Hennepin County in Minnesota allows for a legal process known as a Summons to Employer of Garnishee. This summons is primarily used to enforce a debt collection by instructing an employer to withhold a portion of an employee's wages and redirect them to the creditor. This article provides a comprehensive overview of what this summons entails, including its purpose, procedure, and potential variations. The Hennepin Minnesota Summons to Employer of Garnishee is typically issued when a creditor has obtained a judgment against a debtor and wishes to collect the owed debt through wage garnishment. This legal document acts as a notice to the debtor's employer, known as the garnishee, to withhold a certain amount from the employee's wages until the debt is fully satisfied. This sum includes the outstanding debt, interest, and any applicable fees. The summons is an integral part of the garnishment process, ensuring that the employer is aware of their obligations to the creditor. It serves as a formal request for the employer to deduct the specified amount from the employee's paycheck and forward it to the creditor or their representative. Non-compliance with the summons can result in penalties and legal consequences for the employer. Different types of Hennepin Minnesota Summons to Employer of Garnishee may exist depending on the specific circumstances of the debt collection case. These variations may include: 1. Regular Wage Garnishment Summons: This is the most common type of summons, where a creditor seeks to garnish a debtor's wages on a regular basis until the debt is fully repaid. 2. Lump Sum Garnishment Summons: In certain cases, a creditor may request a one-time deduction of a specific amount from the employee's wages. This type of summons is often used when the debtor has a large outstanding debt balance to be settled in a single payment. 3. Multiple Creditor Summons: In situations where a debtor has multiple creditors seeking to garnish their wages concurrently, multiple summonses may be issued to each respective employer. This ensures that each creditor receives their portion of the garnished wages, proportionate to the debt owed. It is important to note that the Hennepin Minnesota Summons to Employer of Garnishee is a legal document that follows specific legal procedures and timelines. Employers should carefully review the summons, calculate and deduct the appropriate amount from the employee's wages, and promptly forward the payments to the creditor. In conclusion, the Hennepin Minnesota Summons to Employer of Garnishee is a crucial legal instrument used to enforce debt collection through wage garnishment. It serves as a formal notice to the employer, instructing them to deduct a specified amount from the employee's wages and remit it to the creditor until the debt is repaid. Different variations of this summons exist, based on the specific circumstances of the debt collection case. Employers should ensure compliance, adhere to legal procedures, and promptly respond to these summonses to avoid penalties and legal consequences.

Hennepin Minnesota Summons to Employer of Garnishee

State:

Minnesota

County:

Hennepin

Control #:

MN-8454D

Format:

Word;

