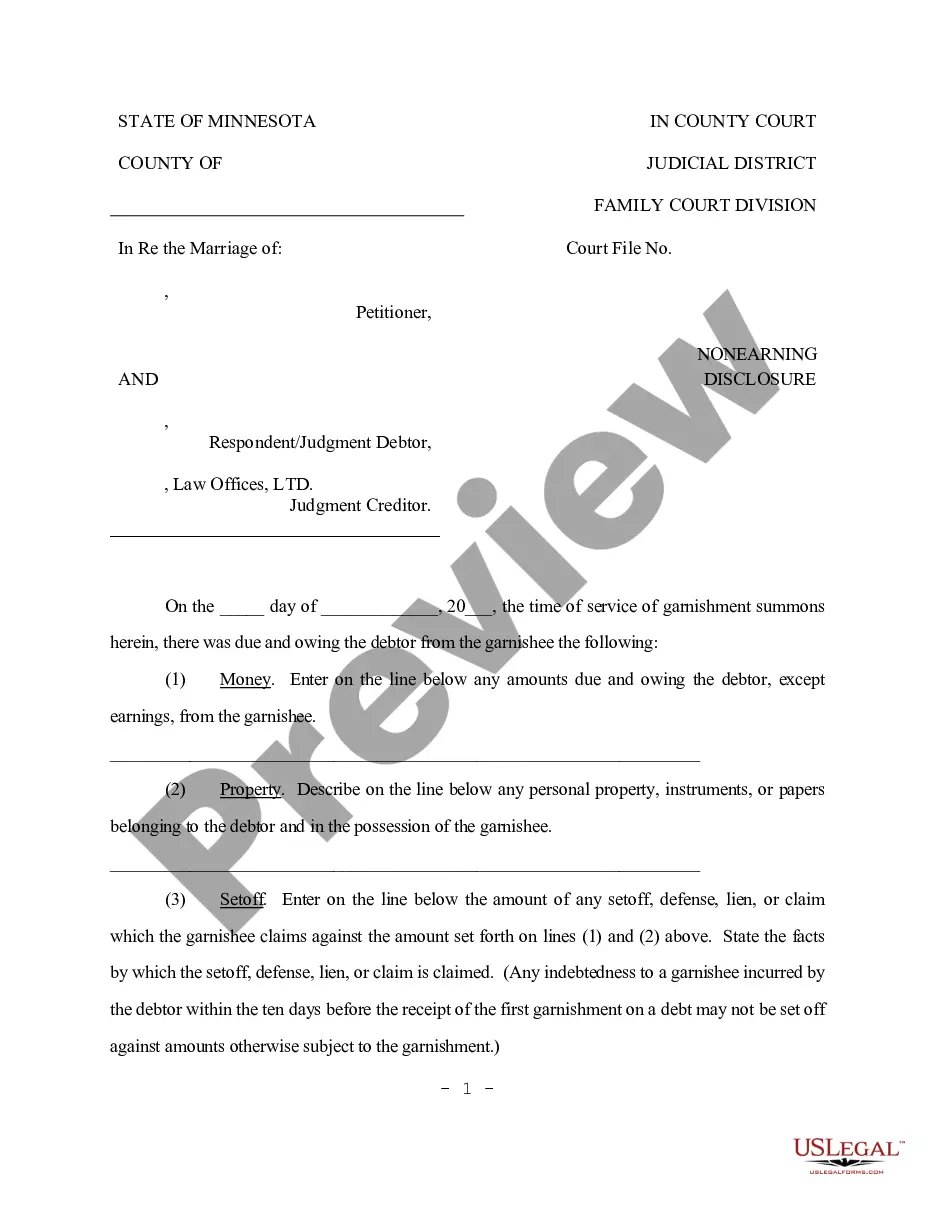

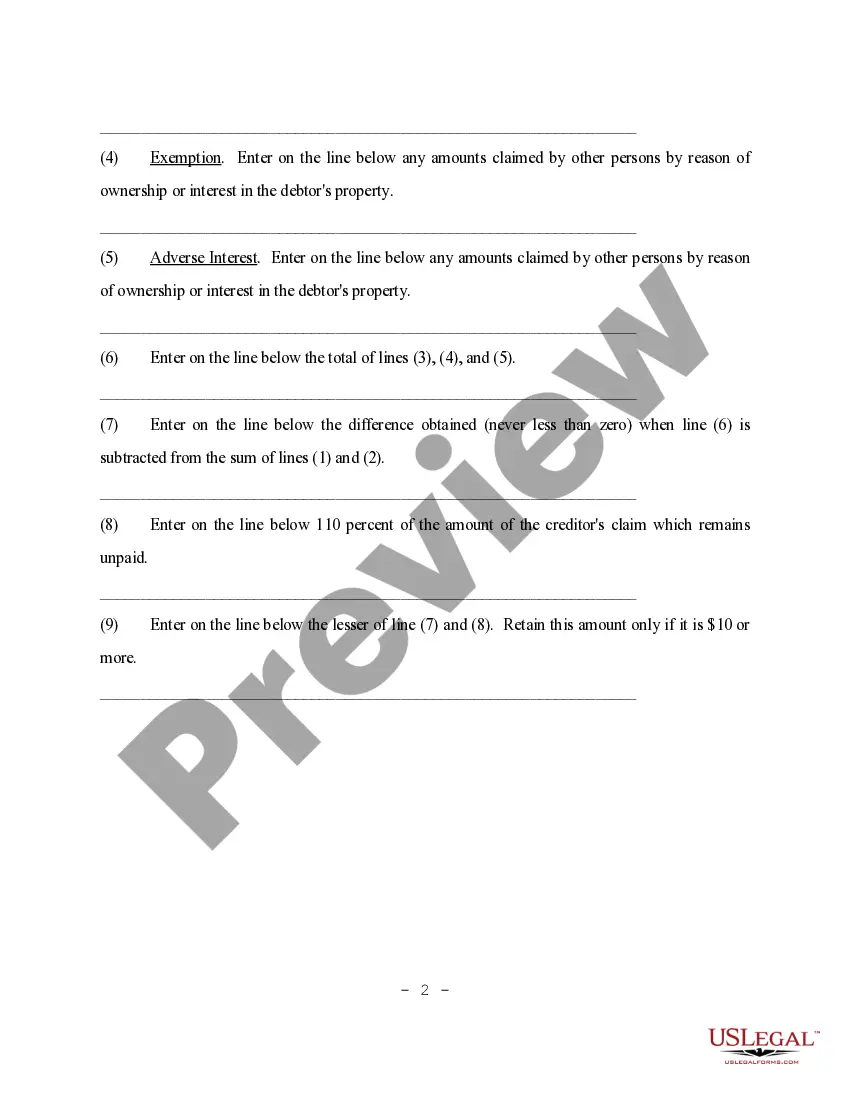

Saint Paul Minnesota Nonearning Disclosure refers to a legal requirement in Saint Paul, Minnesota, that obliges nonprofit organizations to provide detailed information regarding their financial activities and expenditures. This disclosure aims to promote transparency and accountability within the nonprofit sector. The Saint Paul Minnesota Nonearning Disclosure encompasses various types, including: 1. Financial Statements: Nonprofit organizations are required to provide comprehensive financial statements that detail their income, expenses, assets, and liabilities. These statements should follow generally accepted accounting principles (GAAP) to ensure accurate and standardized reporting. 2. Fundraising Activities: Organizations must disclose detailed information about their fundraising activities, including the percentage of funds raised that were used for charitable purposes versus administrative costs. It is essential to provide transparency on how the raised funds are allocated and utilized. 3. Administrative Costs: This type of disclosure focuses on providing an overview of the organization's administrative expenses, such as salaries, office rent, utilities, and other operational costs. It helps potential donors and stakeholders understand how efficiently the nonprofit manages its resources. 4. Compensation and Benefits: Nonprofit organizations need to disclose information about executive salaries, compensation packages, and benefits. This ensures transparency in the allocation of financial resources and avoids any potential conflicts of interest. 5. Program Expenses: This type of disclosure sheds light on how funds are allocated towards programmatic activities and mission-oriented initiatives. It helps in evaluating the effectiveness and impact of the nonprofit's work. 6. Board of Directors: Organizations should disclose the names, affiliations, and