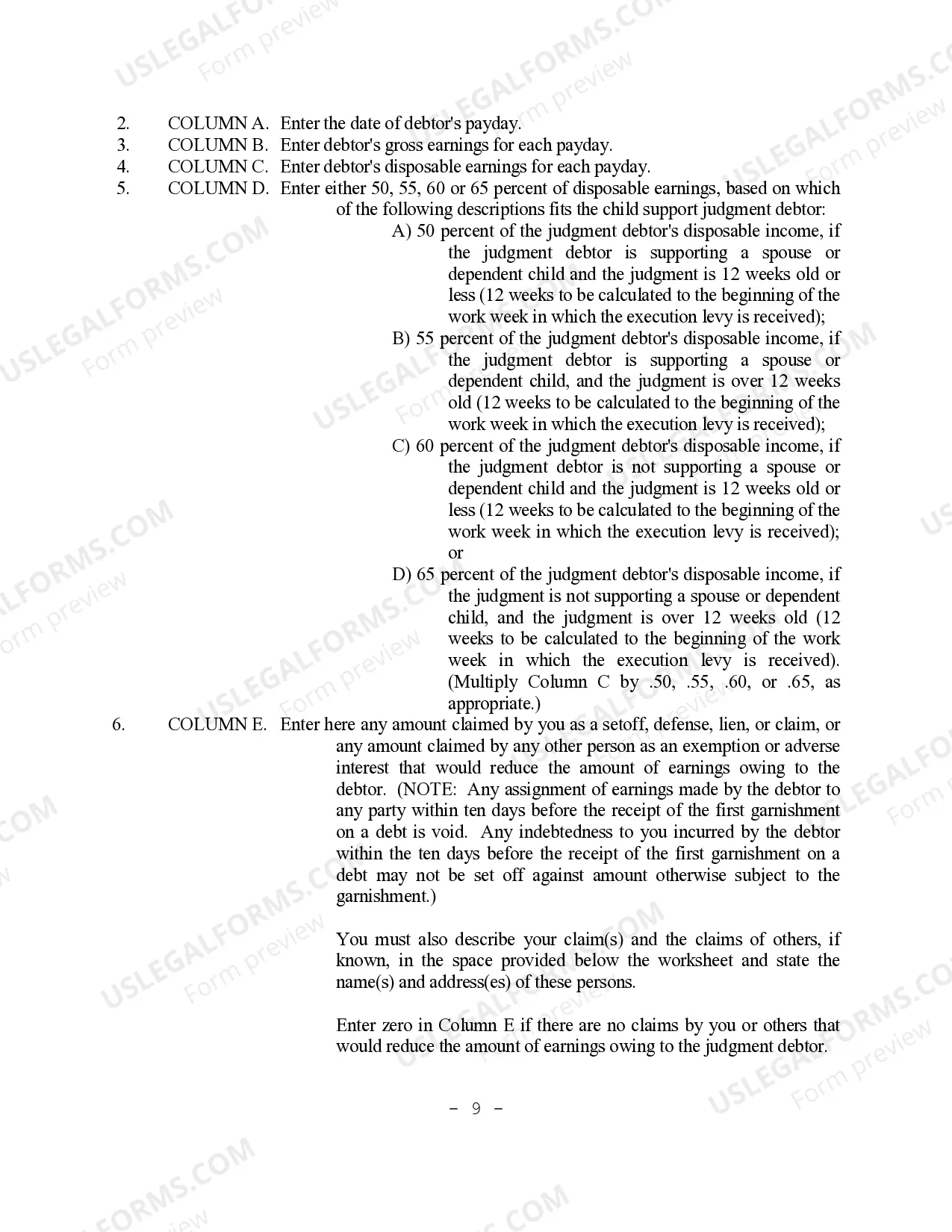

Saint Paul Minnesota Garnishment Earnings Disclosure Instructions are the guidelines and procedures that individuals or employers must follow when notifying the court and determining the amount of wages that can be garnished from an employee's earnings in the city of Saint Paul, Minnesota. This process involves disclosing personal financial information and calculating the maximum amount that can be withheld from an employee's paycheck to fulfill a garnishment order. The purpose of Saint Paul Minnesota Garnishment Earnings Disclosure Instructions is to ensure that the garnishment process is fair and transparent for both the employee and the creditor seeking to collect a debt. These instructions outline the specific steps that must be taken by the employer or garnishee in order to comply with state laws and regulations. There are different types of Garnishment Earnings Disclosure Instructions in Saint Paul, Minnesota, including: 1. Wage Garnishment: This is the most common type where a creditor obtains a court order to seize a portion of an employee's wages to repay a debt. 2. Child Support Garnishment: This type of garnishment is specifically related to fulfilling child support obligations, where a percentage of the employee's wages may be withheld to pay for child support payments. 3. Tax Levy Garnishment: In cases where an employee owes back taxes to the government, a tax levy garnishment may be imposed, allowing the government to seize a portion of the employee's wages to cover the outstanding tax debt. The Saint Paul Minnesota Garnishment Earnings Disclosure Instructions ensure that all parties involved understand the process and are aware of their rights and responsibilities. It provides a clear framework for employers to follow when handling garnishments and ensures that the proper amount is withheld from an employee's wages, leaving them with a fair and reasonable income to meet their basic needs. Compliance with these instructions is essential to avoid legal repercussions and protect the rights of both employees and creditors.

Saint Paul Minnesota Garnishment Earnings Disclosure Instructions

Description

How to fill out Saint Paul Minnesota Garnishment Earnings Disclosure Instructions?

Take advantage of the US Legal Forms and get instant access to any form you want. Our helpful platform with thousands of templates makes it easy to find and obtain almost any document sample you need. You are able to download, fill, and sign the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions in a matter of minutes instead of surfing the Net for hours trying to find the right template.

Using our library is a wonderful strategy to increase the safety of your record submissions. Our professional legal professionals regularly review all the documents to ensure that the templates are relevant for a particular state and compliant with new laws and regulations.

How do you obtain the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions? If you have a profile, just log in to the account. The Download option will be enabled on all the samples you look at. Furthermore, you can find all the earlier saved documents in the My Forms menu.

If you don’t have an account yet, follow the instructions listed below:

- Open the page with the template you require. Make sure that it is the form you were seeking: check its name and description, and utilize the Preview function when it is available. Otherwise, use the Search field to find the appropriate one.

- Start the saving procedure. Click Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Select the format to get the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions and modify and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy document libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Saint Paul Minnesota Garnishment Earnings Disclosure Instructions.

Feel free to make the most of our form catalog and make your document experience as efficient as possible!