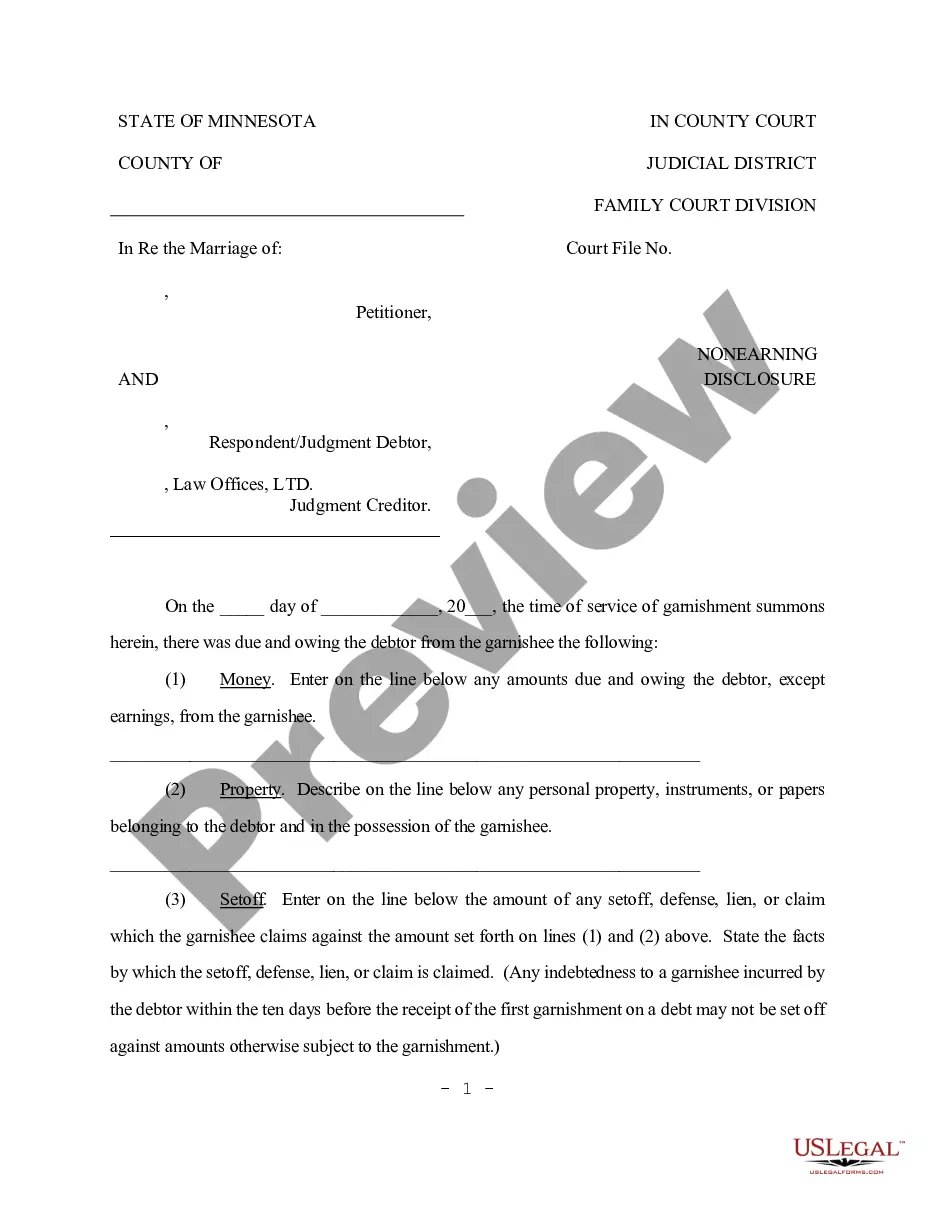

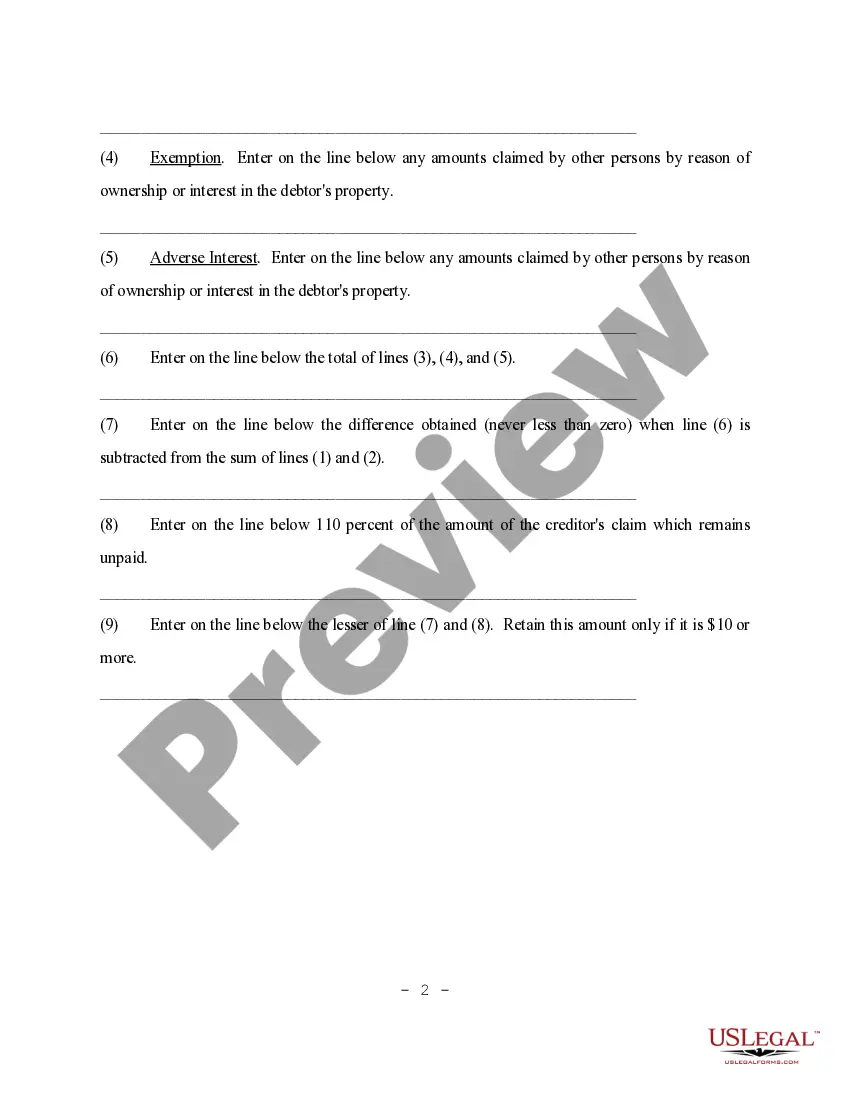

Minneapolis Minnesota Nonearning Disclosure is a legal requirement in the state of Minnesota that aims to promote transparency and safeguard consumers' interests. It pertains to the disclosure of information related to nonearning activities conducted by individuals or organizations operating in Minneapolis, without the purpose of generating financial profit. This disclosure requirement is in place to ensure that consumers are well-informed about the true intentions and nature of the activities conducted by these entities. One type of Minneapolis Minnesota Nonearning Disclosure is focused on nonprofit organizations. Nonprofit organizations are required to disclose detailed information about their nonearning activities, including their mission, programs, and the impact they aim to achieve in the community. This disclosure aims to provide transparency regarding how the nonprofit utilizes the resources it receives, such as donations or grants, to benefit the public and advance its stated mission. Another type of Minneapolis Minnesota Nonearning Disclosure pertains to community events or gatherings where nonearning activities take place. Event organizers are obligated to provide attendees with clear and concise information regarding the purpose, goals, and expected outcomes of the event. This disclosure ensures that participants are well-informed about the event's nonearning nature and can make informed decisions about their involvement. Furthermore, certain businesses or individuals engaged in nonearning activities, such as educational workshops, public awareness campaigns, or community service projects, may also fall under the scope of Minneapolis Minnesota Nonearning Disclosure. These entities are required to disclose their intentions, methodologies, and the potential impact of their initiatives to the public, allowing individuals to make informed decisions and understand the value of their participation. In conclusion, Minneapolis Minnesota Nonearning Disclosure plays a crucial role in promoting transparency and protecting the interests of consumers. Nonprofit organizations, event organizers, and individuals engaging in nonearning activities are required to provide detailed information about their mission, goals, and expected outcomes to ensure accountability and build trust within the community.

Minneapolis Minnesota Nonearning Disclosure

Description

How to fill out Minneapolis Minnesota Nonearning Disclosure?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone without any law education to draft this sort of papers from scratch, mostly due to the convoluted jargon and legal subtleties they come with. This is where US Legal Forms can save the day. Our service provides a massive library with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also serves as a great asset for associates or legal counsels who want to save time using our DYI forms.

Whether you want the Minneapolis Minnesota Nonearning Disclosure or any other paperwork that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Minneapolis Minnesota Nonearning Disclosure quickly using our trusted service. If you are presently an existing customer, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, if you are unfamiliar with our library, make sure to follow these steps before obtaining the Minneapolis Minnesota Nonearning Disclosure:

- Be sure the template you have found is suitable for your area considering that the rules of one state or area do not work for another state or area.

- Review the document and go through a short description (if provided) of cases the document can be used for.

- In case the form you picked doesn’t meet your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or create one from scratch.

- Select the payment method and proceed to download the Minneapolis Minnesota Nonearning Disclosure as soon as the payment is through.

You’re all set! Now you can go ahead and print the document or fill it out online. In case you have any issues getting your purchased forms, you can quickly access them in the My Forms tab.

Regardless of what case you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.