brief biographical information of their board members, providing visibility into the leadership and governance structure. By adhering to the Saint Paul Minnesota Nonearning Disclosure requirements, nonprofit organizations demonstrate their commitment to transparency and build trust among stakeholders, including donors, beneficiaries, and the community at large. These disclosures enable informed decision-making and help individuals contribute to causes that align with their values and objectives.

Saint Paul Minnesota Nonearning Disclosure

Description

How to fill out Saint Paul Minnesota Nonearning Disclosure?

Regardless of societal or occupational position, completing legal documents is an unfortunate requirement in today's society.

Often times, it’s nearly unattainable for an individual lacking legal expertise to generate such documentation from scratch, primarily due to the intricate language and legal nuances they encompass.

This is where US Legal Forms can come to the rescue.

Ensure the form you have selected is appropriate for your locality since the regulations of one state or area do not apply to another state or area.

Review the document and go through a brief overview (if available) of situations the form can be utilized for.

- Our platform offers an extensive collection of over 85,000 ready-to-use state-specific documents applicable to almost any legal circumstance.

- US Legal Forms is also a valuable resource for associates or legal advisors seeking to enhance efficiency by utilizing our DIY forms.

- Whether you need the Saint Paul Minnesota Nonearning Disclosure or any other paperwork applicable in your state or locality, with US Legal Forms, everything is readily available.

- Here is how you can swiftly acquire the Saint Paul Minnesota Nonearning Disclosure using our reliable platform.

- If you are already an existing member, you can directly Log In to your account to obtain the necessary form.