Rich Text

Instant download

Description

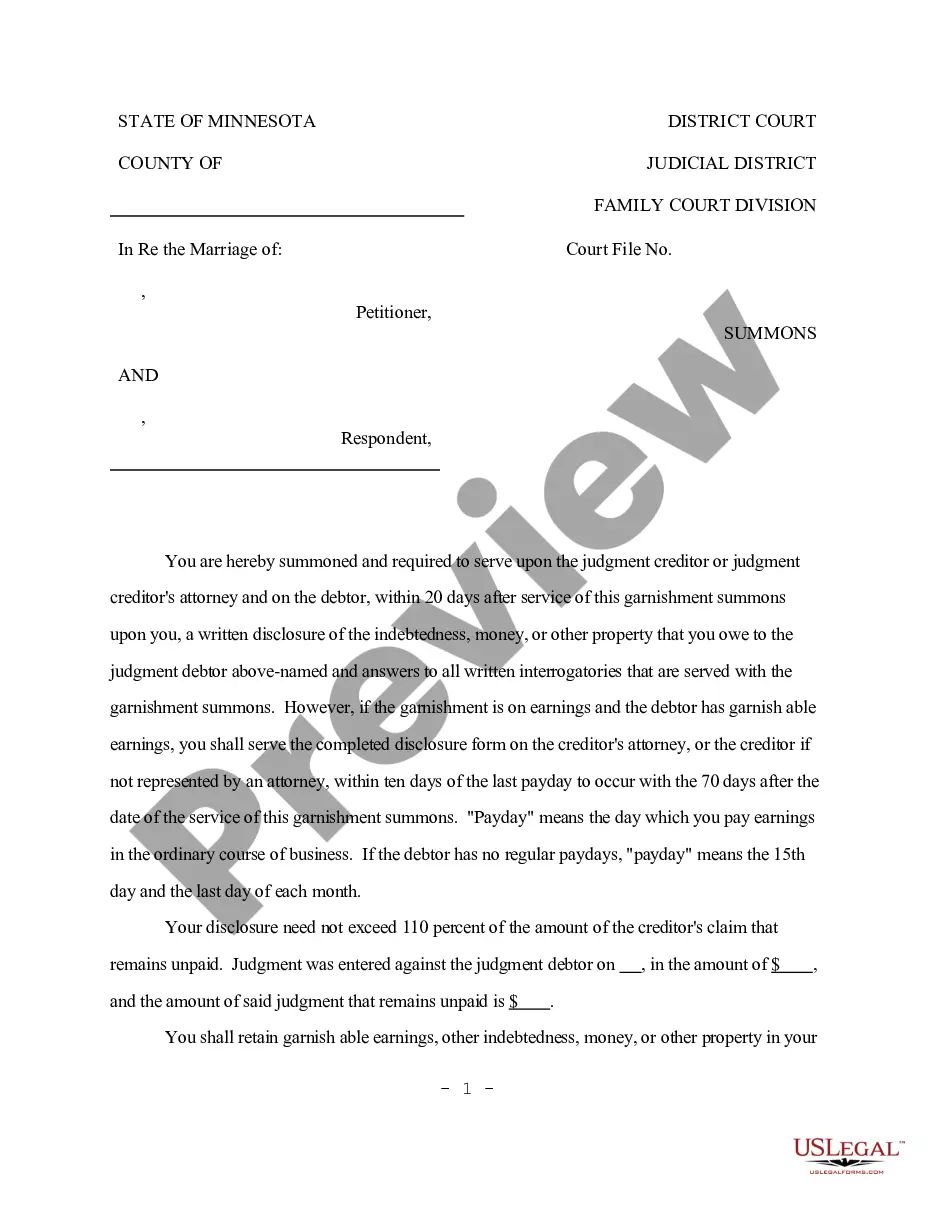

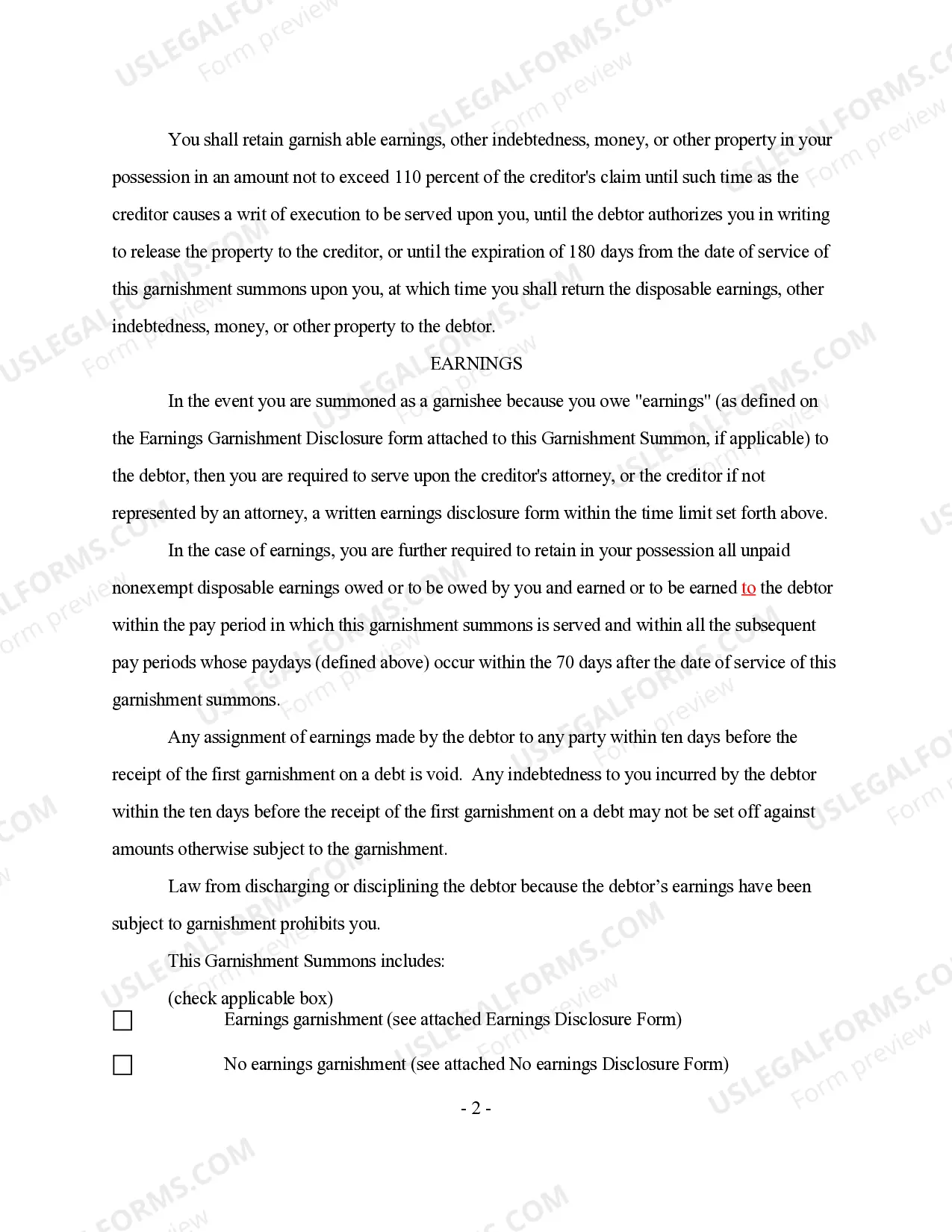

This form is a summons concerning a garnishment action in a dissolution of marriage proceeding. The garnishee is required to serve upon the judgment creditor or judgment creditor's attorney and on the debtor, within 20 days after service of the garnishment summons, a written disclosure of the indebtedness, money, or other property that the garnishee owes to the judgment debtor and answers to all written interrogatories that are served with the garnishment summons.

Hennepin County in Minnesota allows for a legal process known as a Summons to Employer of Garnishee. This summons is primarily used to enforce a debt collection by instructing an employer to withhold a portion of an employee's wages and redirect them to the creditor. This article provides a comprehensive overview of what this summons entails, including its purpose, procedure, and potential variations. The Hennepin Minnesota Summons to Employer of Garnishee is typically issued when a creditor has obtained a judgment against a debtor and wishes to collect the owed debt through wage garnishment. This legal document acts as a notice to the debtor's employer, known as the garnishee, to withhold a certain amount from the employee's wages until the debt is fully satisfied. This sum includes the outstanding debt, interest, and any applicable fees. The summons is an integral part of the garnishment process, ensuring that the employer is aware of their obligations to the creditor. It serves as a formal request for the employer to deduct the specified amount from the employee's paycheck and forward it to the creditor or their representative. Non-compliance with the summons can result in penalties and legal consequences for the employer. Different types of Hennepin Minnesota Summons to Employer of Garnishee may exist depending on the specific circumstances of the debt collection case. These variations may include: 1. Regular Wage Garnishment Summons: This is the most common type of summons, where a creditor seeks to garnish a debtor's wages on a regular basis until the debt is fully repaid. 