The Hennepin Minnesota Payment Plan Agreement is a contractual arrangement designed to help individuals with delinquent accounts in Hennepin County, Minnesota manage their financial obligations through a structured installment plan. This agreement aims to assist individuals who are unable to make a lump sum payment by providing them with a more flexible and manageable payment schedule. The Hennepin Minnesota Payment Plan Agreement for Delinquent Account allows individuals to repay their outstanding debts over time, avoiding the immediate burden of full payment. By entering into this agreement, individuals can avoid more adverse consequences such as further collections actions, legal proceedings, or negative impacts on their credit score. Keywords: Hennepin County, Minnesota, Payment Plan Agreement, delinquent account, installment plan, financial obligations, structured payment schedule, manageable, lump sum payment, flexible, outstanding debts, collections actions, legal proceedings, credit score. Different types of Hennepin Minnesota Payment Plan Agreement for Delinquent Account: 1. Personal Loan Payment Plan Agreement: This type of agreement is usually established between an individual and a bank or lending institution for the repayment of a personal loan. It allows borrowers to make regular, monthly payments towards the outstanding debt. 2. Credit Card Payment Plan Agreement: This agreement is commonly utilized to manage delinquent credit card accounts. It allows cardholders to repay their credit card debts gradually, usually through fixed monthly payments, avoiding the need for immediate full settlement. 3. Utility Bill Payment Plan Agreement: This type of payment plan agreement is specifically designed for individuals who are struggling to pay their overdue utility bills. It allows them to spread out their payments over an extended period, ensuring continued access to essential services like electricity, water, or gas. 4. Medical Bill Payment Plan Agreement: When faced with excessive medical bills that cannot be paid in full, individuals can opt for a payment plan agreement with healthcare providers or hospitals. This agreement allows them to fulfill their financial obligations over time, relieving the immediate financial strain caused by medical expenses. 5. Tax Payment Plan Agreement: Individuals with delinquent tax accounts in Hennepin County can enter into a payment plan agreement with the tax authorities. This agreement enables taxpayers to pay off their tax debts over a specified period, avoiding more severe consequences such as liens or levies. Keywords: Personal loan, bank, lending institution, credit card, utility bill, medical bill, tax, repayment, monthly payments, overdue, fixed, access to essential services, healthcare providers, hospitals, tax authorities, financial strain, liens, levies.

Hennepin Minnesota Payment Plan Agreement for Delinquent Account

State:

Minnesota

County:

Hennepin

Control #:

MN-8552D

Format:

Word;

