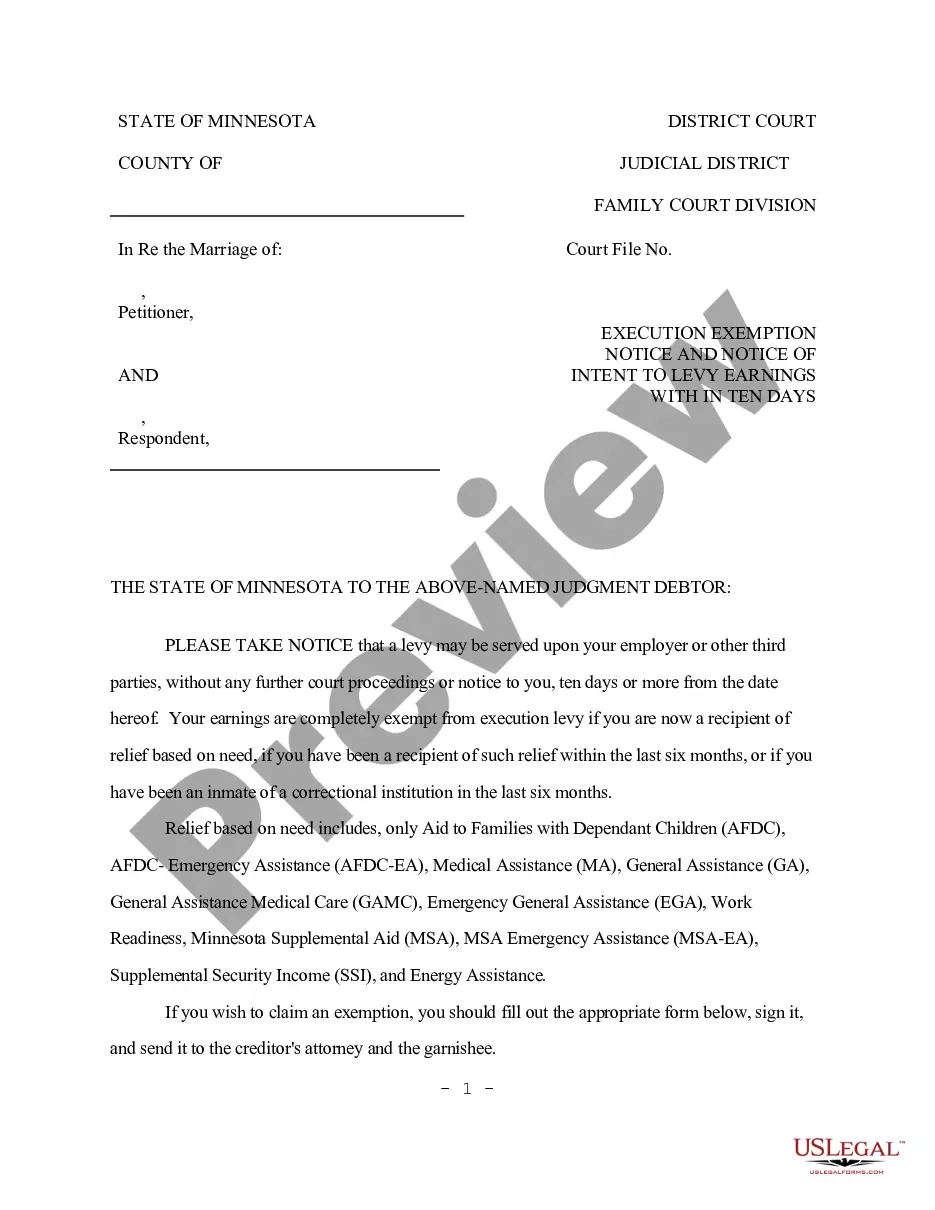

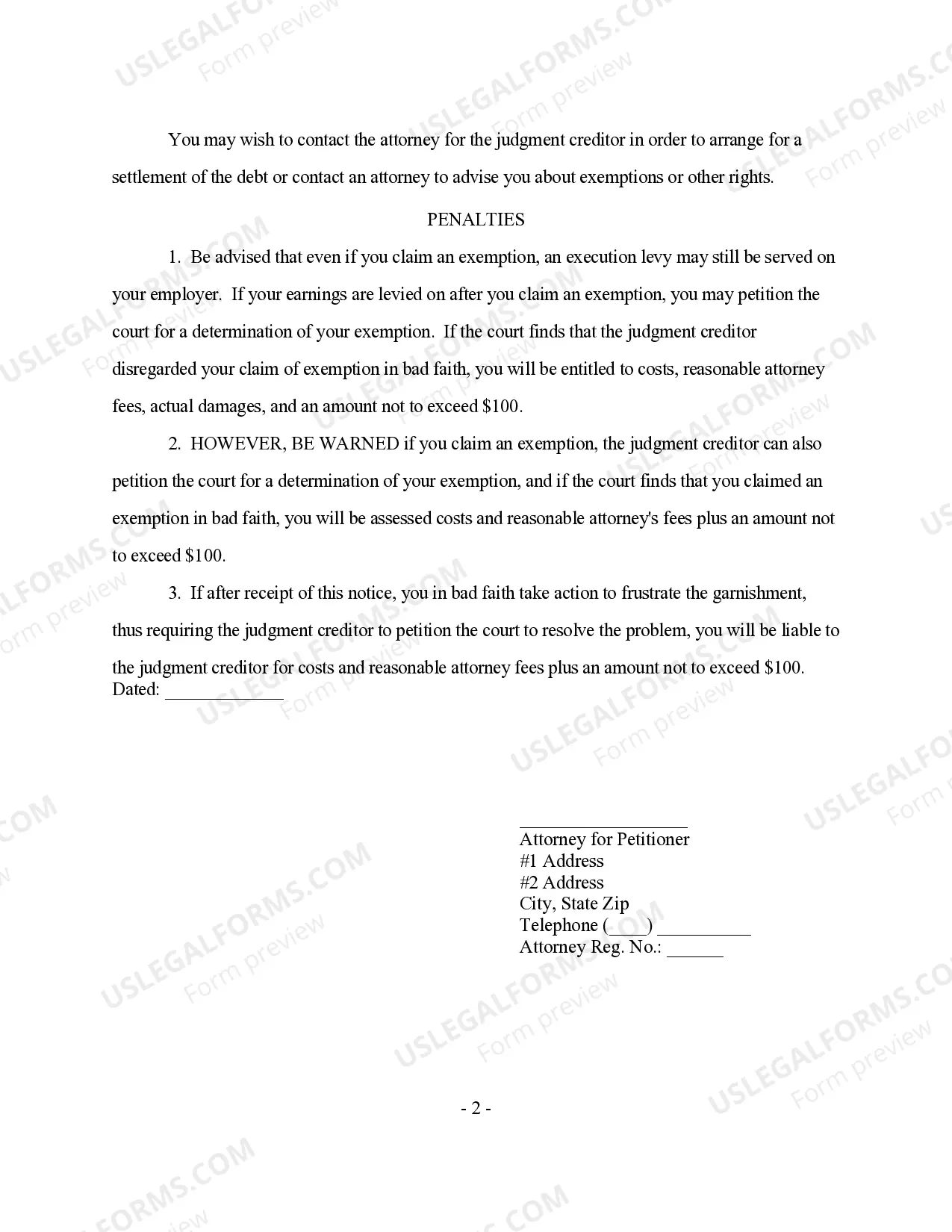

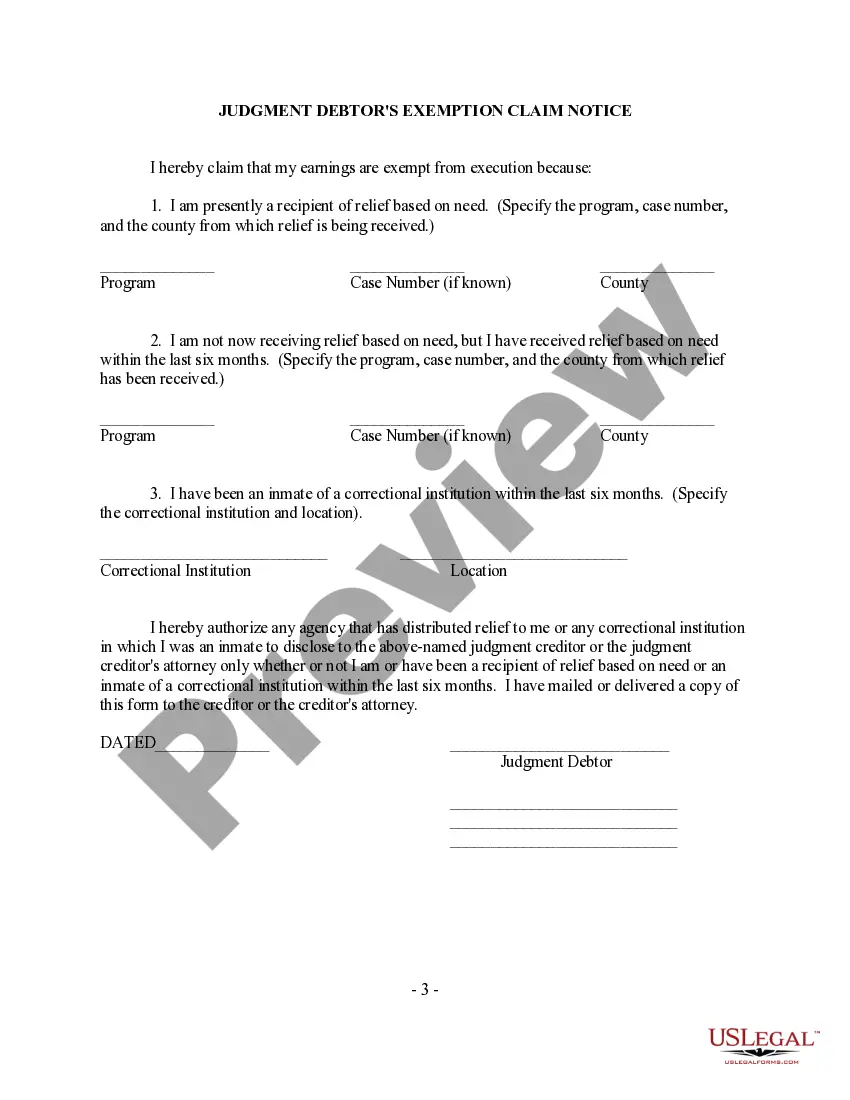

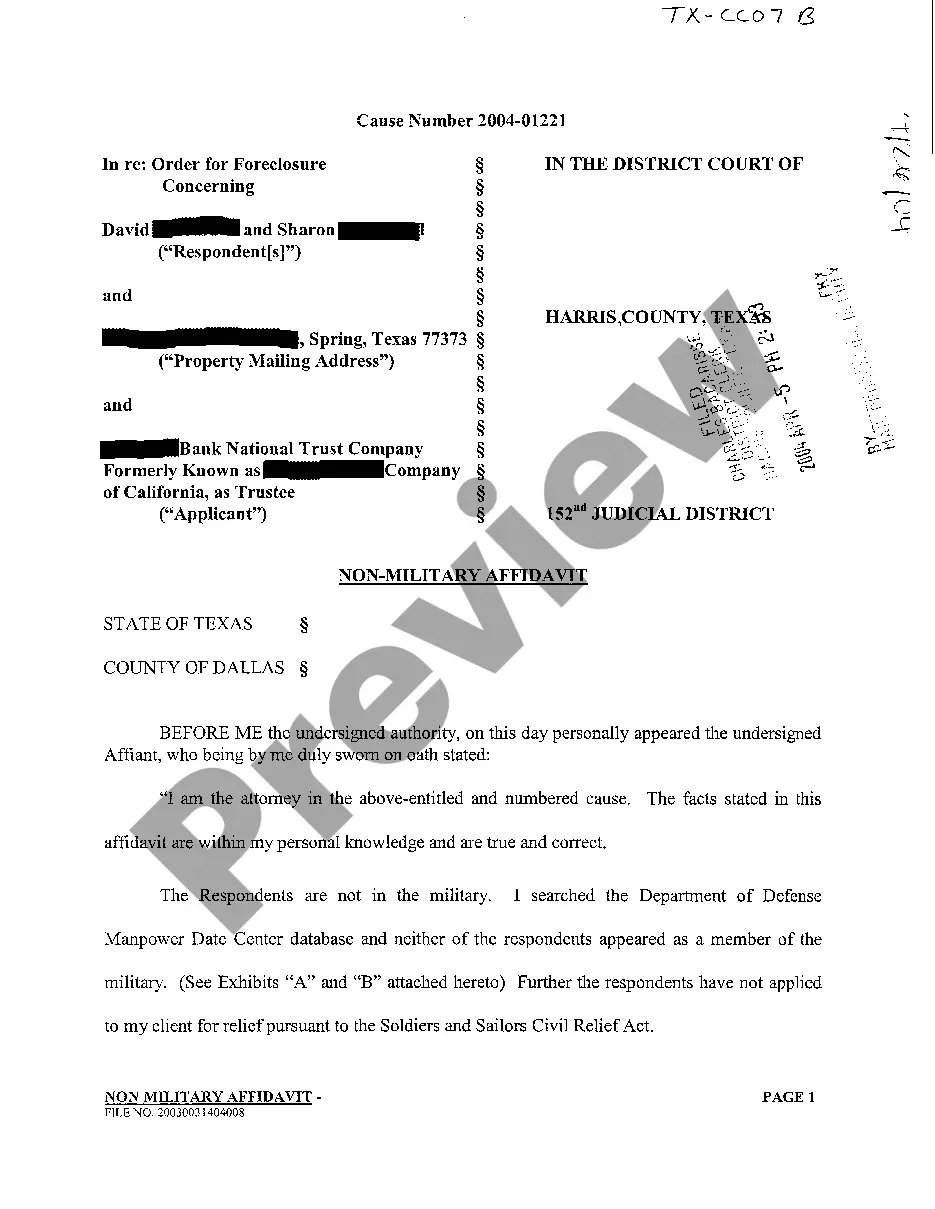

The Hennepin Minnesota Notice to Garnishee of Intent to Levy Earnings is a legal document that informs the garnishee (the person or entity holding the debtor's wages) about the intention to garnish the debtor's earnings in order to satisfy a debt. This notice is issued by the creditor or the creditor's attorney and is an important step in the garnishment process. Keywords: Hennepin Minnesota, Notice to Garnishee, Intent to Levy Earnings, legal document, garnishment, debtor's wages, satisfy a debt, creditor, attorney, garnishment process. Different types of Hennepin Minnesota Notice to Garnishee of Intent to Levy Earnings may include: 1. Standard Garnishment Notice: This type of notice is used to inform the garnishee about the intent to levy the debtor's wages in order to collect a debt owed to the creditor. It includes details such as the debtor's name, the amount of the debt, and instructions for calculating the amount that can be garnished. 2. Continuing Garnishment Notice: In cases where the debtor has ongoing earnings, a continuing garnishment notice may be issued. This notice informs the garnishee that a portion of the debtor's wages should be withheld regularly until the debt is fully satisfied. It also provides instructions on how to calculate and remit the garnished amount. 