The Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement refers to the process of adjusting the monthly payment terms for a retainer agreement that has fallen behind in payments. It is a legal arrangement designed to help clients and attorneys navigate financial challenges and ensure that the services provided by the attorney can continue. In Saint Paul, Minnesota, there are several types of restructuring options available for monthly payments related to past-due retainer agreements. These options may include: 1. Negotiated Payment Plan: This type of restructuring involves discussions between the client and the attorney to establish a new payment plan that takes into account the outstanding balance and the client's financial situation. This can result in adjusted payment amounts, revised due dates, or extended payment periods. 2. Lump Sum Settlement: In some cases, clients may have the option to settle the past-due retainer agreement by making a one-time payment of a reduced amount. This can help clients resolve their outstanding balance quickly and avoid further financial strain. 3. Fee Adjustment: If the retainer agreement includes ongoing or recurring fees, the attorney may consider adjusting the fees to make them more manageable for the client. This can involve reducing the hourly rate, modifying the scope of work, or offering discounts for future services. 4. Waiver or Reduction of Interest: If interest has accrued on the past-due retainer agreement balance, the attorney may consider waiving or reducing the interest charges to alleviate the client's financial burden. 5. Extension of Payment Term: In situations where the client is struggling to make timely payments, the attorney may agree to extend the payment term for the retainer agreement. This allows the client to make smaller monthly payments over an extended period, easing the financial pressure. 6. Supplemental Financing: If the client is unable to afford the monthly payments even after restructuring options have been explored, the attorney may suggest alternative financing options, such as obtaining a loan or finding additional sources of funding to cover the outstanding balance. The Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement aims to find a fair and mutually beneficial solution for both the attorney and the client. This process allows clients to fulfill their financial obligations while ensuring attorneys can continue providing their services. It is important for both parties to engage in open communication, transparency, and negotiation to arrive at an agreement that addresses their respective needs.

Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement

Category:

State:

Minnesota

City:

Saint Paul

Control #:

MN-8569D

Format:

Word;

Rich Text

Instant download

Description

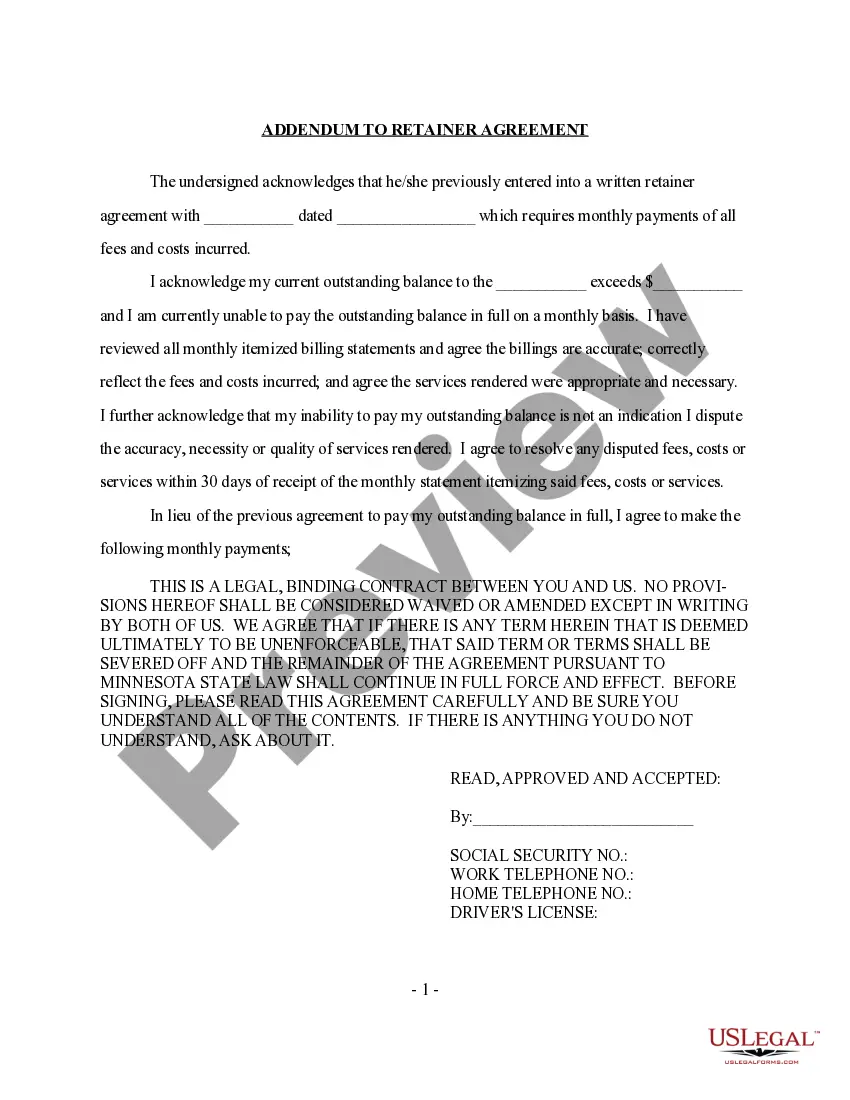

An addendum for client to sign: client is unable to pay full monthly balance of attorney's fees, but acknowledges accuracy of said fees and promises to pay by designated monthly payments.

The Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement refers to the process of adjusting the monthly payment terms for a retainer agreement that has fallen behind in payments. It is a legal arrangement designed to help clients and attorneys navigate financial challenges and ensure that the services provided by the attorney can continue. In Saint Paul, Minnesota, there are several types of restructuring options available for monthly payments related to past-due retainer agreements. These options may include: 1. Negotiated Payment Plan: This type of restructuring involves discussions between the client and the attorney to establish a new payment plan that takes into account the outstanding balance and the client's financial situation. This can result in adjusted payment amounts, revised due dates, or extended payment periods. 2. Lump Sum Settlement: In some cases, clients may have the option to settle the past-due retainer agreement by making a one-time payment of a reduced amount. This can help clients resolve their outstanding balance quickly and avoid further financial strain. 3. Fee Adjustment: If the retainer agreement includes ongoing or recurring fees, the attorney may consider adjusting the fees to make them more manageable for the client. This can involve reducing the hourly rate, modifying the scope of work, or offering discounts for future services. 4. Waiver or Reduction of Interest: If interest has accrued on the past-due retainer agreement balance, the attorney may consider waiving or reducing the interest charges to alleviate the client's financial burden. 5. Extension of Payment Term: In situations where the client is struggling to make timely payments, the attorney may agree to extend the payment term for the retainer agreement. This allows the client to make smaller monthly payments over an extended period, easing the financial pressure. 6. Supplemental Financing: If the client is unable to afford the monthly payments even after restructuring options have been explored, the attorney may suggest alternative financing options, such as obtaining a loan or finding additional sources of funding to cover the outstanding balance. The Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement aims to find a fair and mutually beneficial solution for both the attorney and the client. This process allows clients to fulfill their financial obligations while ensuring attorneys can continue providing their services. It is important for both parties to engage in open communication, transparency, and negotiation to arrive at an agreement that addresses their respective needs.

How to fill out Saint Paul Minnesota Restructuring Of Monthly Payments For Past-Due Retainer Agreement?

If you’ve already used our service before, log in to your account and download the Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your document:

- Ensure you’ve located an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Saint Paul Minnesota Restructuring of Monthly Payments for Past-Due Retainer Agreement. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!