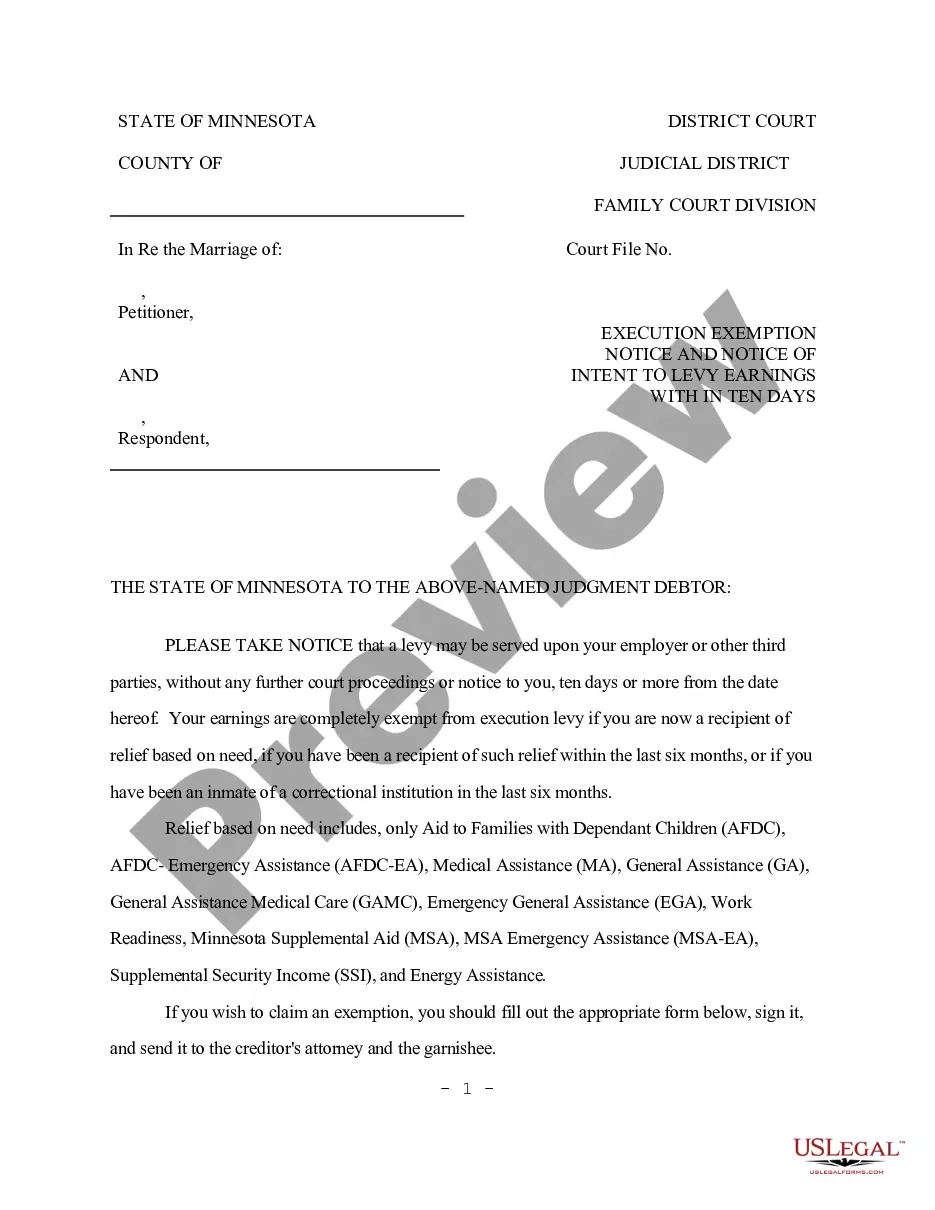

Minneapolis Minnesota Notice to Garnishee of Intent to Levy Earnings

Description

How to fill out Minnesota Notice To Garnishee Of Intent To Levy Earnings?

We consistently aim to reduce or prevent legal complications when managing intricate legal or financial matters.

To achieve this, we enlist legal services that are typically quite costly.

Yet, not all legal issues are similarly complicated; most can be handled independently.

US Legal Forms is an online repository of current DIY legal documents ranging from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button next to it. If you happen to misplace the document, you can always retrieve it again in the My documents section. The procedure is equally simple if you’re not familiar with the website! You can set up your account in just a few minutes. Remember to verify that the Minneapolis Minnesota Notice to Garnishee of Intent to Levy Earnings adheres to the laws and regulations of your particular state and area. Furthermore, it’s crucial to review the form’s description (if available), and if you see any inconsistencies with your initial requirements, look for an alternative template. Once you confirm that the Minneapolis Minnesota Notice to Garnishee of Intent to Levy Earnings suits your situation, you can choose a subscription plan and proceed with payment. Following that, you can download the document in any appropriate file format. For over 24 years in the industry, we’ve assisted millions by providing readily customizable and current legal documents. Take advantage of US Legal Forms now to conserve your efforts and resources!