3. Multiple Garnishment Notice: When there are multiple creditors seeking to garnish the same debtor's wages, a multiple garnishment notice may be required. This notice alerts the garnishee about the existence of multiple garnishments and provides instructions on how to distribute the garnished funds among the creditors appropriately. 4. Exemption Claim Notice: In certain situations, the debtor may be entitled to claim exemptions that protect a portion of their earnings from garnishment. An exemption claim notice is used to inform the garnishee about the debtor's intent to claim exemptions and the specific laws or regulations that support their claim. 5. Termination of Garnishment Notice: Once the debt is fully satisfied or other circumstances arise, such as bankruptcy, a termination of garnishment notice is issued to inform the garnishee that the garnishment order is no longer valid. This notice advises the garnishee to stop withholding funds from the debtor's wages and to release any remaining garnished funds. Remember, this information is provided for general informational purposes only, and it is recommended to consult with an attorney or legal professional for specific guidance related to Hennepin Minnesota Notice to Garnishee of Intent to Levy Earnings.

Hennepin Minnesota Notice to Garnishee of Intent to Levy Earnings

Description

How to fill out Hennepin Minnesota Notice To Garnishee Of Intent To Levy Earnings?

If you’ve already used our service before, log in to your account and download the Hennepin Minnesota Notice to Garnishee of Intent to Levy Earnings on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Make certain you’ve located the right document. Look through the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Hennepin Minnesota Notice to Garnishee of Intent to Levy Earnings. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your individual or professional needs!

Form popularity

FAQ

Limits on Wage Garnishment in Minnesota In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage.

That hold is in effect for 21 days?a period during which you can act to stop the levy. After the 21 days have passed, unless the levy is reversed, your bank must transfer the funds to the IRS. If the initial bank levy does not satisfy the debt in full, the IRS can go back to your bank for additional monies.

The garnishment law allows up to 50% of a worker's disposable earnings to be garnished for these purposes if the worker is supporting another spouse or child, or up to 60% if the worker is not. An additional 5% may be garnished for support payments more than l2 weeks in arrears.

Garnishments and levies are collection tools used by creditors to seize an asset or stream of income that belongs to you. For the most part, levies apply to your financial accounts, and garnishments apply to your wages.

Under federal law, most creditors are limited to garnish up to 25% of your disposable wages.

If the IRS levies (seizes) your wages, part of your wages will be sent to the IRS each pay period until: You make other arrangements to pay your overdue taxes, The amount of overdue taxes you owe is paid, or. The levy is released.

Minnesota Wage Garnishment Process The creditor files a lawsuit.You must respond within 21 days.There's a court hearing.You can raise objections or defenses.The judge makes a decision.After this court order and judgment are made, the creditor can request a garnishment order.

There are four ways to stop a garnishment in Minnesota: (1) claim an exemption; (2) negotiate a settlement; (3) vacate the judgment; and (4) file bankruptcy.

A Garnishment Summons served on an employer requires the employer to withhold garnishment deductions from an employee's earnings. The garnishment amount is limited to 25% of the employee's disposable earnings. A Garnishment Summons allows garnishment deductions to begin before a court judgment is final.

You can avoid a levy by filing returns on time and paying your taxes when due. If you need more time to file, you can request an extension. If you can't pay what you owe, you should pay as much as you can and work with the IRS to resolve the remaining balance.