Rich Text

Instant download

Description

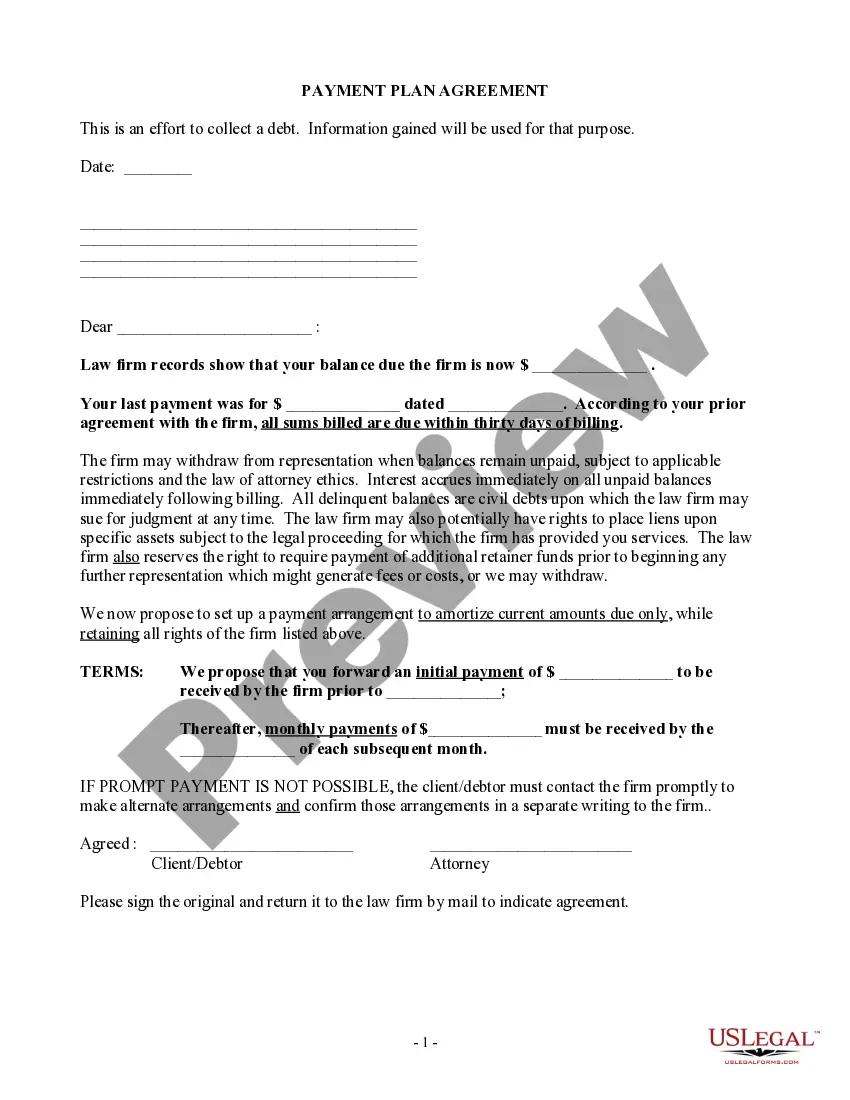

An agreement for client to pay overdue legal fees on a monthly basis, while preserving the rights of law firm if client fails to make good.

The Hennepin Minnesota Payment Plan Agreement is a contractual arrangement designed to help individuals with delinquent accounts in Hennepin County, Minnesota manage their financial obligations through a structured installment plan. This agreement aims to assist individuals who are unable to make a lump sum payment by providing them with a more flexible and manageable payment schedule. The Hennepin Minnesota Payment Plan Agreement for Delinquent Account allows individuals to repay their outstanding debts over time, avoiding the immediate burden of full payment. By entering into this agreement, individuals can avoid more adverse consequences such as further collections actions, legal proceedings, or negative impacts on their credit score. Keywords: Hennepin County, Minnesota, Payment Plan Agreement, delinquent account, installment plan, financial obligations, structured payment schedule, manageable, lump sum payment, flexible, outstanding debts, collections actions, legal proceedings, credit score. Different types of Hennepin Minnesota Payment Plan Agreement for Delinquent Account: 1. Personal Loan Payment Plan Agreement: This type of agreement is usually established between an individual and a bank or lending institution for the repayment of a personal loan. It allows borrowers to make regular, monthly payments towards the outstanding debt. 2. Credit Card Payment Plan Agreement: This agreement is commonly utilized to manage delinquent credit card accounts. It allows cardholders to repay their credit card debts gradually, usually through fixed monthly payments, avoiding the need for immediate full settlement. 3. Utility Bill Payment Plan Agreement: This type of payment plan agreement is specifically designed for individuals who are struggling to pay their overdue utility bills. It allows them to spread out their payments over an extended period, ensuring continued access to essential services like electricity, water, or gas. 4. Medical Bill Payment Plan Agreement: When faced with excessive medical bills that cannot be paid in full, individuals can opt for a payment plan agreement with healthcare providers or hospitals. This agreement allows them to fulfill their financial obligations over time, relieving the immediate financial strain caused by medical expenses. 5. Tax Payment Plan Agreement: Individuals with delinquent tax accounts in Hennepin County can enter into a payment plan agreement with the tax authorities. This agreement enables taxpayers to pay off their tax debts over a specified period, avoiding more severe consequences such as liens or levies. Keywords: Personal loan, bank, lending institution, credit card, utility bill, medical bill, tax, repayment, monthly payments, overdue, fixed, access to essential services, healthcare providers, hospitals, tax authorities, financial strain, liens, levies.

How to fill out Hennepin Minnesota Payment Plan Agreement For Delinquent Account?

If you’ve already utilized our service before, log in to your account and save the Hennepin Minnesota Payment Plan Agreement for Delinquent Account on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your file:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Obtain your Hennepin Minnesota Payment Plan Agreement for Delinquent Account. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have constant access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!