- Our library enables you to take control of your affairs without relying on legal counsel.

- We offer access to legal form templates that may not always be readily available.

- Our templates are tailored to specific states and areas, which greatly simplifies the search.

- Utilize US Legal Forms when you need to quickly and securely find and download the Minneapolis Minnesota Notice to Garnishee of Intent to Levy Earnings or any other form.

Form popularity

FAQ

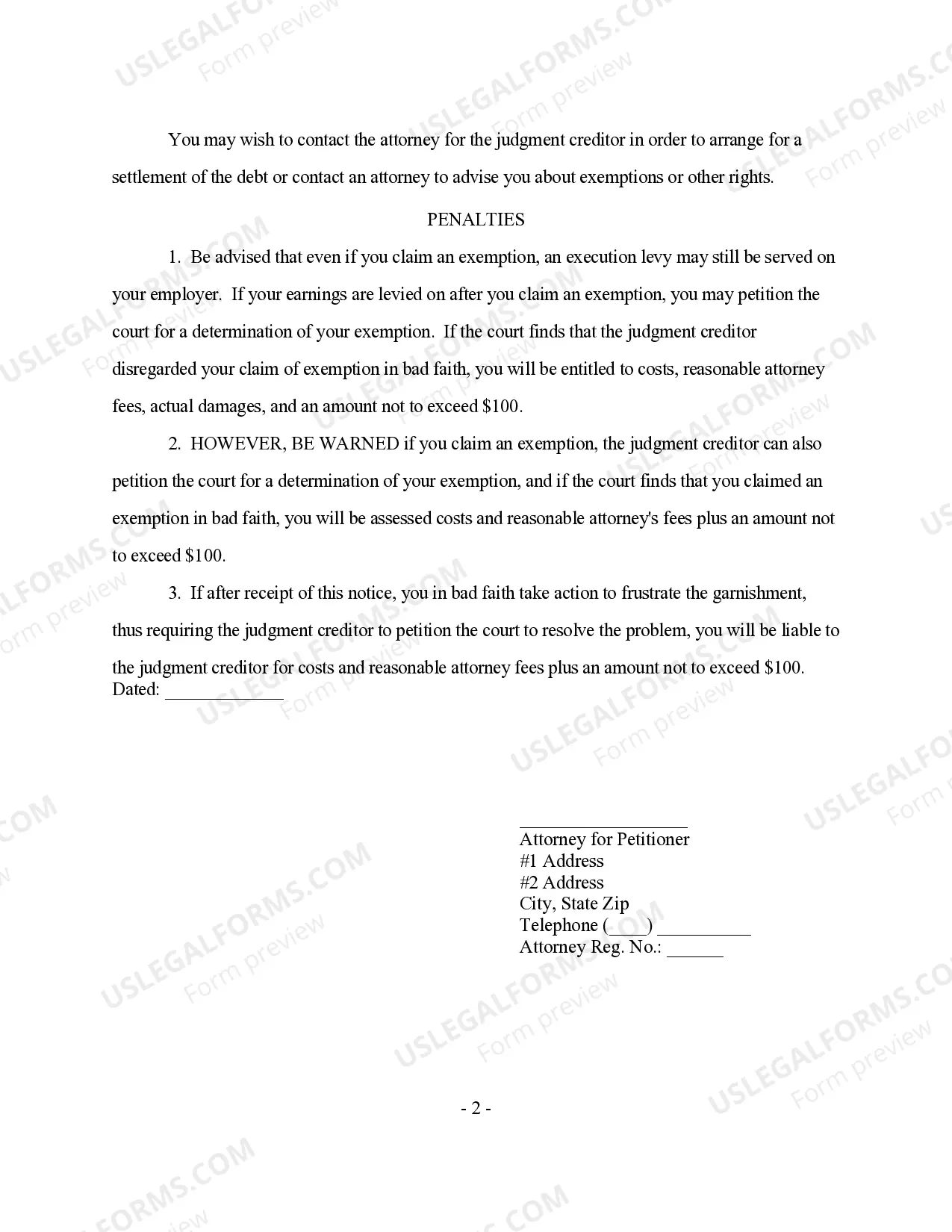

Limits on Wage Garnishment in Minnesota In Minnesota, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings, or. the amount by which your weekly disposable earnings exceed the greater of 40 times the federal or state hourly minimum wage.