2. Lump Sum Garnishment Summons: In certain cases, a creditor may request a one-time deduction of a specific amount from the employee's wages. This type of summons is often used when the debtor has a large outstanding debt balance to be settled in a single payment. 3. Multiple Creditor Summons: In situations where a debtor has multiple creditors seeking to garnish their wages concurrently, multiple summonses may be issued to each respective employer. This ensures that each creditor receives their portion of the garnished wages, proportionate to the debt owed. It is important to note that the Hennepin Minnesota Summons to Employer of Garnishee is a legal document that follows specific legal procedures and timelines. Employers should carefully review the summons, calculate and deduct the appropriate amount from the employee's wages, and promptly forward the payments to the creditor. In conclusion, the Hennepin Minnesota Summons to Employer of Garnishee is a crucial legal instrument used to enforce debt collection through wage garnishment. It serves as a formal notice to the employer, instructing them to deduct a specified amount from the employee's wages and remit it to the creditor until the debt is repaid. Different variations of this summons exist, based on the specific circumstances of the debt collection case. Employers should ensure compliance, adhere to legal procedures, and promptly respond to these summonses to avoid penalties and legal consequences.

Free preview

How to fill out Hennepin Minnesota Summons To Employer Of Garnishee?

If you’ve already used our service before, log in to your account and save the Hennepin Minnesota Summons to Employer of Garnishee on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Hennepin Minnesota Summons to Employer of Garnishee. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!