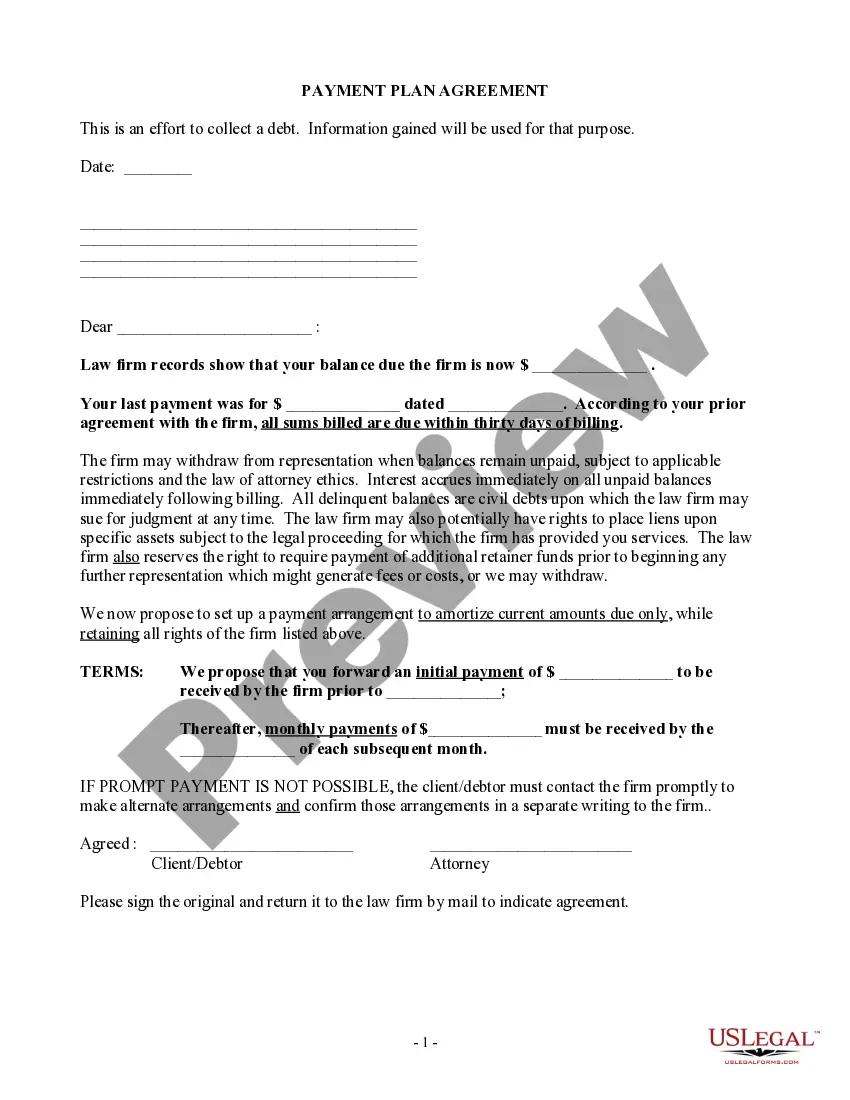

The Minneapolis Minnesota Payment Plan Agreement for Delinquent Account is a legal agreement designed to help individuals or businesses who have fallen behind on their payments to establish a structured repayment plan with their creditors. This agreement allows debtors in Minneapolis, Minnesota to come to an arrangement with their creditors to pay off their outstanding debts over a predetermined period of time. The Minneapolis Minnesota Payment Plan Agreement for Delinquent Account is a valuable tool for both debtors and creditors. It benefits debtors by providing them with an opportunity to regain control of their finances, avoid legal actions or collections, and prevent further damage to their credit score. Creditors also benefit from this agreement as it ensures a steady flow of payments and increases their chances of recovering the outstanding debt. Keywords: Minneapolis Minnesota, payment plan agreement, delinquent account, structured repayment plan, creditors, legal agreement, individuals, businesses, outstanding debts, predetermined period of time, debtors, valued tool, regain control of finances, legal actions, collections, credit score, steady flow of payments, outstanding debt recovery. There are different types of Minneapolis Minnesota Payment Plan Agreements for Delinquent Accounts, including: 1. Personal Payment Plan Agreement: This type of agreement is suitable for individuals who have fallen behind on their personal loans, credit card bills, or other forms of personal debt. 2. Business Payment Plan Agreement: This agreement is tailored for businesses that have outstanding debts with suppliers, creditors, or other business-related expenses. 3. Medical Payment Plan Agreement: This type of agreement is specifically designed for individuals who have accumulated medical bills and need a structured plan to repay their healthcare providers. 4. Municipal Payment Plan Agreement: This agreement is applicable to individuals or businesses that owe delinquent taxes, fines, or fees to the City of Minneapolis or any other local government agency. 5. Utility Payment Plan Agreement: This agreement caters to individuals who are unable to pay their utility bills on time and need a payment arrangement with utility companies such as electricity, gas, or water providers. Each type of payment plan agreement varies slightly in terms of the specific terms and conditions, eligibility requirements, and repayment terms. It is recommended to consult with a legal professional or financial advisor to ensure the agreement is customized to individual circumstances.

Minneapolis Minnesota Payment Plan Agreement for Delinquent Account

Description

How to fill out Minneapolis Minnesota Payment Plan Agreement For Delinquent Account?

Are you looking for a trustworthy and affordable legal forms provider to buy the Minneapolis Minnesota Payment Plan Agreement for Delinquent Account? US Legal Forms is your go-to choice.

No matter if you require a simple agreement to set regulations for cohabitating with your partner or a set of forms to advance your divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and area.

To download the form, you need to log in account, locate the needed template, and hit the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Find out if the Minneapolis Minnesota Payment Plan Agreement for Delinquent Account conforms to the regulations of your state and local area.

- Read the form’s description (if provided) to learn who and what the form is good for.

- Restart the search if the template isn’t good for your specific scenario.

Now you can register your account. Then pick the subscription option and proceed to payment. As soon as the payment is done, download the Minneapolis Minnesota Payment Plan Agreement for Delinquent Account in any provided file format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about wasting hours researching legal paperwork online once and for all.