- However, if you are new to our collection, please follow these steps before downloading the Saint Paul Minnesota Nonearning Disclosure.

Form popularity

FAQ

All single family, duplex, condominium, and townhomes are required to have a TISH evaluation completed prior to the marketing of a property for sale.

Like Minneapolis, St. Paul requires TISH inspections for single-family homes, duplexes, and townhomes. It is also required for condos and co-op homes. You must complete your TISH inspection within three days of offering your home for sale and before any buyers walk through it.

The City of South St. Paul requires a Time-of-Sale Home Inspection prior to selling your home. The program is intended to enhance the supply of safe housing and to prevent the deterioration of the overall housing in the city.

Saint Paul requires a Truth-In-Sale of Housing (TISH) evaluation on every single family home, duplex, townhome, and condo listed for sale.

Phone. To speak to a Customer Service Representative, call any time from a.m. ? p.m., Monday through Friday: 651-266-8989.

All single family, duplex, condominium, and townhomes are required to have a TISH evaluation completed prior to the marketing of a property for sale.

Chapter 189 of the Saint Paul Legislative Code requires all single family, duplex, condo, townhouse and co-op homes for sale in the city to have a Truth-in-Sale of Housing disclosure report prepared and available to prospective buyers.

The following property types require a Truth in Sale of Housing (TISH) evaluation before you sell them: Single-family houses. Duplexes. Townhouses. First-time condominium conversions.

What cities in Minnesota require a TISH inspection? City of Bloomington Time-of-Sale Housing inspection. City of Maplewood Truth-in-Sale of Housing report. City of Minneapolis Truth-in-Sale of Housing evaluation. City of New Hope Point of Sale inspection. City of Richfield Point of Sale Housing inspection.