A bank levy is a legal action that allows creditors to take funds from your bank account. Your bank freezes funds in your account, and the bank is required to send that money to creditors to satisfy your debt.

Ways to Stop A Garnishment Paying off the debt in full. Filing an objection to the garnishment with the court if you have legal basis, such debt was a result of fraud or identity theft. Filing for court protection and debt resolution through Chapter 13 or Chapter 7 bankruptcy.

If the IRS levies (seizes) your wages, part of your wages will be sent to the IRS each pay period until: You make other arrangements to pay your overdue taxes, The amount of overdue taxes you owe is paid, or. The levy is released.

If the IRS levies (seizes) your wages, part of your wages will be sent to the IRS each pay period until: You make other arrangements to pay your overdue taxes, The amount of overdue taxes you owe is paid, or. The levy is released.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

Garnishments and levies are collection tools used by creditors to seize an asset or stream of income that belongs to you. For the most part, levies apply to your financial accounts, and garnishments apply to your wages.

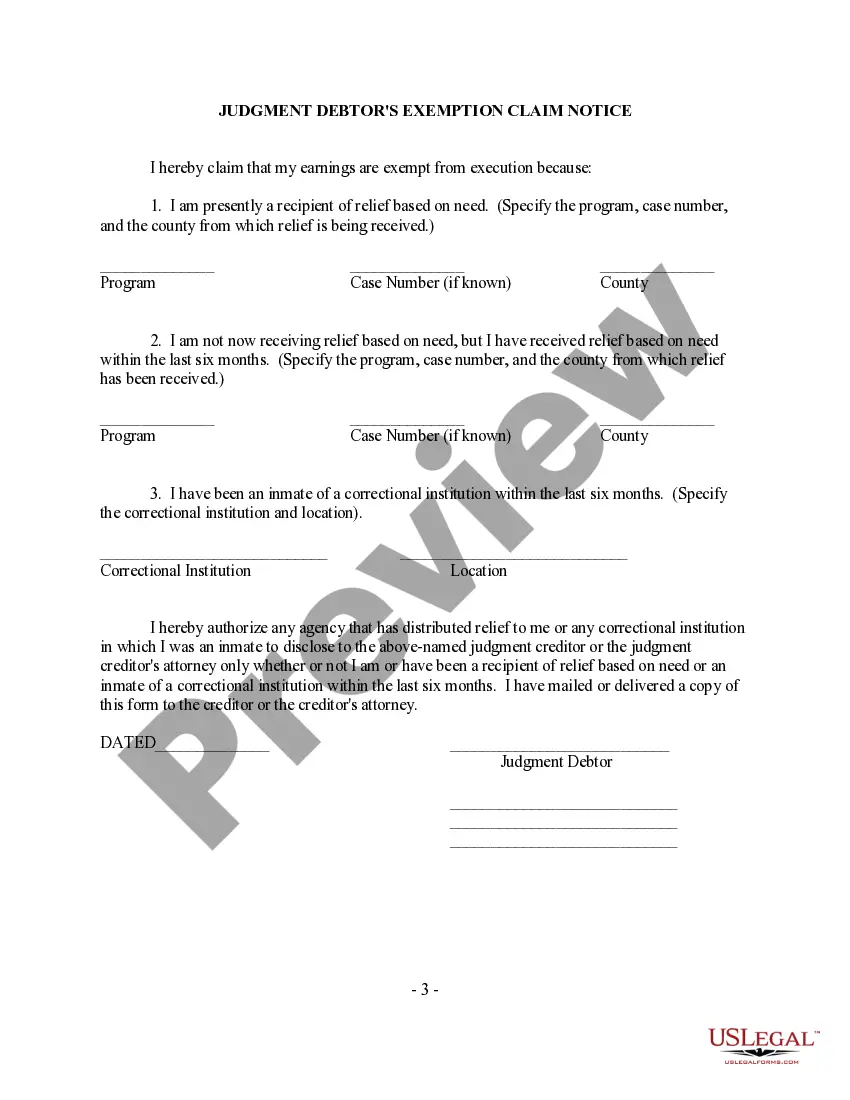

If you receive a notice of a wage garnishment order, you might be able to protect or exempt some or all of your wages by filing an exemption claim with the court. You can also stop most garnishments by filing for bankruptcy. Your state's exemption laws determine the amount of income you'll be able to keep.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

A garnishment is the legal action which your employee's creditor may use to claim funds that you, the employer, owe to the employee (salary or hourly wages, for example). The summons is a warning not to transfer those funds to the employee.